Crypto up, FTX sales fail to hit sentiment - optimism ahead?

Around $30bn in market cap has been added to oversold crypto markets since early September selloffs saw Bitcoin dip to below $26k.

The latest rally (all prices noted at time of writing) saw Solana's token SOL jump 13% to just under $20. Bitcoin (BTC) climbed by 6.9% to hold just above $27k and Ether (ETH) added 5.9%, taking it back over $1,600.

The biggest beneficiary among the large cap coins was TON, the independently-produced blockchain of the Telegram messaging network, which skyrocketed 56.3% and entered the top 10 assets by market cap for the first time.

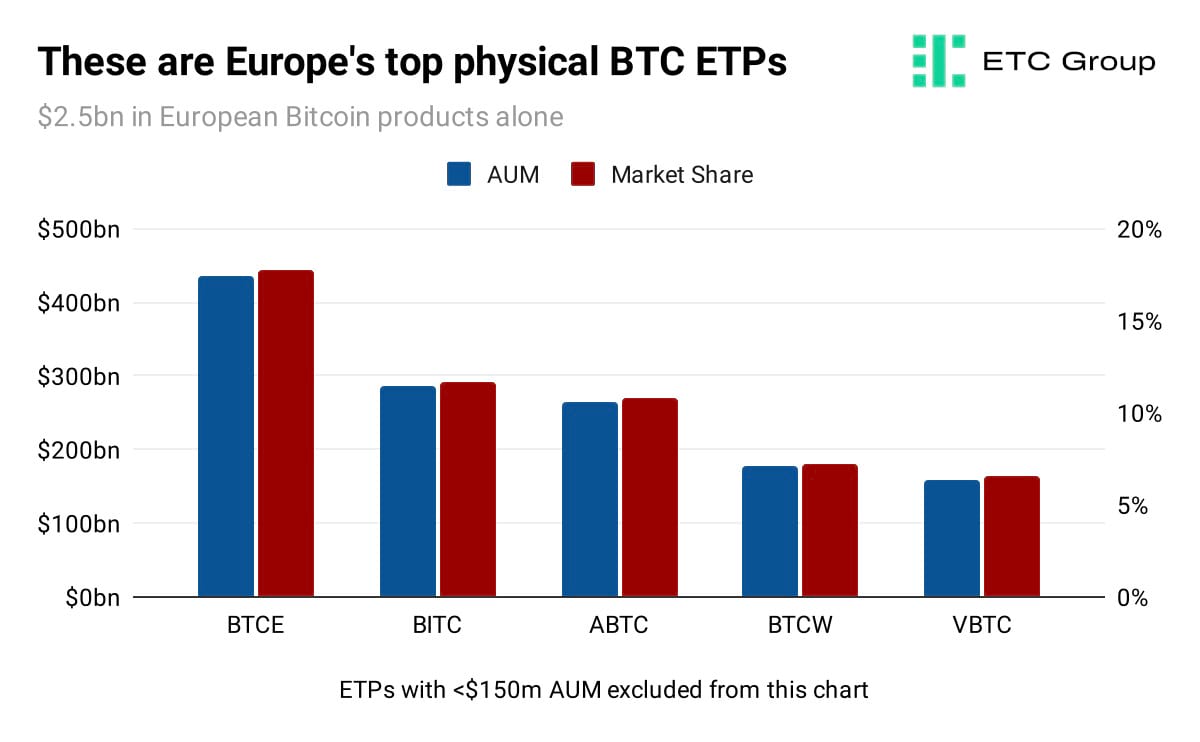

Sentiment appears to be turning a corner in markets generally, and while this has not yet been replicated in ETF and ETP inflows, European markets are showing more resilience than their opposite numbers in North America.

With a legion of upcoming American spot Bitcoin ETFs still very much on the table, this appears to coincide with a weakening of interest in futures-based Bitcoin products compared to those backed by physical crypto.

ProShares' BITO, for example, registered more than $40m of outflows over the past week, 75% of the total and 3.5 times more than physically-backed Bitcoin products put together.

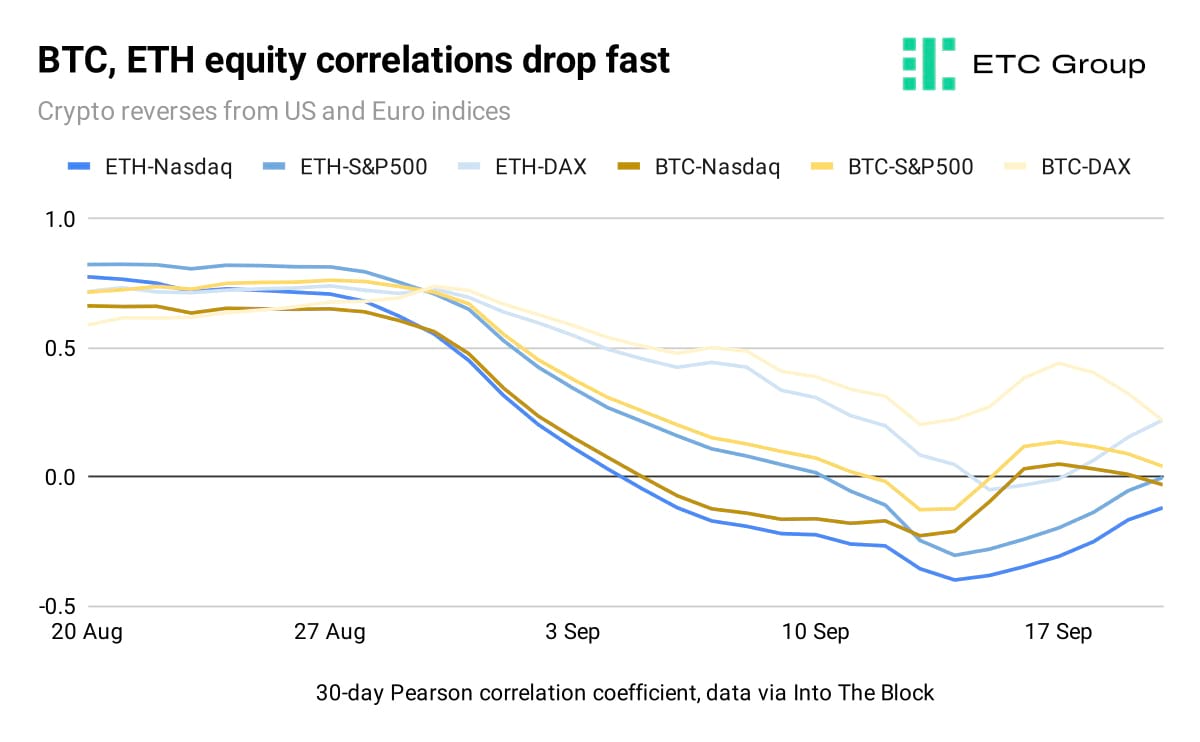

As K33's Senior Analyst Vetle Lund noted on Bloomberg TV this week, Bitcoin and Ethereum correlations with US equities have broken down to below zero, a point not seen since early August. And, if we add Germany's DAX40 index to the equation of ETH and BTC versus the S&P 500 and Nasdaq 100, this shows that Euro-area equities are dancing to the same tune.

The 30-day correlation co-efficient displays how assets tend to move in relation to one another. A correlation near zero implies no directional cohesiveness, while a figure close to -1 shows that crypto and the asset or index in question tend to move in opposite directions.

On longer timeframes, both Bitcoin and Ether are much less correlated than is traditionally supposed. This means both assets can be used to diversify portfolios, and even as hedges against wider market malaise. Lower correlations with equities also imply that the impact of central bank interest rate decisions should prove less impactful than they would be 12 months ago.

Now, noting from a technical perspective that macro interest rate decisions should have less impact on the market than in 2022 and it actually happening are two different things.

But news on 13 September that a Delaware bankruptcy court had assented to FTX selling $3.4bn in crypto assets has produced little impact, giving us the sense that resilience is hardening around current price points. There is also the fact that liquidations of the collapsed exchange's $1.16bn in SOL, $560m in BTC and $192m in ETH are limited to $50m a week, a volume that even lower-liquidity markets can mop up today with little onward impact.

With volatility in Bitcoin and Ethereum both ticking up from their record lows, these small upward shifts in sentiment may produce outsize results.

Institutions demand bigger slice of market slated to rise to $16 trillion by 2040

The US Federal Reserve reversed course to announce a pause on interest rates on Wednesday, 20 September. Ahead of the meeting, traders had priced in virtually zero-percent chance of another rate hike, CME data showed.

The Bank of England may have been similarly caught off-guard by a surprise dip in UK inflation to 6.7%, while the chances of going through with the decision to raise British interest rates by 25bps dropped from 80% to 55% overnight, money market positioning indicated.

The Bank's Monetary Policy Committee was due to announce its decision on Thursday 21 September, before Friday yielded the Bank of Japan's turn, where a hold in rates was the most likely option.

So, while the pivot point to falling interest rates may not yet be in the rearview mirror, that time appears fast approaching.

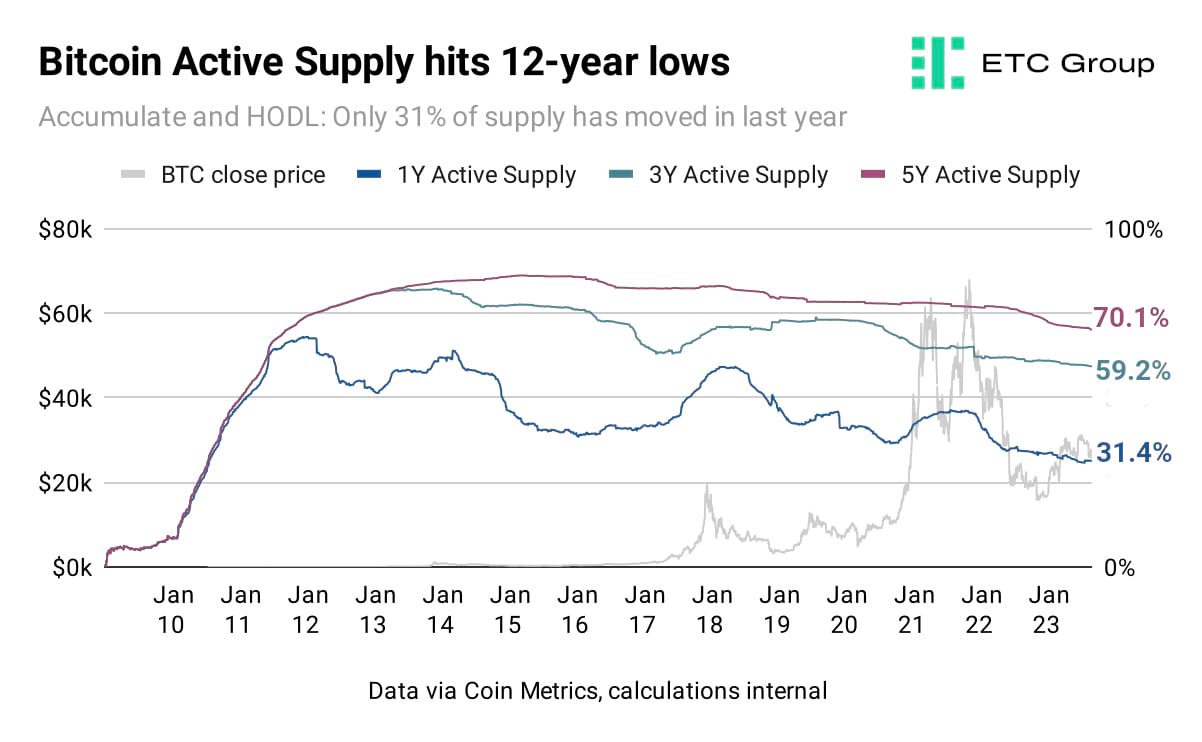

That means a lower cost of borrowing, perkier global growth, and the next crypto bull market kicking off in earnest. We are deep amidst relative value accumulation mode for the savviest participants here, as we noted in Week 36's Crypto Minutes that Bitcoin active supply had hit a 12-year low.

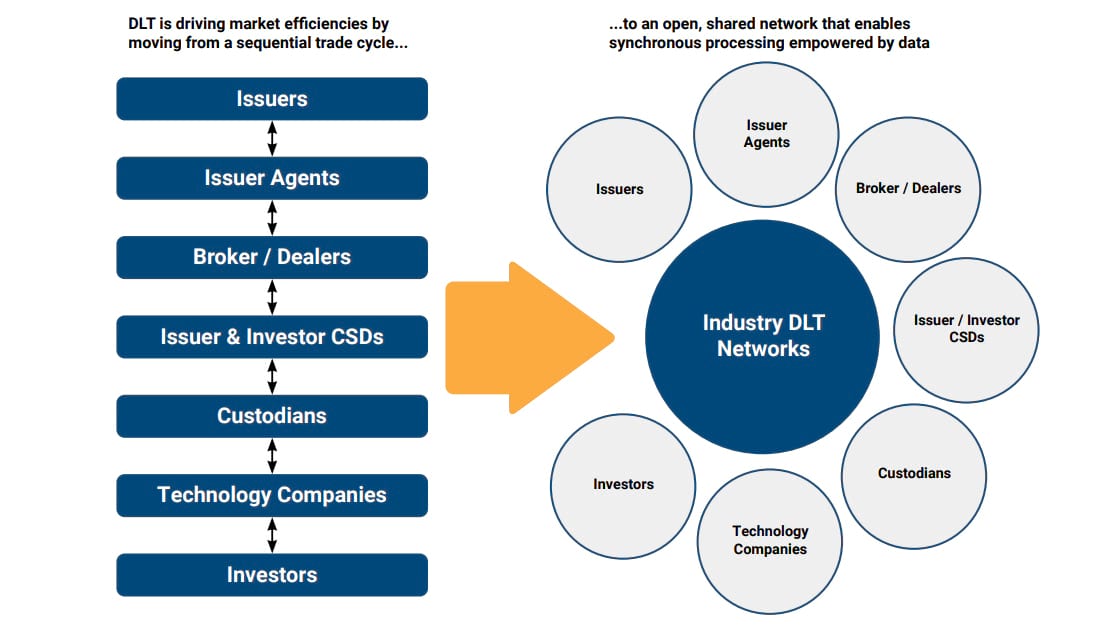

At the same time, institutions continue to ramp up their crypto and blockchain interests. Citigroup started trading digital assets on 18 September, just a couple of weeks after reports emerged the London Stock Exchange was working on its own blockchain-based arm, and days after three of the world's largest clearing agencies published an unusual tripartite paper demanding a seat at the table to providing institutions with digital asset support.

Market participants are citing dramatic cost savings of up to 60% from the use of different blockchain protocols, the joint DTCC, Euroclear and Clearstream paper notes.

We are at an inflection point as an industry when it comes to DLT and digital assets. With digital assets forecasted to grow in value to around $16 trillion over the next 15 years, now is the time to assess what is needed to propel advancement,

said DTCC's managing director Jennifer Peve.

Source: FMI Standards, DTCC, September 2023

Source: FMI Standards, DTCC, September 2023

Between them, DTCC, Euroclear and Clearstream are responsible for several quadrillion dollars in asset clearing per year. And since clearinghouses provide settlement and cross-border assurances, but rely on manual processes, blockchain-based settlement threatens this business model to a degree.

It is worth considering the 180-degree tone shift, and the deep concern of being left behind implicit in statements like this:

There is broad recognition of the growing need for well-regulated, neutral players to provide trust, resilience and standardized connectivity in their respective ecosystems – the role FMIs [Financial Market Institutions] like DTCC have played for decades – to drive digital asset adoption.

No-one - not the most important finance entities in the world, nor its most intransigent - can afford to ignore the coming regime change.

Buy pressure on Ethereum as devs push ETH staking limit

Almost exactly 12 months after the biggest software upgrade in the history of crypto - Ethereum's Merge - its top developers are calling for a limit on how much of the crypto asset can be staked on the network.

Switching Ethereum's security model from Proof of Work to Proof of Stake (which we explored in a detailed Linkedin post ) was, by any metric, a dramatic success.

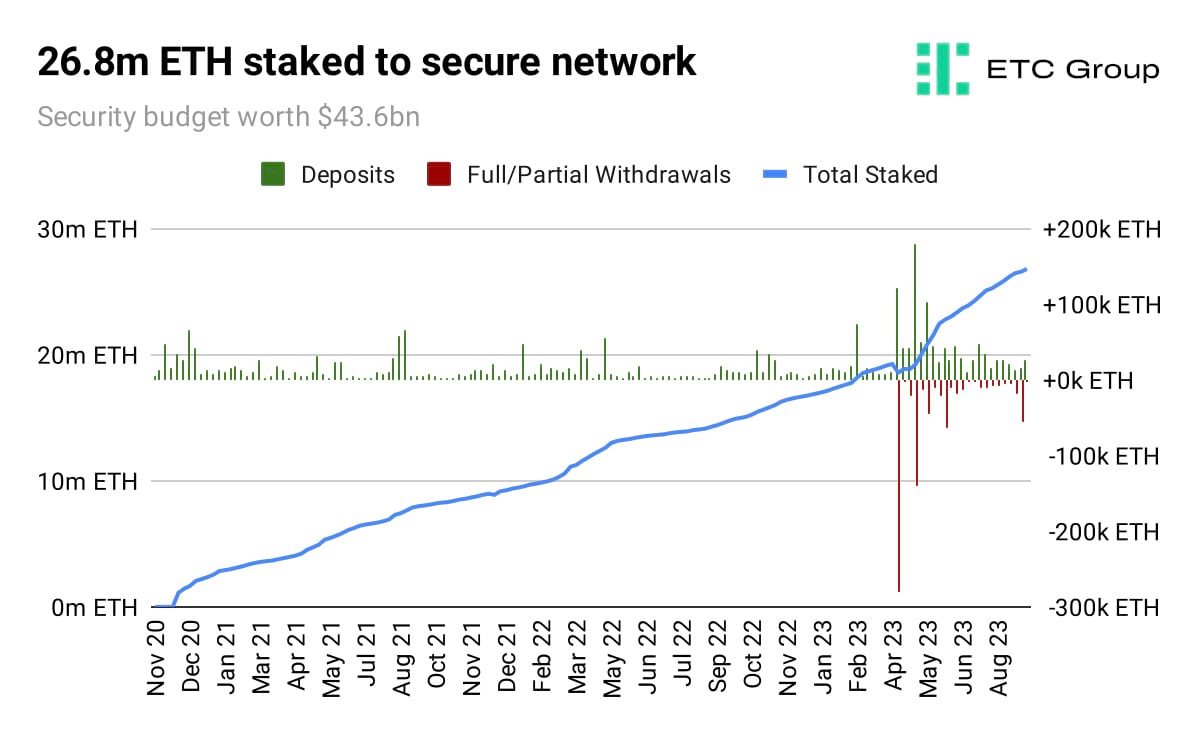

Ethereum holders have been able to collect 3-6% yield on their ETH holdings since December 2020. The ability to withdraw and realise that yield, however, only appeared in two and a half years later, in April 2023, with the Shapella network upgrade.

Since then, more than $46.3bn has been directed to support Ethereum's security budget.

The architect of the Merge, the noted Ethereum developer Tim Beiko, recently published a jointly-authored proposal (EIP-7514) calling for a network change that would limit the number of validators who could deposit blocks of 32 ETH to gain staking rewards.

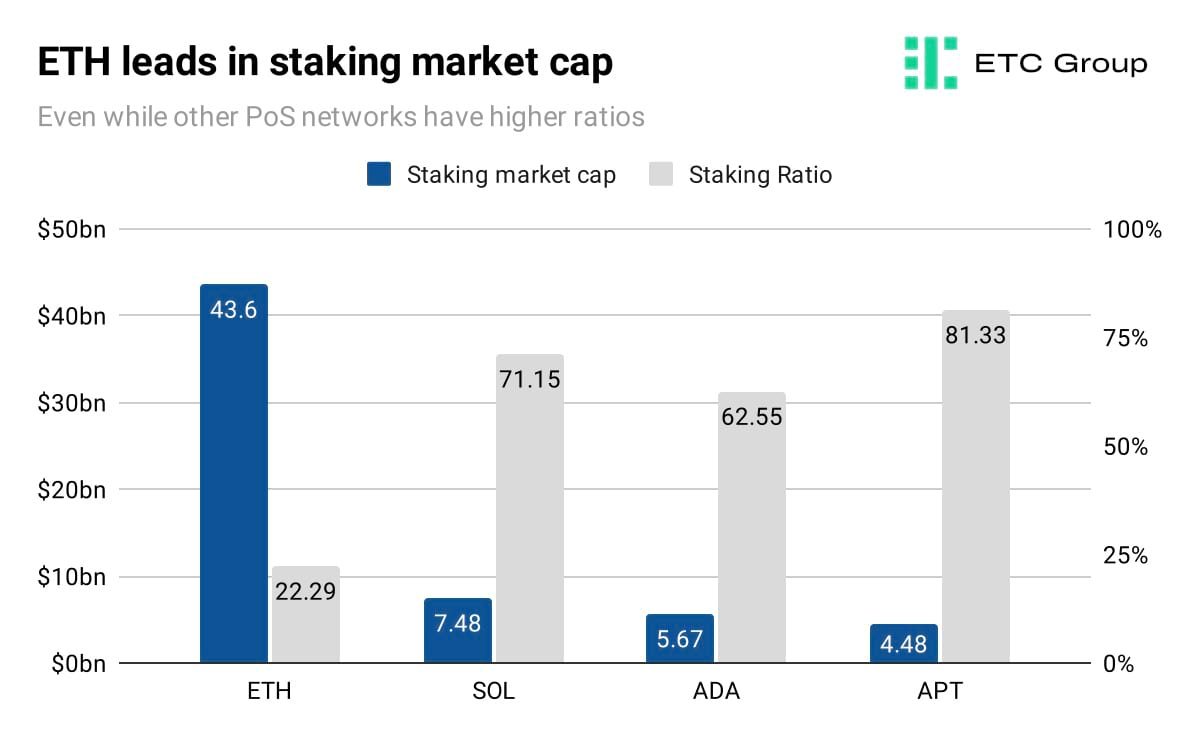

Ethereum is by far the market leader in the value of tokens dedicated to securing the network from attack or disruption.

Staking ETH had been an unexpected success far beyond Ethereum development teams' biggest projections, Beiko said.

But Ethereum has a much lower percentage of its circulating supply locked up in staking. While this ignores the prence of liquid staking derivatives, it remains true that would-be Layer 1 blockchain challengers like Solana and Aptos have around three-quarters of their entire supply dedicated to staking.

Still, if the current rate continues, the ETH Staking Ratio could rise to as much as 75% by the end of September 2024, leaving fewer ETH available for transactions.

Instead, dev teams decided to cap the number of validators that could join the network every six minutes. EIP-7514 will be included in Dencun, Ethereum's next major software upgrade, slated for late 2023.

That naturally puts inevitable buy pressure on ETH itself, and a rush by validators to join the queue for one of the only reliable ways to earn yield in crypto - aside from esoteric DEX strategies that will not concern the average investor.

It is not the first time that Ethereum's adult-in-the-room approach has left it a victim of its own successes. The popularity of the network for launching tokens and executing smart contracts has meant slower speeds and higher transaction costs as far back as 2017.

At that point, Layer 2 teams like Polygon, and Arbitrum (and more recently Coinbase's Base) started to relieve pressure on the network by bundling transactions together and settling them off-chain.

Base has emerged as the fastest-growth Ethereum L2 entity, rapidly gathering half a billion dollars in Total Value Locked, according to L2Beat. Transactions have also soared to over a million per day, the chain's explorer shows, giving Coinbase an additional revenue of over $40,000 a day.

Supporting the buy pressure claim, EY's Global Blockchain Leader Paul Brody repeated in a recent op-ed for Coindesk that all other blockchains would migrate to Ethereum eventually.

If history is a prologue, then Ethereum is going to eat the entire blockchain sector and everything that is not Ethereum will eventually become an Ethereum Layer 2,

he wrote.

Incidentally, Fidelity's latest discounted cash flow valuation model: ‘Ethereum's Potential as Digital Money and as a Yield-Bearing Asset', puts the fair price of ETH at $2,090, or more than 22% undervalued at time of writing.

Echoing a recent X post by Brody, one might reliably conclude:

From: Analysts To: Everyone on Earth Re: Ethereum - I told you so.

Important Information

This publication constitutes a marketing communication and is provided for informational purposes only. It does not constitute investment advice, a personal recommendation, or an offer or solicitation to buy or sell any financial instrument.

This document (which may take the form of a presentation, press release, social media post, blog article, broadcast communication or similar instrument – collectively referred to as a “Document”) is issued by Bitwise Europe GmbH (“BEU” or the “Issuer”) and has been prepared in accordance with applicable laws and regulations, including those relating to financial promotions.

Bitwise Europe GmbH, incorporated under the laws of Germany, is the issuer of the Exchange Traded Products (“ETPs”) referenced in this Document under a base prospectus and the applicable final terms, as supplemented from time to time, approved by the German Federal Financial Supervisory Authority (BaFin). The approval of the prospectus by BaFin relates solely to the completeness, coherence and comprehensibility of the prospectus in accordance with the Prospectus Regulation and does not constitute an endorsement, recommendation or assessment of the merits of the products.

The market analyses, views and scenarios presented reflect the assessment as of the date of publication and are based on information considered reliable. However, no representation or warranty is made as to their accuracy or completeness. Forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Past performance is not a reliable indicator of future results.

Capital at risk. Cryptoassets are highly volatile and involve a high degree of risk. The value of investments in cryptoassets and crypto-linked ETPs may fluctuate significantly, and investors may lose part or all of their invested capital. No capital protection or guaranteed compensation mechanism applies in respect of market losses.

Any investment decision should be made solely on the basis of the relevant base prospectus, the applicable final terms and the key information document, in particular the section entitled “Risk Warning”. The base prospectus, final terms and additional risk information are available at: www.bitwiseinvestments.eu

Access to certain documents may require self-certification regarding your jurisdiction and investor status and may be subject to additional disclaimers and important information.

For further details, please refer to the full disclaimer available at: www.bitwiseinvestments.eu/disclaimer