In traditional equity markets, the Capital Asset Pricing Model (CAPM) posits a straightforward trade-off: investors demand more returns for more risk. Theoretically, higher-beta stocks should, over time, earn higher returns than their lower-beta peers.

But 50+ years ago, researchers noticed an anomaly: In practice, low-beta stocks often outperformed their higher-beta peers over time. Researchers have proposed various reasons for this, including investor preference for high-flying stocks that are well covered by the media.

But whatever the reason, the anomaly has been stubbornly persistent, and has offered savvy investors a way to get more return with less risk in their equity portfolios. As crypto emerges as a major new asset class, we've seen few studies of whether this low volatility anomaly exists in crypto. In this Crypto Market Espresso report, we aim to decipher if the Low Beta Anomaly is present and significant in crypto or not.

Key Takeaways:

- The Low Beta Anomaly is neither present nor significant.

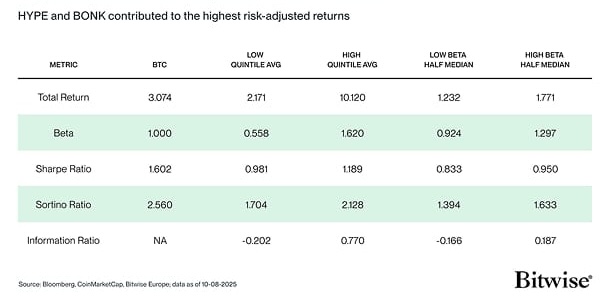

- High-beta buckets outperform low-beta buckets across all total return and risk-adjusted metrics including Sharpe Ratio, Sortino Ratio and Information Ratio.

- The Information Ratio is statistically significant but still shows that BTC outperforms high-and-low beta buckets.

Main Methodology

The universe is the top 50 cryptoassets by market cap, excluding stablecoins. Bitcoin (BTC) is the yardstick for beta, active return, and tracking error. The risk‑free benchmark is the U.S. 10‑year Treasury yield. We use daily log returns and annualize where appropriate.

We measure overall efficiency (Sharpe Ratio), downside discipline (Sortino Ratio), and benchmark‑relative risk-adjusted return (Information Ratio).

After ranking the crypto asset universe by beta, we cut the list two ways to fit the test we're running. For Welch's t-test, we compare the extremes-the lowest 20% vs the highest 20%-to see if their average results are different. For the Mann–Whitney U test, we make a simple halfway split (about 50/50) and compare the rank order of results across the two halves; keeping more tokens in each group gives this rank-based test more statistical power.

Results

Low-beta tokens underperform across all total return and risk-adjusted return ratios. In practice, that means low beta tokens may experience shallower drawdowns but fail to compound as effectively as high-beta buckets or BTC.

Due to the retail nature of the asset class, especially ex-BTC & ETH, flows clearly favour assets with visible upside optionality as depicted in the total return of memecoins and the 6–9-month craze in the lead up to and aftermath of the 2024 US election. Investors also allocated to major blue-chip assets with strong fundamentals such as Hyperliquid and Solana.

Narrative flow has clearly concentrated in high-beta leaders (e.g., top L1s and L2s such as Solana, Near, Hyperliquid; memecoins such as Doge, Pepe, Bonk, TRUMP and Pengu) compared to low-beta laggards (e.g., Bitget Token OKB, GateToken, UNUS and others). These names absorb capital in risk-on regimes and deliver outsized upside capture that supports Sharpe Ratio, Information Ratio and total return.

High Beta Buckets outperform Low Beta Buckets

Source: Bloomberg, CoinMarketCap, Bitwise Europe; data as of 10-08-2025

Source: Bloomberg, CoinMarketCap, Bitwise Europe; data as of 10-08-2025

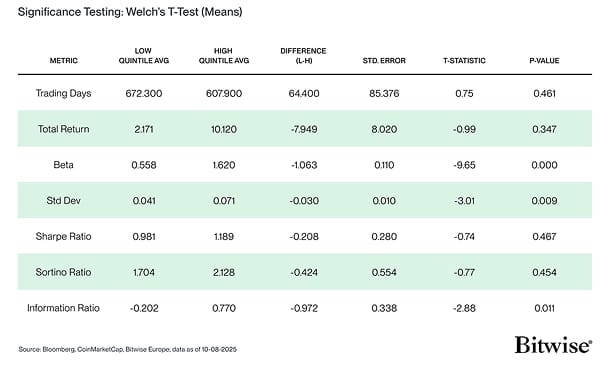

Low Beta Anomaly is not significant to crypto asset returns

Now, to address the significance of these results. The Information Ratio is benchmarked to BTC: it asks how much excess return was earned over BTC for each unit of tracking error. By judging everything relative to BTC, you strip out the broad market move that pushes most crypto assets together. That removal of the common trend lowers the noise and highlights where tokens truly differ in performance versus the benchmark.

High beta buckets still don't beat BTC's upside by a wider margin without a proportional jump in tracking error, while low-beta names tended to lag BTC yet still carried idiosyncratic risks.

That creates a cleaner separation in the Information Ratio-large enough for the tests to flag significance (≈0.05 on Welch; ≈0.01 on Mann–Whitney). Overall, only the Information Ratio was statistically significant.

By contrast, Sharpe Ratio and Sortino Ratio remain absolute measures; higher upside and higher volatility largely offset each other, so their group differences wash out and the p-values stay high.

Low Beta Anomaly is not present according to significance testing

Source: Bloomberg, CoinMarketCap, Bitwise Europe; data as of 10-08-2025

Source: Bloomberg, CoinMarketCap, Bitwise Europe; data as of 10-08-2025

Allocation Implications

BTC still provides the best exposure to risk-adjusted returns than compared to Alt coins. However, it is also clear that total returns are skewed by high-beta outliers, in the extreme splits (quintiles).

Avoid over-allocating to the “belly” of the crypto curve-neither blue chip or narrative plays; select high-beta quality such as SOL and tightly size convex exposures such as PEPE, BONK, or others, where appropriate.

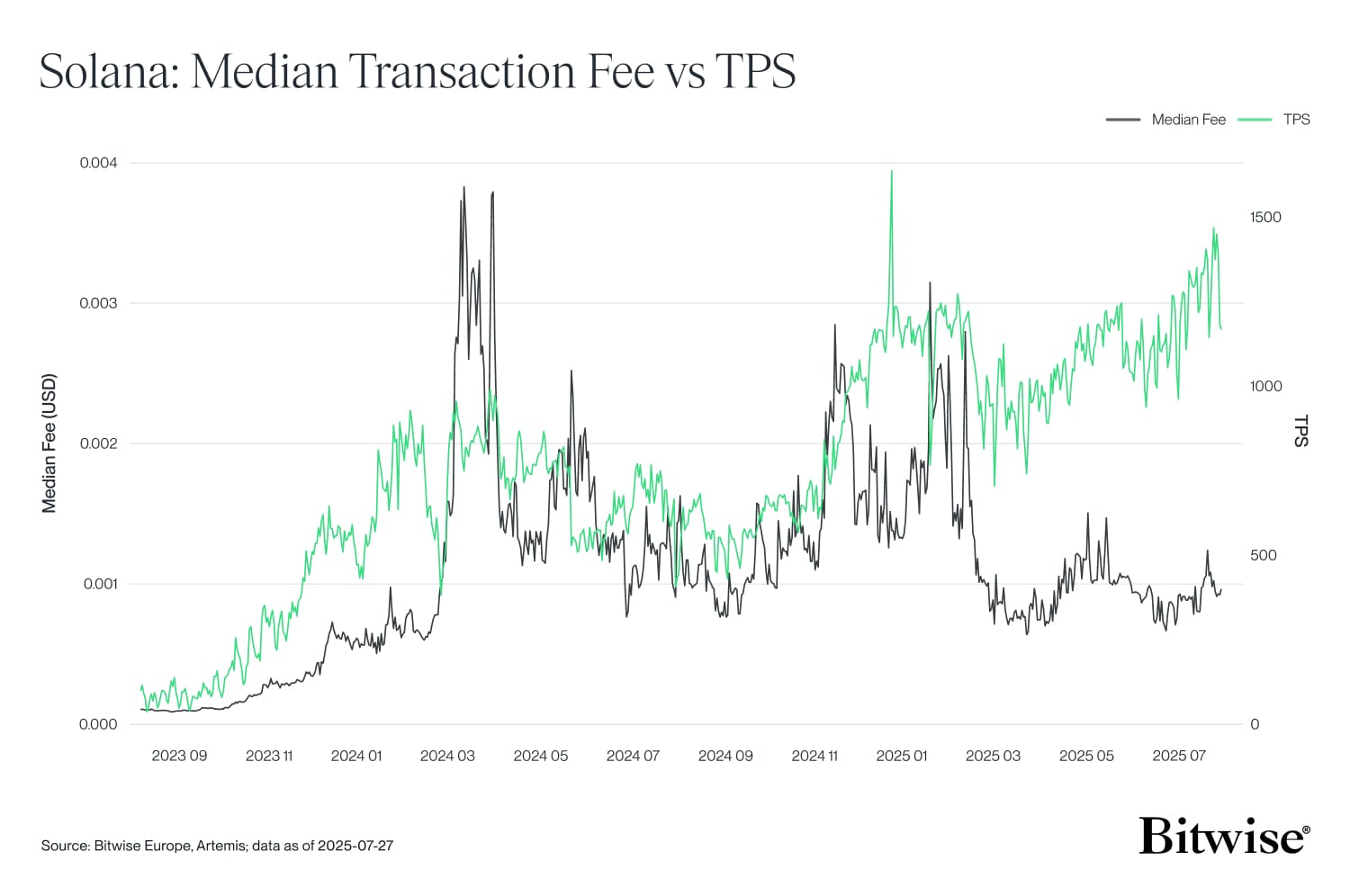

The High-Beta Quality Rebel: Solana (SOL)

SOL's outperformance sits on real “quality” supports-busy developer ecosystem, clear consumer use-cases, high throughput and reliability, deep liquidity, and strong retail mindshare. Those fundamentals help SOL turn big moves into compounding and recover faster after setbacks, even though the ride is still bumpy.

Solana has been rewarded for shipping through adversity. A clear roadmap, an aligned and active developer base, and rising product-market fit in internet-native capital markets continue to compound. Solana is positioning to serve both institutional and retail flows, with escape velocity within reach.

Solana: Median Transaction Fee vs TPS

Source: Bitwise Europe, Artemis; data as of 27-07-2025

Source: Bitwise Europe, Artemis; data as of 27-07-2025

Conclusion

In this cross-section, the low-beta anomaly does not show. Relative to a BTC benchmark, low-beta cohorts trail on total return, Sharpe, and Information Ratio, while their advantage on Sortino Ratio-most visible in the tail (quintile) splits-reflects shallower drawdowns rather than superior compounding. Welch's t-tests and Mann–Whitney U confirm the picture: the performance gap favours high beta, with median Information Ratio negative for low beta and positive for high beta. In practice, flows, leverage, and narrative intensity continue to concentrate in select high-beta assets-quality leaders and reflexive memes-leaving much of the low-beta “belly of the curve” with active risk that is not compensated by active reward.

For allocation, the implication is straightforward. If the goal is downside efficiency, a measured low-beta sleeve can lift portfolio Sortino Ratio; if the goal is outperformance versus BTC or benchmark-relative efficiency, emphasis should remain on select high-beta quality complemented by tightly sized convex exposures.

Avoid over-allocating to the belly, monitor upside/downside capture by bucket, and revisit the conclusions by regime as market structure and liquidity conditions evolve.

Important Information

This publication constitutes a marketing communication and is provided for informational purposes only. It does not constitute investment advice, a personal recommendation, or an offer or solicitation to buy or sell any financial instrument.

This document (which may take the form of a presentation, press release, social media post, blog article, broadcast communication or similar instrument – collectively referred to as a “Document”) is issued by Bitwise Europe GmbH (“BEU” or the “Issuer”) and has been prepared in accordance with applicable laws and regulations, including those relating to financial promotions.

Bitwise Europe GmbH, incorporated under the laws of Germany, is the issuer of the Exchange Traded Products (“ETPs”) referenced in this Document under a base prospectus and the applicable final terms, as supplemented from time to time, approved by the German Federal Financial Supervisory Authority (BaFin). The approval of the prospectus by BaFin relates solely to the completeness, coherence and comprehensibility of the prospectus in accordance with the Prospectus Regulation and does not constitute an endorsement, recommendation or assessment of the merits of the products.

The market analyses, views and scenarios presented reflect the assessment as of the date of publication and are based on information considered reliable. However, no representation or warranty is made as to their accuracy or completeness. Forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Past performance is not a reliable indicator of future results.

Capital at risk. Cryptoassets are highly volatile and involve a high degree of risk. The value of investments in cryptoassets and crypto-linked ETPs may fluctuate significantly, and investors may lose part or all of their invested capital. No capital protection or guaranteed compensation mechanism applies in respect of market losses.

Any investment decision should be made solely on the basis of the relevant base prospectus, the applicable final terms and the key information document, in particular the section entitled “Risk Warning”. The base prospectus, final terms and additional risk information are available at: www.bitwiseinvestments.eu

Access to certain documents may require self-certification regarding your jurisdiction and investor status and may be subject to additional disclaimers and important information.

For further details, please refer to the full disclaimer available at: www.bitwiseinvestments.eu/disclaimer