- Bitcoin dips to $40k and conviction holders dollar-cost average in; TP ICAP enters crypto with

ETC Group trades; Goldman sees Bitcoin stealing ‘store of value' market from gold; Polkadot and

Tezos outperform; and NFTs shine as corporates race in.

We're only two weeks into the New Year and there is already a glut of news to parse in crypto,

the space that never sleeps.

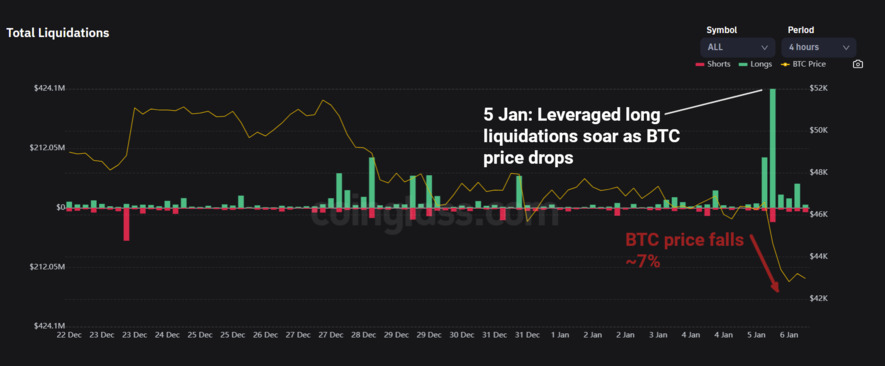

Bitcoin closed 2021 up 78%, before trending sideways in the early part of the New Year, then

taking a bath with a near 7% drop, driven by two major macroeconomic and geopolitical factors,

both occurring on or around 5 January 2022.

First was the

report on the Fed's FOMC Minutes, which is very closely watched by Wall Street and the

market. US central bankers were unanimous in saying that US rates would rise further and faster

than previously anticipated, initiating selling of risk-on assets.

Traders in Asia led this charge, with the spectre of Evergrande and the debt crisis in the

background heaping on the pressure to unwind their positions.

The second factor was the infrastructural collapse in Kazakhstan where around a fifth of Bitcoin

hashrate is located, with that price shock and the subsequent cascade of liquidations from

speculative traders' leveraged long positions. Read our research piece on that here .

Source: Coinglass, 10 Jan 2022

Source: Coinglass, 10 Jan 2022

Long-term holders DCA in as Bitcoin dips to $40k

At time of publication, Bitcoin prices had stabilised in the $40-42k region.

We are not calling the bottom just yet: we know via Josh Lim, head of derivatives at Genesis

that there remains a slew of leveraged long positions sitting

below the $40k mark . We're watching closely for a relief rally, but if those stops get

triggered we could see a much larger cascade down to support in the $34k region.

However.

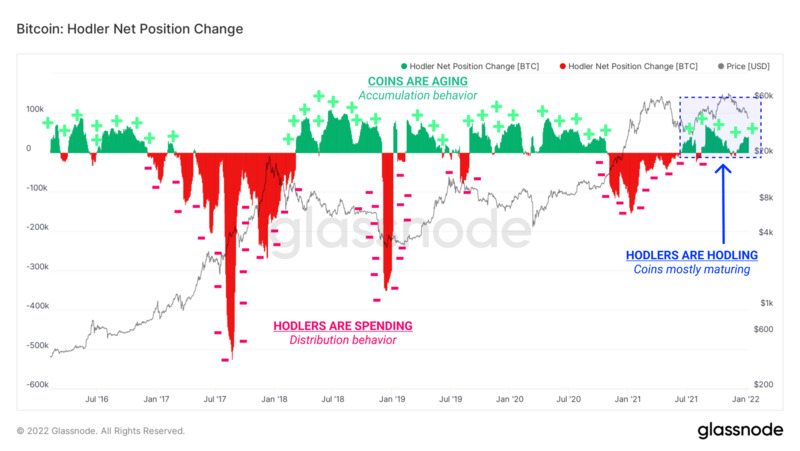

Long-term, high-conviction Bitcoin holders are undeterred, with recent on-chain analysis showing

it is highly levered weak hands who have sold out at a loss.

Glassnode 's charting remains the best in the business. And it's their ‘Hodler Net

Position Change' graph which demonstrates that long-term holders are continuing to accumulate at

these levels.

Positive (green) values mean coins are ageing at a higher rate than spending.

Typically, bearish conditions with long-term accumulation by high conviction buyers.

Negative (red) values show higher rates of spending, particularly from older

coins, outpacing accumulation. This is frequently observed at the height of bull markets and at

moments of total capitulation when older hands are more likely to relinquish holdings.

Far be it from us to suggest anything as gauche as ‘buying the dip', but you only have to look

at how long-term Bitcoin holders are behaving to tell you what they think of where bitcoin and

crypto is going next.

For institutional investors still on the sidelines - having watched Bitcoin retrace from its

$69,000 all time high - consensus is starting to form that now may be an attractive entry point.

Long-term holders have been dollar-cost averaging (DCA) into Bitcoin recently, including the

high net worth marginal buyers from the previous two years. On 30 December 2021 Michael Saylor's

Nasdaq-listed business software firm Microstrategy added 1,914 BTC to the

firm's holdings at an average $49,229 for a $94.2m outlay. That makes the enterprise analytics

company a $3.75bn HODLer with a $30,159 average. It does rather beg the question: In 10 years,

will anyone remember that this was a business intelligence software company?

Canadian crypto miner Bitfarms announced on 10 January it had picked up

1,000 BTC for $43m at an average price of $43,200, just weeks after securing a $100m credit facility from

Galaxy Digital , the merchant bank that investors can find as a major

constituent of ETC Group's Digital Asset and Blockchain Equity UCITS ETF.

Billionaire value investor Bill Miller also recently came out to say that he holds 50% of his

net worth in Bitcoin and related assets, specifically for their censorship-resistant,

seizure-resistant properties.

As Blocktower's Ari Paul noted in a recent conversation on the Macro Hive podcast:

If I

want a million dollars-worth of censorship resistance, I need a million dollars-worth of

Bitcoin, I don't really care about the price.

Miller - lauded among private investors in the same hushed tones as Warren Buffett and Peter

Lynch - bought his first Bitcoin at $200 and said he added heavily at the $30,000 region in the

summer of 2021.

That, co-incidentally, was after China first turned off the power to bitcoin miners, then banned

crypto transactions altogether and the Bitcoin price fell from a then-high of $64,000 to bottom

out at around $29,700.

The billionaire said in the recently-published interview with Wealthtrack:

Bitcoin has gone up, on average, 170% every year for the past 11 years

adding that he

has long-term conviction enough to ride out the kind of volatility we are seeing now. In the

same period Bitcoin's price has -- three times -- plummeted more than 80%.

And so, people naturally continue to ask us if we are concerned about the latest dip in Bitcoin

prices. Not really. We were very concerned when one of the largest trading venues globally

imploded, and the price of bitcoin plummeted 66% over the course of the next year, from $900 to

around $300 - but that was Mt Gox and it happened between 6 and 7 years ago. At that point, we

wondered whether this little experiment may have run its course.

For another line on the illogicality of such bearishness, we can turn to the Bitcoin Fear and

Greed Index, which offers a quick (if unsophisticated) overview of market sentiment.

If a picture is worth a thousand words, then for this we have Alejandro at

Pastore Captial on Twitter to thank.

This is Bitcoin at $40k in 2021 on the left, compared to Bitcoin at $40k in 2022 on the

right.

As one wag interjected: isn't the point to buy low, and sell high?

OpenSea NFT market hits $13bn valuation as AP, Samsung bite

OpenSea is the latest crypto startup to eye a potential future public markets debut, saying it

raised $300m in a

Series C round for a $13.3bn valuation. The NFT marketplace raised $100m in a Series B round led

by Andreessen Horowitz (a16z) in July 2021 which valued it at $1.5bn. This financing marks a

ten-fold increase inside six months.

OpenSea transaction volume soared 600x last year.

Co-founder Devin Finzer notably said the cash would be used to

lower the barriers to entry

for NFTs by introducing features and simplified flows that abstract away the complexity of

blockchain.

That statement could be applied to the crypto market at large, which certainly need to improve

its UI and UX in general to attract users beyond the early adopters that have enthusiastically

sponsored it to date.

NFTs were the go-to Christmas gift for tech-minded people in 2021 (certainly in our office,

anyway) and the trend shows no sign of slowing down.

At time of publication, OpenSea unique user addresses just breached their previous all time

highs, suggesting enduring interest in NFT creation as well as buying and selling.

Source: @bit_hedge via Etherscan.io

Source: @bit_hedge via Etherscan.io

The rate of retail penetration of NFTs may have surprised even the most ardent crypto market

watchers, but most mainstream analysis decrying the space as a speculative bubble ignores the

simple fact that people - especially fans of artists, creators and musicians - love to own

things that others don't.

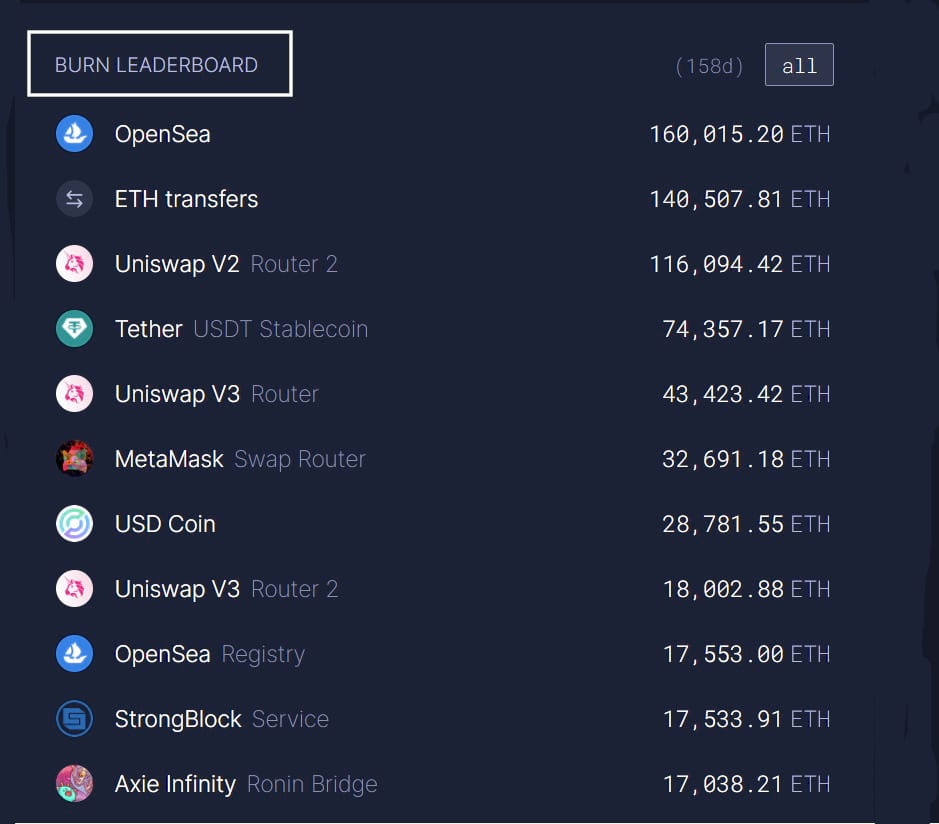

Ethereum-based OpenSea regularly tops the table of the highest ETH burners and has destroyed

over 160,000 ETH since the introduction of EIP-1559 in August 2021's hard fork. Then, the

currency introduced a deflationary mechanism where a small amount of ETH is permanently removed

from circulation every time an operation is performed. Post-Merge, when Ethereum switches off

Proof of Work and becomes instead of Proof of Stake blockchain, its supply rate is slated to

drop to

negative 2.4% .

Source: Ultrasound.money, 11 Jan 2022

Source: Ultrasound.money, 11 Jan 2022

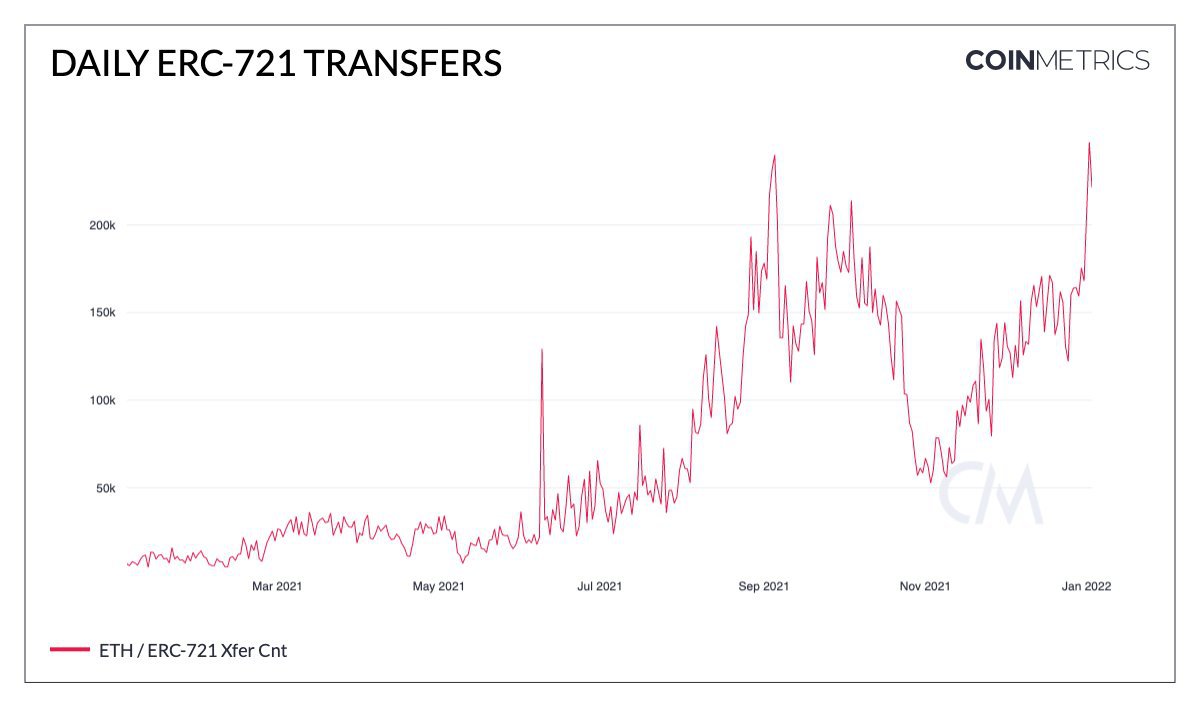

Coinmetrics analyst Kyle Waters noted on Twitter that NFT activity is off to a flying start in

January 2022, with ERC-721 token transfers reaching their own fresh all time high.

On 3 January there were 247,000 ERC-721 token transfers (buys and sells) which beats last year's

daily high of 240,000, on September 5, 2021.

As ETC Group noted in its Q3 2021 Ethereum market

report , NFTs will be the Trojan horse that brings crypto to its first billion users.

The Wall Street Journal reported an exclusive on 6 January that Gamestop was

entering cryptocurrency and NFT markets in a bid to switch from meme stock short-squeeze

candidate to truly profitable enterprise, and hiring more than 20 people to run this new

division.

Japanese gaming giant Konami has now

followed the likes of Assassin's Creed publisher Ubisoft - which launched in-game NFTs

on

Tezos late last year - with its own collection

After $440bn market cap Samsung 's entry into the space, announcing on 3

January three TV models for 2022 including

extensive support for NFTs , with a screen-based explorer, galleries and marketplace

aggregator, the shoe dropped for one other venerable institution: the

Associated Press .

The AP is the gold standard globally in photojournalism. It said on 10 January it would use

blockchain-as-a-service provider Xooa to build aPolygon -based NFT marketplace

to sell its journalists' work. The newswire service previously announced in October last year it

was

working with oracle feed provider Chainlink to help developers access

AP data.

Institutions don't wait: TP ICAP enters crypto, JP Morgan, Goldman see $100k

Bitcoin

Digital asset market infrastructure is increasingly shifting institutional, as the world's

largest interbroker-dealer TP ICAP

moves into trading crypto. It comes as little surprise that as their first trade they

utilised the world's most liquid Bitcoin ETP, ETC Group's BTCE, which is physically-backed 1:1

with the underlying, centrally-cleared and trades on regulated exchanges.

TP ICAP facilitates transactions between investment banks, hedge funds and other large financial

institutions. Which is why the financial world sits up and takes notice of whatever it does. It

has been trading in Europe for clients including Goldman Sachs, Jane Street and Flow Traders,

digital asset leads Simon Forster and Duncan Trenholme told Coindesk .

Trading an equity-linked product on an exchange is probably the easiest way for clients to

get comfortable with digital assets, Forster said, adding that the firm had been active in

trading ETPs such as ETC Group's physical bitcoin product, BTCE

Will Canny, Coindesk, 10 January 2022

One of the bigger shocks for hedging traders is that last year, amid US inflation spiking to a

39-year high (and UK inflation at a 10 year high, and EU inflation the highest since the euro

was introduced), gold prices

fell 4% to close the year at $1,829. Traditionally gold is seen as a place to protect

investor cash from inflation. It failed fairly spectacularly on that count in 2021. We know that

investors have been parking their cash in Bitcoin and crypto in ever greater numbers: as the

market cap of all cryptoassets rose from $700bn in January 2021 to

over $3 trillion by November 2021.

The world's biggest investment banks, JP Morgan and Goldman

Sachs , both agree with that assessment. Each put out client research notes last

week.

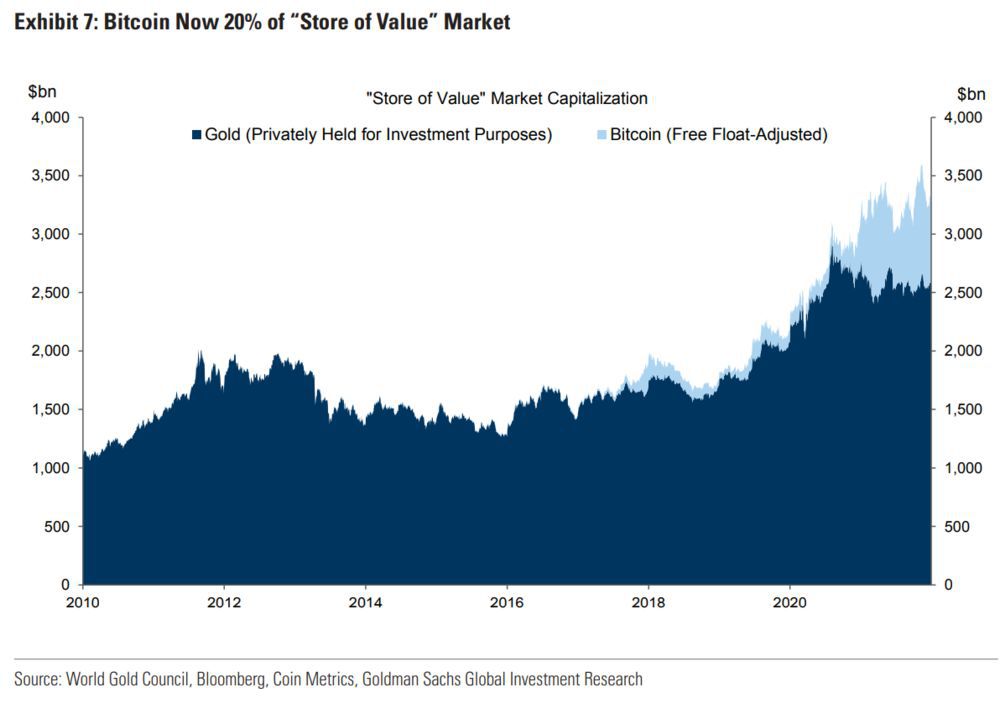

Zach Pandl, co-head of FX and emerging markets strategy at Goldman Sachs Group, released a

research note on 4 January 2022 predicting Bitcoin's move to $100,000 as it continues to take

‘store of value' market share from gold.

The value of gold available for investment is around $2.6trn, while Pandl estimates Bitcoin's

float-adjusted market cap is just under $700bn. That accounts for 20% share of the store of

value market, which Goldman says comprises Bitcoin and gold.

If Bitcoin were to increase its market share from 20% to 50% over the next five years, that

would put prices just above $100,000 per BTC, representing a 17% or 18% compound annualized

return, Pandl wrote.

Kenneth Worthington, equity research analyst at JP Morgan, followed a client note on 7 January

2022, noting that institutional and mainstream crypto adoption would continue to grow in 2022,

and adding that Bitcoin is “particularly well designed as a modern store of

value , and the strong design has contributed to increased confidence in the value

of Bitcoin”.

Markets

BTC/USD

This two-week trading period saw the original cryptocurrency drop 20.7% of its value, but while

short-term bearish sentiment gripped markets, its sink into the low $40k region was halted just

below that round number mark, putting the price gains of 2021 into stark context. The bleeding

appears to have been stemmed for now, and while short-term or highly levered hands are nervously

awaiting the next move, higher conviction traders and newer entrants who have sat on the

sidelines to date and see Bitcoin now 40% cheaper than its $69k all time high may view this as

an interesting entry point.

Data as of 11 January 2022 | Source:

TradingView.com

Data as of 11 January 2022 | Source:

TradingView.com

ETH/USD

Ethereum dripped below a support area around $4,000 just as our two-week trading period began,

and at the same time Bitcoin markets got crushed, but it too is exhibiting some more positive

signs at the $3,000 level. Bearish attempts to push ETH down below that figure markedly failed,

and a 7.6% bounce up to $3,160.24 to close out the fortnight are a potential bright spark on the

horizon.

Data as of 11 January 2022 | Source:

TradingView.com

Data as of 11 January 2022 | Source:

TradingView.com

LTC/USD

Litecoin exhibited remarkable staying power across the two weeks as it was less negatively

affected by the price dip that took out leveraged hands in Bitcoin. Holding a tight range

between $145 and $150 for more than a week, something had to give, and in this case it was a dip

to the downside. In all LTC shed 16.1% against the dollar, but proponents of the payments

protocol can take heart from its relative stability amid all the chaos, and the 7.6% return up

to $130 from a low of $120.72 a handy guide for how traders feel.

Data as of 11 January 2022 | Source:

TradingView.com

Data as of 11 January 2022 | Source:

TradingView.com

BCH/USD

During the fortnight Bitcoin Cash showed resilience, bouncing upwards off support as it had done

four times in December at $420, with a healthy 7.5% swing to the upside matching earlier moves

in the digital cash blockchain. It appears the combination of geopolitical and macroeconomic

factors that hit Bitcoin on 5 January was the only thing to see it breach this strong support

area. Certainly the outlook for BCH remains positive in the long run as developers continue to

push out updates to claim Bitcoin Cash's place as a DeFi and NFT-capable programmable chain.

Data as of 11 January 2022 | Source:

TradingView.com

Data as of 11 January 2022 | Source:

TradingView.com

ADA/USD

Cardano traders lost no momentum going into the New Year, one of the only coins to add to its

starting point with a shift up from $1.50 to $1.54, and with the $1.30 level proving to be a

significant area of support in the Layer 1 Ethereum alternative. Six times, ADA bounced off

$1.20 in December, with a subsequent 33% run up as high as $1.60. As with the wider market,

slipping below this area seems bearish, but there was no capitulation in traders and as the

fortnight closed out some positive intent seemed back on the table, as Cardano added 10.2% from

a low of $1.07, attempting to reconfigure $1.20 as near-term support.

Data as of 11 January 2022 | Source:

TradingView.com

Data as of 11 January 2022 | Source:

TradingView.com

DOT/USD

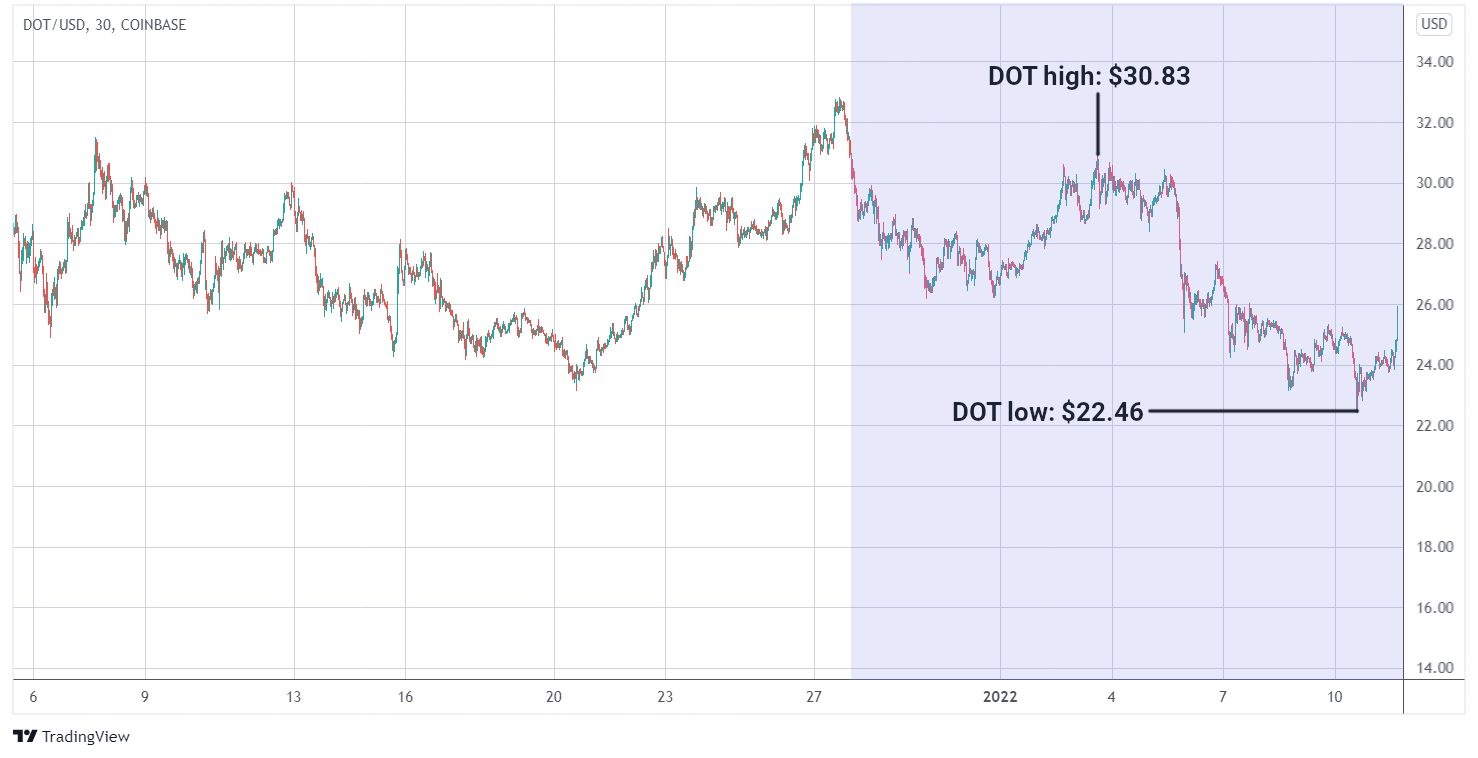

Polkadot's much-vaunted parachain slot auctions went off with much fanfare and without a hitch

across late December 2021, adding fuel to the fire of speculation that the Ethereum alternative

could grab considerable market share throughout 2022. On a short-term trading level, DOT saw

quite a different price structure to the rest of the market, starting at $30.34, dipping to

$26.22 and then running back higher than its starting point to peak 17.5% higher at $30.83. A

15.2% race to the upside to finish the fortnight at nearly $26 is a stronger bounce than most,

and will continue to suggest DOT can maintain outperformance of its rivals.

Data as of 11 January 2022 | Source:

TradingView.com

Data as of 11 January 2022 | Source:

TradingView.com

SOL/USD

Solana's recent attempt to maintain fresh air above $200 seems less of a chore when we realise

it has only managed that feat for five and a half weeks of its entire lifespan to date. The

Layer 1 Ethereum alternative has been adding yield-bearing staking products, NFTs and DeFi

marketplaces with gay abandon over the last few months, giving it many industry bona fides

alongside its lightning fast transaction throughput. Bullish traders could maintain an upswing

only briefly and then the $170 to $180 tight trading range became its home for the next week or

so. From there, along with its competitors Solana dipped 22.8% to $129.64, but again a 9.5%

bounce to the upside to finish the fortnight adds a positive spin to the rest of January.

Data as of 11 January 2022 | Source:

TradingView.com

Data as of 11 January 2022 | Source:

TradingView.com

XTZ/USD

Tezos' recent infrastructural wins will likely support its XTZ currency as a staking product if

market conditions turn medium-term bearish. That kind of real yield will be hard to find in what

are extraordinarily inflationary times. At a trading level, across the two weeks XTZ encountered

the same difficulties as most of the market, but outperformed almost all of its rivals with a

10.5% positive swing in the early part of the New Year. $5.35 proved to be the high point before

it succumbed to the same macro dip that dragged the market lower. But again, an 11.3% bounce to

$4.22 to finish the fortnight will be of interest to bargain hunters seeking strength.

Data as of 11 January 2022 | Source:

TradingView.com

Data as of 11 January 2022 | Source:

TradingView.com

XLM/USD

Stellar has been around for years, unlike many of its rivals, and as such showed much lower

volatility with older hands holding onto XLM coins despite difficult macro conditions proving a

drag on the total crypto market cap. The cross-border currency pair started January with a swing

in its step, adding 3.5% to $0.30 and staying there for good measure. And despite the dip to

$0.24, a hard bounce off this support proved relatively positive, with a healthy 8.3% gain to

finish out the fortnight.

Data as of 11 January 2022 | Source:

TradingView.com

Data as of 11 January 2022 | Source:

TradingView.com

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.