- The SEC has just approved the spot Ethereum ETFs in the US - we expect approximately 1.65 bn USD potential net inflows into US Ethereum ETFs 3 months after trading launch

- If we assumed the historical "performance multiplier" of 6.15 to Ethereum flows to be true, then a ~15% increase in global Ethereum ETF AuM would be associated with ~92% performance

- The approval marks a significant shift in sentiment within the SEC and among US regulators in general but US investors still received inferior investment vehicles compared to European vehicles

6.5 years

The SEC has just approved spot Ethereum ETFs for trading in the US.

Although the exact date of trading launch is unknown and could take a few months, this approval marks a significant shift in sentiment within the SEC and US regulators in general.

The Grayscale Ethereum Trust (ETHE) was launched on 14 December 2017. It was the first investment vehicle that allowed professional investors to gain exposure to the second largest cryptoasset – Ethereum.

Nearly 6.5 years later, US investors finally have a more efficient investment vehicle to participate in Ethereum's performance.

US ETF issuers made last-minute adjustments to their 19b-4 filings to meet the final deadline for the SEC's decision on VanEck's spot Ethereum ETF application, which was due on 23 May.

Bloomberg ETF analysts had previously commented that approval could come as early as Wednesday this week, beating consensus expectations for a later approval date. Other applicants included the same companies that applied for a spot bitcoin ETF previously, such as iShares and Fidelity.

The sudden increase in approval odds caught many by surprise, as Bloomberg ETF analysts unexpectedly raised their approval odds from 25% to 75% after the SEC asked exchanges to expedite their 19b-4 filings. Meanwhile, the odds of approval by the end of May on popular betting sites also jumped to over 50%, up from 10% just a few days earlier.

This unexpected rise in approval odds also surprised Ethereum futures short sellers, causing short liquidations in Ethereum futures contracts to surge to their highest level since March.

This caused the price of Ethereum to jump more than 10% in a matter of hours, reversing much of its underperformance against bitcoin this year.

So, the market had already started to anticipate a potential approval.

But what's next?

1. How many fund flows should we expect?

Many market observers have tried to guide down expectations for an Ethereum ETF trading launch.

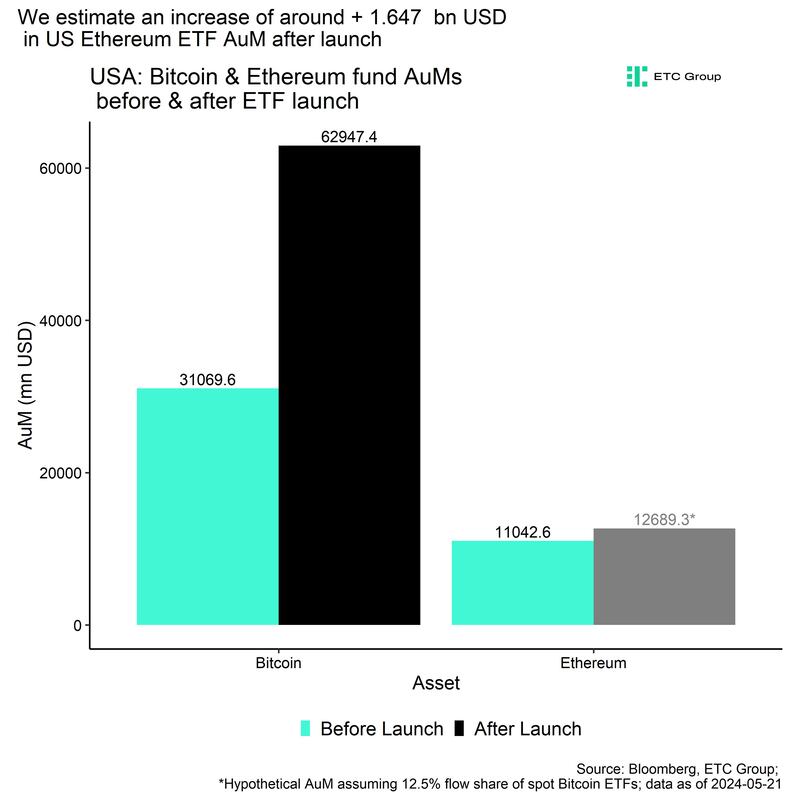

The reason is that the Ethereum spot ETF approval is coming after a bonanza in fund flows into US spot Bitcoin ETFs which is why Bloomberg ETF analysts expect only around 10%-15% of Bitcoin ETF flows to flow into Ethereum ETFs.

At the time of writing, US spot Bitcoin ETFs have already seen cumulative net fund inflows in the amount of +13.2 bn USD since trading launch on the 11 th of January 2024.

12.5% of that amount would imply approximately 1.65 bn USD potential net inflows into US Ethereum ETFs.

This amount would currently be equivalent to ~15% of current global Ethereum ETP assets-under-management (AuM) or around 0.7% of Ethereum's realized cap, i.e. the amount invested on-chain.

2. What could be the price effect of this approval?

Nonetheless, this amount of capital could potentially still have a very significant impact on Ethereum's performance going forward.

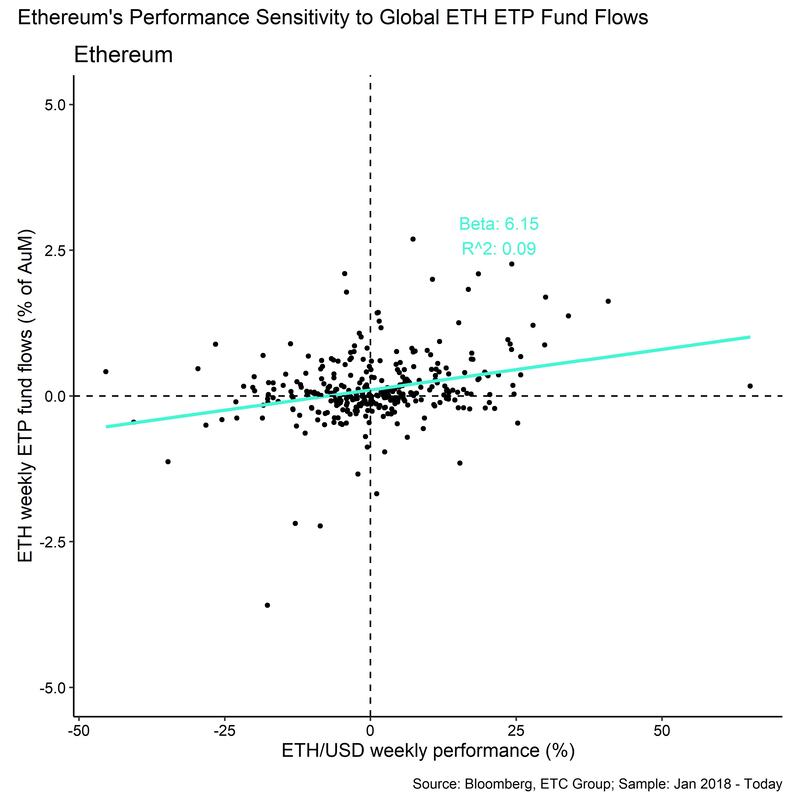

The reason is that Ethereum's performance has shown a significantly higher sensitivity to global ETP flows than Bitcoin in the past.

While Bitcoin's performance sensitivity to global ETP flows was around ~1.0, Ethereum's performance has shown an average sensitivity of around 6.15 to global ETP flows in the past.

In other words, an increase of global ETH ETP AuM by 1% per week was associated with an average ETH/USD performance of 6.15% per week.

Now, if we assumed the abovementioned "multiplier" of 6.15 to be true, then a ~15% increase in global Ethereum ETF AuM would be associated with ~92% performance!

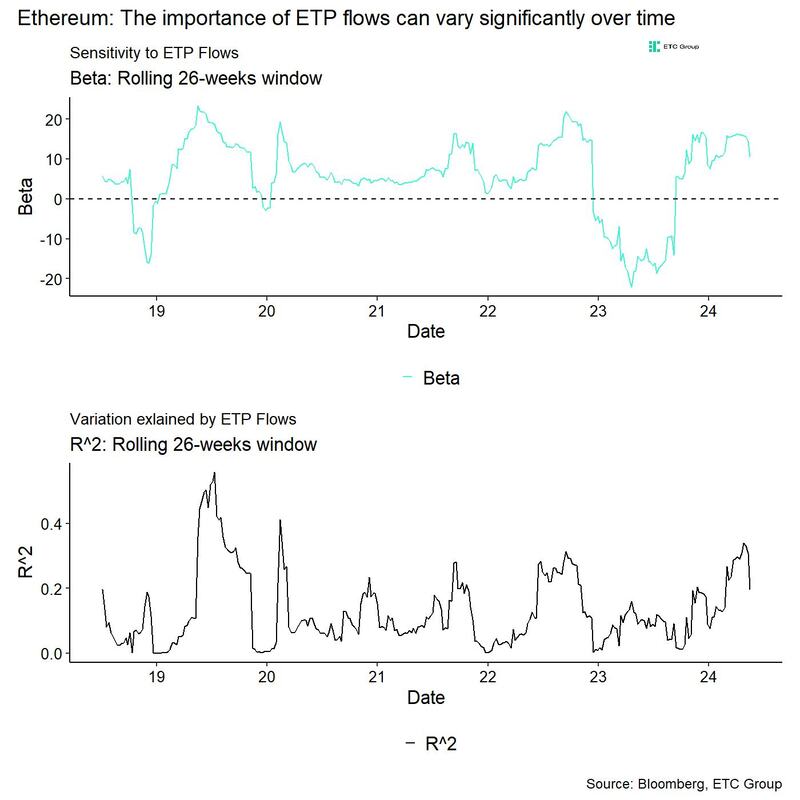

That being said, the sensitivity of Ethereum's performance to weekly ETP flows can vary significantly over time and has been around ~10.5 more recently.

As a caveat, keep in mind that correlation does not imply causation and that higher net inflows could possibly not cause increases in price.

More specifically, we estimate that global Ethereum ETP flows could only explain around 19.6% in the variation of Ethereum over the past 6 months. So, other factors such as macro or coin-specific factors have played a larger role.

3. What's special about these Ethereum ETFs?

The approval marks a significant shift in sentiment within the SEC and US regulators more general. The recent passing of the “crypto bill” in the US senate has demonstrated that there is bipartisan consensus on the importance of cryptoassets for the United States.

The fact that the Trump campaign has recently started accepting crypto donations for campaign finance speaks volumes in this regard as Trump had personally shown a rather anti-crypto stance in the past.

Thus, viewed more broadly within the context of recent domestic political developments in the US, this approval could be evidence of a more mainstream acceptance of cryptoassets as a legitimate asset class.

However, US investors still receive a suboptimal investment vehicle for Ethereum: The creation-redemption mechanism is still not done in kind and staking has not been allowed within the filings. Thus, US investors won't be able to fully capture Ethereum's total return profile via staking returns that currently amount to around 3.2% p.a. European investors are once again better served with products that allow investors to participate in these total returns such as the ETC Group Ethereum Staking ETP.

Bottom Line

- The SEC has just approved the spot Ethereum ETFs in the US - we expect approximately 1.65 bn USD potential net inflows into US Ethereum ETFs 3 months after trading launch

- If we assumed the historical "performance multiplier" of 6.15 to Ethereum flows to be true, then a ~15% increase in global Ethereum ETF AuM would be associated with ~92% performance

- The approval marks a significant shift in sentiment within the SEC and among US regulators in general but US investors still received inferior investment vehicles compared to European vehicles

Important Information

This publication constitutes a marketing communication and is provided for informational purposes only. It does not constitute investment advice, a personal recommendation, or an offer or solicitation to buy or sell any financial instrument.

This document (which may take the form of a presentation, press release, social media post, blog article, broadcast communication or similar instrument – collectively referred to as a “Document”) is issued by Bitwise Europe GmbH (“BEU” or the “Issuer”) and has been prepared in accordance with applicable laws and regulations, including those relating to financial promotions.

Bitwise Europe GmbH, incorporated under the laws of Germany, is the issuer of the Exchange Traded Products (“ETPs”) referenced in this Document under a base prospectus and the applicable final terms, as supplemented from time to time, approved by the German Federal Financial Supervisory Authority (BaFin). The approval of the prospectus by BaFin relates solely to the completeness, coherence and comprehensibility of the prospectus in accordance with the Prospectus Regulation and does not constitute an endorsement, recommendation or assessment of the merits of the products.

The market analyses, views and scenarios presented reflect the assessment as of the date of publication and are based on information considered reliable. However, no representation or warranty is made as to their accuracy or completeness. Forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Past performance is not a reliable indicator of future results.

Capital at risk. Cryptoassets are highly volatile and involve a high degree of risk. The value of investments in cryptoassets and crypto-linked ETPs may fluctuate significantly, and investors may lose part or all of their invested capital. No capital protection or guaranteed compensation mechanism applies in respect of market losses.

Any investment decision should be made solely on the basis of the relevant base prospectus, the applicable final terms and the key information document, in particular the section entitled “Risk Warning”. The base prospectus, final terms and additional risk information are available at: www.bitwiseinvestments.eu

Access to certain documents may require self-certification regarding your jurisdiction and investor status and may be subject to additional disclaimers and important information.

For further details, please refer to the full disclaimer available at: www.bitwiseinvestments.eu/disclaimer