- Bitcoin sold off more than -10% yesterday after a speculative research note suggested that the SEC might reject the ETFs in January

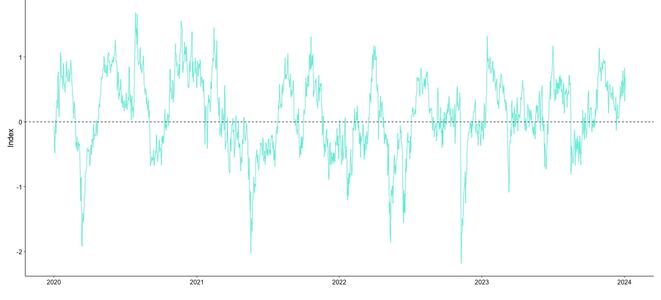

- Our in-house Cryptoasset Sentiment Index still remains elevated following yesterday’s sell-off

- However, the latest developments indicate no material change with respect to a potential approval of the spot Bitcoin ETFs in the US

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, ETC Group

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, ETC Group

Sentiment Check

Is the SEC rejecting the Bitcoin ETFs in

January?

Bitcoin

has sold off more than -10% during yesterday’s trading session. Market

participants have attributed the most recent sell-off to a weekly research note

by Singapore-based crypto service provider Matrixport that suggested that the

SEC might reject all ETF applications in January.

The

curious thing about Matrixport’s research note is that Matrixport published a rather

contradictory daily research note on the very same day that suggested that an

ETF approval is imminent. Many pundits have therefore

suggested that Matrixport may have tried to manipulate the market for unknown

reasons.

Nonetheless,

as a result, there were massive futures long liquidations in Bitcoin futures

market which accelerated the decline in prices. According to data provided by

Glassnode, yesterday saw more than 109 mn USD in futures long liquidations

across major futures exchanges. Most of these liquidations happened on Binance

which is mostly dominated by retail investors.

It

is important to highlight that, despite the sharp spike in futures long

liquidations yesterday, Bitcoin futures open interest on the Chicago Mercantile

Exchange (CME), which is populated with institutional investors, hit a fresh

all-time in BTC-terms.

So,

institutional investors even appear to have increased their overall Bitcoin

exposure into the most recent sell-off. CME is currently the biggest Bitcoin

futures exchange based on open interest.

However,

we still saw significant reversals in key on-chain and derivatives metrics

yesterday:

Perpetual

funding rates

for Bitcoin perpetual contracts across major exchanges reached -1.3% on an

intraday basis yesterday - one of the most negative readings ever recorded.

Bitcoin’s

futures basis rate

reversed sharply as well from an intraday high of above 22% p.a. to around 16%

p.a., at the time of writing.

Futures

long liquidations

in Bitcoin futures spiked to 82 mn USD in a matter of only 10 minutes during

yesterday’s sell-off.

Short-term

holder spent output profit ratio (STH-SOPR)

declined below 1 to the lowest reading

since October 2023 suggesting that “weak hands” spent coins on average at a

loss which is a sign of short-term capitulation.

We

have certainly seen that movie before. The abovementioned metrics usually imply

seller exhaustion in the short-term and therefore limited downside risk but

there is more to it.

What’s next?

Although

the Matrixport research note appears to be one of the major catalysts of the

sell-off, the market was generally ripe for a correction as sentiment was

elevated heading into the potential ETF approval by the SEC.

We

have also highlighted this in our weekly research note published ahead of the

Christmas holidays here.

That

being said, our in-house Cryptoasset Sentiment Index still remains

elevated despite the most recent sell-off (see above).

The

reason is that we have not seen clear capitulation in broader segments of the

market such as low realized losses and many derivatives traders were quick in

increasing their exposure massively after the sell-off again.

For

instance, BTC perpetual funding rates have increased significantly following

yesterday’s sell-off which implies an outsized imbalance between demand and

supply for perpetual futures contracts on Bitcoin again.

All

in all, the market still appears to be a bit frothy in the short-term based on

our in-house Cryptoasset Sentiment Index.

In

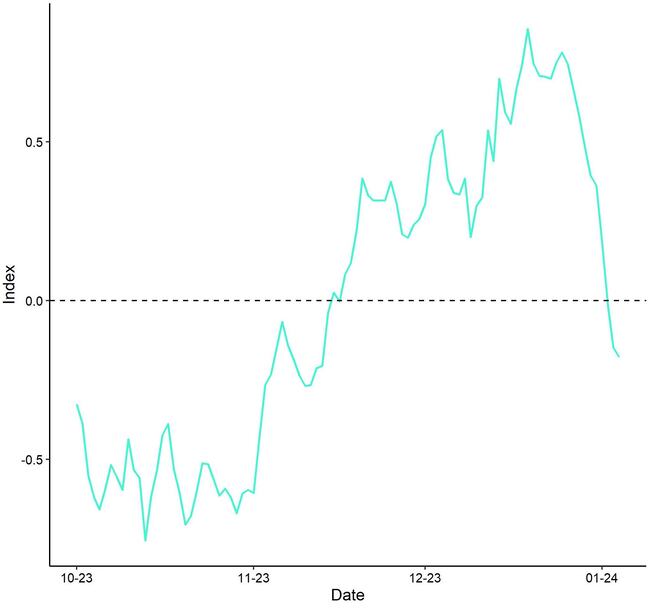

the broader macro context, we have been observing a general decline in market

sentiment in traditional financial markets that appears to have accelerated

since the Christmas holidays. This can be seen in our Cross Asset Risk Appetite

(CARA) index which measures traditional market sentiment across equities,

bonds, commodities, and FX.

Cross Asset Risk Appetite (CARA, 3M change)

Source: Bloomberg, ETC Group

Source: Bloomberg, ETC Group

This

general decline in TradFi market sentiment could also affect Bitcoin and

cryptoassets negatively in the short term if correlations reassert itself. In

general, changes in traditional cross asset risk appetite tend to be correlated

with changes in cryptoasset performances.

That being said, any further weakness is potentially a good opportunity to increase exposure ahead of the ETF approvals and, above all, the Bitcoin Halving anticipated in April 2024.

We have formulated a fairly optimistic outlook for 2024 based on these factors and many others in our latest ETC Group 2024 Outlook as well.

Concerning the prospects of an ETF approval in the US, after yesterday’s sell-off, many ETF experts expressed that there was no material change in their expectation regarding an ETF approval in January.

To the contrary, we have even received more evidence throughout the day that point into that direction.

For instance, the SEC held meetings yesterday with the New York Stock Exchange, Nasdaq, and Cboe to finalize comments on spot Bitcoin ETFs. Moreover, Fidelity filed a registration of securities for its spot Bitcoin ETF with the SEC.

It is still assumed that the SEC might notify the applicants of an approval this Friday already.

Furthermore, Grayscale’s Bitcoin Trust (GBTC) is still trading at a NAV discount of only -8.1% per yesterday’s close which implies a probability of approval of around ~92%.

So, market participants have not adjusted their expectations of an ETF approval significantly either.

Bottom Line

- Bitcoin sold off more than -10% yesterday after a speculative research note suggested that the SEC might reject the ETFs in January

- Our in-house Cryptoasset Sentiment Index still remains elevated following yesterday’s sell-off

- However, the latest developments indicate no material change with respect to a potential approval of the spot Bitcoin ETFs in the US

Important Information

This publication constitutes a marketing communication and is provided for informational purposes only. It does not constitute investment advice, a personal recommendation, or an offer or solicitation to buy or sell any financial instrument.

This document (which may take the form of a presentation, press release, social media post, blog article, broadcast communication or similar instrument – collectively referred to as a “Document”) is issued by Bitwise Europe GmbH (“BEU” or the “Issuer”) and has been prepared in accordance with applicable laws and regulations, including those relating to financial promotions.

Bitwise Europe GmbH, incorporated under the laws of Germany, is the issuer of the Exchange Traded Products (“ETPs”) referenced in this Document under a base prospectus and the applicable final terms, as supplemented from time to time, approved by the German Federal Financial Supervisory Authority (BaFin). The approval of the prospectus by BaFin relates solely to the completeness, coherence and comprehensibility of the prospectus in accordance with the Prospectus Regulation and does not constitute an endorsement, recommendation or assessment of the merits of the products.

The market analyses, views and scenarios presented reflect the assessment as of the date of publication and are based on information considered reliable. However, no representation or warranty is made as to their accuracy or completeness. Forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Past performance is not a reliable indicator of future results.

Capital at risk. Cryptoassets are highly volatile and involve a high degree of risk. The value of investments in cryptoassets and crypto-linked ETPs may fluctuate significantly, and investors may lose part or all of their invested capital. No capital protection or guaranteed compensation mechanism applies in respect of market losses.

Any investment decision should be made solely on the basis of the relevant base prospectus, the applicable final terms and the key information document, in particular the section entitled “Risk Warning”. The base prospectus, final terms and additional risk information are available at: www.bitwiseinvestments.eu

Access to certain documents may require self-certification regarding your jurisdiction and investor status and may be subject to additional disclaimers and important information.

For further details, please refer to the full disclaimer available at: www.bitwiseinvestments.eu/disclaimer