- Performance: While cryptoasset markets experienced short-term volatility over the past month due to fluctuating institutional flows and elevated geopolitical uncertainty, the dominant drivers remain macroeconomic. Easing financial conditions, robust growth prospects, fading coin-specific supply headwinds, and historically attractive valuations suggest that bitcoin and broader cryptoassets remain significantly mispriced. Once risk appetite fully reasserts itself, a substantial catch-up to macro fundamentals appears likely.

- Macro: Bitcoin’s recent underperformance versus precious metals is best explained by idiosyncratic on-chain headwinds - particularly the Long-Term Holder supply distribution and Q4 liquidation cascade - rather than any “quantum discount,” with risk-off “muscle memory” further driving investors into familiar safe havens like gold amid geopolitical uncertainty. That said, a material catch-up potential is building: the BTC/gold ratio looks underpriced versus global money supply, gold tends to lead bitcoin by 4–7 months, and a rotation from crowded precious metals into bitcoin could emerge as risk appetite returns and catalysts (policy and ETF flows) take hold into early 2026. Meanwhile, both FX and commodity markets are already sending clear signals for a renewed global reflation which, in our view, is very bullish for bitcoin.

- On-Chain: With the market experiencing its largest drawdown of the current cycle, Bitcoin investors are facing the most challenging conditions observed thus far, resulting in elevated loss-taking pressure. Despite this, both on-chain and technical valuation metrics indicate that Bitcoin is trading in a deeply undervalued state. As valuations compress to more attractive levels, demand for exposure typically increases. Once a sufficient volume of supply is absorbed by investors with a higher willingness to hold at these prices, a durable price floor can begin to form. Furthermore, Bitcoin remains under-expressive relative to both risk assets and hard-money hedges. Historically, such divergences have tended to resolve through a normalisation in relative volatility rather than through continued dislocation, although the timing of such an adjustment remains difficult to forecast.

Chart of the Month

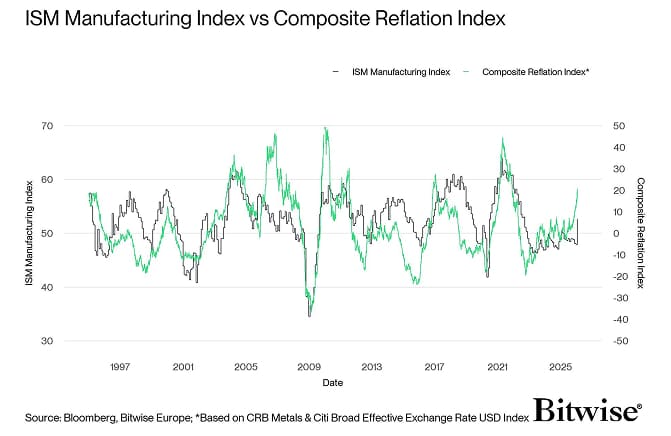

FX and Commodity Markets are sending clear reflation signals

Performance

Over the past month, cryptoasset markets were primarily driven by a dynamic interplay between macroeconomic tailwinds, shifting institutional flows, and episodic geopolitical risk. While short-term performance was volatile, the broader picture continues to point towards a macro-driven mispricing of bitcoin and other major cryptoassets relative to global liquidity conditions, economic growth prospects, and alternative stores of value such as gold.

Cryptoassets initially outperformed traditional assets amid rising geopolitical tensions, demonstrating notable resilience despite elevated headline risk. However, this outperformance proved uneven over the course of the month as institutional demand temporarily decelerated. Global crypto ETP flows fluctuated meaningfully, with phases of net outflows driven by miner supply, subdued risk appetite, and long futures liquidations, followed by a renewed acceleration in inflows towards month-end.

Importantly, the period of institutional weakness appears increasingly transitory. While net institutional demand turned negative on a 30-day basis at one point - reflecting both increased new supply and miner distribution - this coincided with historically typical behaviour near market bottoms. Subsequent weeks saw a sharp rebound in ETP inflows, reaching the highest weekly levels since October 2025, signalling a clear return of institutional risk appetite.

At the same time, on-chain dynamics have improved materially. Long-term holder selling, a major headwind throughout Q4 2025, has continued to decelerate significantly. Given that long-term holders tend to represent more sophisticated investors, the fading of this supply pressure suggests that coin-specific headwinds are gradually abating.

From a macro perspective, financial conditions have continued to ease. Federal Reserve assets have resumed an upward trend following the effective reversal of quantitative tightening, pointing to a return of de facto QE. This easing bias is further reinforced by decelerating US inflation dynamics, which grant the Fed additional policy flexibility even as economic growth remains robust.

Political developments surrounding the Federal Reserve introduced short-term volatility. Investigations related to Fed leadership and speculation around future appointments led to a weaker US dollar, new all-time highs in gold, and episodic rallies in bitcoin. While markets briefly priced in risks to Fed independence, prediction markets continue to assign a relatively low probability to disruptive leadership changes before mid-2026. Independent of political noise, the underlying liquidity impulse remains supportive for risk assets.

Geopolitical risks - most notably around Greenland and broader US trade tensions - temporarily weighed on cryptoassets and supported further gains in precious metals. However, historical evidence suggests that such geopolitical shocks tend to have only short-lived negative effects on bitcoin, with no lasting medium- to long-term impact observable in the data.

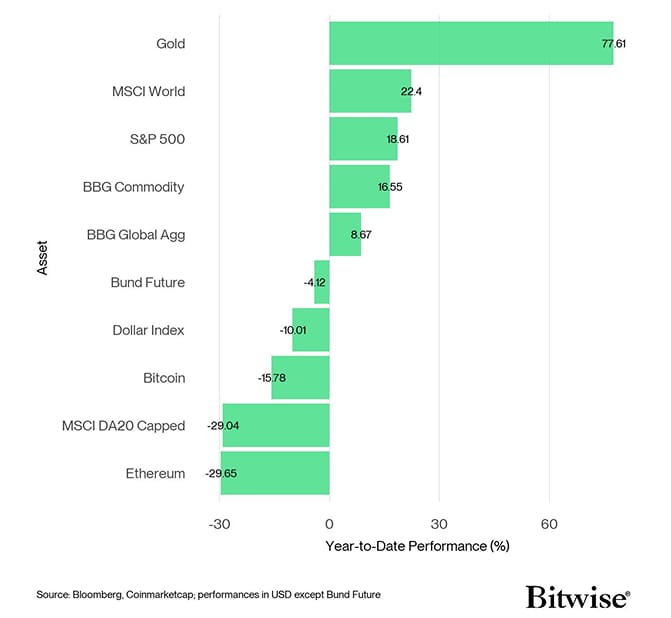

The most striking cross-asset signal remains the extreme divergence between bitcoin and gold. Despite record highs in precious metals and a weakening US dollar, bitcoin continues to trade at a historically depressed valuation relative to global money supply and gold. The BTC/gold ratio has reached levels of underpricing last observed in 2015, implying substantial relative value in bitcoin. At the same time, stretched positioning indicators in precious metals suggest that the current divergence is unlikely to persist indefinitely.

From a valuation and sentiment standpoint, conditions have become increasingly asymmetric. Bitcoin's MVRV ratio has fallen to the lowest level ever recorded on a 2-year rolling basis, effectively signalling “fire-sale” valuations. Sentiment indicators have simultaneously reached levels comparable to major capitulation events, historically associated with attractive medium-term entry points.

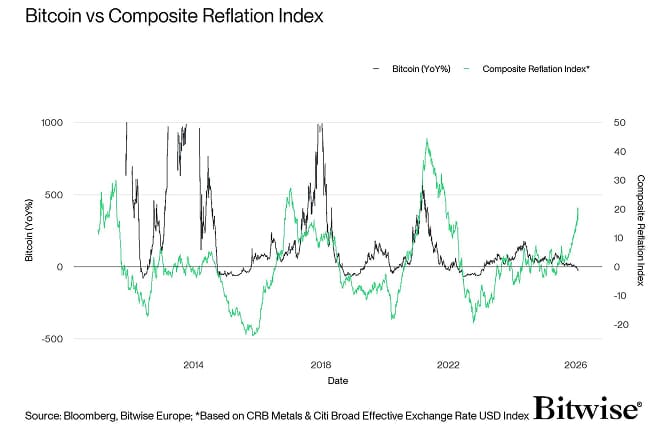

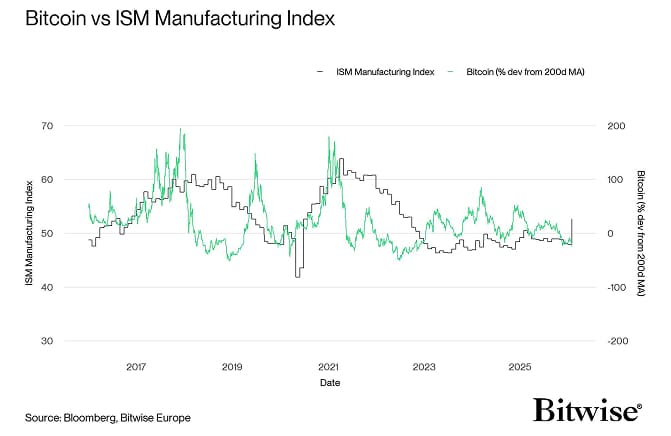

Looking ahead, the macro setup remains highly constructive. High-frequency indicators point towards a global reflationary impulse, with rising precious metals prices and improving manufacturing activity historically coinciding with bull markets in cryptoassets. Moreover, accelerating institutional adoption - particularly via ETPs - continues to underpin our expectation that crypto investment vehicles could absorb more than 100% of newly mined supply in 2026.

Cross Asset Performance (YtD)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

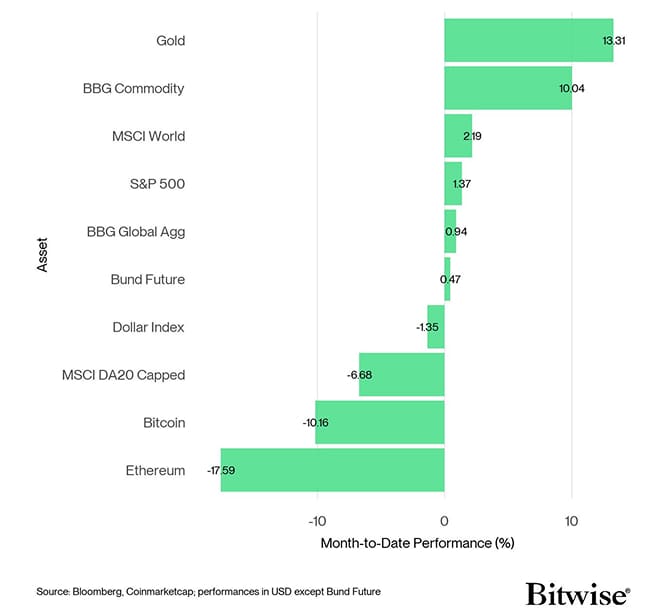

Cross Asset Performance (MtD)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Cross Asset Performance (MtD)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Bottom Line: While cryptoasset markets experienced short-term volatility over the past month due to fluctuating institutional flows and elevated geopolitical uncertainty, the dominant drivers remain macroeconomic. Easing financial conditions, robust growth prospects, fading coin-specific supply headwinds, and historically attractive valuations suggest that bitcoin and broader cryptoassets remain significantly mispriced. Once risk appetite fully reasserts itself, a substantial catch-up to macro fundamentals appears increasingly likely.

Macro Environment

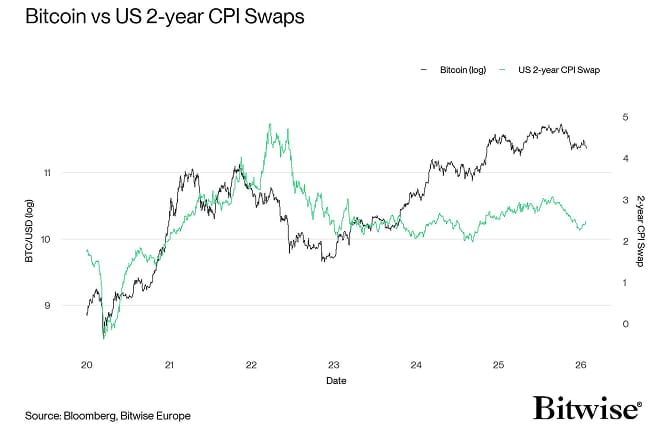

A key macro theme among investors remains the debasement trade and hedge against inflation.

The meteoric rise of precious metals in particular gold and silver has left many crypto investors puzzled as to why bitcoin has so far failed to participate in the rally.

Popular explanations mostly centre around the thesis that, unlike bitcoin, gold is not exposed to a potential quantum risk and that there might be a “quantum discount” present in the price of bitcoin.

However, this thesis is flawed since essentially all major crypto assets are exposed to quantum risk eventually. However, the fact that Bitcoin Cash (BCH) has outperformed Bitcoin (BTC) although it is also exposed to the same risks implies that the underperformance is not related to “quantum risk” but rather other idiosyncratic factors. Note that we generally believe that quantum computing is not an existential risk for the Bitcoin network as highlighted here .

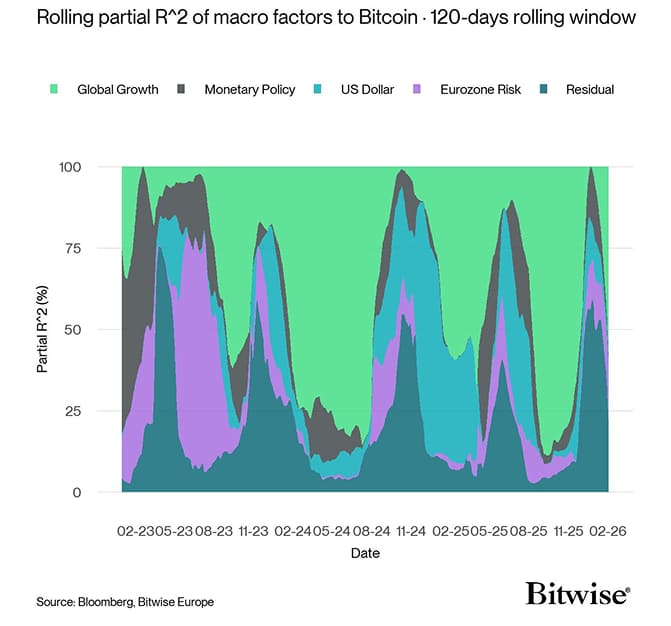

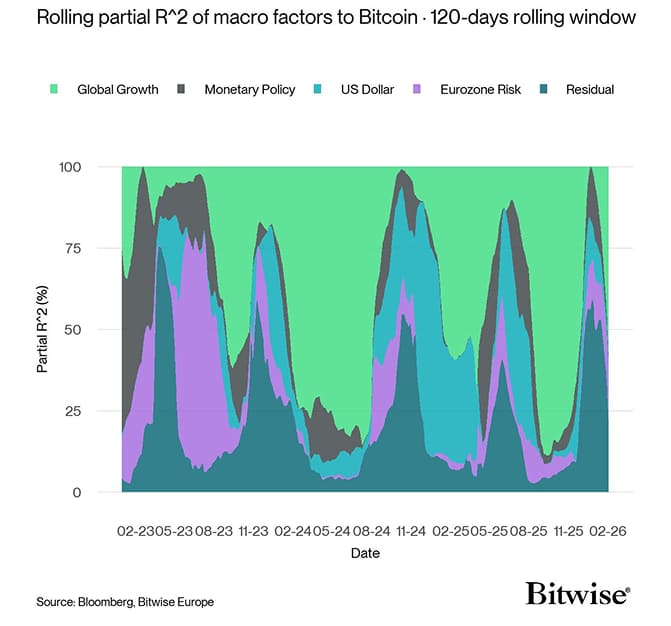

In general, bitcoin performance over the past 6 months has been mostly explained by non-macro factors (read: idiosyncratic / coin-specific factors).

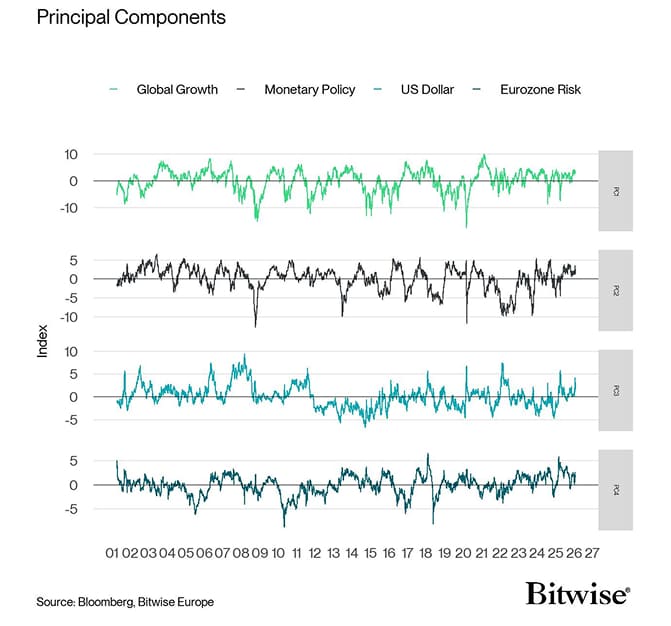

How much of Bitcoin's performance can be explained by macro factors?

Source: Bloomberg, Bitwise Europe

Source: Bloomberg, Bitwise Europe

Therefore, we believe that negative on-chain headwinds (idiosyncratic factors) especially the Long-Term Holder supply distribution and subsequent liquidation cascade in Q4 have most-likely played the key role in explaining the recent underperformance and divergence. Note that Long-Term Holders (LTHs) are defined as investors who have held at least 155 days.

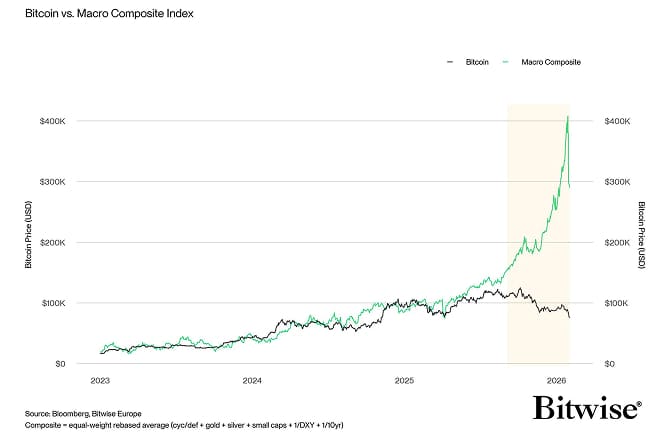

This is also consistent with the observation that bitcoin hasn't only created an underpricing relative to gold but also other major traditional assets as highlighted by the following chart:

Our simple explanation for the most recent underperformance of bitcoin vis-à-vis gold is that, during times of uncertainty, investors exhibit a kind of “muscle memory” and resort to those assets that they are familiar with – in our case, gold.

Increasing geopolitical uncertainty has so far weighed on riskier assets like bitcoin and buoyed traditional safe haven assets like gold.

That being said, we believe that a significant catch-up potential in bitcoin is continuing to build, especially relative to gold.

From our perspective, a potential rotation from gold and other precious metals to bitcoin remains the “elephant in the room” due to its potentially very sizeable performance effect on bitcoin.

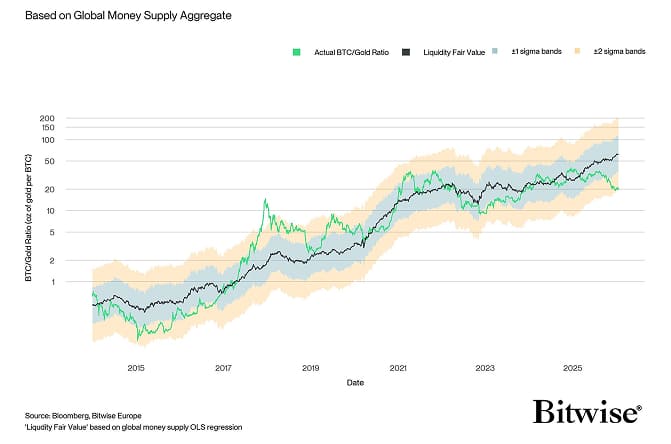

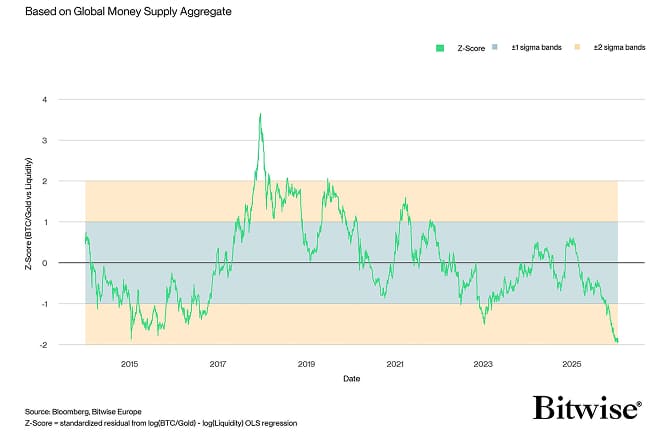

Firstly, the bitcoin/gold-ratio is now underpricing the trajectory of global money supply by 2 standard deviations – the BTC/Gold ratio is at 16 Oz. although the “fair value” implied by the model is around 50 Oz. per BTC.

We have highlighted a significant degree of underpricing by bitcoin relative to global money supply in our previous edition of the Bitcoin Macro Investor as well.

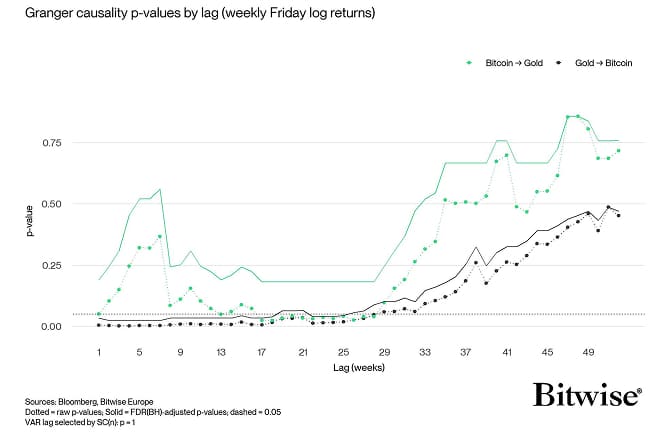

Moreover, Granger causality tests imply that gold tends to move first before bitcoin but not the other way around.

More specifically, gold's performance tends to lead Bitcoin's performance by 4-7 months. This implies that we should expect a catch-up to start possibly in Q1 2026 already.

Key to understand why gold is leading bitcoin is connected to monetary policy and financial conditions. Gold tends to be a leading indicator for the stance of monetary policy as it used to correlate very well with medium-term real yields. In that context, gold is already signalling deeply negative real yields and very loose financial conditions which tend to affect bitcoin with a lag.

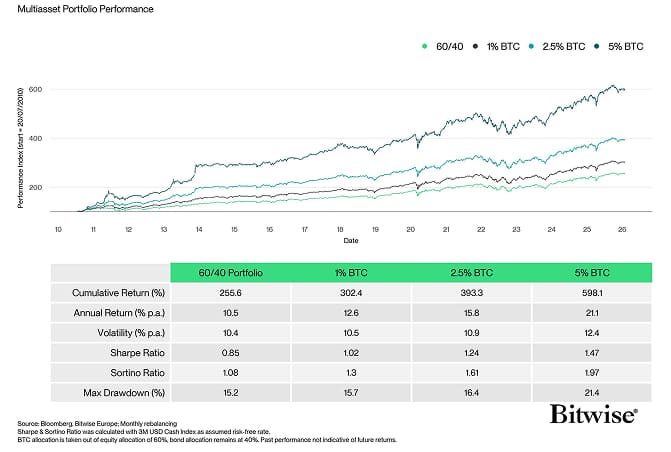

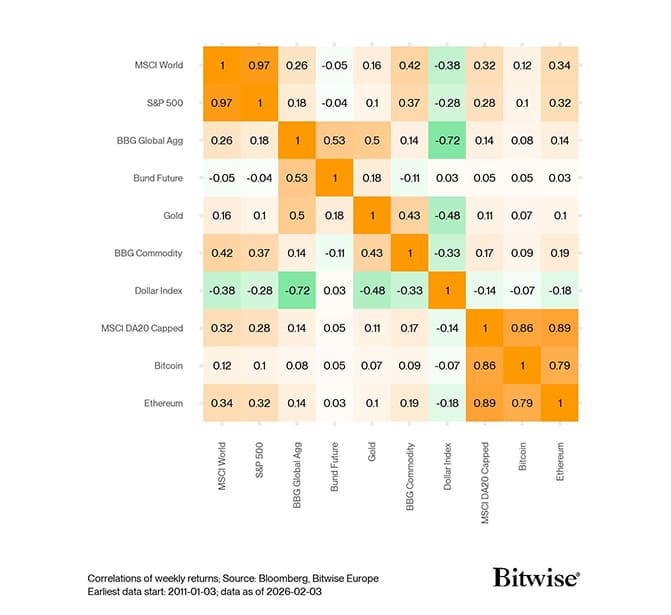

Besides, from a pure portfolio perspective, it is worth combining both bitcoin and gold into a traditional multi asset portfolio as highlighted in one of our recent CIO Memos .

What could be the catalyst for a rotation into bitcoin?

A key view which we have voiced in our previous Bitcoin Macro Investor reports as well is that bitcoin is essentially pricing in a recession which will most likely NOT materialise.

- Our macro thesis remains that once positive risk appetite returns and idiosyncratic headwinds dissipate, bitcoin's pricing should catch up to these rather positive macro expectations.

In addition, we have identified a couple of positive catalysts in our latest Quarterly Review as well, most notably the initial wirehouse ETF flows from Q4 approvals in the US.

Another potential macro catalyst could be renewed QE by the Bank of Japan and possibly other central banks amid negative spillovers from the frothy JGB market to other major sovereign bond markets.

In truth, the Japanese JGB market is increasingly showing signs of illiquidity which amid capital flight and Yen depreciation which implies an increasing likelihood for large-scale central bank interventions. We imagine that the Japanese bond market could experience a similar scenario like the UK Gilt market in September 2022.

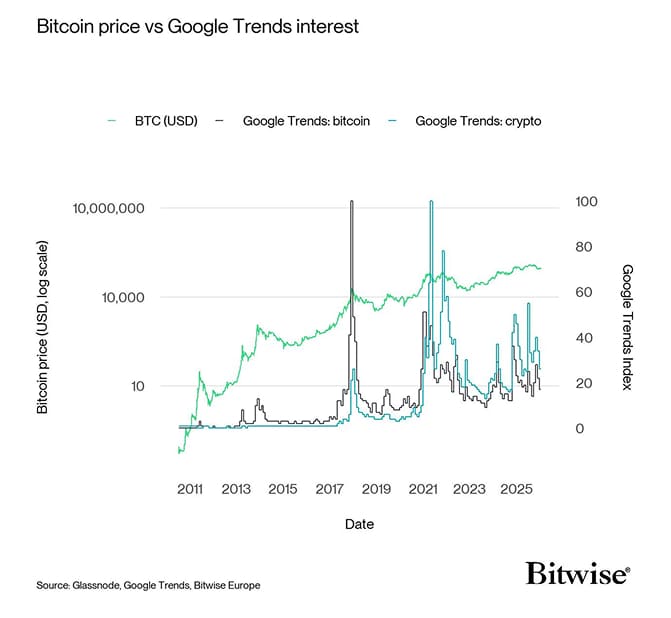

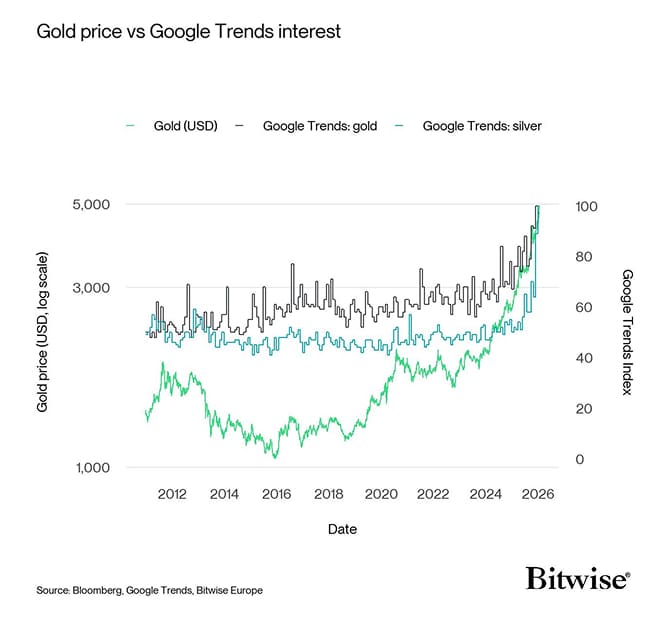

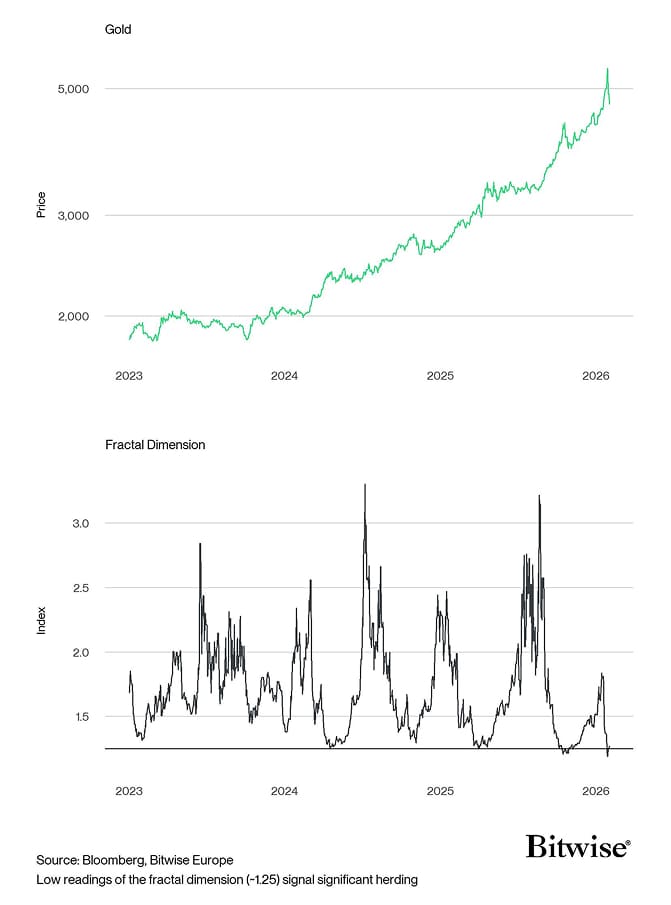

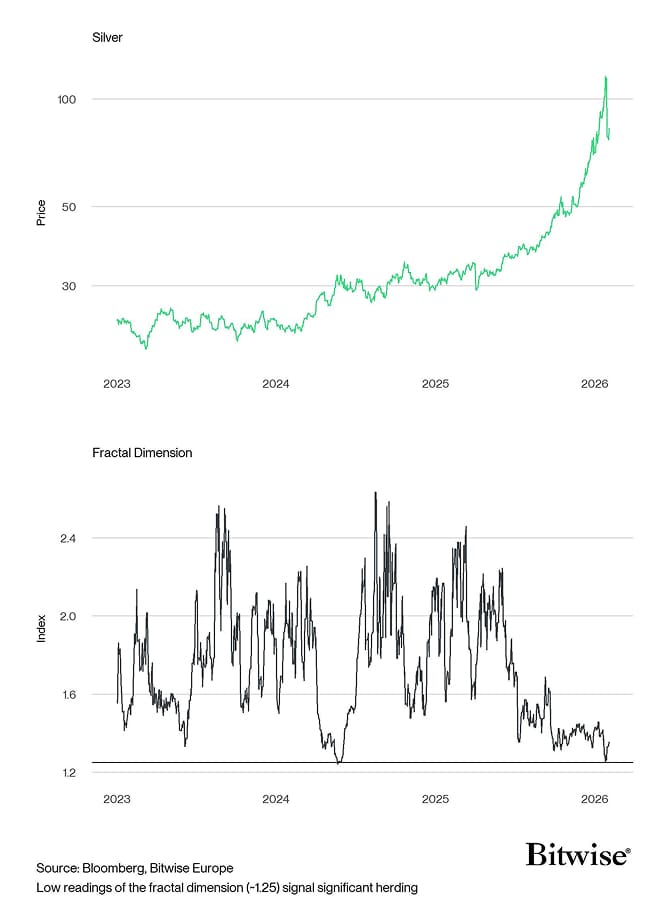

In any case, the rally in gold and silver appear to be long in the tooth and show signs of unsustainable herding.

These can be seen in relative Google search trends for “gold” and “silver” relative to “bitcoin” or “crypto” which implies max attention on precious metals but almost no attention on bitcoin and crypto assets.

In fact, the fractal dimension in both gold and silver already imply a significant degree of herding and have flashed a contrarian sll signal for both precious metals. This is consistent with the most recent price correction as well:

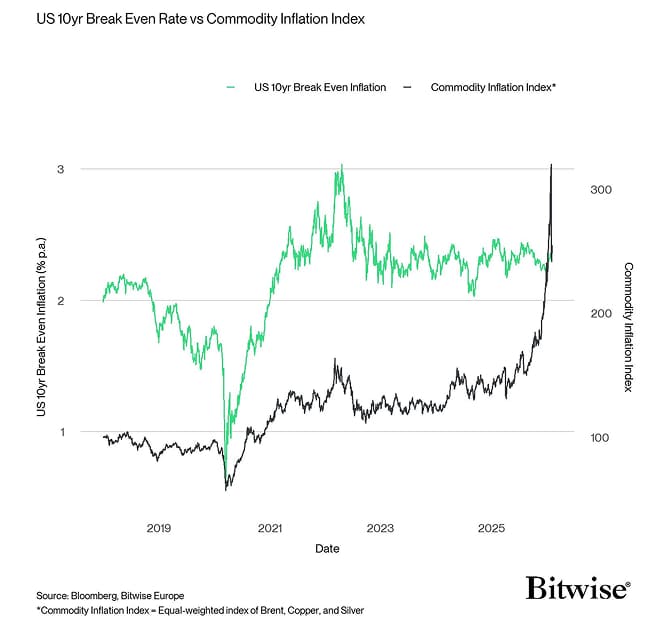

That being said, the rally in precious metals is a warning sign for a potentially material increase in market-based inflation expectations which could lead to further increases in bond yields.

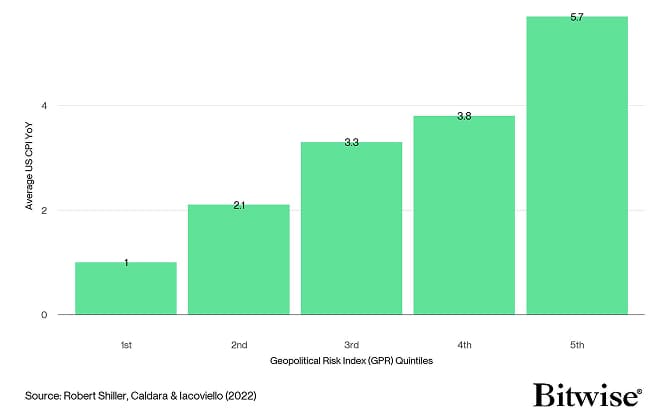

In fact, periods of elevated geopolitical risk are historically associated with high inflation. The signal from precious metals is that this environment is already being anticipated.

A key point to note here is that Bitcoin's price has been positively associated with market-based inflation expectations, especially since Covid. So, any spike in inflation expectations is generally a net tailwind for bitcoin.

Another key point to make here is that high-frequency indicators for inflation such as the one published by Truflation currently signal a significant decline in headline inflation over the coming months.

Moreover, US money supply dynamics also imply no significant reacceleration in inflation dynamics in the near future.

Seen from this angle, we might be looking at a “goldilocks scenario” with high growth and relatively low inflation rates in the US which could prolong the business cycle well into 2026 et seqq.

That being said, the latest inflation dynamic could potentially be exacerbated by

- Additional Fed rate cuts and further yield curve steepening and money supply growth

- Structural Dollar weakness

- Further increasing geopolitical risks and recovery in commodity prices, especially energy

On the point of structural Dollar weakness, there is an ongoing decline in the share of the US Dollar in international FX reserves. What is more is that the decline has recently started to accelerate even more based on newly available high-frequency data. While the %-share needed 22 years to decline by 10%-points from 2000 to 2022, it has only needed an additional 3 years to decline by another 10%-points. In other words, De-Dollarization has recently accelerated by more than previously anticipated. This is generally a tailwind for bitcoin as recently highlighted in one of our previous Bitcoin Macro Investor reports.

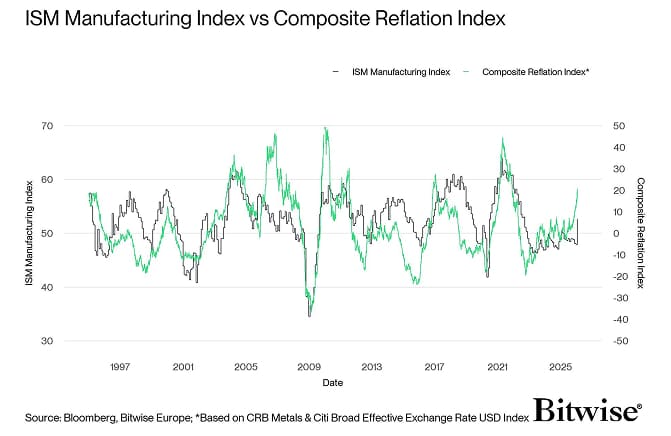

What is even more apparent is that both commodity and FX markets are sending clear reflation signals. Not only precious metals have been rallying significantly but also industrials metals like copper have recently reached new all-time highs as well. At the same the time, the US Dollar Index (DXY) has fallen to a fresh 4-year low.

Our take is that this global reflationary impulse is originating from China, not the US, judging by the amount of credit creation happening in China right now.

Both of these signals should be taken seriously be investors since they imply a renewed reflation and reacceleration in ISM Manufacturing Index and a prolonged US business cycle. In our view, these developments are bullish for bitcoin since it tends to cycle with the ISM Manufacturing Index as well.

img In any case, professional investors should not be too complacent with respect to the inflation outlook and should contemplate effective strategies to hedge against such a scenario.

Bottom Line: Bitcoin's recent underperformance versus precious metals is best explained by idiosyncratic on-chain headwinds - particularly the Long-Term Holder supply distribution and Q4 liquidation cascade - rather than any “quantum discount,” with risk-off “muscle memory” further driving investors into familiar safe havens like gold amid geopolitical uncertainty.

That said, a material catch-up potential is building: the BTC/gold ratio looks underpriced versus global money supply, gold tends to lead bitcoin by 4–7 months, and a rotation from crowded precious metals into bitcoin could emerge as risk appetite returns and catalysts (policy and ETF flows) take hold into early 2026.

Both FX and commodity markets are already sending signals for a renewed global reflation which, in our view, is bullish for bitcoin.

On-Chain Developments

Bitcoin Diverges from Macro Peers

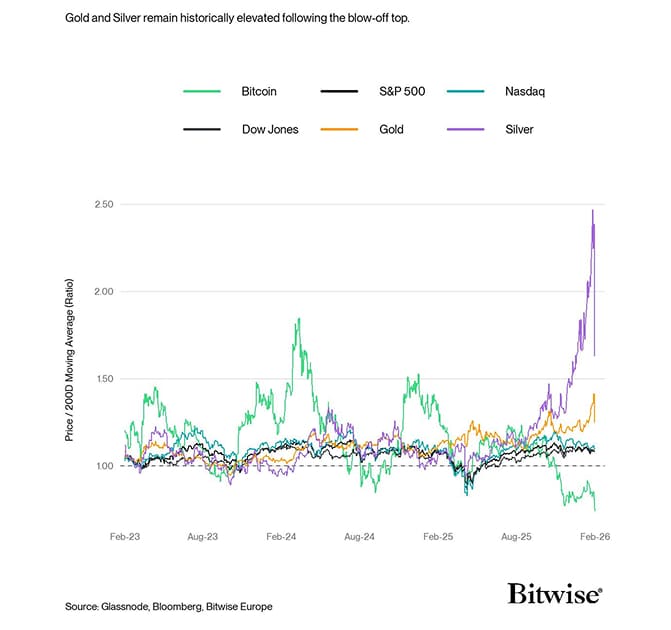

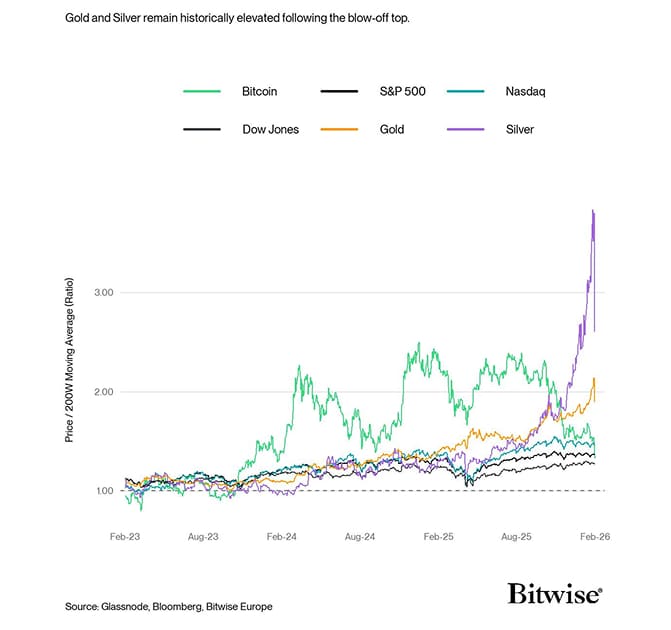

Amid elevated geopolitical risk and persistent macro uncertainty, capital has increasingly rotated toward assets offering protection from monetary debasement and systemic instability. This environment initially supported a strong advance across hard-money assets, with gold leading and higher-beta counterparts such as silver significantly outperforming. Risk equities also continued to trend higher in parallel.

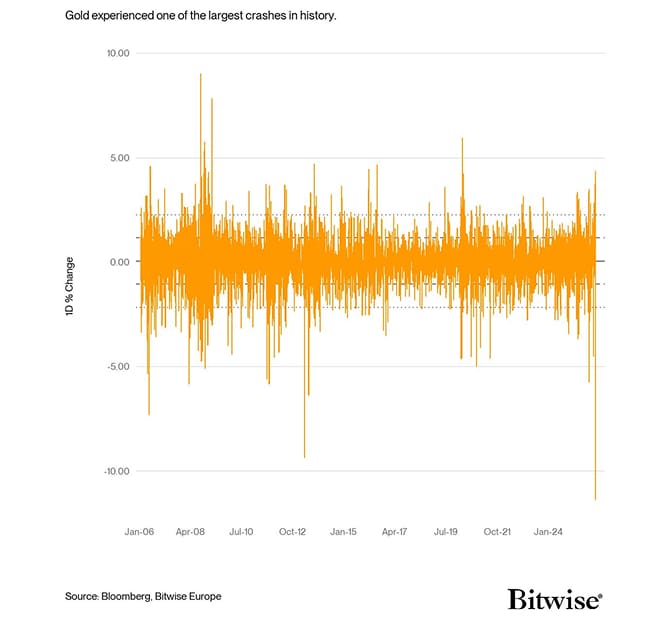

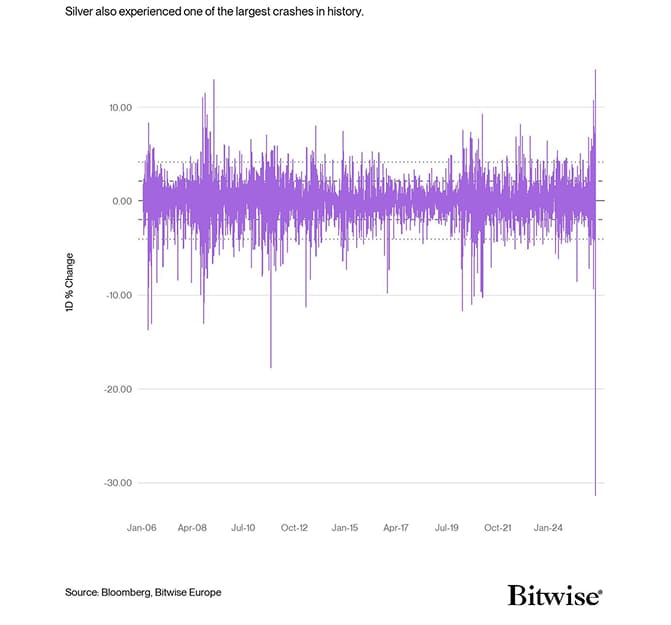

However, following an extended period of parabolic appreciation, the precious metals complex has undergone a sharp mean reversion, with both gold and silver recording some of the largest short-term drawdowns on record. Bitcoin, which had remained comparatively muted during the upside phase, has since experienced a notable price contraction as well.

Notably, gold experienced its largest drawdown of the past 20 years, declining by 11.4%.

In parallel, silver experienced an even more severe dislocation, registering a 31.4% single-day decline, the largest move observed over the same period.

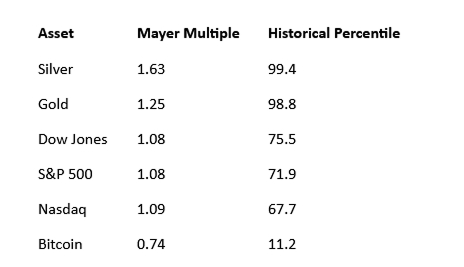

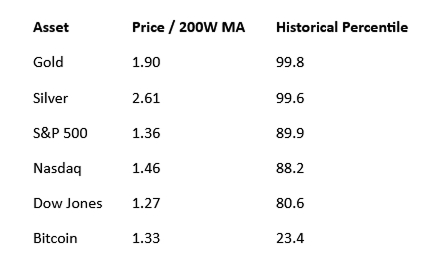

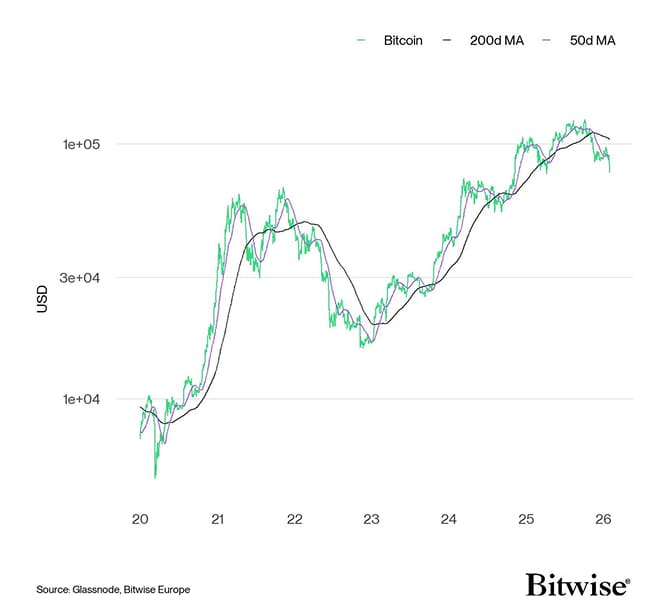

Despite the broad-based pullback, momentum conditions remain materially divergent across asset classes. To quantify this, we apply the Mayer Multiple, defined as the ratio between spot price and the 200-day moving average. This metric is commonly used to assess trend strength and regime positioning. By contextualising the Mayer Multiple within its historical distribution, we can compare relative momentum across markets.

In spite of the recent correction, precious metals continue to trade at extreme historical percentiles, indicating an overhang of overvaluation. Major U.S. equity indices also persist in relatively stretched regimes. In contrast, Bitcoin is positioned near the 11th historical percentile of its Mayer Multiple, underscoring pronounced relative underperformance versus both hard-money assets and risk equities from a medium-term trend perspective.

We can extend this framework by examining the ratio between spot price and the 200-week moving average, offering a longer-duration perspective on trend positioning and relative valuation.

This longer-duration lens reinforces the divergence observed across shorter time horizons. Precious metals continue to trade at extreme historical percentiles, while U.S. equity indices remain elevated relative to long-term trend baselines. In contrast, Bitcoin persists near the lower quartile of its historical valuation range, indicating comparatively subdued positioning on a multi-year basis.

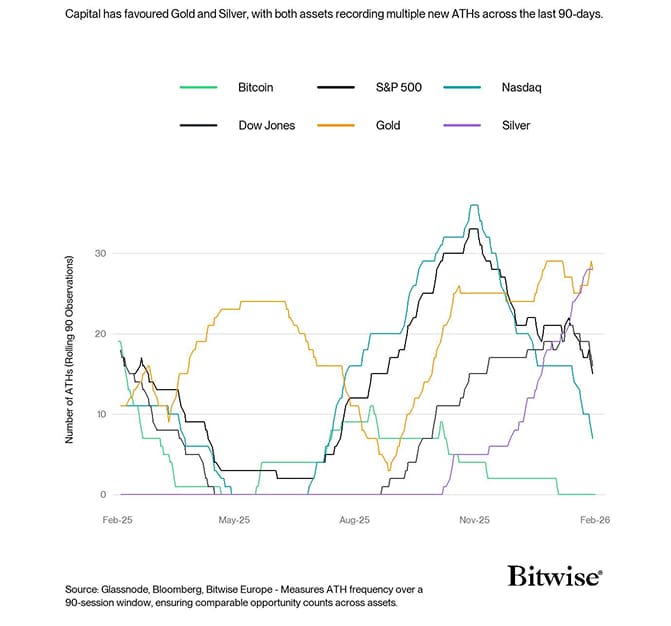

Another perspective through which to assess the divergence between digital assets, equities, and precious metals is the frequency of rolling all-time highs (ATHs) over a 90-day window. This metric captures the persistence of price discovery and the consistency of upside momentum.

Across both precious metals and major equity indices, ATH occurrences have been frequent, signalling sustained capital inflows and elevated conviction. Bitcoin, by contrast, has failed to register a single ATH over the same observation period.

- Silver: 28 ATHs

- Gold: 28 ATHs

- S&P 500: 16 ATHs

- Dow Jones: 15 ATHs

- Nasdaq: 7 ATHs

- Bitcoin: 0 ATHs

The resulting disparity underscores that price discovery and investor conviction have been expressed across both hard-money assets and risk equities, while Bitcoin remained entirely absent from the recent regime of upside expansion.

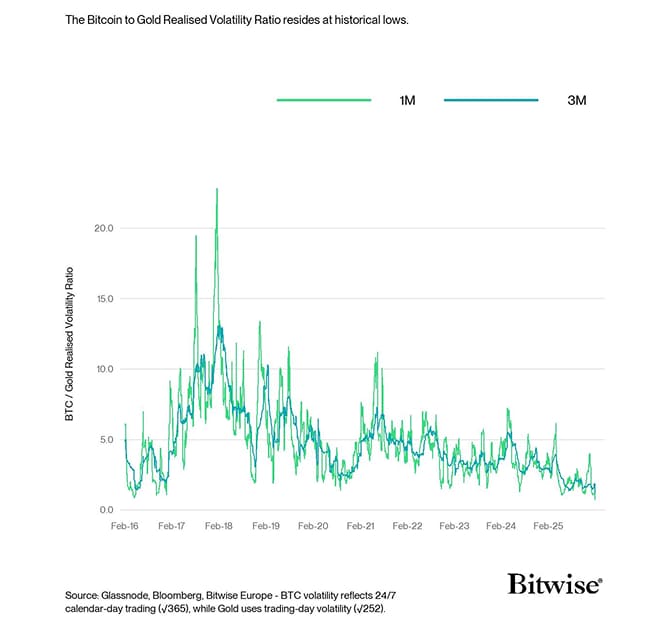

Interestingly, Bitcoin volatility relative to gold has compressed to extreme historical lows. The BTC-to-gold realised volatility ratio, measured across both 1-month and 3-month horizons, now sits at the lower bound of its historical distribution.

- 1M BTC / Gold Volatility Ratio: 0.74 (0.03rd percentile)

- 3M BTC / Gold Volatility Ratio: 1.22 (0.03rd percentile)

This divergence reflects the interaction of two forces: a sharp expansion in realised volatility across gold markets, alongside only a modest uptick in Bitcoin volatility. The net effect is a pronounced under-reaction in Bitcoin during a period of heightened macro uncertainty, with its volatility remaining largely decoupled from both macro-hedge dynamics and broader risk-asset regimes.

Taken together, Bitcoin appears underpriced relative to both equities and hard assets from both a valuation and volatility perspective. The collapse in the BTC-to-gold realised volatility ratio highlights gold's role as the primary macro hedge in the current environment. The magnitude of this separation points to an asymmetric market structure in which Bitcoin is under-expressing prevailing market conditions. Historically, such divergences have tended to resolve through a normalisation in relative volatility rather than through continued dislocation.

Investor Stress Reaches Cycle Extremes

With the Bitcoin market under the greatest degree of pressure observed this cycle, we examine current investor sentiment and how market participants are responding to these conditions.

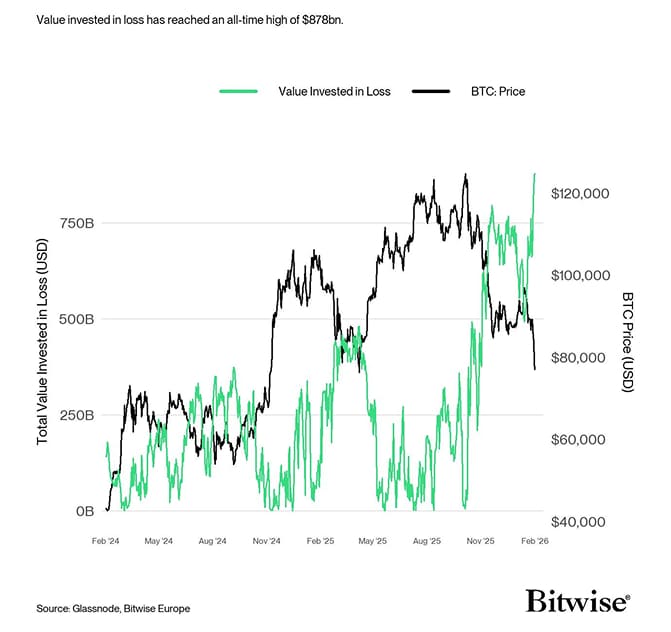

Investor stress has intensified materially. The aggregate value of capital held at an unrealised loss has risen to a new all-time high of approximately $873B, accounting for 78% of total invested capital. Historically, only 20% of trading days have recorded a greater share of capital underwater, underscoring the severity of financial stress currently experienced by market participants.

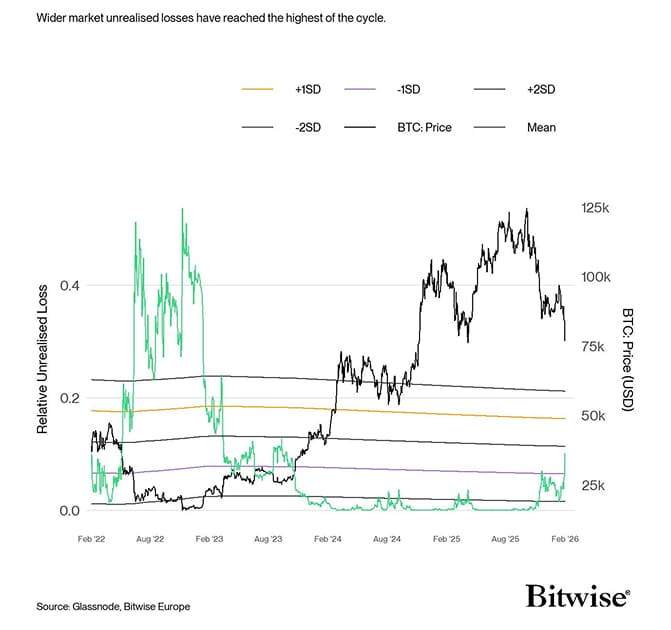

Furthermore, the Relative Unrealised Loss metric, which normalises the aggregate paper losses held by investors by the total market capitalisation, has also risen sharply to its highest reading of the cycle. At present, Relative Unrealised Loss are equivalent to 10% of the market cap, approaching its long-term mean of 11.4%. Historically, sustained elevations beyond this threshold have coincided with the onset of late-stage bear market conditions, suggesting that further deterioration from current levels would signal increasing downside risk.

Taken together, these sentiment indicators suggest investors are experiencing the most severe stress since the 2021–2022 bear market.

After establishing that investors are under the most pressure experienced this cycle, we turn to loss taking metrics to assess how they reacted. Unsurprisingly, realized losses has spiked to a value of $3.4bn when summed over the last week, its second largest capitulation of the cycle.

Notably, this remains lower than the initial Nov 2025 crash. The decline in loss taking suggests an increasing resilience within the range, with many investors opting to de-risk during the first contraction.

While Short-Term Holders remain the primary source of realised losses (74%), Long-Term Holder losses are also rising (26%), suggesting that higher-cost buyers from the past two years are beginning to capitulate, behaviour typically observed in deeply depressed market conditions.

_thumb.jpg)

When measured in BTC terms, thereby normalising for market growth and enabling cross-cycle comparison, loss throughput remains elevated at approximately 6.3k BTC, positioning it in the 73.5th historical percentile.

_thumb.jpg)

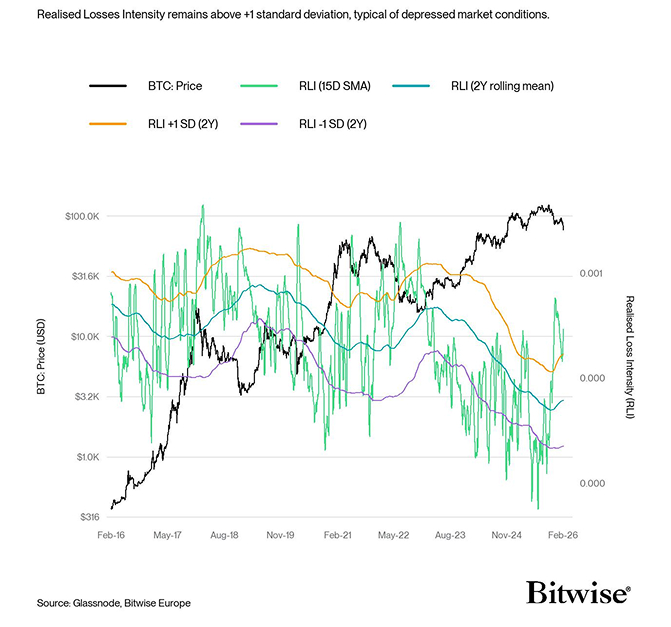

Furthermore, the Realized Loss Intensity metric offers a robust lens for assessing the magnitude of realised losses relative to the total value invested in the network. By normalising realised losses against the Realised Cap, the metric measures capital outflows as a proportion of the network's capital base.

At present, Realized Loss Intensity remains elevated above its +1σ band, indicating that loss-taking pressure is still pronounced. Historically, sustained breaches of this threshold have aligned with periods of heightened capitulation.

However, the absolute magnitude remains below that observed during prior macro capitulation events, suggesting that downside stress may yet intensify before a durable inflection is established.

Looking Ahead

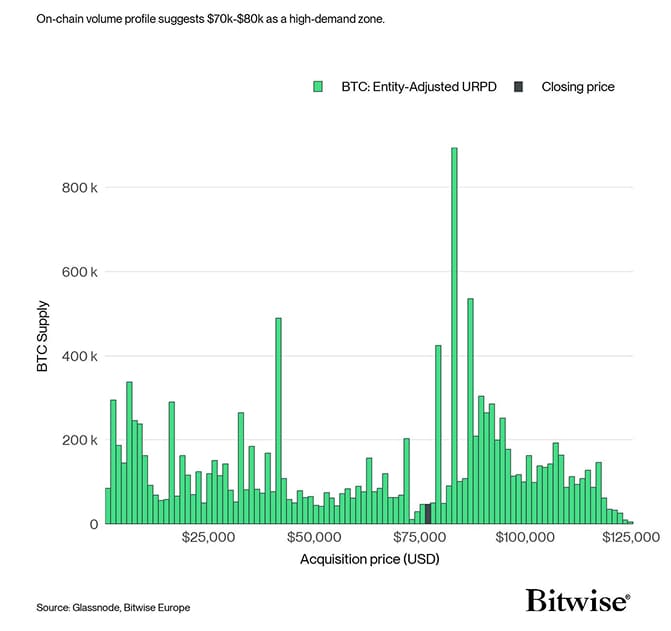

Bitcoin is currently trading between an air-gapped price region spanning $70k and $80k, an area where historical on-chain activity indicates limited coin activity. This is mirrored in market structure, with price spending relatively little time trading within this zone. Such low-volume regions are frequently revisited, as the market seeks to re-establish demand and test liquidity. A constructive outcome would involve sustained absorption across this range, characterised by coins migrating from weaker to stronger hands.

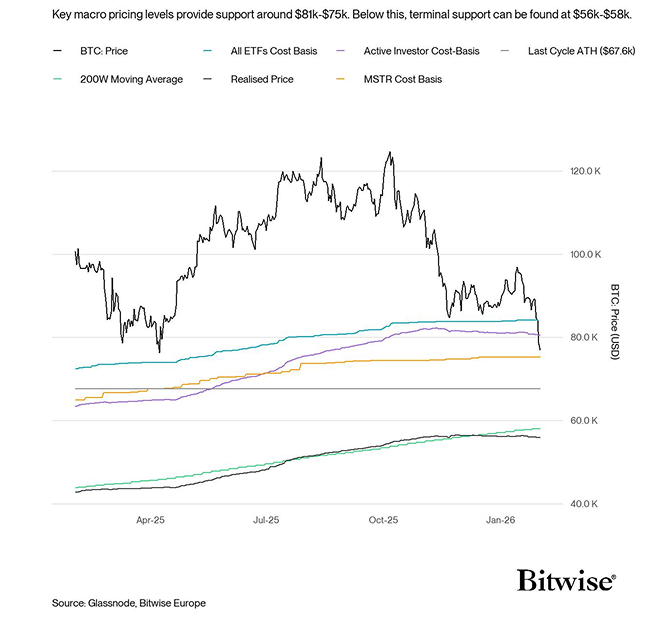

When assessing macro pricing levels, the market is currently trading between a confluence of on-chain, ETF, and treasury company cost-basis anchors. These include the True Market Mean, which approximates the average active investor purchase price, alongside the ETF average cost basis and the MSTR cost basis. Collectively, these levels cluster within the $75k–$81k range. Additional structural support is reinforced by the prior cycle all-time high near $68k, as well as the 2024 consolidation zone at the lower bound of this range. Taken together, the broader $70k–$80k region represents the highest-probability zone for a market bottom to form.

However, markets remain inherently difficult to forecast, particularly amid a rapidly evolving geopolitical and macroeconomic backdrop. In the event of further downside expansion, the Realised Price at $56k and the 200-week moving average at $58k define the most probable region for terminal downside in a full capitulation scenario.

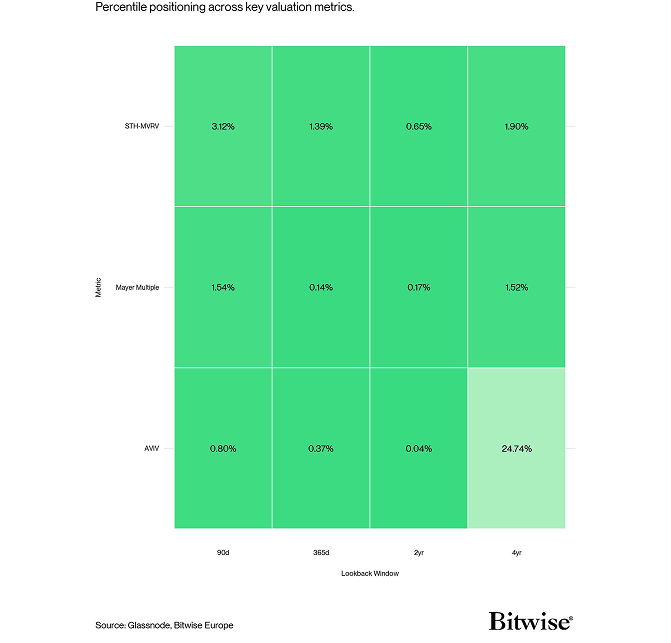

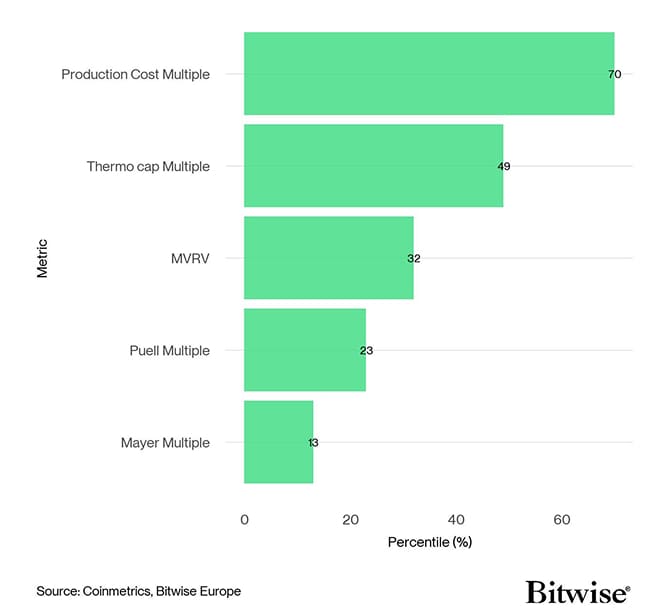

With investors facing the most challenging market conditions of the current cycle, we revisit a set of key technical and on-chain valuation metrics to assess whether Bitcoin is trading at discounted levels and to uate potential opportunity. The following indicators form the basis of this assessment:

- The Mayer Multiple, a widely referenced momentum metric, which often delineates the boundary between long-term trend expansion and contraction.

- The AVIV Ratio, which measures the average unrealised profit or loss held by active investors, providing insight into the degree of stress or euphoria experienced by the typical market participant.

- STH-MVRV, which captures the average profit or loss held by recent buyers and has historically acted as a regime boundary between local bullish and bearish conditions.

Notably, the Z-score percentiles across these metrics indicate that the market is trading at deeply discounted levels, with only the 4-year Z-score of the AVIV Ratio registering a moderately elevated percentile. Taken together, this suggests that Bitcoin is positioned within a substantially undervalued regime across multiple time horizons, a condition that has historically occurred infrequently.

Bottom Line

With the market experiencing its largest drawdown of the current cycle, Bitcoin investors are facing the most challenging conditions observed thus far, resulting in elevated loss-taking pressure. Despite this, both on-chain and technical valuation metrics indicate that Bitcoin is trading in a deeply undervalued state. As valuations compress to more attractive levels, demand for exposure typically increases. Once a sufficient volume of supply is absorbed by investors with a higher willingness to hold at these prices, a durable price floor can begin to form.

Furthermore, Bitcoin remains under-expressive relative to both risk assets and hard-money hedges. Historically, such divergences have tended to resolve through a normalisation in relative volatility rather than through continued dislocation, although the timing of such an adjustment remains difficult to forecast.

Bottom Line

- Performance: While cryptoasset markets experienced short-term volatility over the past month due to fluctuating institutional flows and elevated geopolitical uncertainty, the dominant drivers remain macroeconomic. Easing financial conditions, robust growth prospects, fading coin-specific supply headwinds, and historically attractive valuations suggest that bitcoin and broader cryptoassets remain significantly mispriced. Once risk appetite fully reasserts itself, a substantial catch-up to macro fundamentals appears likely.

- Macro: Bitcoin’s recent underperformance versus precious metals is best explained by idiosyncratic on-chain headwinds - particularly the Long-Term Holder supply distribution and Q4 liquidation cascade - rather than any “quantum discount,” with risk-off “muscle memory” further driving investors into familiar safe havens like gold amid geopolitical uncertainty. That said, a material catch-up potential is building: the BTC/gold ratio looks underpriced versus global money supply, gold tends to lead bitcoin by 4–7 months, and a rotation from crowded precious metals into bitcoin could emerge as risk appetite returns and catalysts (policy and ETF flows) take hold into early 2026. Meanwhile, both FX and commodity markets are already sending clear signals for a renewed global reflation which, in our view, is very bullish for bitcoin.

- On-Chain: With the market experiencing its largest drawdown of the current cycle, Bitcoin investors are facing the most challenging conditions observed thus far, resulting in elevated loss-taking pressure. Despite this, both on-chain and technical valuation metrics indicate that Bitcoin is trading in a deeply undervalued state. As valuations compress to more attractive levels, demand for exposure typically increases. Once a sufficient volume of supply is absorbed by investors with a higher willingness to hold at these prices, a durable price floor can begin to form. Furthermore, Bitcoin remains under-expressive relative to both risk assets and hard-money hedges. Historically, such divergences have tended to resolve through a normalisation in relative volatility rather than through continued dislocation, although the timing of such an adjustment remains difficult to forecast.

Appendix

Cryptoasset Market Overview

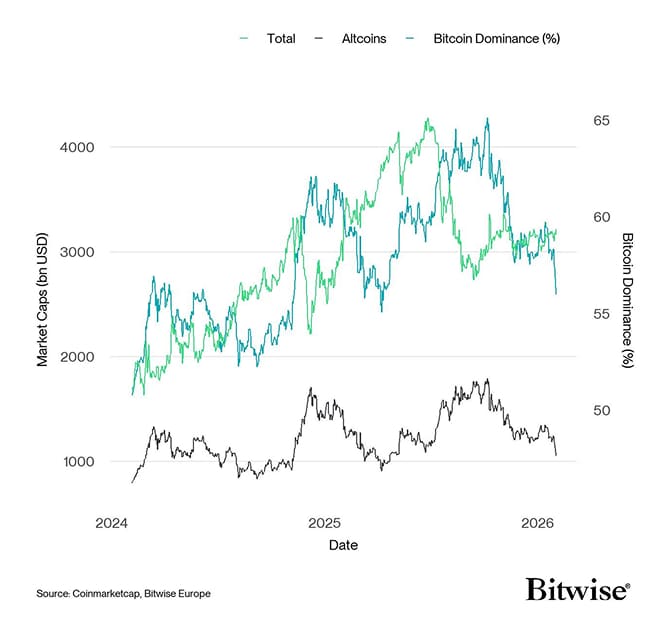

Global Cryptoasset Market Caps

Source: Glassnode, Bitwise Europe

Bitcoin Performance

Source: Glassnode, Bitwise Europe

Bitcoin Performance

Source: Glassnode, Bitwise Europe

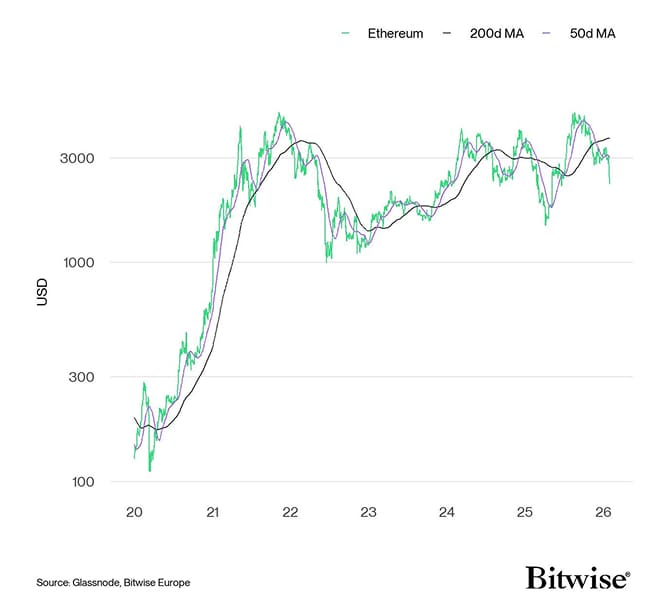

Ethereum Performance

Source: Glassnode, Bitwise Europe

Ethereum Performance

Source: Glassnode, Bitwise Europe

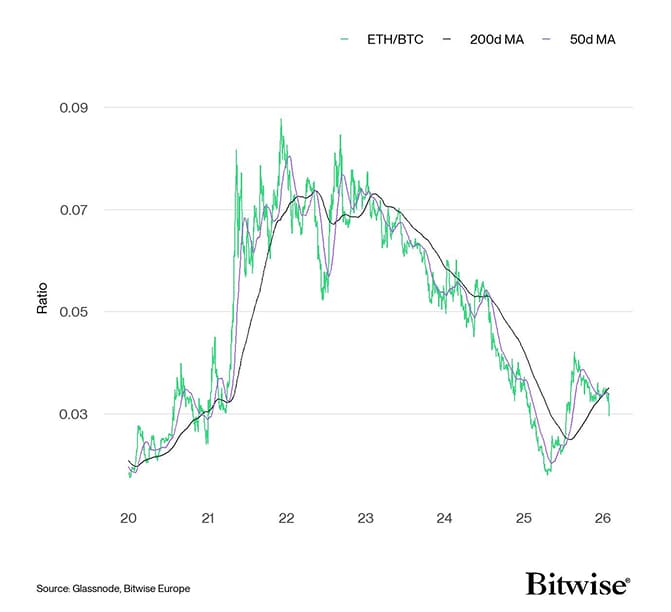

Ethereum vs Bitcoin Relative Performance

Source: Glassnode, Bitwise Europe

Ethereum vs Bitcoin Relative Performance

Source: Glassnode, Bitwise Europe

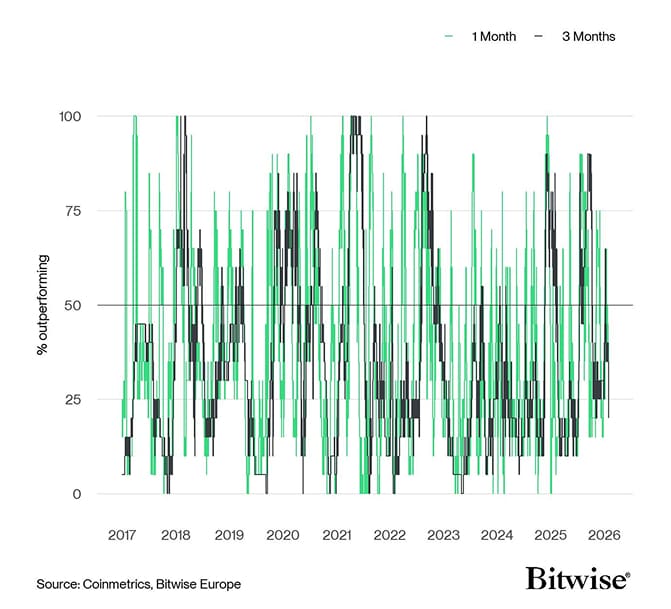

Altseason Index

Source: Glassnode, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

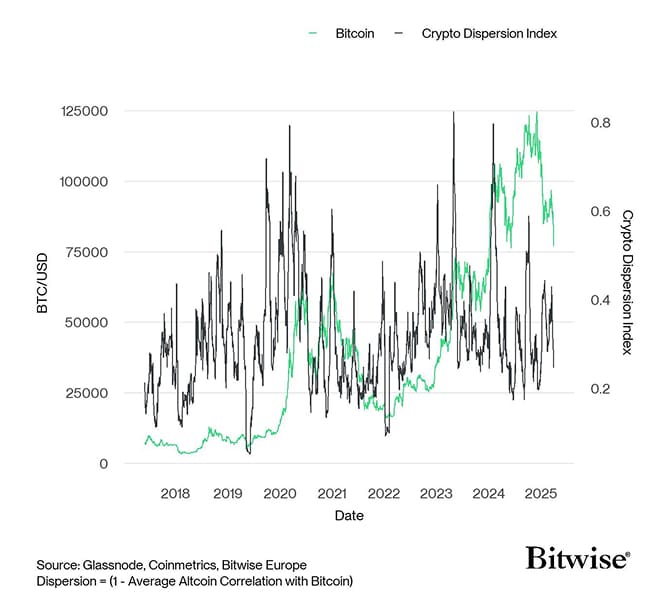

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Glassnode, Coinmetrics, Bitwise Europe; Despersion = (1 - Average Altcoin Correlation with Bitcoin)

Source: Glassnode, Coinmetrics, Bitwise Europe; Despersion = (1 - Average Altcoin Correlation with Bitcoin)

Cryptoassets & Macroeconomy

Macro Factor Pricing

Source: Bloomberg, Bitwise Europe

How much of Bitcoin's performance can be explained by macro factors?

Source: Bloomberg, Bitwise Europe

How much of Bitcoin's performance can be explained by macro factors?

Source: Bloomberg, Bitwise Europe

Source: Bloomberg, Bitwise Europe

Cryptoassets & Multiasset Portfolios

Multiasset Performance with Bitcoin (BTC)

Source: Bloomberg, Bitwise Europe; Monthly rebalancing; Sharpe Ratio was calculated with 3M USD Cash Index as assumed risk-free rate; BTC allocation is taken out of equity allocation of 60%, bond allocation remains at 40%; Past performance not indicative of future returns.

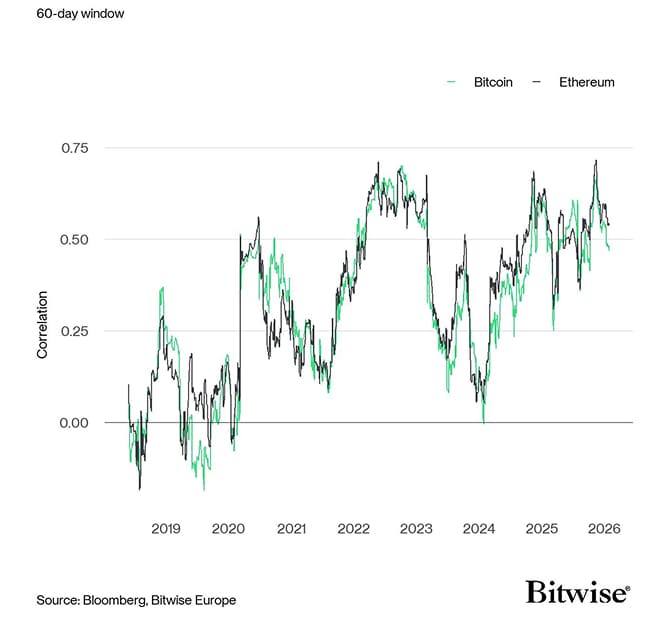

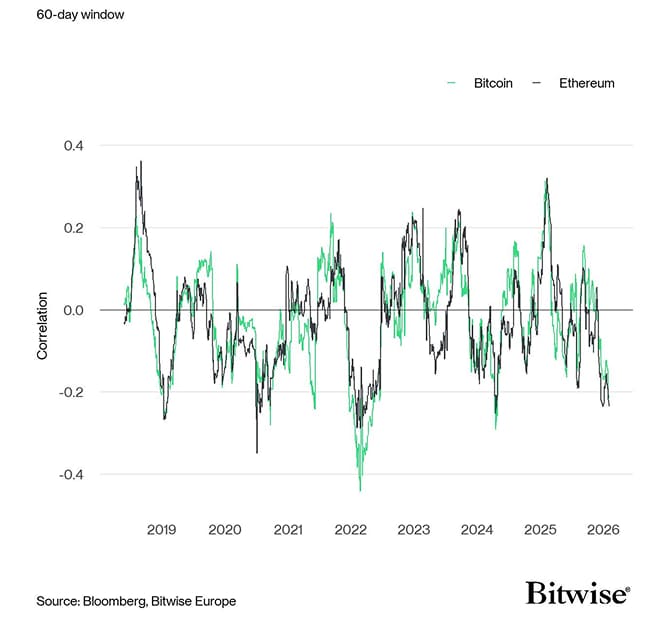

Rolling correlation: S&P 500

Source: Bloomberg, Bitwise Europe; Monthly rebalancing; Sharpe Ratio was calculated with 3M USD Cash Index as assumed risk-free rate; BTC allocation is taken out of equity allocation of 60%, bond allocation remains at 40%; Past performance not indicative of future returns.

Rolling correlation: S&P 500

Source: Bloomberg, Bitwise Europe

Rolling correlation: Bund Future

Source: Bloomberg, Bitwise Europe

Rolling correlation: Bund Future

Source: Bloomberg, Bitwise Europe

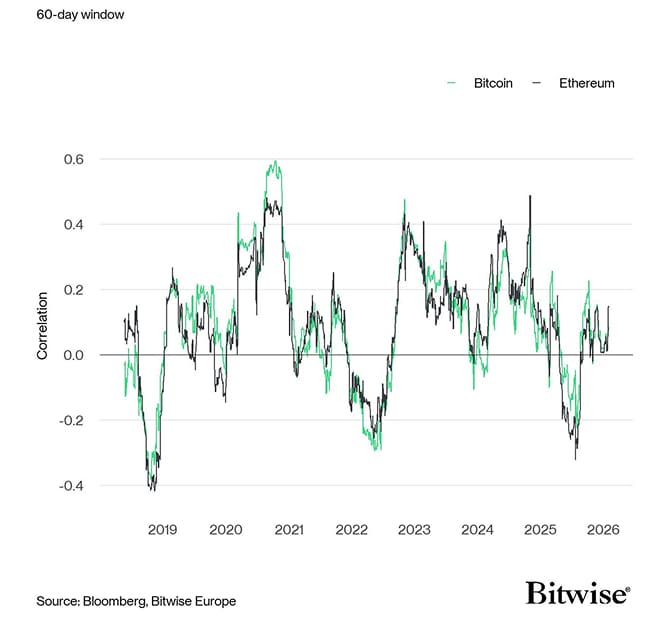

Rolling correlation: Gold

Source: Bloomberg, Bitwise Europe

Rolling correlation: Gold

Source: Bloomberg, Bitwise Europe

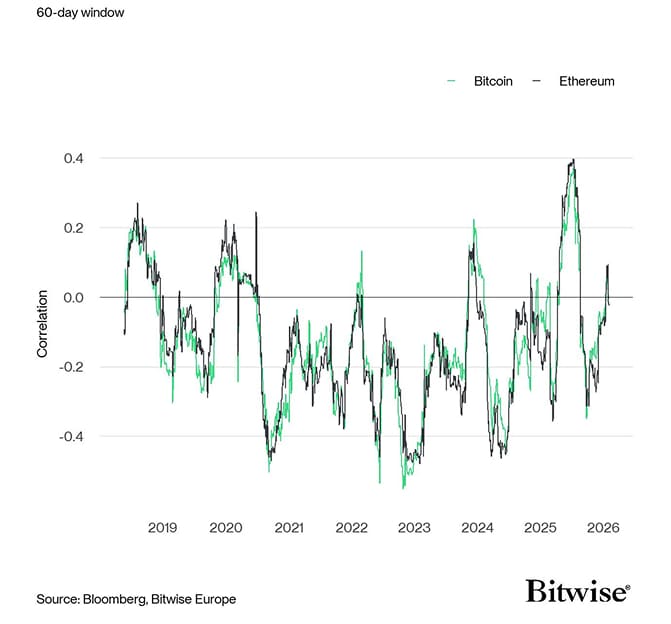

Rolling correlation: Dollar Index (DXY)

Source: Bloomberg, Bitwise Europe

Rolling correlation: Dollar Index (DXY)

Source: Bloomberg, Bitwise Europe

Cross Asset Correlation Matrix

Source: Bloomberg, Bitwise Europe

Cross Asset Correlation Matrix

Cryptoasset Valuations

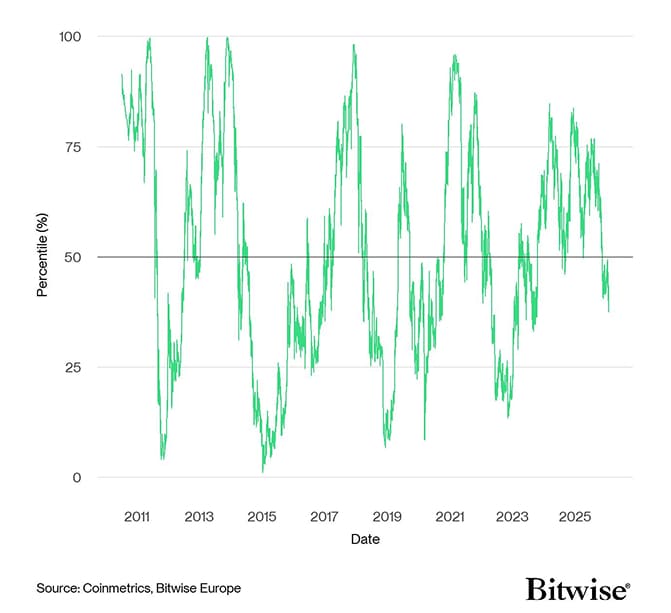

Bitcoin: Composite Valuation Indicator

Source: Coinmetrics, Bitwise Europe

Bitcoin: Price vs Composite Valuation Indicator

Source: Coinmetrics, Bitwise Europe

Bitcoin: Price vs Composite Valuation Indicator

Source: Coinmetrics, Bitwise Europe

Bitcoin: Valuation Metrics

Source: Coinmetrics, Bitwise Europe

Bitcoin: Valuation Metrics

Source: Coinmetrics, Bitwise Europe

Source: Coinmetrics, Bitwise Europe

On-Chain Fundamentals

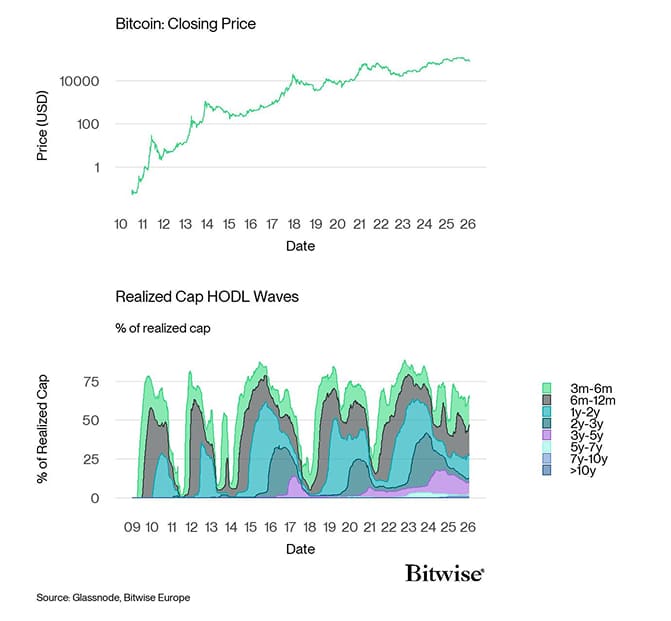

Bitcoin: Closing Price

Source: Glassnode

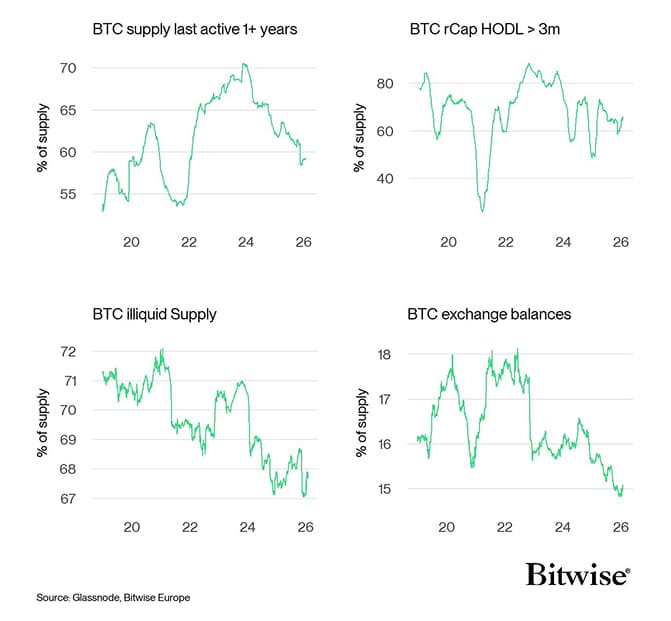

Bitcoin's supply scarcity is more pronounsed that during the last cycle

Source: Glassnode

Bitcoin's supply scarcity is more pronounsed that during the last cycle

Source: Glassnode, Bitwise Europe

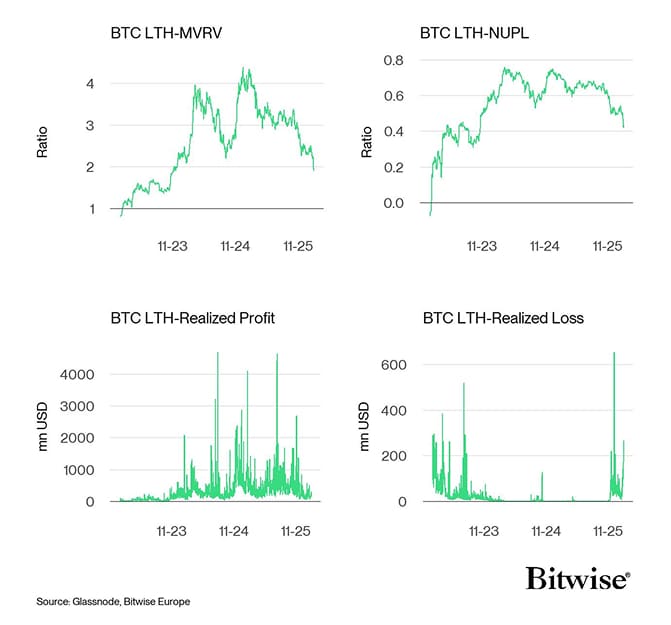

Bitcoin Long-term Holder (LTH) Dashboard

Source: Glassnode, Bitwise Europe

Bitcoin Long-term Holder (LTH) Dashboard

Source: Glassnode, Bitwise Europe

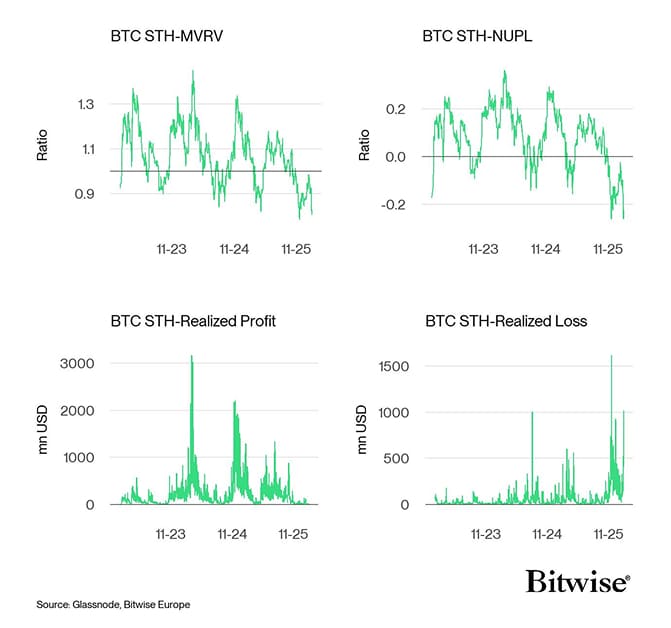

Bitcoin Short-term Holder (STH) Dashboard

Source: Glassnode, Bitwise Europe

Bitcoin Short-term Holder (STH) Dashboard

Source: Glassnode, Bitwise Europe

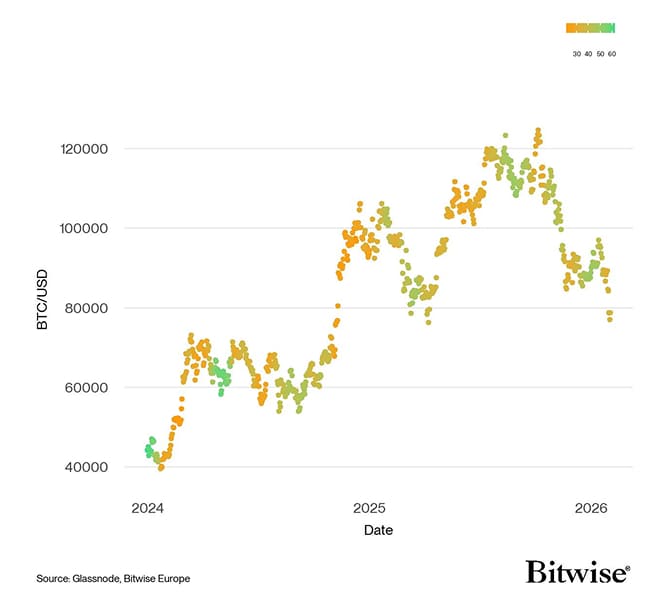

Bitcoin: Price vs Average Accumulatio Score

Source: Glassnode, Bitwise Europe

Bitcoin: Price vs Average Accumulatio Score

Source: Glassnode, Bitwise Europe

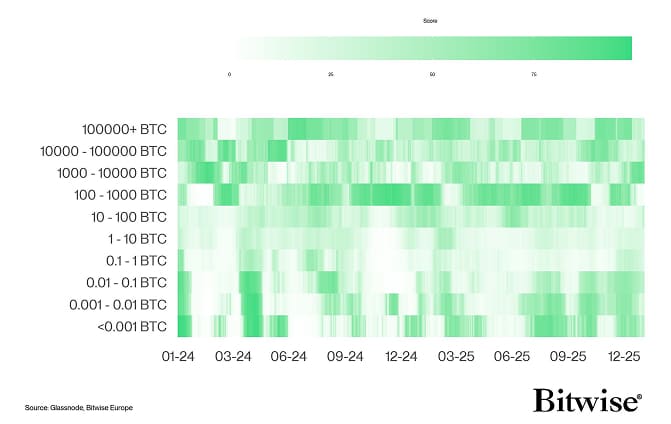

Bitcoin Accumulation Score

Source: Glassnode, Bitwise Europe

Bitcoin Accumulation Score

Source: Glassnode, Bitwise Europe

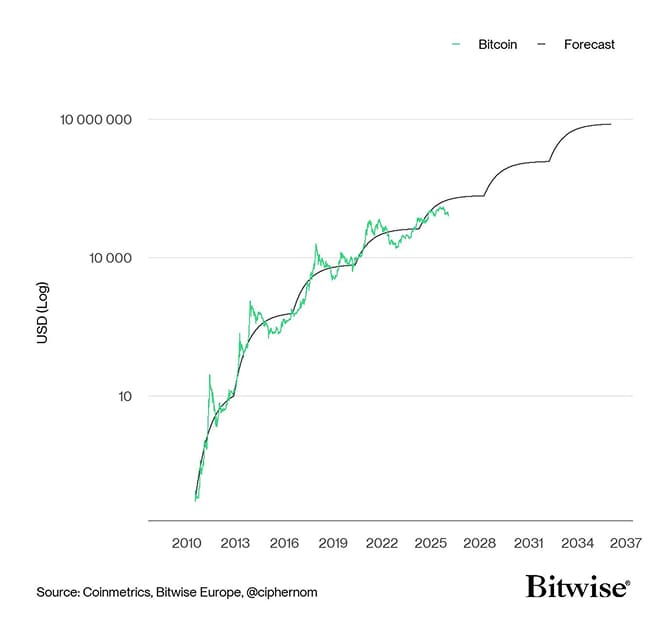

Bitcoin: Steady increase in scarcity will provide a tailwind for price appreciations

Source: Glassnode, Bitwise Europe

Bitcoin: Steady increase in scarcity will provide a tailwind for price appreciations

Source: Coinmetrics, Bitwise Europe; @ciphernom

Source: Coinmetrics, Bitwise Europe; @ciphernom

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com