- Bullish momentum grips markets, pro-Bitcoin EU regulatory win dominates headlines, Dubai

legalises crypto and politicians push for legal tender worldwide, while Ethereum 2 is

tantalisingly close with the success of its Proof of Stake testnet merge.

EU dismisses Proof of Work ban on Bitcoin

Perhaps the most striking news of the fortnight was the timely reversal by the EU's most powerful

financial committee to act in favour of Bitcoin.

On 14 March 2022 the ECON, the EU's Committee on Economic and Monetary Affairs responsible for

the regulation of financial services and oversight of the European Central Bank, voted against a

proposal that could have seen the end of Bitcoin mining in Europe.

A last-minute addition to the bloc's upcoming Markets in Crypto Assets (MiCA) framework aimed to

limit the use of cryptocurrencies powered by Proof of Work.

A majority of MEPs from the EPP, ECR, Renew and ID parties voted against, while a minority of MEP

from the Greens, S&D and GUE mainly voted in favour. The final tally was 32 against and just 24

for it.

As hoped for by Bitcoin proponents, the amendment was voted down, with politicians instead

favouring instead new draft rules to protect consumers and make Proof of Work mining more

sustainable.

This was a source of huge relief in the crypto community and a gigantic political success for

Bitcoin in Europe.

Dr Stefan Berger's alternative amendment was supported instead of the ban. It reads:

By

January 2025, the Commission shall present to the European Parliament and to the Council, as

appropriate, a legislative proposal to amend Regulation (EU) 2020/852, in accordance with

Article 10 of that legislation, with a view to including in the EU sustainable finance

taxonomy any crypto-asset mining activities that contribute to climate change migration and

adaptation.

With all the work going on to use otherwise wasted flared gas in North America by using these

harmful emissions to instead mine Bitcoin, more efforts will be required over the coming years

to counter false assertions that Bitcoin mining is itself wasteful.

Oil majors are starting to come around to the idea, with the $133bn market cap Conoco

Phillips (NYSE:COP) just starting to

sell waste gas to Bitcoin miners in North Dakota. The natural gas giant said in February

it was running a pilot project to sell gas destined for burning to a Bitcoin processor instead.

Similar projects have seen a reduction of around 63% in CO2 emissions compared to flaring.

Bitcoin's annual energy usage amounts to a rounding error, being responsible for

just 0.08% of global CO2-equivalent emissions.

For a comparison, the cement industry is

responsible for 7-8% of global CO2-equivalent emissions and its annual production uses

three times more energy than Bitcoin, on a par with the entire output of Germany and France.

Ethereum 2 Proof of Stake merge success, prices bounce

Ethereum has taken a critically-important step forward with the successful launch of Proof of

Stake on its final testnet.

The non-profit Ethereum Foundation announced that Ethereum

2 Proof of Stake merge had successfully completed on 15 March 2022 on the Kiln testnet.

Blockchain testnets are not live trading environments, but instead an alternative environment

that mimic the conditions of the main chain, allowing developers and app producers to experiment

and scrutinise how their software will work before it is publicly launched.

At time of writing Ethereum was trading in spot markets at $3,010, up 18% on the week.

Today Ethereum relies on miners to validate and process transactions, just like Bitcoin. But this

Proof of Work method will be replaced by Proof of Stake, where ETH holders lock up their coins

to secure the network and receive ETH rewards in return.

Stakers, who can earn 4-5% yield on their ETH by locking up tokens in the ETH 2

deposit contract , have to date deposited over 10 million ETH worth more than $32bn.

An additional catalyst for ETH prices long term is that when Ethereum undergoes its final

transformation, the deflationary pressure introduced by EIP-1559 in August 2021 should turn into

outright deflation. Market tracker Ultrasound Money

indicates that Ethereum supply issuance will fall from +3.5% today to minus 0.6% when the merge

is complete.

Locked ETH adds additional supply pressure by reducing circulating supply, cutting the number of

ETH available to trade the open market and effectively reducing the free float.

With the merge test run successfully complete, we expect mainnet launch, and hence Ethereum's

long-awaited switch from Proof of Work to Proof of Stake to occur, by the end of June 2022.

Aside from its changing tokenomics, which should encourage more institutions to invest in ETH,

greater adoption of the technology behind Ethereum has been on the cards for months.

In November, the world's largest clearinghouse, the Depository Trade and Clearing Corporation

(DTCC) said it would cross the blockchain Rubicon to

use the Ethereum blockchain to digitise and modernise private markets. The ability for

blockchain technology to speed up and automate trade finance is well known. Settlement is

possible in a matter of minutes, without manual oversight, because using blockchain's

cryptographic architecture we can prove mathematically that transactions have completed to our

satisfaction.

Faster settlement times also cut counterparty risk, so it should come as no surprise that the

DTCC has been investigating distributed ledgers since

this 2016 white paper, and began a pilot programme in 2019 to move

$11 trillion of derivatives onto the blockchain.

Currently trade settlement happens on a T+2 (trade date plus two days) basis. This is an

improvement over the five-day standard (T+5) that applied up to 1995, and slightly better than

the T+3 in action between 1995 and 2017. But two-day settlement is still a really long time in a

world where blockchains can speed that up by a factor of 10.

It's worth noting that the figures involved in trade settlement globally are brain-breakingly

large. The DTCC clears trades worth around

$2.3 quadrillion (a thousand times a trillion) each year, and these numbers are only

growing.

In an

April 2019 paper discussing the potential benefits that blockchain could bring to the

clearing and settlement process, the US Committee on Capital Markets Regulation noted:

Even with the recent improvement, the DTCC estimates that the relatively lengthy settlement

period forces system participants to hold over $5 billion collectively, on average, in risk

margin to manage counterparty default risk.

Long settlement times exacerbate risk and leave billions of dollars sitting around doing nothing,

when it could be being put to work.

Institutions are just starting to realise that blockchain can fix this.

US sets ‘global leader' status, Dubai legalises crypto: South Korea, Serbia, Malaysia

next?

Macro market watchers reacted with glee to US President Joe Biden's Executive Order on digital

assets on 9 March, as he indicated a favourable regulatory environment for cryptocurrencies

going forward. The US is already the global leader in Bitcoin mining after the departure of

China in May 2021.

Text from the order, which sets a 180-day deadline on departments reporting on the risks and

opportunities from cryptocurrencies, calls for a comprehensive and co-ordinated approach to

digital asset policy.

[It's] unequivocally bullish for the crypto ecosystem over all timeframes,

said

Travis Kling, CEO at Ikigai Asset Management

told CNBC.

It's easy to lose sight of how much ground this ecosystem has covered

in the last two years in terms of legitimacy and stance from the US government, but this

E.O. makes it clear the US government is not banning crypto, it is embracing it.

In the same week, Dubai

adopted its first law legalising digital assets and set up a financial watchdog to

oversee the industry. Announcing the news on 9 March 2022 ruler Sheikh Mohammed bin Rashid said

he wanted to position the emirate as a world leader in cryptocurrency and blockchain.

A day later, South Korea elected President Yoon Suk-yeol on a

specific platform of deregulating the cryptocurrency industry in the south-east Asian

state. The President elect will take office in May. As part of a broad range of cryptocurrency

pledges, Yoon Suk-yeol said he would allow ICOs, boost South Korea's burgeoning industry and

promised not to impose taxes on digital asset trading gains of up to 50 million won ($40,000),

treating them in the same manner as gains from equities.

Markets

BTC/USD

Data as of 22 March 2022 | Source:

TradingView.com

Data as of 22 March 2022 | Source:

TradingView.com

ETH/USD

Ethereum has had a strong fortnight, with spot prices climbing almost exactly 20% from the

mid-$2,500s beyond the key $3,000 mark before continuing higher. The successful debut of

Ethereum 2 – albeit in a testing environment and not yet live – should push ETH further, with

the expected June 2022 launch of Proof of Stake now looking like to be a critical point in the

history of the blockchain.

Data as of 22 March 2022 | Source:

TradingView.com

Data as of 22 March 2022 | Source:

TradingView.com

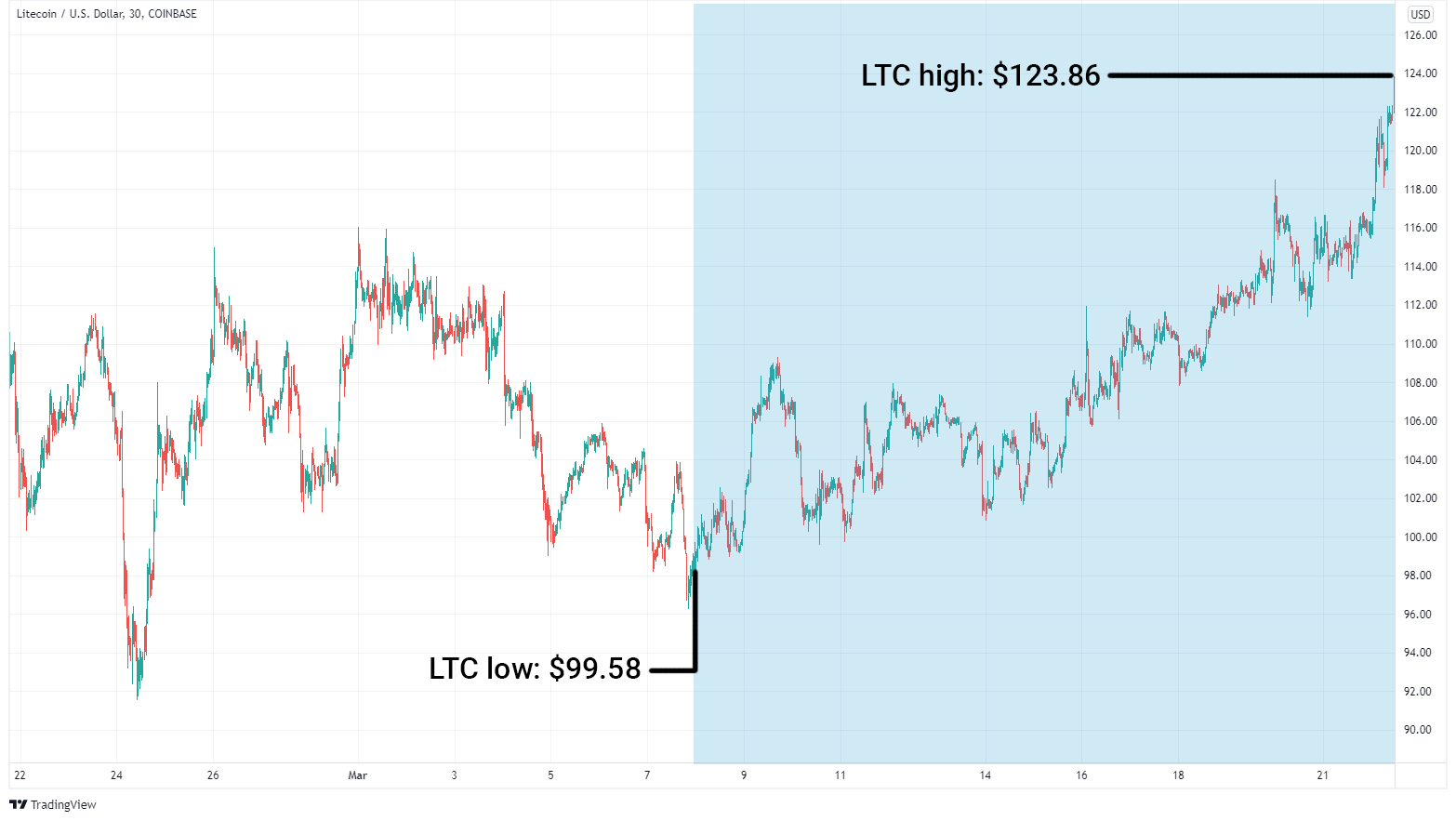

LTC/USD

Litecoin trading volume has exploded in the past fortnight, with LTC moving up the charts to

become the fourth-most traded digital asset behind Cardano, Bitcoin and Ethereum. $100 now looks

like a distant memory, with the critical $125 pivot point the next key domino to fall. The shift

upwards from $99.58 to $123.86 represents a healthy 24.3% gain across the fortnight.

Data as of 22 March 2022 | Source:

TradingView.com

Data as of 22 March 2022 | Source:

TradingView.com

BCH/USD

The addition of DeFi and smart contract capability to Bitcoin Cash may have come later in the

game than holders would have liked, given how newer rivals like Avalanche have managed to scoop

up market share along with tens of millions of dollars in revenue from users. But smartBCH is

attracting new users to the payments-focused blockchain and this is just starting to be

reflected in BCH pricing. From a $276 start, prices reached $370, and have turned parabolic in

recent days, with BCH adding a total of 33.8% against the US dollar across the two-week session.

Data as of 22 March 2022 | Source:

TradingView.com

Data as of 22 March 2022 | Source:

TradingView.com

ADA/USD

The launch of the first smart contract-based decentralised apps on Cardano have produced a

notable sentiment switch among traders, with prices rallying back towards the $1 level after

several weeks drifting around in the $0.80 area. Bullish momentum has gripped ADA, with trading

volumes four times higher than Bitcoin in the last 24 hours, according to crypto data analytics

site Messari.

Data as of 22 March 2022 | Source:

TradingView.com

Data as of 22 March 2022 | Source:

TradingView.com

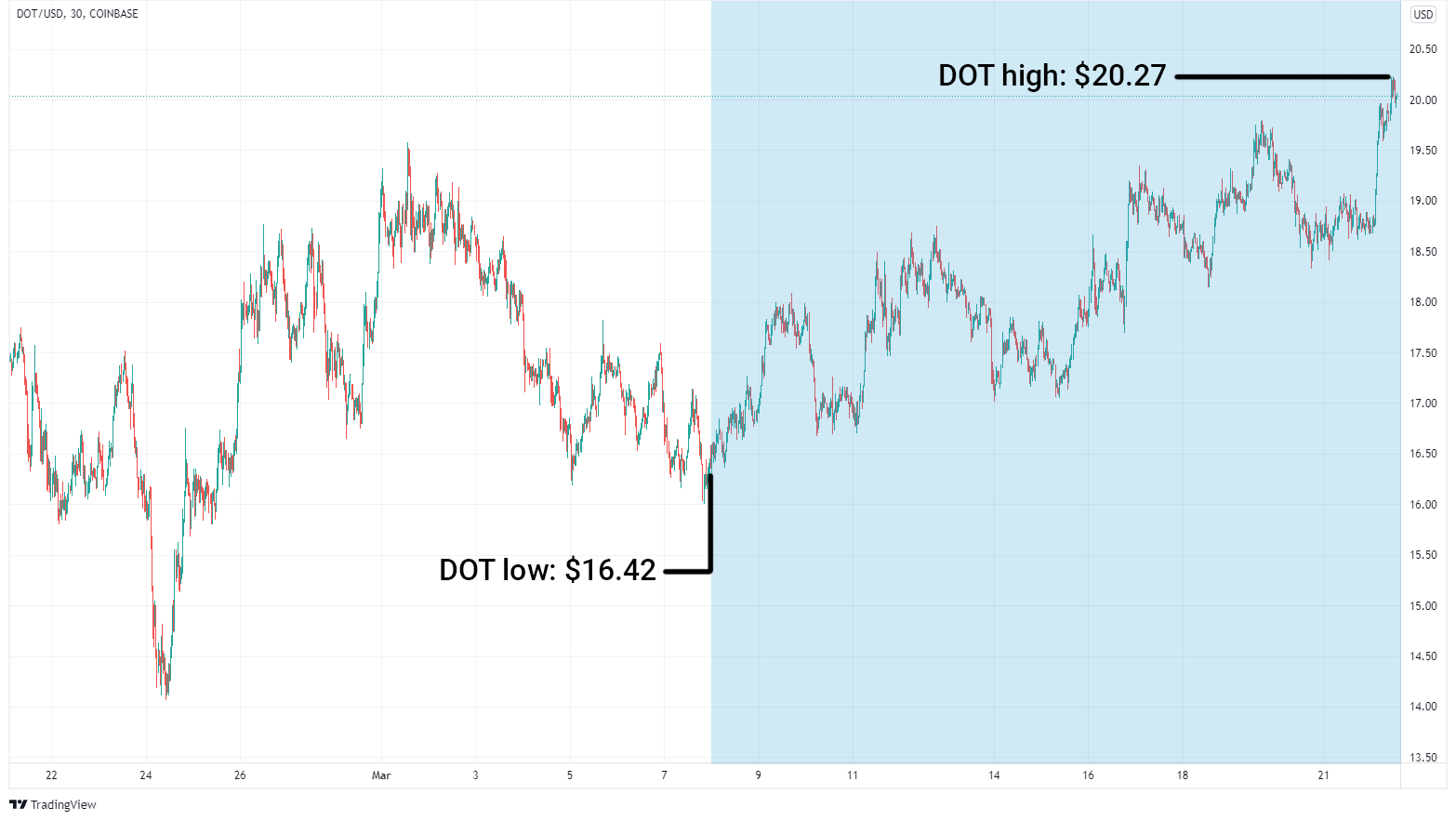

DOT/USD

Polkadot appears to have broken out of its trading range in recent days, with bulls attempting to

turn the psychologically important $20 level from resistance into support. This price point has

been rejected several times in past weeks, most recently in the second week of February, so

recapturing it bodes well going forward. In summary, it has been a happy fortnight for DOT

bulls, with the interoperable blockchain adding a total of 22.1% across the two weeks.

Data as of 22 March 2022 | Source:

TradingView.com

Data as of 22 March 2022 | Source:

TradingView.com

SOL/USD

Solana has been quiet as of late, with more media and market attention focused on rival Layer 1

chains like Avalanche, Cosmos and Polkadot. Gains of 11.3% across the fortnight are relatively

minor when looking at the moves of coins outside the top 10 by market cap but this is at least

heartening to see SOL shifting back towards the $100 mark after what has been a tough March.

Data as of 22 March 2022 | Source:

TradingView.com

Data as of 22 March 2022 | Source:

TradingView.com

XTZ/USD

On an adoption level Tezos continues to impress, with swathes of NFT and DeFi integrations across

multiple industries, alongside fresh support from $10bn AUM institutional cold storage custody

provider GK8. Spot prices have not followed as of yet, and while XTZ is back trading above $3,

there is a possible buying opportunity here for those with an eye on a strong second half of

2022.

Data as of 22 March 2022 | Source:

TradingView.com

Data as of 22 March 2022 | Source:

TradingView.com

XLM/USD

Given the more positive signals from the rest of the market, Stellar's XLM was not willing to be

left behind, with the cross-border currency climbing 21% from $0.171 to $0.207 across the

fortnight. Reclaiming $0.20 will have cheered bulls, given that XLM spent the latter half of

January – as well as the past five weeks – meandering around below this point. Now all eyes are

on the critical $0.238 level that acted as support way back in June 2021, that turned into a

significant resistance point in February this year.

Data as of 22 March 2022 | Source:

TradingView.com

Data as of 22 March 2022 | Source:

TradingView.com

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com