- Last week, Bitcoin consolidated around $77K after retreating from $87K, as escalating U.S. trade tariffs triggered a wave of risk-off sentiment across global markets. With downside liquidity clusters cleared and macro risks rising, Bitcoin is increasingly positioned as a beneficiary of future monetary easing and geopolitical diversification—particularly if policy pivots dovish to cushion slowing global growth.

- Our in-house Cryptoasset Sentiment Index deteriorated further last week—from -0.67 to -0.84—driven by negative price momentum and weak demand indicators. Only 1 of 15 indicators remains above its short-term trend.

- Bitcoin outperformed equities between March 31 and April 7 (Chart-of-the-Week) underscoring its resilience during the tariff-driven volatility.

Chart of the Week

Liberation Day Fallout: Bitcoin and Equities Unwind as Risk Accelerates

Indexed Intraday Performance | March 31-April 7, 2025 | Price Action Through Escalating Tariff Shocks

Source: Bloomberg, Bitwise Europe

Source: Bloomberg, Bitwise Europe

Performance

Last week, Bitcoin largely traded within a range, oscillating between $81K and $87K amid a backdrop of intensifying macro stress. The Trump administration's aggressive new tariffs-dubbed “Liberation Day”-triggered global backlash and sent ripples through both traditional and digital asset markets. Equities wobbled, commodities spiked, and volatility picked up as global markets digesting not only the economic ramifications but also the re-emergence of political unpredictability as a core market driver.

While equities struggled to find footing, Bitcoin initially showed notable resilience. Over the period from March 31 to April 7 (Chart-of-the-week), Bitcoin held up better than traditional assets through the first wave of tariff-related volatility.

Liberation Day Fallout: Bitcoin and Equities Unwind as Risk Accelerates

Indexed Intraday Performance | March 31-April 7, 2025 | Price Action Through Escalating Tariff Shocks

Source: Bloomberg, Bitwise Europe

Source: Bloomberg, Bitwise Europe

On April 2-dubbed “Liberation Day”-Trump unveiled a sweeping 10% baseline tariff on all imports, along with significantly higher rates for nations running large trade surpluses: 34% on China, 25% on South Korea, 24% on Japan, and 20% on the EU. The move was quickly followed by 25% auto tariffs on April 3. China's response came on April 4 with a full 34% tariff on all U.S. goods and new restrictions on critical exports like rare earths. These measures triggered sharp, synchronized declines across global risk assets. The S&P 500 is now on track for a 15% drawdown over just three trading days-one of the steepest in recent memory-amid surging volatility, record retail outflows, and the deepest sentiment collapse since March 2020.

Our Cross Asset Risk Appetite (CARA) metric reflects this dynamic clearly: it deteriorated from +0.12 on April 2 to -1.09 by April 7, marking a decisive pivot into extreme risk-off territory. When asked about the market fallout, Trump simply remarked, “Sometimes you have to take medicine.” While Bitcoin eventually participated in the broader drawdown, the pace and scale of its decline were more contained, underscoring a relatively cleaner positioning environment compared to equities.

The recent selloff has materially shifted Bitcoin's market structure. As of this morning, with price trading around $75K, it's evident that long positioning was heavily concentrated in the $78K–$82K range-levels that have now been forcefully unwound. The sharp move lower reflects a combination of cascading liquidations and deteriorating sentiment, not just in crypto but across all risk markets.

Importantly, the current liquidation map no longer shows meaningful downside liquidity clusters nearby, suggesting that the majority of leverage has already been flushed from the system. On the upside, however, a dense wall of short liquidations remains between $84K and $85K, which could serve as a magnet should risk sentiment stabilize. For now, the absence of directional liquidity below suggests that Bitcoin's short-term trajectory will be less about mechanical stops and more about the broader repricing of global risk.

The return of tariff warfare doesn't just weigh on GDP projections-it reactivates the core investment case for Bitcoin as a non-sovereign monetary rail. Historically, tariff-induced slowdowns-if they don't ignite another inflation wave-can provide cover for central banks to shift dovish, which Bitcoin tends to front-run. Meanwhile, the weaponization of trade and currency infrastructure continues to accelerate Bitcoin's role in geopolitical diversification.

Institutional behaviour affirms this thesis. US Spot ETF Net Flows posted over $860 million YTD despite market turbulence. Exchange-held Bitcoin supply remains at multi-year lows, with consistent outflows indicating conviction-led accumulation.

Put simply: while traders battle over the next $5K swing, long-term allocators are quietly repositioning for a more fragmented, crypto-aligned global order.

When stepping back from the immediate volatility, two distinct paths emerge from the tariff shock. The first is a conciliatory one: trading partners may enter negotiations with the U.S., as Commerce Secretary Howard Lutnick emphasized ‘it's the only option.' In this scenario, diplomatic concessions could be exchanged for exemptions or reduced tariff rates-an outcome that would ease global tensions and likely trigger a relief rally across risk assets.

The alternative, however, is a structural pivot away from the U.S. as a dependable trade partner. Should this path materialize, the tariffs may remain in place, leading to a broader slowdown in global trade. Under this regime, deflationary pressures from weaker growth could outpace any inflation driven by the tariffs themselves-dragging the U.S. Dollar Index (DXY) lower, alongside bond yields.

This dynamic may already be playing out. The 10-year Treasury yield dipped below 4% last week for the first time since October, suggesting that markets are beginning to price in weaker growth expectations. Compounding this is the pressure from the massive wall of debt refinancing due this year. To manage these rollover risks and maintain fiscal sustainability, policymakers may aim to keep yields suppressed, supporting looser financial conditions.

Should growth risks persist, the policy response-both in the U.S. and abroad-is likely to tilt dovish. Any shift toward stimulus aimed at cushioning the slowdown will, by design or by leakage, feed into broader monetary liquidity-much of which tends to filter into risk assets. A softer dollar, in turn, gives other countries the space to inject their own liquidity without sparking extreme currency depreciation. And if we do enter a new round of coordinated or parallel easing, the resulting dilution of fiat value would likely bolster demand for hard monetary assets-especially Bitcoin, which remains immune to inflation, free from central issuer risk, and uniquely positioned as a decentralized reserve asset.

While the short-term outlook is clouded by the current policy uncertainty, the medium- to long-term setup increasingly favours assets like Bitcoin-those structurally insulated from sovereign dysfunction and positioned to benefit from rising global liquidity.

Cross Asset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Coinmarketcap

Source: Coinmarketcap

In general, among the top 10 crypto assets TRON, UNUS SED LEO and Bitcoin were the relative outperformers.

Overall, altcoin outperformance vis-à-vis Bitcoin is at sustained levels from last week, with 20% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Ethereum also underperformed Bitcoin last week.

Sentiment

Our in-house “Cryptoasset Sentiment Index” has continued to signal a bearish sentiment.

At the moment, 1 out of 15 indicators are above their short-term trend.

Bitcoin Exchange inflows have been the only observed metrics to improve from last week while we are seeing our Cryptoasset Sentiment Index reflecting the bearish sentiment as it has deteriorated from -0.67 on March 31st to -0.84 at time of writing.

The Crypto Fear & Greed Index currently signals an “Extreme Fear” level of sentiment as of this morning, falling slightly from last week.

Performance dispersion among cryptoassets had followed suit and remains at very low levels, signalling that altcoins have continued to be highly correlated with the performance of Bitcoin lately.

Altcoin outperformance vis-à-vis Bitcoin has sustained from last week, with around 20% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Ethereum also managed to underperform Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin underperformance signals a bearish risk appetite at the moment.

Sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) has fallen dramatically, moving from 0.05 to -1.19. The drop is in line with the general risk-off sentiment due to trade uncertainty, as analysed in our performance section of this report.

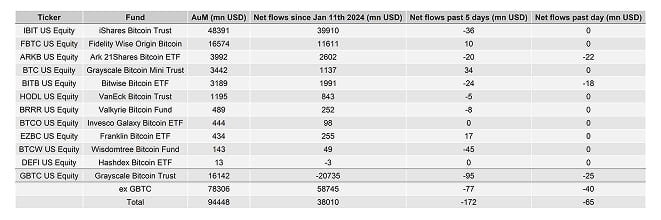

Fund Flows

Weekly fund flows into global crypto ETPs have decelerated last week, further signalling a risk-off posture among institutions.

Global crypto ETPs saw around +35.8 mn USD in weekly net inflows across all types of cryptoassets, after +225.8 mn USD in net inflows the previous week.

GlobalBitcoinETPs have experienced net outflows totalling -224.0 mn USD last week, of which -170.8 mn USD in net outflows were related to US spot Bitcoin ETFs.

The Bitwise Bitcoin ETF (BITB) in the US experienced minor net outflows, totalling -24.0 mn USD last week.

In Europe, the Bitwise Physical Bitcoin ETP (BTCE) also experienced minor net outflows equivalent to -4.6 mn USD, while the Bitwise Core Bitcoin ETP (BTC1) managed to attract capital of around +0.2 mn USD.

The Grayscale Bitcoin Trust (GBTC) saw outflows equivalent to -95.5 mn USD last week. The iShares Bitcoin Trust (IBIT) also experienced net outflows of around -35.5 mn USD last week.

Meanwhile, flows into globalEthereumETPs flipped negative last week, with around -42.2 mn USD in net outflows last week

US Ethereum spot ETFs, also recorded net outflows of around -49.9 mn USD on aggregate. The Grayscale Ethereum Trust (ETHE) followed suit and experienced net outflows of around -31.1 mn USD last week.

The Bitwise Ethereum ETF (ETHW) in the US experienced minor net outflows of around -6.2 mn USD last week.

In Europe, the Bitwise Physical Ethereum ETP (ZETH) saw minor net inflows of +0.1 mn USD while the Bitwise Ethereum Staking ETP (ET32) saw minor net outflows of -0.4 mn USD

Altcoin ETPs ex Ethereum have continued its positive trend last week, with around +3.8 mn USD in global net inflows.

Furthermore, thematic & basket crypto ETPs experienced net inflows of around +298.2 mn USD on aggregate last week. The Bitwise MSCI Digital Assets Select 20 ETP (DA20) had sticky AuM (+/- 0 mn USD).

Global crypto hedge funds have started to decrease their market exposure to Bitcoin. The 20-days rolling beta of global crypto hedge funds' performance to Bitcoin decreased to around 0.77 per yesterday's close, down from 0.83 the week before.

On-Chain Data

In general, Bitcoin's on-chain developments have deteriorated further from last week.

Selling pressure has continued from last week, with around -1.13 bn USD in net selling volumes on BTC spot exchanges.

In terms of Spot Cumulative Volume Delta (CVD), which measures the difference between buying and selling volume, the metric has been negative most of last week, indicating dominance of sell-side pressure. However, it is worth noting that supply dynamics on exchanges tend to provide a slightly clearer explanation of price action.

In terms of supply dynamics, we are observing a confluence of more sell side pressure. Whales have added bitcoins from exchanges on a net basis, indicating an increase in whale selling pressure. More specifically, BTC whales added a further +114,711 BTC on exchanges last week. Network entities that possess at least 1,000 Bitcoin are referred to as whales.

At the time of writing, only 2.64 million BTC remain on exchanges (13.2% of circulating supply), according to data provided by Glassnode, the lowest level since November 2018.

That being said, a measure of “apparent demand” for bitcoin over the past 30 days has continued its negative trend since February 2025 which is signalling that demand for bitcoins has been decelerating lately.

Additionally, Realized Cap has continued to rise while Market Cap remains flat, highlighting a structural divergence where real capital is entering the market, but prices aren't responding. This dynamic typically signals a bearish regime-where sustained sell pressure absorbs new inflows, preventing upward momentum.

In bull markets, small inflows can push prices higher due to thin sell-side liquidity. The opposite is true now: even large capital deployment fails to move the needle, reinforcing that the current trend is more likely distribution than accumulation. Until this gap between Realized Cap and Market Cap narrows-either through reduced sell pressure or a reacceleration in demand-price action is likely to remain muted.

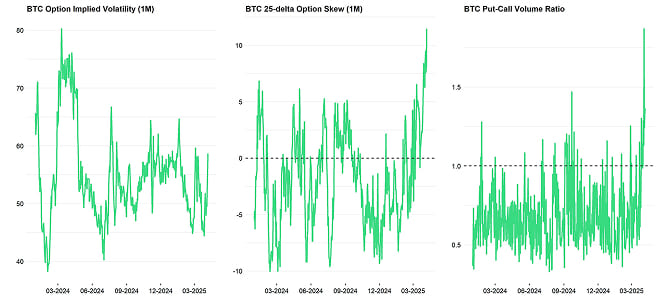

Futures, Options & Perpetuals

Last week, BTC futures open interest increased by around +10.3k BTC while perpetual open interest increased by around +11.5k BTC.

BTC perpetual funding rates remained positive last week, signalling a slightly bullish sentiment among perpetual futures traders.

In general, when the funding rate is positive (negative), long (short) positions periodically pay short (long) positions, which is indicative of bullish (bearish) sentiment.

The BTC 3-months annualised basis dropped from around 4.7% p.a last week to around 4.6% p.a. averaged across various futures exchanges. BTC option open interest increased by around +31k BTC. The put-call open interest ratio had experienced an increase from 0.58 to 0.64.

The 1-month 25-delta skew for BTC continued to rise last week, indicating a modest increase in demand for put options and a less bullish market sentiment.

BTC option implied volatilities flipped last week, with 1-month realized volatility increasing by 8.24%.

At the time of writing, implied volatilities of 1-month ATM Bitcoin options are currently at around 58.67% p.a.

Bottom Line

- Last week, Bitcoin consolidated around $77K after retreating from $87K, as escalating U.S. trade tariffs triggered a wave of risk-off sentiment across global markets. With downside liquidity clusters cleared and macro risks rising, Bitcoin is increasingly positioned as a beneficiary of future monetary easing and geopolitical diversification—particularly if policy pivots dovish to cushion slowing global growth.

- Our in-house Cryptoasset Sentiment Index deteriorated further last week—from -0.67 to -0.84—driven by negative price momentum and weak demand indicators. Only 1 of 15 indicators remains above its short-term trend.

- Bitcoin outperformed equities between March 31 and April 7 (Chart-of-the-Week) underscoring its resilience during the tariff-driven volatility.

Appendix

Bitcoin Price vs Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomberg, Bitwise Europe; data as of 04-04-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data as of 04-04-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg, Bitwise Europe; data as of 04-04-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Bloomberg, Bitwise Europe; data as of 04-04-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-04-06

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-04-06

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-04-06

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe; data as of 2025-04-06

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe

Source: Glassnode, Bitwise Europe

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com