- Performance: Despite September’s historical reputation as bitcoin’s weakest month, the asset surprised to the upside, significantly outperforming ether and most altcoins, but still diverging from gold’s strength. While short-term sentiment remains mixed, improving monetary policy and financial conditions are set to extend bitcoin’s structural bull market well into 2026.

- Macro: The Fed’s renewed easing cycle, set against rising inflation expectations and expanding global liquidity, points to a medium-term bullish backdrop for bitcoin. With real yields declining, money supply growth accelerating, and global growth expectations turning up, conditions are aligning for crypto assets to benefit meaningfully from looser financial conditions.

- On-Chain:Despite significant selling pressure by long-term holders, bitcoin remains relatively resilient due to ongoing outsized institutional demand and a decline in liquid supply (on exchanges). Bearish sentiment and on-chain metrics imply that sellers are becoming increasingly exhausted and signal that bitcoin might be in the process of bottoming out already.

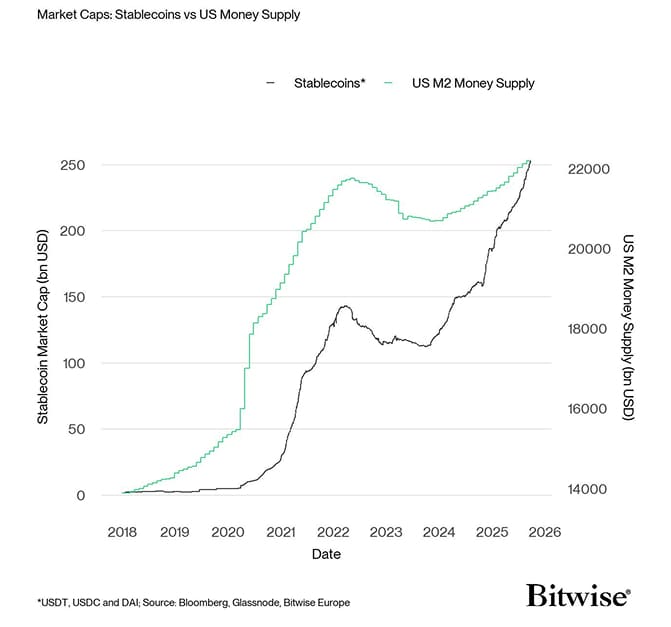

Chart of the Month

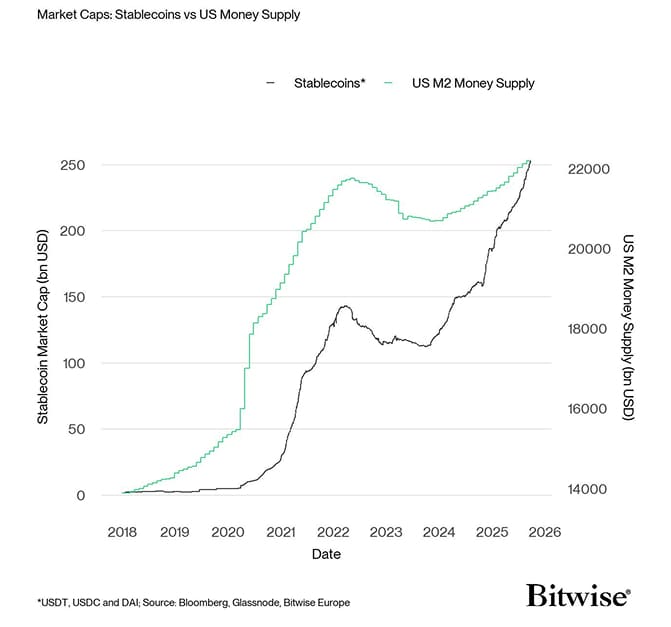

Increasing stablecoin market caps are consistent w/ increasing macro liquidity

Performance

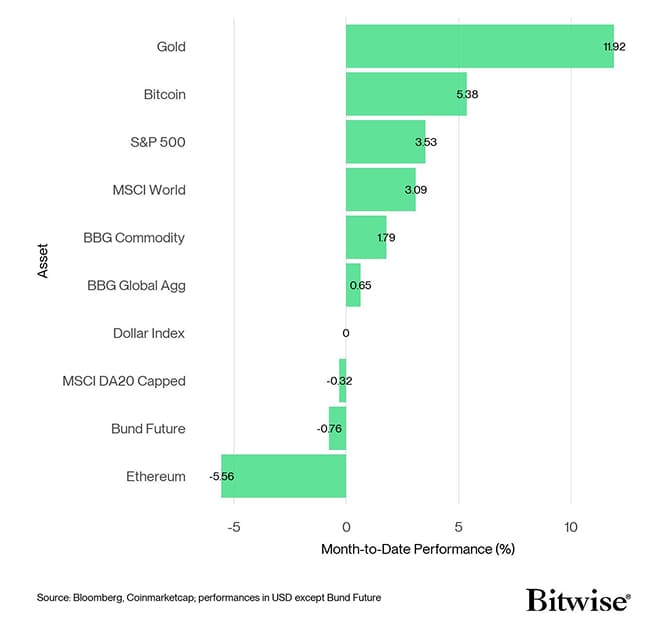

Cryptoasset performance in September were unusually strong, defying the negative seasonality pattern of bitcoin. Historically speaking, performance-wise, September tends to be the worst month for bitcoin with an average monthly performance of around -4% since 2010 as highlighted in our latest Crypto Market Compass report as well.

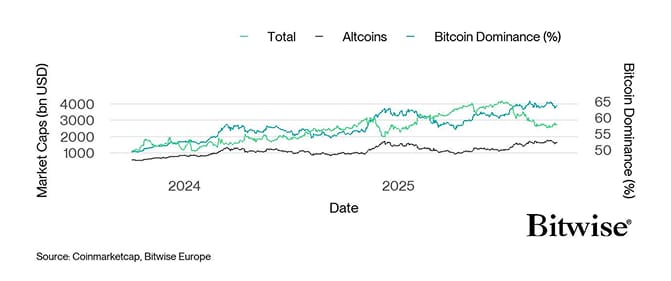

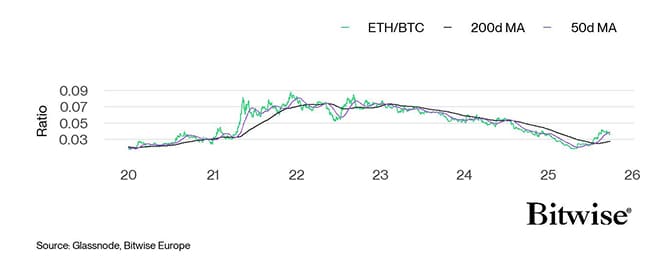

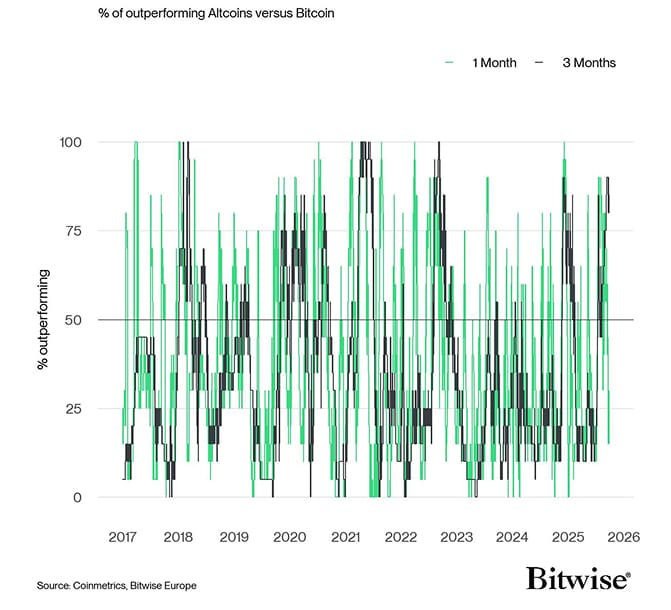

However, unlike August, the capital rotation from bitcoin to ether and other alts came to a halt as most altcoins underperformed bitcoin in September. Ether also underperformed bitcoin significantly in September. Bitcoin's market cap dominance also reclaimed 59% in September – up almost 2%-points compared to August.

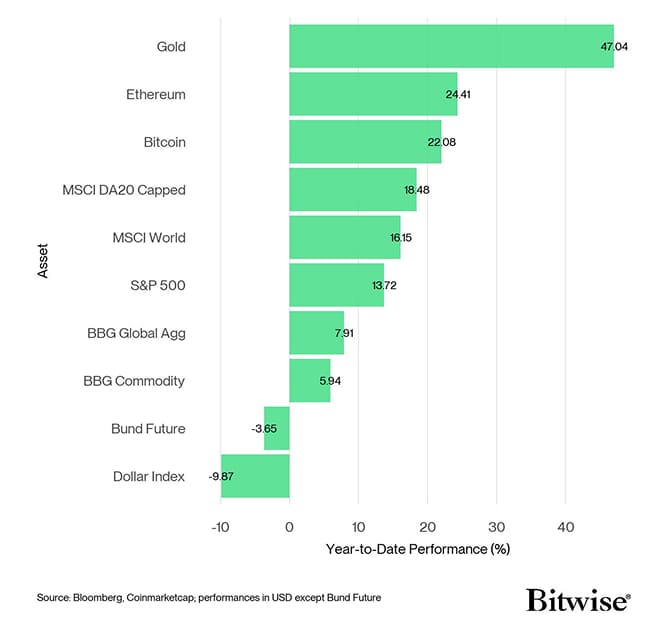

Crypto market sentiment was mostly bearish while cross asset sentiment (measured by our own Cross Asset Risk Appetite Index) continued to be bullish – a notable divergence. Another notable divergence could be observed between Gold and Bitcoin. Bitcoin's performance has significantly trailed gold's performance in September – this could be due to differing macro factors influencing both hard assets:

While Bitcoin's performance has been mostly influenced by changes in global growth expectations, gold's performance has been mostly influenced by changes in monetary policy & US Dollar expectations (see charts in this post as well). This might also explain why bitcoin has recently diverged from the positive trend in global money supply as well. However, it is worth highlighting that changes in global growth expectations tend to follow changes in monetary policy expectations. This means that improving global growth expectations are likely going to provide a renewed tailwind for bitcoin's rally. Our base case is that the improvement in monetary policy and financial conditions induced by the continuation of the Fed's rate cutting cycle will prolong the current bull market well into 2026.

Cross Asset Performance (YtD)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Cross Asset Performance (MtD)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Cross Asset Performance (MtD)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Bitwise Europe Product Performance Overview (%)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

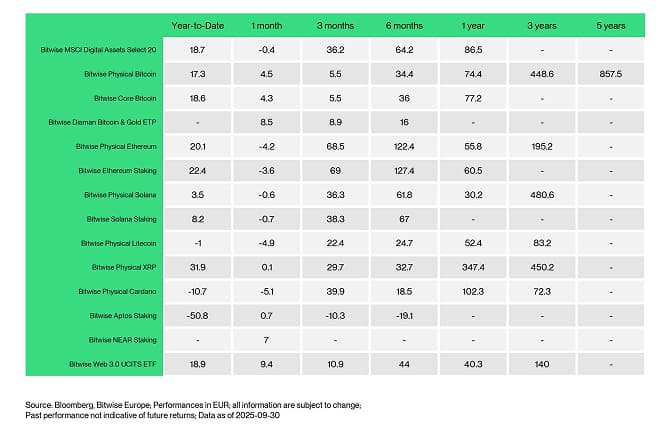

Bitwise Europe Product Performance Overview (%)

Source: Bloomberg, Bitwise Europe; Performances in EUR; all information are subject to change; past performance not indicative of future returns; Data as of 2025-09-30

Source: Bloomberg, Bitwise Europe; Performances in EUR; all information are subject to change; past performance not indicative of future returns; Data as of 2025-09-30

A closer look at our product performances also reveals that bitcoin outperformed most altcoins in September. The Bitwise Diaman Bitcoin & Gold ETP (BTCG) was the main outperformer due to the strong performance of gold in September.

Performance dispersion among altcoins increased slightly implying less correlation between bitcoin's performance and those of alts. However, only 20% of our tracked altcoins managed to outperform bitcoin on a monthly basis.

Bottom Line: Despite September's historical reputation as bitcoin's weakest month, the asset surprised to the upside, significantly outperforming ether and most altcoins, but still diverging from gold's strength. While short-term sentiment remains mixed, improving monetary policy and financial conditions are set to extend bitcoin's structural bull market well into 2026.

Macro Environment

Last month, the Federal Reserve has delivered its first 25 bps rate cut of the year - a move that was fully anticipated by markets. Bitcoin's muted price action at first suggested this was largely a “sell-the-news” event. A contributing factor could be the $1.6bn in FTX creditor distributions by late September, which may have added near-term selling pressure.

That said, we continue to see the Fed's easing cycle as a major medium-term tailwind for bitcoin and crypto assets.

History is clear: Fed rate-cutting cycles have often aligned with powerful bitcoin rallies as highlighted in one of our recent weekly Crypto Market Compass reports.

The drivers are threefold:

- Rate cuts usually steepen the yield curve; a dynamic tied to faster money supply growth. Bitcoin, one of the most responsive gauges of global liquidity expansion, tends to thrive in this backdrop. Global money supply has already pushed to new all-time highs and is still rising.

- Bitcoin has a positive historical correlation with market-based inflation expectations especially since Covid. Any renewed uptrend here should further support BTC.

- Real yields are set to decline as inflation accelerates, meaning looser financial conditions-a classically favourable environment for bitcoin.

We have highlighted the strong positive correlation between the steepness of the US Treasury curve and M1 money supply growth in our previous Bitcoin Macro Investor report in September as well.

Crucially, the Fed is cutting against a backdrop of weakening labour market data while headline inflation still sits at 2.9%. By easing under these conditions, the Fed is implicitly signalling tolerance for a higher inflation regime - likely closer to 3%.

Looking ahead, at the time of writing this report, Fed Funds Futures assign an 80% probability of another 50 bps in cuts by year-end, consistent with the “dot plot.” Moreover, new FOMC member Stephen Miran has projected as much as 125 bps of cuts, suggesting the balance of risks is skewing more dovish. The market is generally following the forward guidance by the Fed's latest median projections very closely.

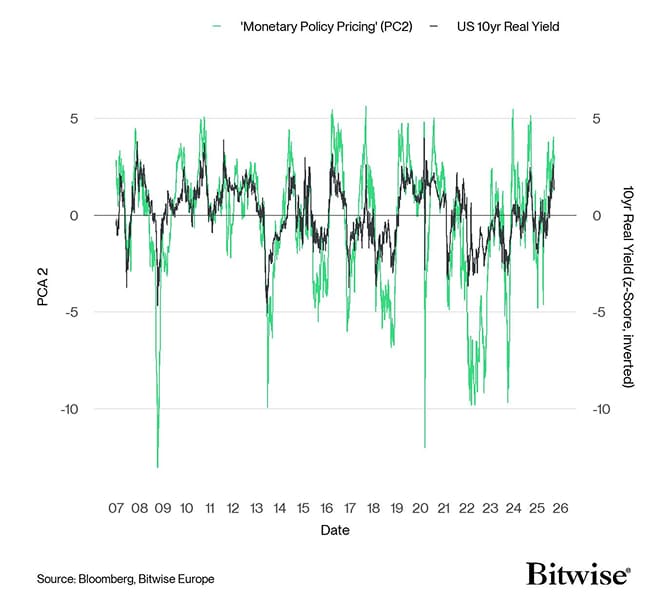

The key to understand though is that the net result of falling rates and rising inflation expectations will most likely be lower real yields which signals a looser stance of monetary policy going forward.

The reason is that real yields tend to be one of the best single indicators for the stance of monetary policy. Lower real yields signal an easing in monetary policy while higher real yields tend to signal a tightening in monetary policy.

Note that the change in real yields is inverted in the following chart:

Monetary Policy Pricing vs US 10yr Real Yield

US real yields generally remain relatively high although they have been declining since late 2023 a bit. Higher inflation expectations and lower nominal yields through Fed rate cuts could set the stage for a sustained decline in US real yields over the medium term. This could further entice investors to look for alternative investments to avoid a gradual erosion of their purchasing power.

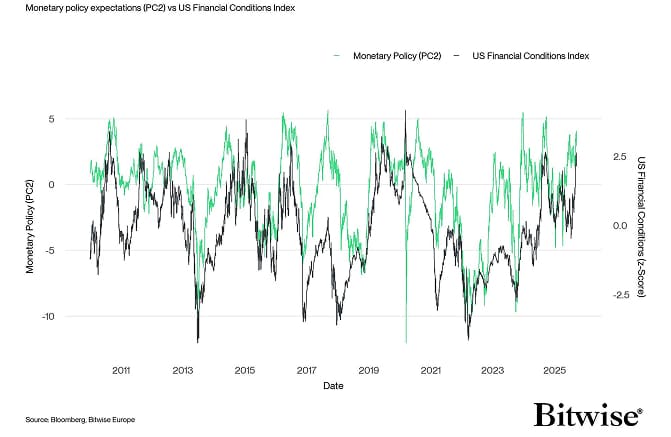

In any case, a looser stance of monetary policy is generally bullish for bitcoin because it tends to ease overall financial conditions as well.

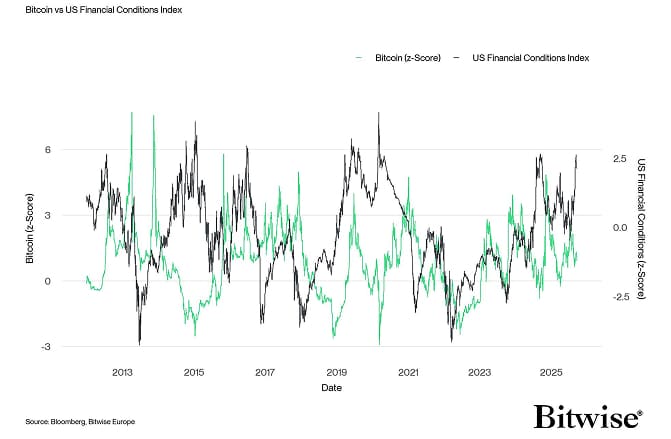

Loose monetary policy directly eases financial conditions

Bitcoin generally tends to thrive in an environment of easing financial conditions and tends to suffer in an environment of tightening financial conditions.

Easy financial conditions continue to support bitcoin

Based on the previous observations made above, we are most likely entering an environment of sustained easing in financial conditions.

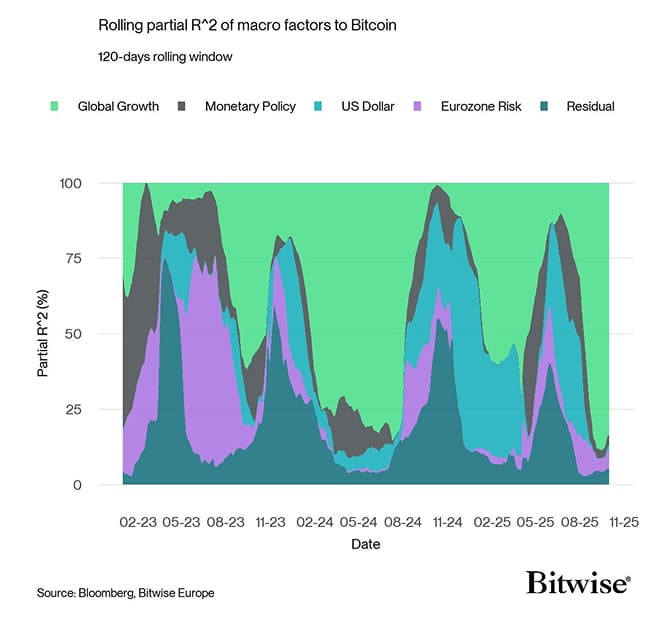

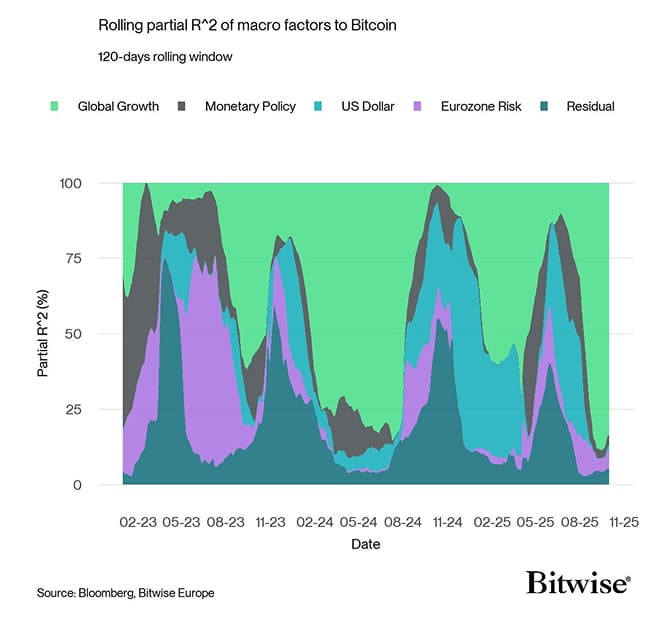

In this context, it is worth noting that global growth factors still appear to be dominating bitcoin's performance from a pure quantitative perspective. This can be seen in our macro factor model which suggests that almost 90% of bitcoin's performance has been explained by changes in global growth expectations – not monetary policy expectations – over the past 6 months.

How much of Bitcoin's performance can be explained by macro factors?

Source: Bloomberg, Bitwise Europe

Source: Bloomberg, Bitwise Europe

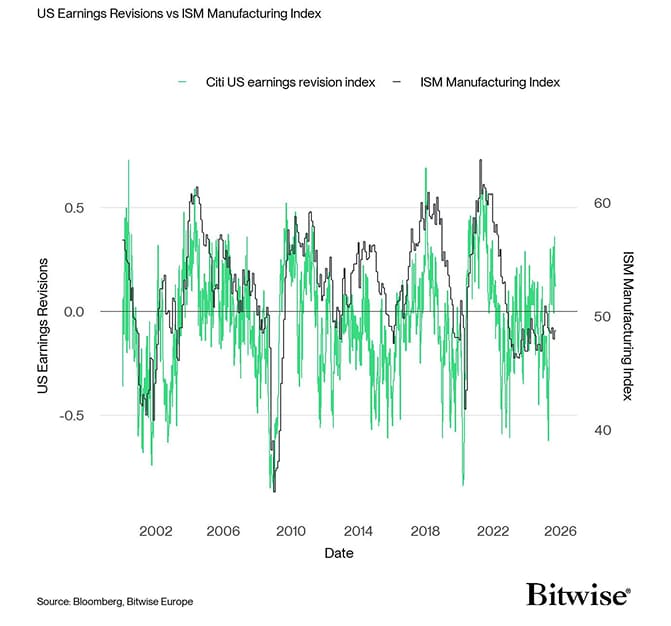

These market-based global growth expectations tend to be highly correlated with changes in leading business cycle indicators like the ISM Manufacturing Index.

The good news is that the ISM Manufacturing Index will likely recover swiftly based on the positive earnings revisions we have seen over the past couple of months. This also suggests that the ISM could significantly surprise to the upside.

US earnings revisions suggest that the ISM will recover swiftly

We have outlined the key reasons for this swift recovery - mostly centring around global monetary easing and liquidity growth – in our previous monthly report here.

It is also important to underscore that improvements in monetary policy expectations tend to lead improvements in global growth expectations. That's why we expect Fed rate cuts to support positive global growth expectations well into 2026.

It is generally key to understand the following dynamics:

- The Fed is easing into stagflation.

- Inflation is re-accelerating, with CPI inflation way above the Fed's 2% inflation target

- Financial repression/negative real yields are back on the horizon.

- Treasuries lose appeal, scarce assets (like bitcoin) gain.

- Cuts will steepen the curve, turbocharging money supply growth and inflation.

- Bitcoin benefits from both higher inflation expectations and looser policy.

Meanwhile, global money supply continues to make new all-time highs which implies higher bitcoin prices as well. Another indicator which also signals an increase in global liquidity is stablecoin market caps.

Aggregate stablecoin market caps have been making new all-time highs every day which is consistent with the observation that macro liquidity is increasing (Chart-of-the-Month):

Increasing stablecoin market caps are consistent w/ increasing macro liquidity

Bottom Line: The Fed's renewed easing cycle, set against rising inflation expectations and expanding global liquidity, points to a medium-term bullish backdrop for bitcoin. With real yields declining, money supply growth accelerating, and global growth expectations turning up, conditions are aligning for crypto assets to benefit meaningfully from looser financial conditions.

On-Chain Developments

September's performance was also heavily influenced by elevated selling pressure by whales. More specifically, bitcoin whales have distributed around 150k BTC since late August based on aggregate whale holdings that excludes miner and exchange wallets.

Nonetheless, Glassnode data show that transfer volumes from whale wallets to exchanges have gradually dissipated over the past couple of weeks which implies a decline in whale selling.

Broadly speaking, there are two major competing forces at play for bitcoin right now –

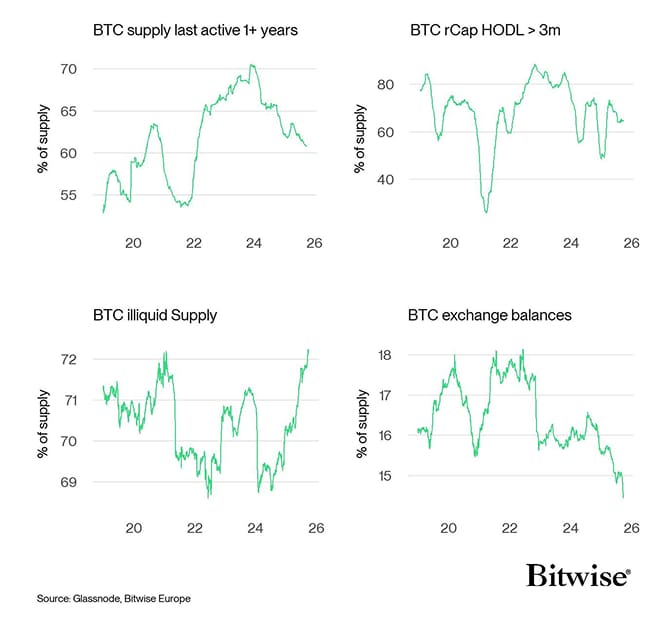

Major long-term holders have been distributing bitcoins while institutions have continued to accumulate. For instance, the percentage of supply last active 2+ years ago has been trending lower since late 2024 already. Meanwhile, the percentage of supply held by long-term holders (i.e. those with a holding period of more than 155 days) has also declined more recently.

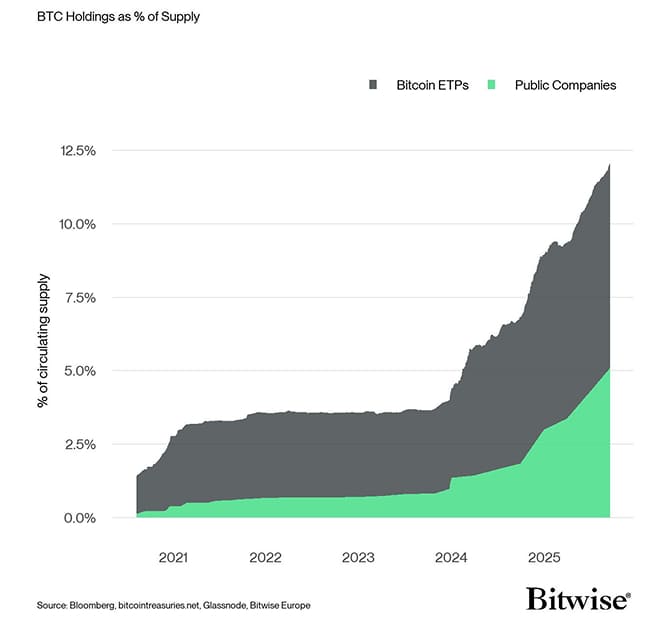

That being said, the percentage of bitcoin supply held by institutions – public companies and bitcoin ETPs – continues to climb and is already close to 12.5%.

In other words, almost every 8th bitcoin that will ever exist is already controlled by an institutional investor.

Funds & Public Companies Now Hold close to 12.5% of All Bitcoin

Companies like Strategy (MSTR) or Metaplanet (3350 JP) have continued buying more recently while global bitcoin ETPs have continued to experience net inflows.

So, “Bitcoin OGs” (multi-year Bitcoin holders) are bailing out, driving down Long-Term Holder metrics. Meanwhile, institutions (ETPs & companies companies) are buying in.

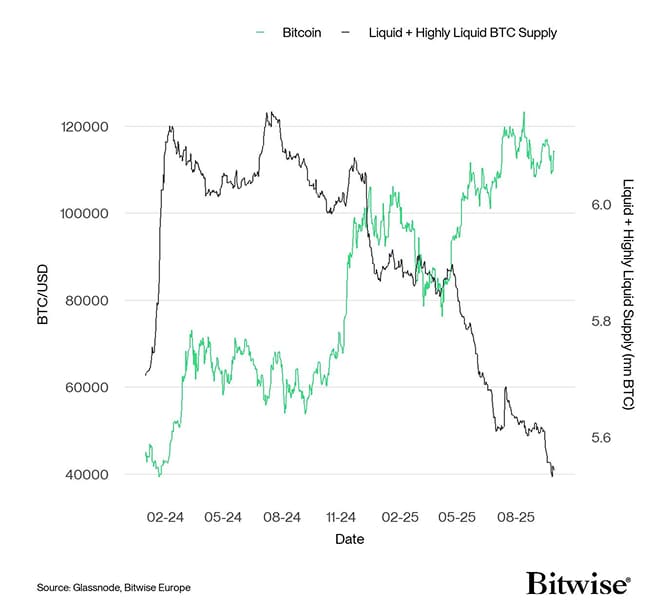

That's why we also continue to see a continued decline in liquid and highly liquid supply (on exchanges) which is exacerbated by ongoing institutional accumulation of bitcoin. This tends to be a strong tailwind for bitcoin going into the fourth quarter.

Bitcoin: Price vs (Highly) Liquid Supply

In the context of long-term holders, it is worth noting that bull cycles are generally characterised by a decline in relative long-term holder supply and an increase in short-term holder supply as new investors and fresh capital flock into the market.

This is exacerbated by signficant whale exchange outflows – these might be due to internal exchange transfers but the aggregate exchange supply still appears to be trending downwards.

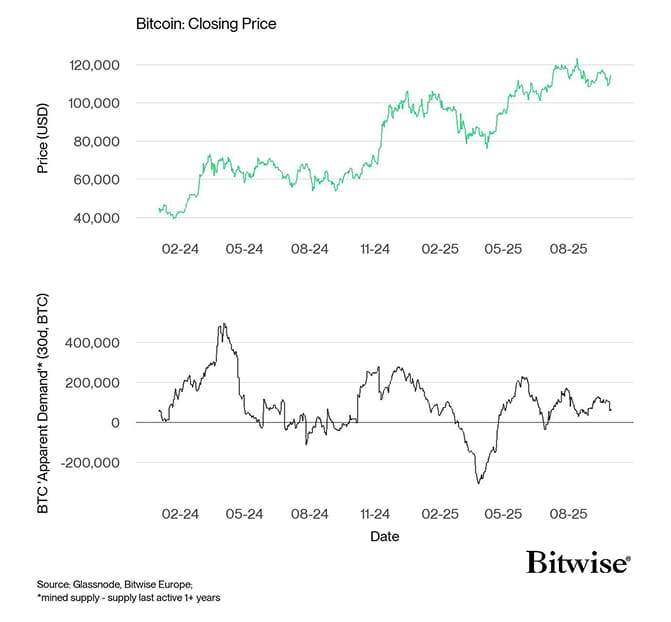

For the time being, we are also observing a positive momentum in “apparent demand” which is also derived from changes in long-term holder supply (i.e. coins held for at least 1 year).

Bitcoin: 'Apparent Demand'*

As far as selling pressure is concerned, we are also seeing increasing evidence for “seller exhaustion”.

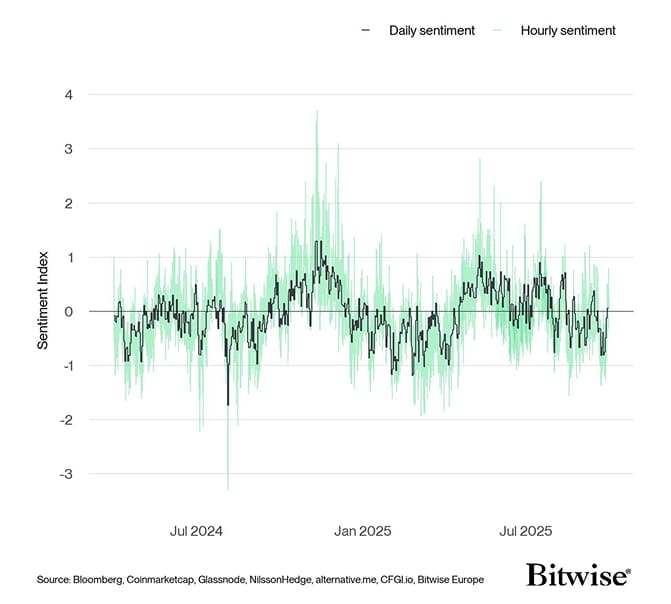

In fact, we might already be in the process of bottoming out as highlighted in our recent Crypto Market Compass as well. For instance, our Cryptoasset Sentiment Index has hit overbought levels on an intraday basis last week twice and the Crypto Fear and Greed Index published by CFGI.io has even reached “extreme fear” levels on an intraday basis as well. This is equivalent to a -1 standard deviation in our hourly Cryptoasset Sentiment Index.

Cryptoasset Sentiment Index: Daily vs Hourly

Bitcoin has shown relative resilience, holding around ~$108k - a level that also aligns with the short-term holder cost basis – this appears to provide a strong support for bitcoin right now as sellers are increasingly exhausted.

Bottom Line: Despite significant selling pressure by long-term holders, bitcoin remains relatively resilient due to ongoing outsized institutional demand and a decline in liquid supply (on exchanges). Bearish sentiment and on-chain metrics imply that sellers are becoming increasingly exhausted and signal that bitcoin might be in the process of bottoming out already.

Bottom Line

- Performance: Despite September’s historical reputation as bitcoin’s weakest month, the asset surprised to the upside, significantly outperforming ether and most altcoins, but still diverging from gold’s strength. While short-term sentiment remains mixed, improving monetary policy and financial conditions are set to extend bitcoin’s structural bull market well into 2026.

- Macro: The Fed’s renewed easing cycle, set against rising inflation expectations and expanding global liquidity, points to a medium-term bullish backdrop for bitcoin. With real yields declining, money supply growth accelerating, and global growth expectations turning up, conditions are aligning for crypto assets to benefit meaningfully from looser financial conditions.

- On-Chain:Despite significant selling pressure by long-term holders, bitcoin remains relatively resilient due to ongoing outsized institutional demand and a decline in liquid supply (on exchanges). Bearish sentiment and on-chain metrics imply that sellers are becoming increasingly exhausted and signal that bitcoin might be in the process of bottoming out already.

Appendix

Cryptoasset Market Overview

Global Cryptoasset Market Caps

Source: Glassnode, Bitwise Europe

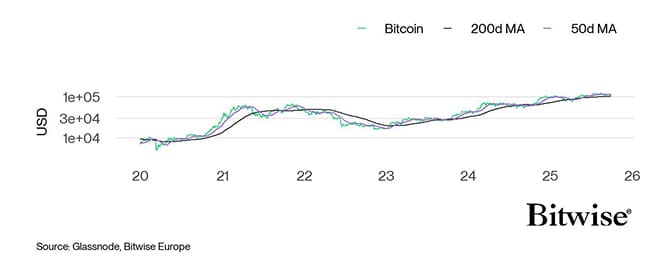

Bitcoin Performance

Source: Glassnode, Bitwise Europe

Bitcoin Performance

Source: Glassnode, Bitwise Europe

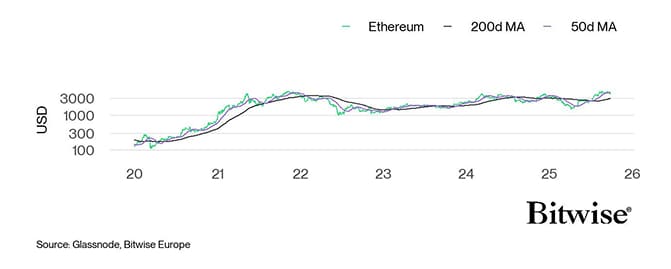

Ethereum Performance

Source: Glassnode, Bitwise Europe

Ethereum Performance

Source: Glassnode, Bitwise Europe

Ethereum vs Bitcoin Relative Performance

Source: Glassnode, Bitwise Europe

Ethereum vs Bitcoin Relative Performance

Source: Glassnode, Bitwise Europe

Altseason Index

Source: Glassnode, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

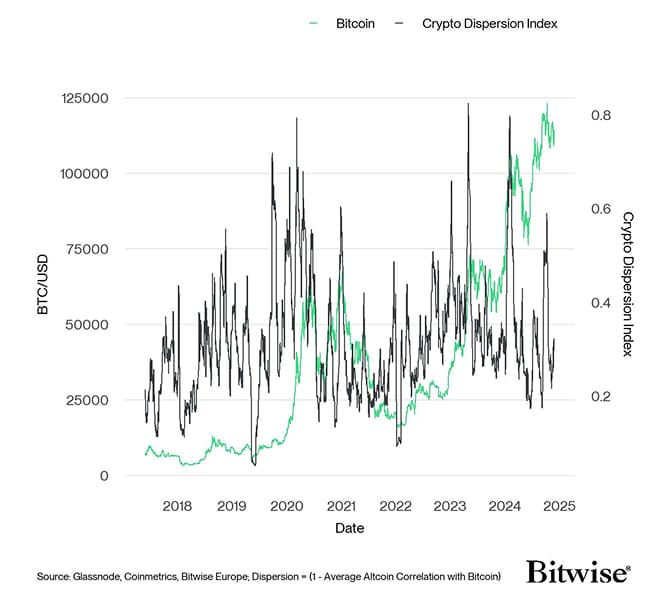

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Glassnode, Coinmetrics, Bitwise Europe; Despersion = (1 - Average Altcoin Correlation with Bitcoin)

Source: Glassnode, Coinmetrics, Bitwise Europe; Despersion = (1 - Average Altcoin Correlation with Bitcoin)

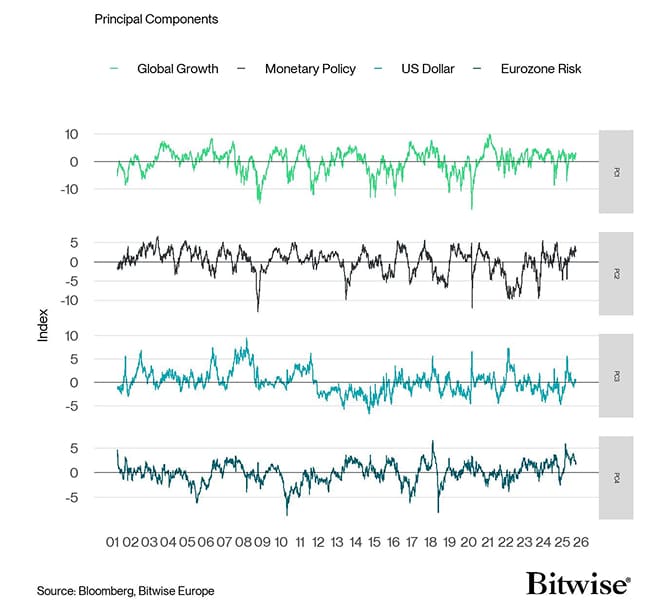

Cryptoassets & Macroeconomy

Macro Factor Pricing

Source: Bloomberg, Bitwise Europe

How much of Bitcoin's performance can be explained by macro factors?

Source: Bloomberg, Bitwise Europe

How much of Bitcoin's performance can be explained by macro factors?

Source: Bloomberg, Bitwise Europe

Source: Bloomberg, Bitwise Europe

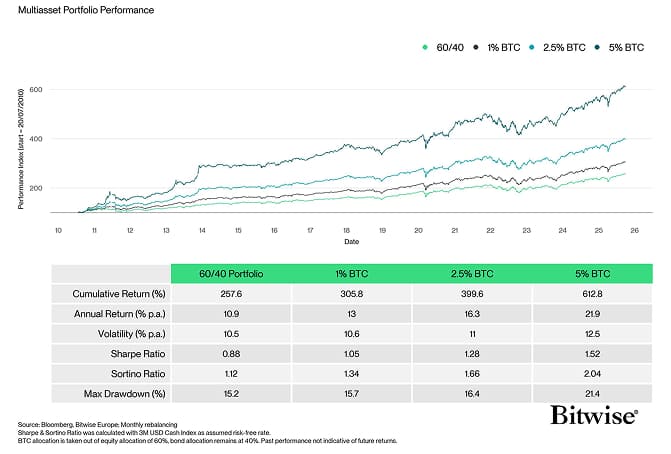

Cryptoassets & Multiasset Portfolios

Multiasset Performance with Bitcoin (BTC)

Source: Bloomberg, Bitwise Europe; Monthly rebalancing; Sharpe Ratio was calculated with 3M USD Cash Index as assumed risk-free rate; BTC allocation is taken out of equity allocation of 60%, bond allocation remains at 40%; Past performance not indicative of future returns.

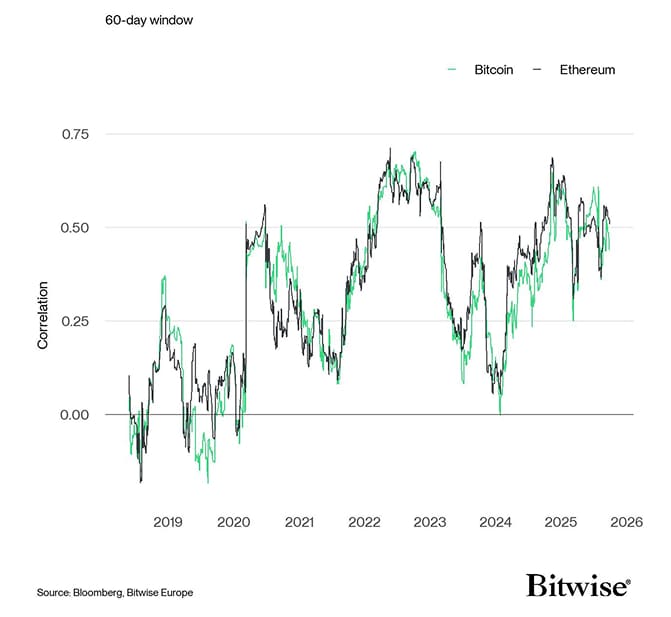

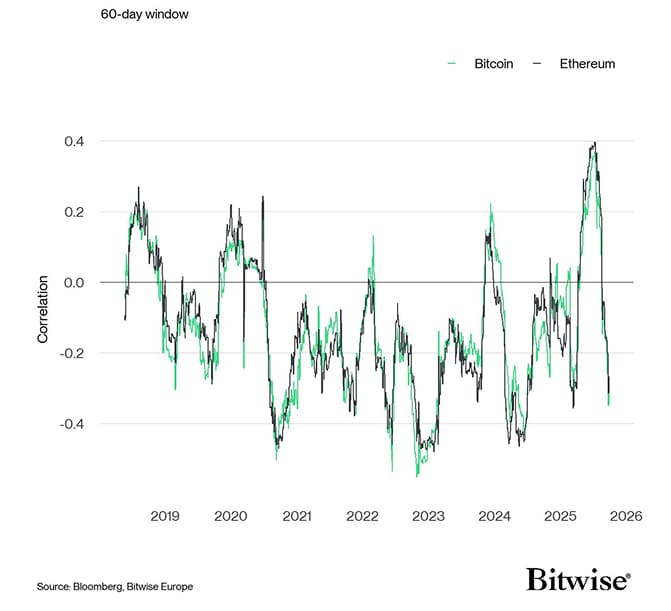

Rolling correlation: S&P 500

Source: Bloomberg, Bitwise Europe; Monthly rebalancing; Sharpe Ratio was calculated with 3M USD Cash Index as assumed risk-free rate; BTC allocation is taken out of equity allocation of 60%, bond allocation remains at 40%; Past performance not indicative of future returns.

Rolling correlation: S&P 500

Source: Bloomberg, Bitwise Europe

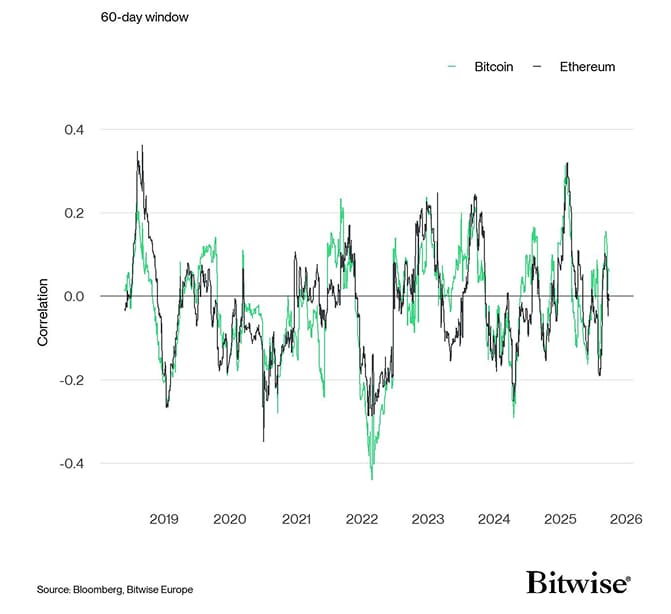

Rolling correlation: Bund Future

Source: Bloomberg, Bitwise Europe

Rolling correlation: Bund Future

Source: Bloomberg, Bitwise Europe

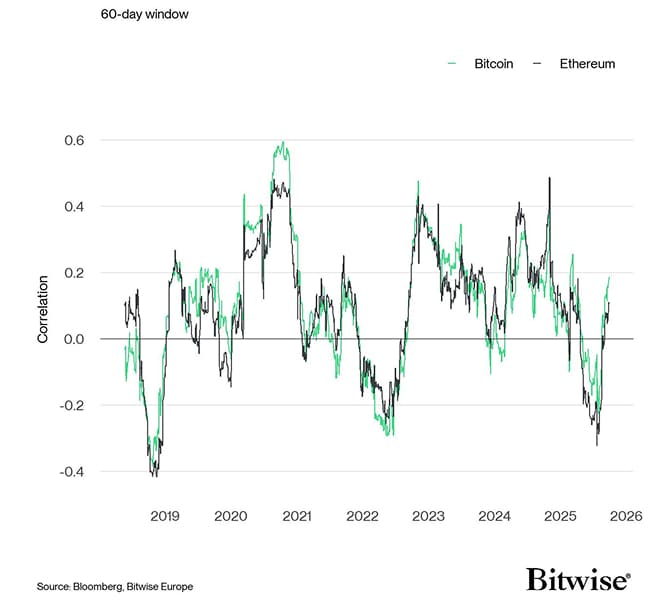

Rolling correlation: Gold

Source: Bloomberg, Bitwise Europe

Rolling correlation: Gold

Source: Bloomberg, Bitwise Europe

Rolling correlation: Dollar Index (DXY)

Source: Bloomberg, Bitwise Europe

Rolling correlation: Dollar Index (DXY)

Source: Bloomberg, Bitwise Europe

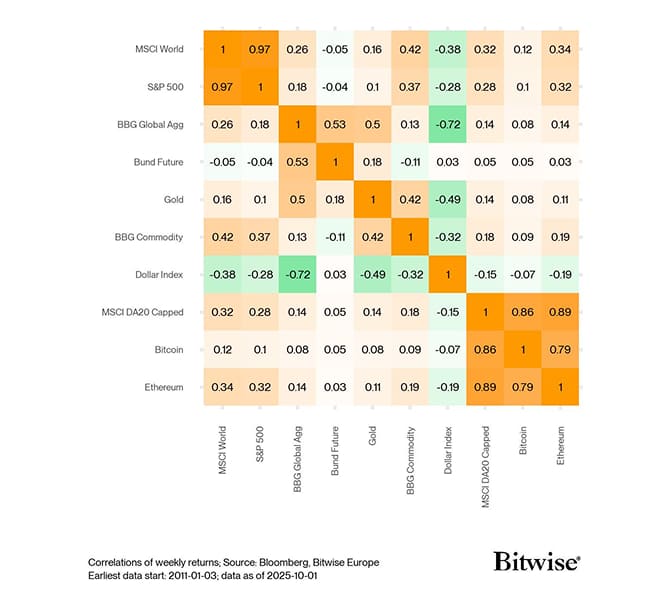

Cross Asset Correlation Matrix

Source: Bloomberg, Bitwise Europe

Cross Asset Correlation Matrix

Source: Correlations of weekly returns; Source: Bloomberg, ETC Group earliest data start: 2011-01-03; data as of 2025-10-01

Source: Correlations of weekly returns; Source: Bloomberg, ETC Group earliest data start: 2011-01-03; data as of 2025-10-01

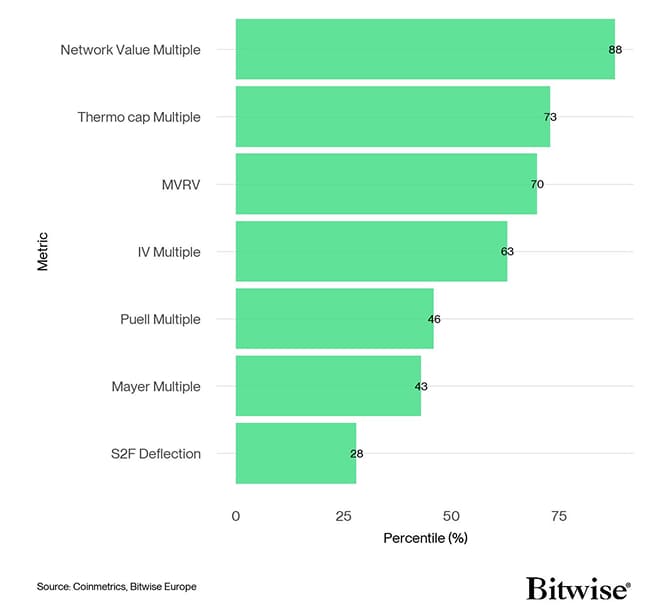

Cryptoasset Valuations

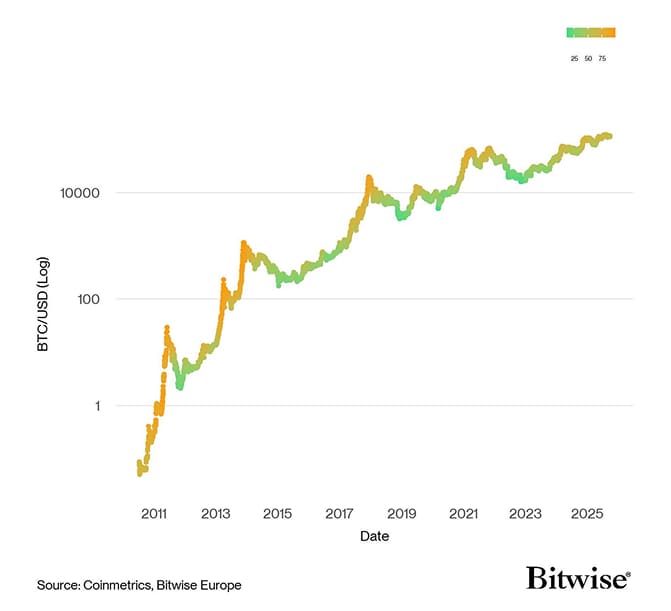

Bitcoin: Price vs Composite Valuation Indicator

Source: Coinmetrics, Bitwise Europe

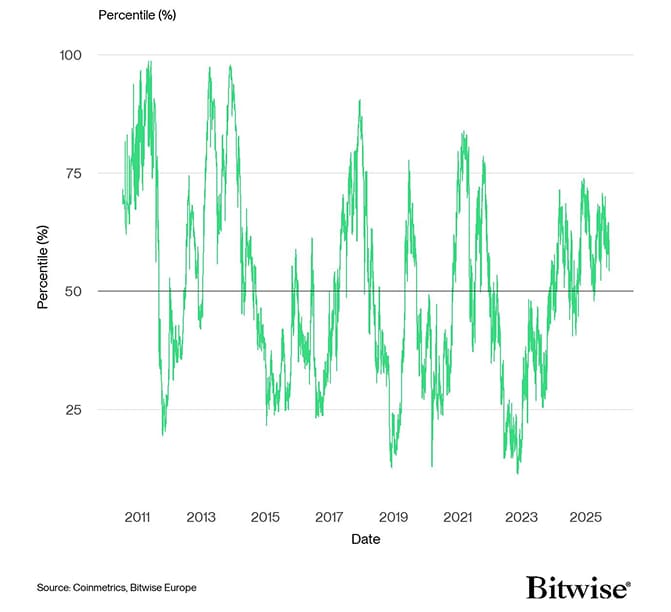

Bitcoin: Composite Valuation Indicator

Source: Coinmetrics, Bitwise Europe

Bitcoin: Composite Valuation Indicator

Source: Coinmetrics, Bitwise Europe

Bitcoin: Valuation Metrics

Source: Coinmetrics, Bitwise Europe

Bitcoin: Valuation Metrics

Source: Coinmetrics, Bitwise Europe

Source: Coinmetrics, Bitwise Europe

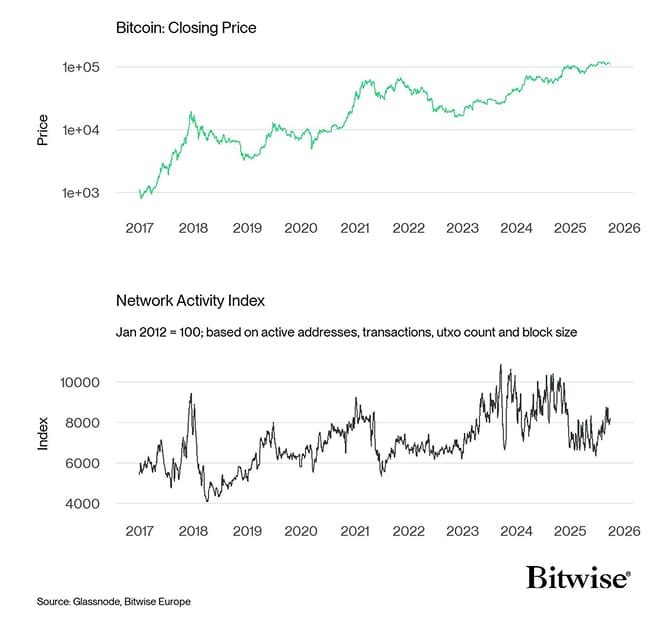

On-Chain Fundamentals

Bitcoin: Price vs Network Activity Index

Source: Glassnode, Bitwise Europe

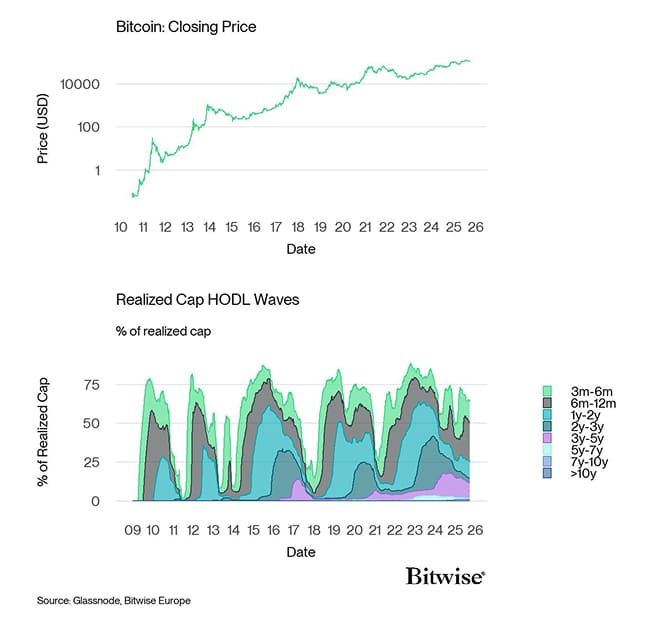

Bitcoin: Closing Price

Source: Glassnode, Bitwise Europe

Bitcoin: Closing Price

Source: Glassnode

Bitcoin's supply scarcity is more pronounsed that during the last cycle

Source: Glassnode

Bitcoin's supply scarcity is more pronounsed that during the last cycle

Source: Glassnode, Bitwise Europe

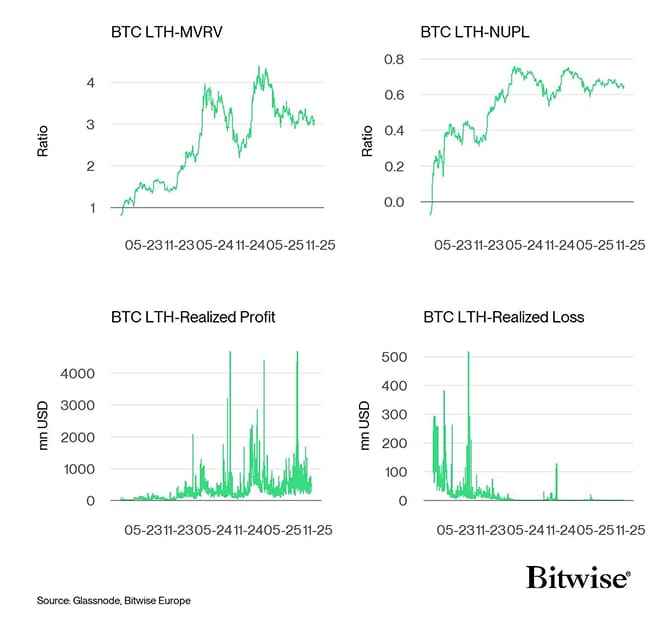

Bitcoin Long-term Holder (LTH) Dashboard

Source: Glassnode, Bitwise Europe

Bitcoin Long-term Holder (LTH) Dashboard

Source: Glassnode, Bitwise Europe

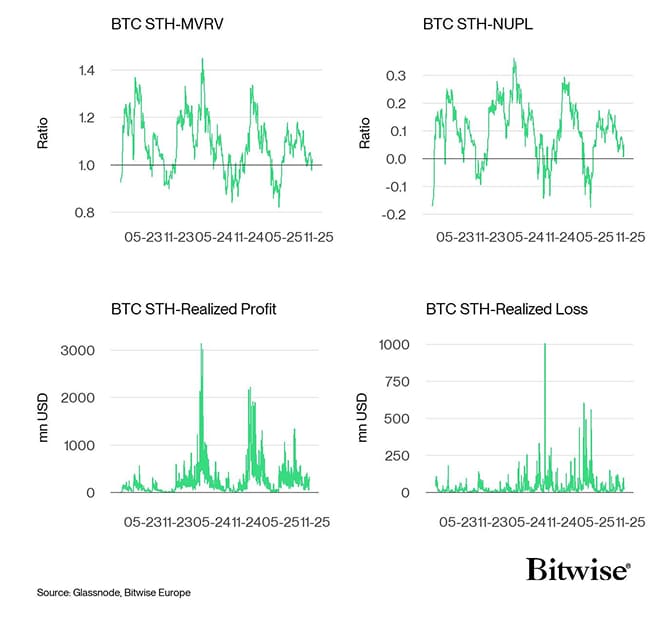

Bitcoin Short-term Holder (STH) Dashboard

Source: Glassnode, Bitwise Europe

Bitcoin Short-term Holder (STH) Dashboard

Source: Glassnode, Bitwise Europe

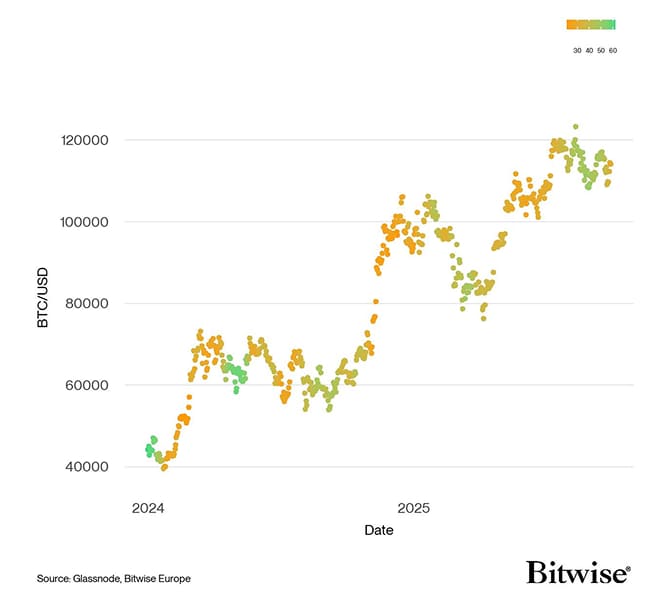

Bitcoin: Price vs Average Accumulatio Score

Source: Glassnode, Bitwise Europe

Bitcoin: Price vs Average Accumulatio Score

Source: Glassnode, ETC Group

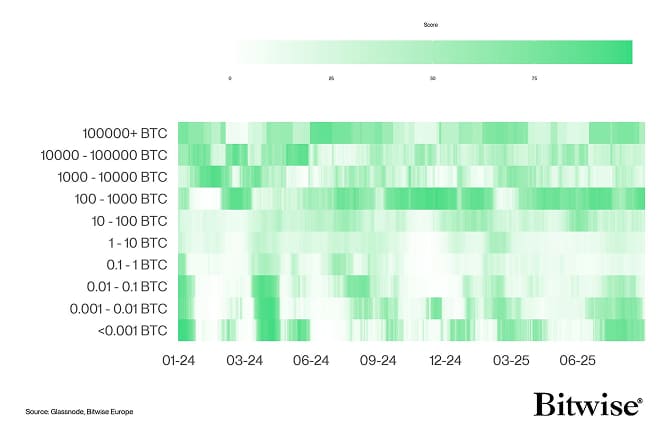

Bitcoin Accumulation Score

Source: Glassnode, ETC Group

Bitcoin Accumulation Score

Source: Glassnode, Bitwise Europe

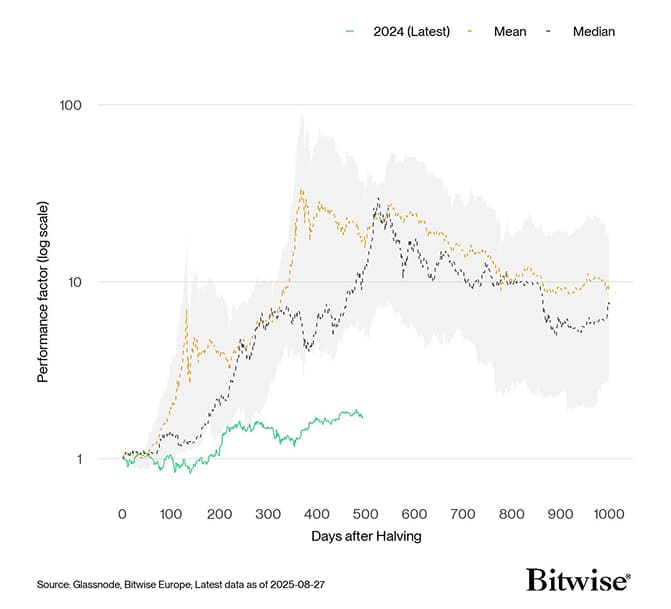

Bitcoin: Post-Halving Performance

Source: Glassnode, Bitwise Europe

Bitcoin: Post-Halving Performance

Source: Glassnode, Bitwise Europe; Results based on the previous Halvings in 2012, 2016, and 2020

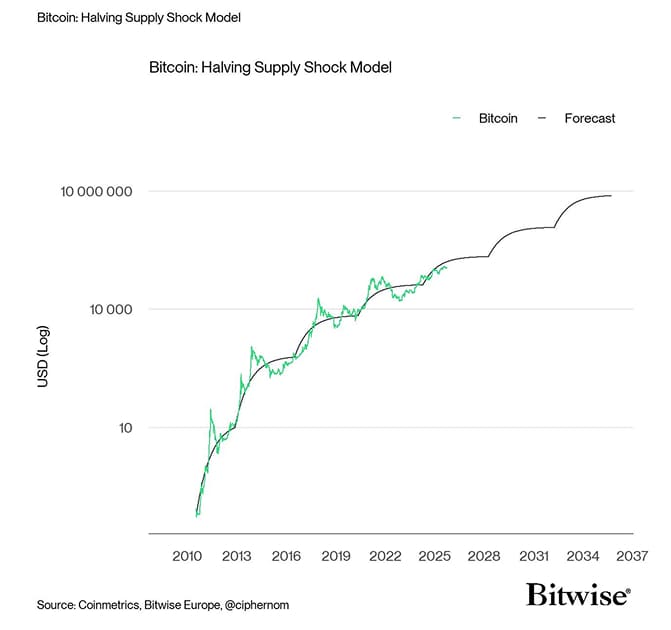

Bitcoin: Steady increase in scarcity will provide a tailwind for price appreciations

Source: Glassnode, Bitwise Europe; Results based on the previous Halvings in 2012, 2016, and 2020

Bitcoin: Steady increase in scarcity will provide a tailwind for price appreciations

Source: Coinmetrics, Bitwise Europe; @ciphernom

Source: Coinmetrics, Bitwise Europe; @ciphernom

Important Information

This publication constitutes a marketing communication and is provided for informational purposes only. It does not constitute investment advice, a personal recommendation, or an offer or solicitation to buy or sell any financial instrument.

This document (which may take the form of a presentation, press release, social media post, blog article, broadcast communication or similar instrument – collectively referred to as a “Document”) is issued by Bitwise Europe GmbH (“BEU” or the “Issuer”) and has been prepared in accordance with applicable laws and regulations, including those relating to financial promotions.

Bitwise Europe GmbH, incorporated under the laws of Germany, is the issuer of the Exchange Traded Products (“ETPs”) referenced in this Document under a base prospectus and the applicable final terms, as supplemented from time to time, approved by the German Federal Financial Supervisory Authority (BaFin). The approval of the prospectus by BaFin relates solely to the completeness, coherence and comprehensibility of the prospectus in accordance with the Prospectus Regulation and does not constitute an endorsement, recommendation or assessment of the merits of the products.

The market analyses, views and scenarios presented reflect the assessment as of the date of publication and are based on information considered reliable. However, no representation or warranty is made as to their accuracy or completeness. Forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Past performance is not a reliable indicator of future results.

Capital at risk. Cryptoassets are highly volatile and involve a high degree of risk. The value of investments in cryptoassets and crypto-linked ETPs may fluctuate significantly, and investors may lose part or all of their invested capital. No capital protection or guaranteed compensation mechanism applies in respect of market losses.

Any investment decision should be made solely on the basis of the relevant base prospectus, the applicable final terms and the key information document, in particular the section entitled “Risk Warning”. The base prospectus, final terms and additional risk information are available at: www.bitwiseinvestments.eu

Access to certain documents may require self-certification regarding your jurisdiction and investor status and may be subject to additional disclaimers and important information.

For further details, please refer to the full disclaimer available at: www.bitwiseinvestments.eu/disclaimer