- Last week, crypto markets posted mixed performance amid escalating trade policy uncertainty. Bitcoin gained 2.45%, supported by institutional interest, while Ethereum declined 6.35% due to delays in its Pectra upgrade. XRP and BNB were the top performers among major altcoins.

- Our in-house Cryptoasset Sentiment Index continues to signal a bearish outlook, though select indicators such as BTC exchange inflows and Crypto Hedge Fund Beta showed modest improvement.

- The Economic Policy Uncertainty Index surged to its highest level since the COVID-19 recession, highlighting investor concern around U.S. trade policy and its potential economic impact

Chart of the Week

U.S. Economic Policy Uncertainty Index Highest since the Covid recession

Source: Bitwise Europe, policyuncertainty.com

Source: Bitwise Europe, policyuncertainty.com

Performance

Recent developments in U.S. trade policy have significantly challenged investor assumptions around economic stability. The perception of tariffs has shifted from negotiating tactics to serious economic tools that appear set to remain central features of U.S. economic policy. This policy shift has materially impacted sentiment, raising concerns around corporate earnings, supply chain disruptions, and broader economic outlook. According to Goldman Sachs, every five-percentage-point increase in U.S. tariff rates could reduce S&P 500 earnings by approximately 1-2%.

The long-held notion of a "Trump put" has been upended by the President's decision to impose additional tariffs on all steel and aluminium imports. Commerce Secretary Howard Lutnick's statement that these measures would continue even at the cost of a recession underscores that protecting market performance is no longer a primary objective. The Economic Policy Uncertainty Index has consequently surged to levels not seen since the COVID-19 recession (Chart-of-the-Week)

Over the past week, major cryptocurrencies have demonstrated mixed performance amid heightened policy uncertainty. Bitcoin registered a moderate gain of 2.45%, while Ethereum declined by 6.35%. Other notable performers included XRP with a 7.65% increase.

While Bitcoin remains approximately 24.3% below its previous all-time highs as gold reaches new peaks, this divergence represents Bitcoin's evolving market position rather than fundamental weakness. A growing number of institutions are actively exploring digital assets' role in diversified portfolios. Bitcoin's decentralized nature and fixed supply continue to offer a compelling alternative amid increasing macroeconomic uncertainty.

On the regulatory front, Ripple has received approval from the Dubai Financial Services Authority (DFSA) to provide regulated crypto payments and services in the Dubai International Finance Centre (DIFC). Ripple will be the first blockchain-enabled payments provider licensed by the DFSA, marking its first license in the Middle East.

Meanwhile, Ethereum has underperformed recently, partly due to delays associated with its upcoming Pectra network upgrade. Core developers, prioritizing long-term stability over short-term expediency, chose to replace the Holesky testnet with a newly created testnet called Hoodi. This decision, made after extensive debate during an All-Core Developers call, means the Pectra hard fork will now occur in mid-May. The move was necessary due to Holesky's congested validator exit queue, which posed significant testing challenges. While some stakeholders, such as Lido and EigenLayer, favoured quicker but riskier solutions to maintain momentum, Ethereum's development teams opted for a more prudent approach to safeguard the network's long-term resilience and compatibility.

This delay demonstrates the development team's commitment to long-term stability over short-term expediency – a mature approach that ultimately strengthens Ethereum's foundation. The Pectra upgrade remains a significant enhancement that will improve both execution and consensus layers while enhancing ETH staking, Layer 2 scalability, and network capacity.

Cross Asset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Coinmarketcap

Source: Coinmarketcap

In general, among the top 10 crypto assets BNB and XRP, were the relative outperformers.

Overall, altcoin outperformance vis-à-vis Bitcoin declined from last week, with only 20% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. However, Ethereum underperformed Bitcoin last week.

Sentiment

Our in-house “Cryptoasset Sentiment Index” continues to signal a bearish sentiment.

At the moment, 4 out of 15 indicators are above their short-term trend.

Crypto Hedge Fund Beta have improved from last week along with BTC Exchange Inflows ,while other indicators remain relatively bearish.

The Crypto Fear & Greed Index currently signals a “Fear” level of sentiment as of this morning, improving from last week.

Performance dispersion among cryptoassets has remained at very low levels, signalling that altcoins have continued to be highly correlated with the performance of Bitcoin lately.

Altcoin outperformance vis-à-vis Bitcoin has declined again last week, with around 20% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Ethereum also managed to underperform Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin underperformance signals a bearish risk appetite at the moment.

Sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) improved slightly last week, moving from 0.15 to 0.23. The index signals a slightly bullish cross asset risk appetite.

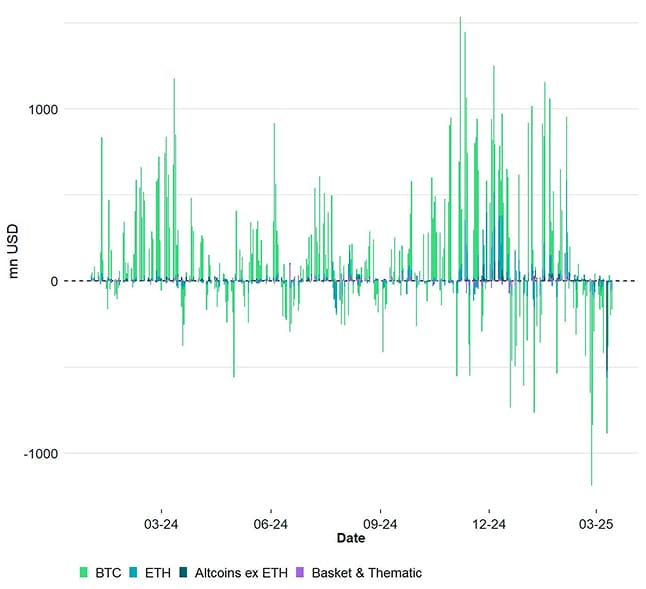

Fund Flows

Weekly fund flows into global crypto ETPs have accelerated last week, remaining negative and inline with the previous week, mainly due to a risk-off posture in the markets.

Global crypto ETPs saw around -1610.4 mn USD in weekly net outflows across all types of cryptoassets, after -863.1 mn USD in net outflows the previous week.

Global Bitcoin ETPs have continued to experience with net outflows totalling -910.7 mn USD last week, of which -967.5 mn USD in net outflows were related to US spot Bitcoin ETFs .

The Bitwise Bitcoin ETF (BITB) in the US experienced minor net outflows, totalling -3.8 mn USD last week.

In Europe, the Bitwise Physical Bitcoin ETP (BTCE) also experienced minor net outflows equivalent to -8.4 mn USD, while the Bitwise Core Bitcoin ETP (BTC1) managed to attract capital of around +0.6 mn USD.

Outflows from the Grayscale Bitcoin Trust (GBTC) continued last week with around -80.6 mn USD in net outflows last week. The iShares Bitcoin Trust (IBIT) also experienced net outflows of around -338.0 mn USD last week.

Meanwhile, flows into global Ethereum ETPs remained negative but accelerated last week, with around – 163.3 mn USD in net outflows last week

US Ethereum spot ETFs even recorded net outflows of around -178.4 mn USD on aggregate. Nonetheless, the Grayscale Ethereum Trust (ETHE) continued to experience net outflows with around -46.5 mn USD last week.

The Bitwise Ethereum ETF (ETHW) in the US saw some net outflows of -1.6 mn USD last week.

In Europe, the Bitwise Physical Ethereum ETP (ZETH) had sticky AuM (+/- 0 mn USD) while the Bitwise Ethereum Staking ETP (ET32) saw minor net outflows of -1.8 mn USD

Altcoin ETPs ex Ethereum continued to be weak last week, with around - 10.1 mn USD in global net outflows.

Furthermore, thematic & basket crypto ETPs experienced minor net outflows of around – 9.3 mn USD on aggregate last week. The Bitwise MSCI Digital Assets Select 20 ETP (DA20) had sticky AuM (+/- 0 mn USD).

Global crypto hedge funds have continued to increase their market exposure to Bitcoin. The 20-days rolling beta of global crypto hedge funds' performance to Bitcoin increased around 0.83 per yesterday's close, up from 0.73 the week before.

On-Chain Data

In general, Bitcoin's on-chain developments have improved slightly from last week.

Selling pressure has flipped from last week, with around +0.17 bn USD in net buying volumes on BTC spot exchanges.

In terms of Spot Cumulative Volume Delta (CVD), which measures the difference between buying and selling volume, the metric has been positive most of last week, indicating dominance of buy-side pressure. However, it is worth noting that supply dynamics on exchanges tend to provide a slightly clearer explanation of price action.

Whales have on removed bitcoins from exchanges on a net basis, indicating a decrease in whale selling pressure. More specifically, BTC whales removed -249,253 BTC off exchanges last week, a massive acceleration from the -8,764 BTC from the week prior. Network entities that possess at least 1,000 Bitcoin are referred to as whales.

At the time of writing, only 2.67 million BTC remain on exchanges (13.4% of circulating supply), according to data provided by Glassnode, the lowest level since November 2018.

That being said, a measure of “apparent demand” for bitcoin over the past 30 days has continued its negative trend since February 2025 which is signalling that demand for bitcoins has been decelerating lately.

Futures, Options & Perpetuals

Last week, BTC futures open interest decreased by around -5k BTC while perpetual open interest decreased by around - 8k BTC.

BTC perpetual funding rates turned slightly negative on Friday last week, signalling bearish sentiment among perpetual futures traders.

In general, when the funding rate is positive (negative), long (short) positions periodically pay short (long) positions, which is indicative of bullish (bearish) sentiment.

The BTC 3-months annualised basis stabilised last week to around 6.4% p.a. averaged across various futures exchanges. BTC option open interest, however, decreased somewhat by around -5k BTC. The put-call open interest ratio remained relatively flat.

The 1-month 25-delta skew for BTC continued to rise last week, indicating a modest increase in demand for put options and a less bullish market sentiment.

BTC option implied volatilities also remained relatively stable, with 1-month realized volatility slightly decreasing.

At the time of writing, implied volatilities of 1-month ATM Bitcoin options are currently at around 53.45% p.a.

Bottom Line

- Last week, crypto markets posted mixed performance amid escalating trade policy uncertainty. Bitcoin gained 2.45%, supported by institutional interest, while Ethereum declined 6.35% due to delays in its Pectra upgrade. XRP and BNB were the top performers among major altcoins.

- Our in-house Cryptoasset Sentiment Index continues to signal a bearish outlook, though select indicators such as BTC exchange inflows and Crypto Hedge Fund Beta showed modest improvement.

- The Economic Policy Uncertainty Index surged to its highest level since the COVID-19 recession, highlighting investor concern around U.S. trade policy and its potential economic impact

Appendix

Bitcoin Price vs Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomberg, Bitwise Europe; data as of 14-03-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data as of 14-03-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg, Bitwise Europe; data as of 14-03-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Bloomberg, Bitwise Europe; data as of 14-03-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-03-16

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-03-16

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-03-16

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe; data as of 2025-03-16

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe

Source: Glassnode, Bitwise Europe

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com