- It's easy to be a bull in a rapidly rising market, but far more demanding to be net long when the sky appears to be falling

Buy the dip? Billionaires load up as BTC, ETH, LTC recover

It's easy to be a bull in a rapidly rising market, but far more demanding to be net long when the sky appears to be falling. The recent reversal from all-time highs spooked some retail investors but left the door open for high net worth investors to swoop in and buy the dip.

That’s according to several institutional trading firms that spoke to TheBlockCrypto in the aftermath of Bitcoin’s price retreat.

Ahead of the market ascent, Genesis Global Trading sent out a note to its counterparties, noting that macro funds began buying at the $35,000 level. The firm said that the selling overnight and into the morning was largely driven by forced liquidations on derivatives venues. These cascading liquidations, which drove the price of bitcoin down, have been quickly bought in past instances.

Frank Chapparo, TheBlockCrypto

The world’s largest cryptoasset climbed from lows around $30,000 on Wednesday 19 May to retry resistance around $38,000, and that’s approximately where it has remained since.

We have said it before, and we will say it again: leverage hurts. When emotion takes over from prudent risk management, traders borrow excessive margin and get hugely overextended, leaving themselves well offside. And when the wheel turns, leveraged money gets washed out, prices reset and the cycle starts again. It’s a painful lesson that some seem unwilling to learn.

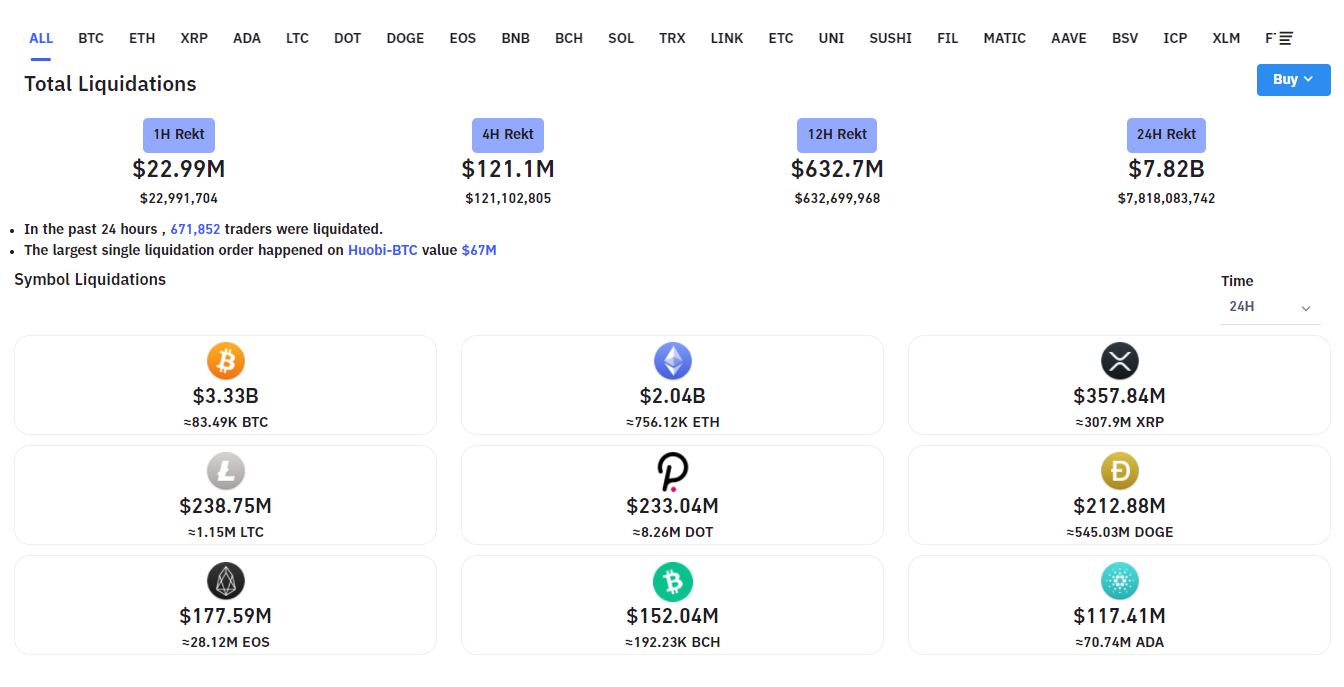

The short-term cascade effect is real. Data from futures and options analysts Bybt.com on 21 May 2021 shows how in a 24-hour period, 670,000 leveraged traders were bumped out of their positions, both long and short, with liquidations totalling nearly $8bn.

Source: Bybt.com ¦ Accessed 21.05.21

Source: Bybt.com ¦ Accessed 21.05.21

Two of the world’s largest crytpoexchanges failed:

both Coinbase and Binance struggled

to maintain uptime in as the market posted large drops, again pointing investors to central counterparty cleared ETPs or ETFs on regulated stock exchanges.

Minimising downside risk with regulated products like these would seem to be the obvious move. As Warren Buffett famously wrote:

Only when the tide goes out do you realise who has been swimming naked.

Such price swings are hardly unknown. Think back to 11 February -17 March 2020 when Bitcoin lost nearly half its value in two weeks, dropping from $9,677 per BTC to $5,243.

But what is particularly interesting about the reaction in the wake of this market crash – and how it differs to what happened 12 months ago – is the response from high net-worth and institutional investors.

Early investor Michael Saylor, CEO of Microstrategy(NASDAQ: MSTR) admitted via Twitter that his firm had bought in near recent lows, acquiring another 229 BTC for $10m in cash at an average price of $43,663 per bitcoin, confirmed in an 8-K regulatory form filed with the SEC.

As of 18 May 2021, the business intelligence software firm holds 92,079 bitcoin, purchased for $2.251bn at an average price of $24,450 each.

It’s a sign of the changing of the guard. A swathe of investors representing multi-billion-dollar institutions came out in favour of Bitcoin in an increasingly common show of support — something that simply would not have happened at the time of the last major price reversal.

As one prominent executive for the $260bn AUM Carlyle Group (NASDAQ: CG) — who, incidentally, is also the president of The Economic Club of Washington DC — told CNBC on Thursday 20 May.

Crypto has come from nowhere to become a force in the market...it’s here to stay. Cryptocurrency is not going away. The idea that the government is going to stop cryptocurrency from being something investors want is unrealistic.

David Rubenstein, Carlyle Group

Bridgewater Associates is the world’s richest hedge fund with $101.9bn AUM, and is led by legendary investor Ray Dalio. He outlined a similar position in conversation with industry website Coindesk on Monday 24 May.

Personally, I’d rather have [exposure to] bitcoin than a bond.

Ray Dalio, Bridgewater Associates

To top it off, Wells Fargo (NYSE:WFC) announced it would offer a bitcoin fund to its wealthiest clients, while a new Goldman Sachs (NYSE:GS) research report posits crypto as “an entirely new asset class”.

Bitcoin is now considered an investable asset. It has its own idiosyncratic risk, partly because it’s still relatively new and going through an adoption phase. And it doesn’t behave as one would intuitively expect relative to other assets given the analogy to digital gold; to date, it’s tended to be more aligned with risk-on assets. But clients and beyond are treating it as a new asset class, which is notable – it’s not often that we get to witness the emergence of a new asset class.

Matthew McDermott, global head of digital assets, Goldman Sachs

Does this make Bitcoin an overnight success 10 years in the making?

>

ETH Q1 2021 results show same revenue as Amazon Web Services in 2015

One independent researcher in the US this week has sparked what could be a new trend of analysts covering cryptocurrencies and cryptoassets not in daily news headlines, but more seriously on a quarterly basis, as they would with any other high-growth software business.

James Wang, writing for the Draecomino newsletter, writes the post in the style of an analyst report, focusing on metrics like staked Ethereum (a proxy for network security), median transaction fees, total transaction volume, and daily active addresses (a proxy for daily active users). These are analogous to revenue, earnings per share, new accounts or any other kind of market-favoured statistics one might find in a strong Netflix (NASDAQ:NFLX) or Apple (NASDAQ:AAPL) trading update.

According to the writer, the Key Results for Ethereum in Q1 2021 include:

-

Total transaction volume on Ethereum increased 20x to $713bn in Q1 2021, compared with $33bn in Q1 2020

-

Daily active addresses increased 71% to 607,000 in Q1 2021, compared with 364,000 in Q1 2020.

-

Total transaction fees, also known as network revenue, increased 200x to $1.7bn in Q1 2021. For the month of April, Ethereum generated annualized revenue run rate of $8.6bn – comparable to Amazon Web Services (AWS) in 2015.

It’s a serious comparison.

As we know, Ethereum is now supported by AWS, and investment bankers at Goldman Sachs have come to the same conclusion. In a recent report, available only to institutional subscribers but published in part by Zerohedge, the bank’s research desk noted:

A blockchain platform like Ethereum could potentially become a market for vendors of trusted information, like Amazon is for consumer goods today.

By far the most profitable division of Amazon (NASDAQ:AMZN), AWS is now considered the utility company of the internet, and there is consensus growing that Ethereum is likely to be the utility blockchain of internet money.

AWS is still growing at an incredible rate, possibly as much as 32% per quarter. And indeed, in Amazon’s Q1 2021 results, it was announced that head of the cloud computing division, Andy Jassy, would replace Jeff Bezos as Amazon’s CEO. High praise indeed.

In Ethereum’s favour long-term is its multi-year switch to Ethereum 2.0. The move away from the Proof of Work consensus mechanism favoured by Bitcoin to Proof of Stake is an architecture change that could see it use 99.95% less energy, according to an article posted this week by prominent Ethereum Foundation developer Carl Beekhuizen.

Despite common misconceptions over Bitcoin’s ESG credentials, investigated in detail in ETC Global’s latest research report, scaling back of Ethereum’s environmental issues while the blockchain scales up to 100,000 transactions per second, using upgrades like sharding and parallel transaction confirmations, can do it no harm at all.

People are realizing that Ethereum isn’t just money, it’s ultra-sound money. While other cryptocurrencies may boast of having a supply ceiling, Ethereum will soon have no supply floor.

Justin Drake, Ethereum Foundation researcher

Finally, the long-term trend of investors locking up assets in DeFi protocols to stake for yield, or with CeFi lending and borrowing platforms like Aave or Nexo has created a dearth of ETH supply. Added to upcoming proposals to ‘burn’ a portion of ETH in each transaction, we’re facing a much changed blockchain which is deflationary at both ends of the scale.

China ‘ban’ is 2017 news while US seeks cross-agency crypto regulation

China’s so-called Bitcoin ‘crackdown’ has been much blamed for Bitcoin’s recent price fall, but in truth Beijing’s stance on cryptocurrency has been little changed in the last eight years.

Recent announcements that the country would ban cryptocurrency mining, prohibit financial institutions from providing services around trading cryptocurrencies, and maintain the embargo on fundraising through Initial Coin Offerings represent no policy shift at all, and only reiterate what government functionaries told markets in both 2013 and 2017.

In other major nations, regulators are moving in the opposite direction. In the US this week, the Office of the Comptroller of the Currency (OCC), the Federal Reserve, and the Federal Deposit Insurance Commission (FDIC) are mulling plans to form an ‘inter-agency sprint team’ to react more quickly to regulatory matters in cryptoassets.

Speaking to a virtual meeting of the House Financial Services Committee, regulators highlighted their concerns about the “fragmented” regulation the asset class faces, along with the previous lack of collaboration between federal bodies.

I am concerned that the regulatory community is taking a fragmented, agency by agency approach to the technology-driven changes taking place today.

Michael Hsu, OCC Acting Comptroller

Currently the FDIC does not insure crypto deposits in the same way as they would bank deposits, but as Ohio Congressman Warren Davidson pointed out to the meeting, fresh guidance is now required given that some cryptoasset firms like Kraken, Anchorage and Avanta Financial have won state or federal charters to provide US cryptobanking services.

Markets

BTC/USD

Bitcoin’s tough week was heavily documented worldwide, with prices dipping 34.1% from a weekly peak of $45,621.11 to $30,025.62. The wider fall from April’s all time high at nearly $65,000 made for a slew of headlines, as bears jumped aboard to call the end of the crypto bull market. It remains to be seen whether the rebound of 26.8% by the is a relief rally or not, as Bitcoin finished the week around the $38,000 mark.

Data as of May 25th, 2021 | Source: TradingView

Data as of May 25th, 2021 | Source: TradingView

ETH/USD

Ethereum was not immune to the price falls sparked by leveraged long liquidations earlier this week, with the price of the second-largest cryptoasset by market cap shedding 51.6% to hit a two-month low of $1,722.91. Like BTC, ETH also managed to stage a recovery, but performed more strongly than its rival by adding 53.2% over the course of a matter of days to recapture the $2,000-mark and finish the week at $2,639.26.

Data as of May 25th, 2021 | Source: TradingView

Data as of May 25th, 2021 | Source: TradingView

LTC/USD

Litecoin followed a relatively similar pattern to ETH this week, with the payments coin’s three-month uptrend stalled by the market dip. LTC retraced away from near its all time high to slide 62.4% from $318.08 to $119.63, a low last touched at the end of January 2021. Its recovery, too, took a corresponding line to the wider crypto market regain, adding 45.4% to close the week out at $173.94.

Data as of May 25th, 2021 | Source: TradingView

Data as of May 25th, 2021 | Source: TradingView

Important Information

This publication constitutes a marketing communication and is provided for informational purposes only. It does not constitute investment advice, a personal recommendation, or an offer or solicitation to buy or sell any financial instrument.

This document (which may take the form of a presentation, press release, social media post, blog article, broadcast communication or similar instrument – collectively referred to as a “Document”) is issued by Bitwise Europe GmbH (“BEU” or the “Issuer”) and has been prepared in accordance with applicable laws and regulations, including those relating to financial promotions.

Bitwise Europe GmbH, incorporated under the laws of Germany, is the issuer of the Exchange Traded Products (“ETPs”) referenced in this Document under a base prospectus and the applicable final terms, as supplemented from time to time, approved by the German Federal Financial Supervisory Authority (BaFin). The approval of the prospectus by BaFin relates solely to the completeness, coherence and comprehensibility of the prospectus in accordance with the Prospectus Regulation and does not constitute an endorsement, recommendation or assessment of the merits of the products.

The market analyses, views and scenarios presented reflect the assessment as of the date of publication and are based on information considered reliable. However, no representation or warranty is made as to their accuracy or completeness. Forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Past performance is not a reliable indicator of future results.

Capital at risk. Cryptoassets are highly volatile and involve a high degree of risk. The value of investments in cryptoassets and crypto-linked ETPs may fluctuate significantly, and investors may lose part or all of their invested capital. No capital protection or guaranteed compensation mechanism applies in respect of market losses.

Any investment decision should be made solely on the basis of the relevant base prospectus, the applicable final terms and the key information document, in particular the section entitled “Risk Warning”. The base prospectus, final terms and additional risk information are available at: www.bitwiseinvestments.eu

Access to certain documents may require self-certification regarding your jurisdiction and investor status and may be subject to additional disclaimers and important information.

For further details, please refer to the full disclaimer available at: www.bitwiseinvestments.eu/disclaimer