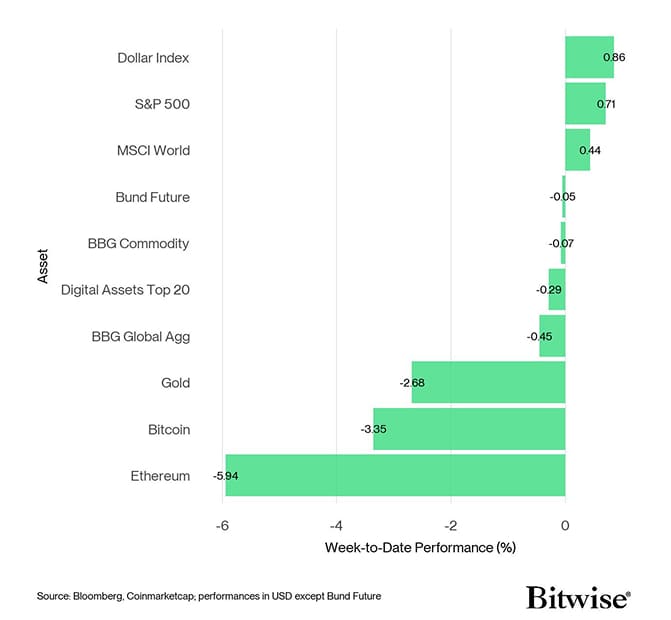

- Last week, cryptoassets underperformed traditional assets in a broad-based risk-off move despite a relatively positive news flow. There was a relaxation in US-China trade relations, the Fed cut rates and announced the end of QT and the US spot Solana ETF debut saw very significant inflows.

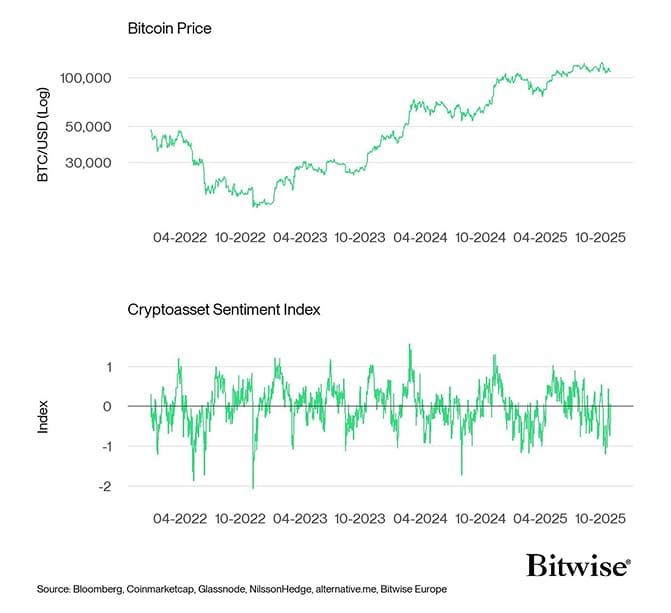

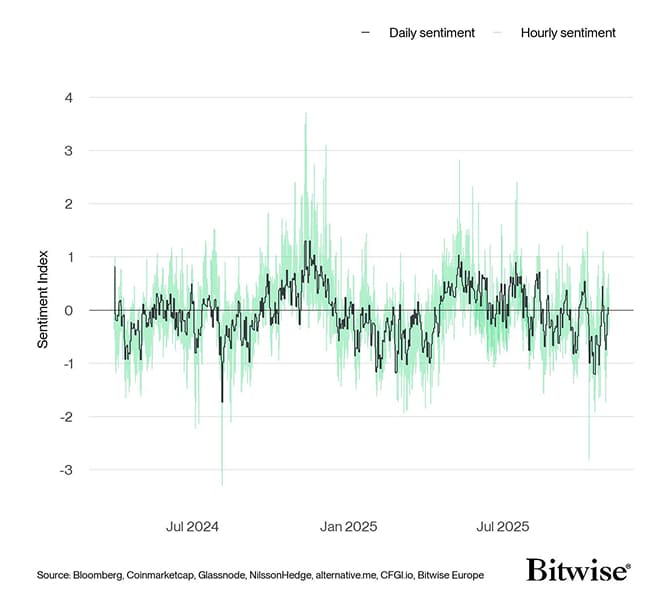

- Our in-house “Cryptoasset Sentiment Index” exhibited very bearish sentiment last week, although flipped back positive on Sunday.

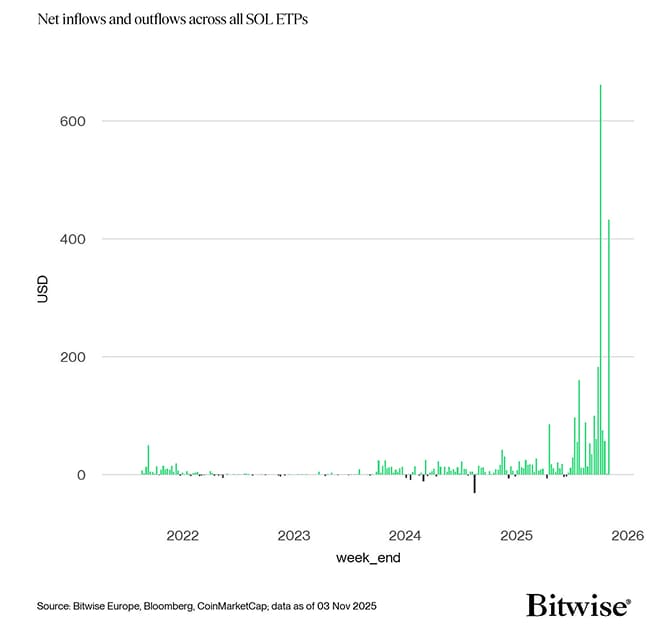

- Chart of the Week: Global weekly net inflows into Solana ETPs surpassed +$400 mn last week – the second highest weekly inflow on record. Bitwise’s Solana Staking ETF (BSOL) was also the best crypto ETP and ranked 16th in terms flows globally.

Chart of the Week

Total SOL ETP Net Flows (weekly)

Performance

Last week, cryptoassets underperformed traditional assets in a broad-based risk-off move despite a relatively positive news flow. There was a relaxation in US-China trade relations, the Fed cut rates and announced the end of QT, and the US spot Solana ETF debut saw very significant inflows.

As far as the latter is concerned, the launch of the spot SOL US ETF marks a major milestone for both the broader digital asset industry and Solana itself.

Last week's developments further institutionalised the asset class, transforming Solana from “an obscure coin on the blockchain” into “a ticker anyone can access through a brokerage account.” The approvals also firmly position the US back in the driver's seat as the global leader in digital assets, a status that had been in jeopardy under the Biden–Gensler–Warren trifecta.

Two Solana ETFs launched: Bitwise's BSOL US Equity and Grayscale's GSOL US Equity, which collectively attracted $199.2 million in net inflows (excluding seed capital). Bitwise dominated the first week, reaching $401 million in AUM as of Friday - representing 9.17% of total SOL ETP AUM and 91% of global SOL ETP flows last week. In comparison, Grayscale's GSOL US Equity saw only $2.18 million in inflows, accounting for 1% of total ETP flow and 2% of total SOL ETP AUM.

In general, global weekly net inflows into Solana ETPs surpassed +$400 mn last week – the second highest weekly inflow on record. Bitwise's Solana Staking ETF (BSOL) was also the best crypto ETP and ranked 16 th in terms flows globally (Chart-of-the-Week).

At the time of writing, total SOL ETP AUM now stands at $4.37 billion, with US-listed products clearly driving the majority of flows. Based on our sensitivity analysis presented in our previous Crypto Market Espresso, a $1 billion net inflow, assuming a beta of 1.5x, could correspond to an estimated 34% increase in price.

Apart from that, we have seen additional rate cuts by the Fed – the FOMC decided to reduce the Fed Funds Target Rate by another 25 basis points last week as was widely anticipated by financial markets. In addition, the Fed announced to end Quantitative Tightening (“QT”), i.e. the run-down of its bond portfolio and balance sheet by December.

As highlighted in our previous Crypto Market Compass report, past monetary policy easing announcements by the Fed have historically led to a significant increase in market-based inflation expectations. Combined with a decline in nominal yields due to rate cuts, real yields will most-likely decline going forward signalling a decisive return of easy monetary policy by the Fed.

It is worth pointing out that all of this comes whilst realized consumer price inflation in the US appears to accelerate again based on alternative US inflation metrics (note that there has not been additional inflation releases due to the ongoing government shutdown).

Nonetheless, this implies at least a higher inflation tolerance by the Fed which also has bullish implications for bitcoin and cryptoassets.

We think that easier monetary policy will continue to support positive US and global growth expectations and, above all, risk appetite. The strong inflows into Solana ETFs in the US mentioned above could be a harbinger of that.

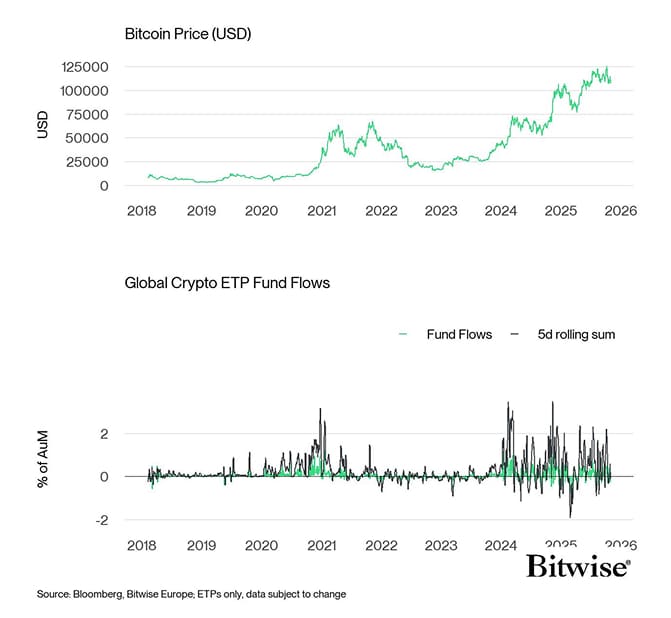

In general, there is a strong seasonality not only in bitcoin's performance but also in global bitcoin ETP flows. As is widely known, November has historically exhibited the best performance for bitcoin with an average monthly performance of 35.5% since 2010.

What is more is that global Bitcoin ETP flows tend to double within last 50 trading days of the year. This seasonal pattern alone combined with the abovementioned easing in monetary policy should provide a strong tailwind for bitcoin and other cryptoassets over the coming months and well into 2026.

Cross Asset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

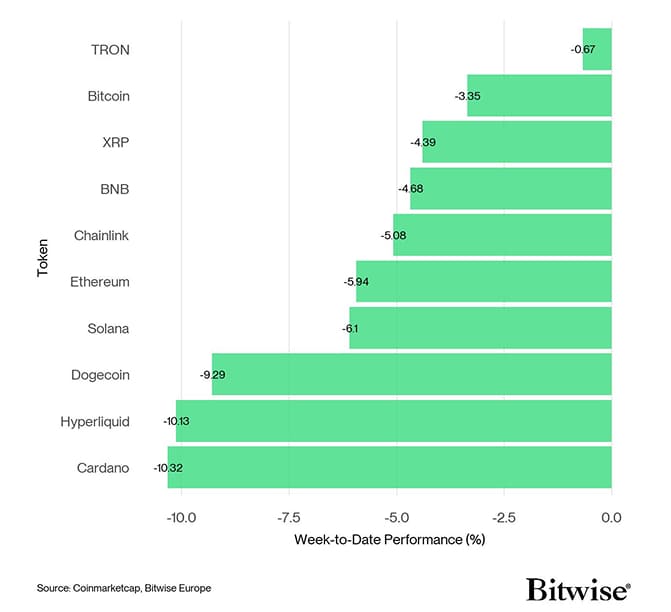

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Coinmarketcap

Source: Coinmarketcap

In general, among the top 10 crypto assets TRON, Bitcoin, and XRP were the relative outperformers.

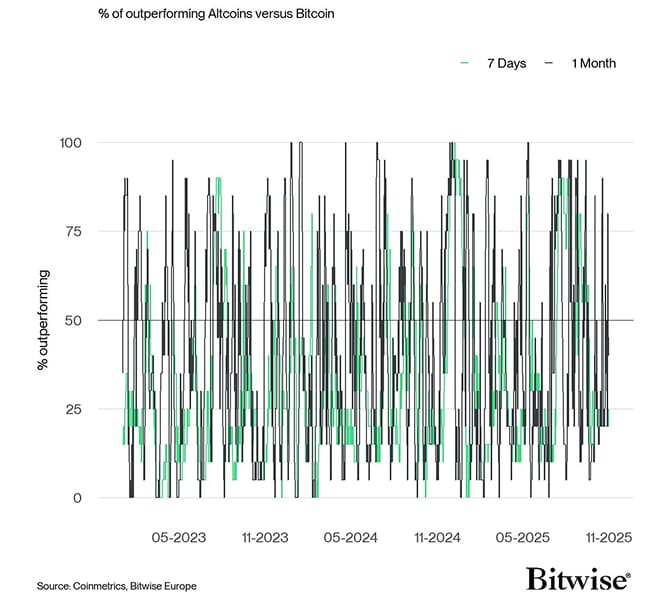

Overall, altcoin outperformance vis-à-vis bitcoin has continued to be low last week, with only 45% of our tracked altcoins managing to outperform bitcoin on a weekly basis. Ethereum also slightly underperformed bitcoin last week.

Sentiment

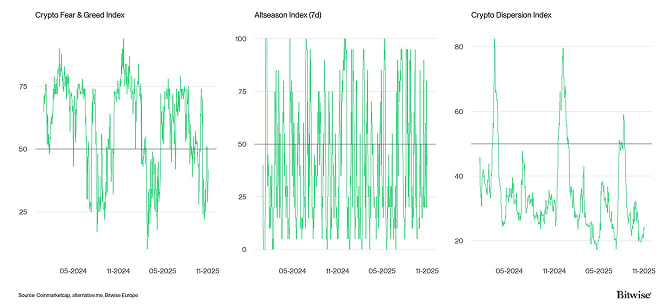

Our in-house “Cryptoasset Sentiment Index” exhibited very bearish sentiment last week, although flipped back positive on Sunday.

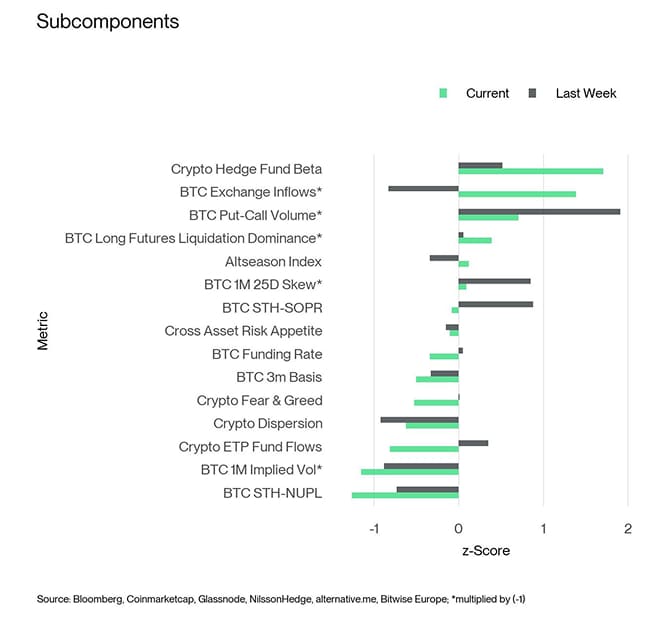

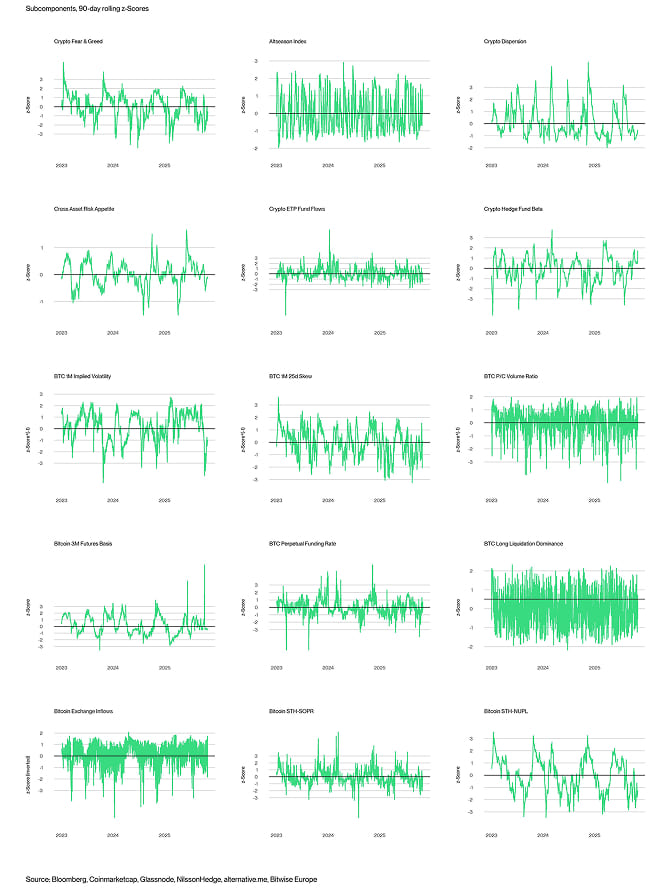

At the moment, 6 out of 15 indicators are above their short-term trend.

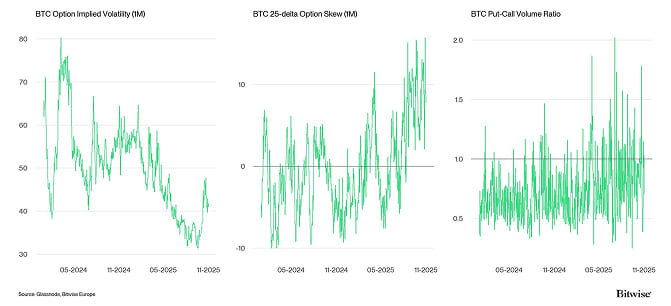

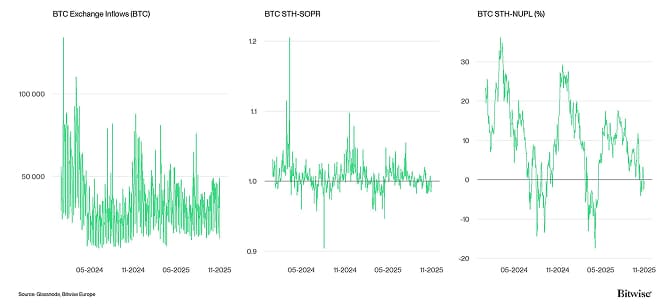

Last week, Bitcoin Exchange inflows, Crypto Hedge Fund Beta, BTC Put-Call Volume, BTC Long Futures Liquidation Dominance, Altseason Index, and 1M 25delta skew metrics showed positive momentum.

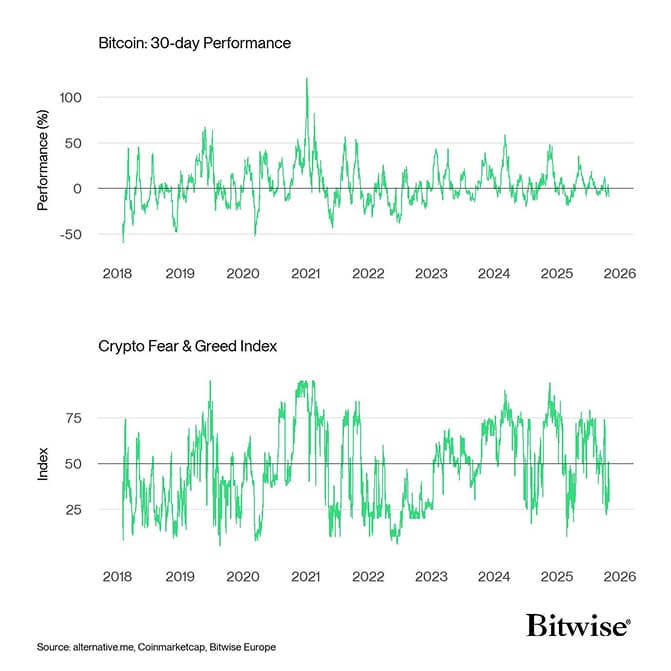

The Crypto Fear & Greed Index currently signals a “Fear” level of sentiment as of this morning. This change is not uncommon as the index has spent the majority of the last month in between “Neutral” and “Fear”.

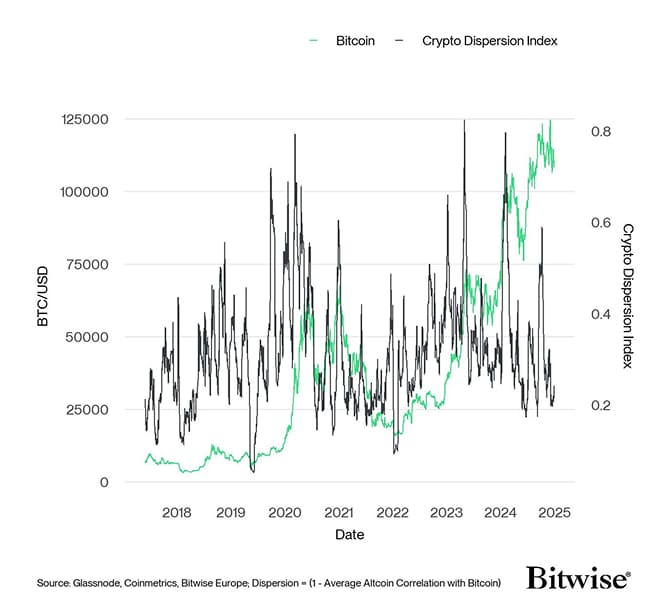

Performance dispersion among cryptoassets has trended up slightly last week, signalling that while altcoins have continued to be highly correlated with the performance of bitcoin, this is a metric to keep an eye on.

Altcoin outperformance vis-à-vis Bitcoin has increased from last week, with around 45% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Ethereum also underperformed Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin outperformance signals a increasing risk appetite at the moment.

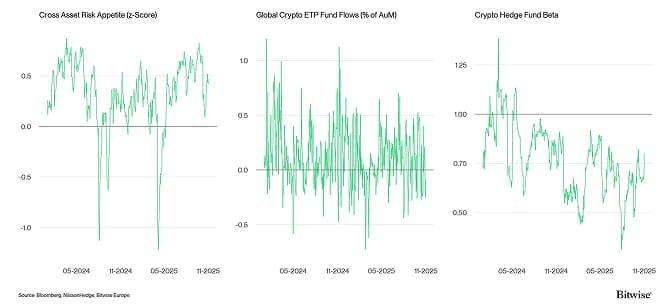

Sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) has also decreased, moving from 0.46 to 0.42. This is a notable divergence between tradfi and crypto asset sentiment that should be watched closely.

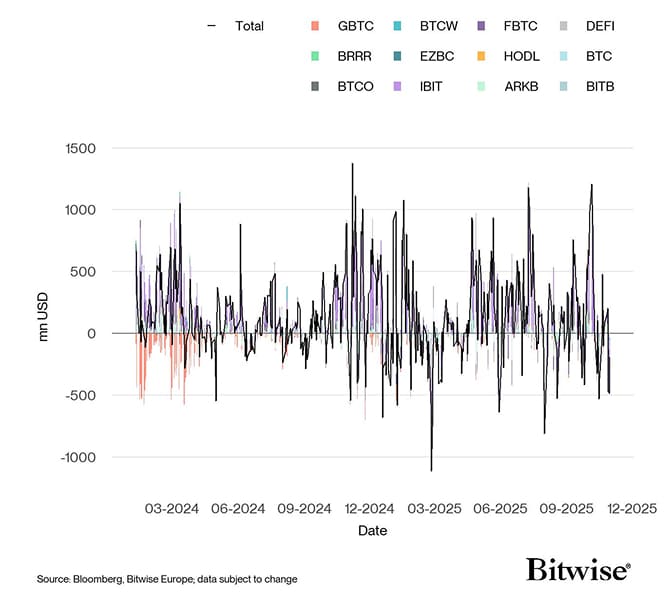

Fund Flows

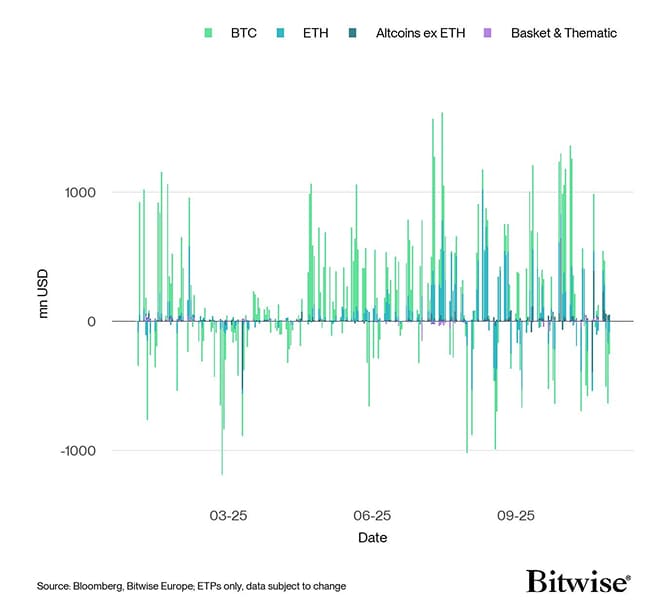

While weekly fund flows into global crypto ETPs decelerated last week mainly from outflows across Bitcoin products. Inflows across Ethereum and ex-Ethereum altcoins and basket products still suggest steady allocation. This coincides with a slight rise in performance dispersion, indicating that correlations remain high, but divergences are beginning to widen.

Global crypto ETPs saw around -246.6 mn USD in weekly net outflows across all types of cryptoassets, after +1699.6 mn USD in net inflows the previous week.

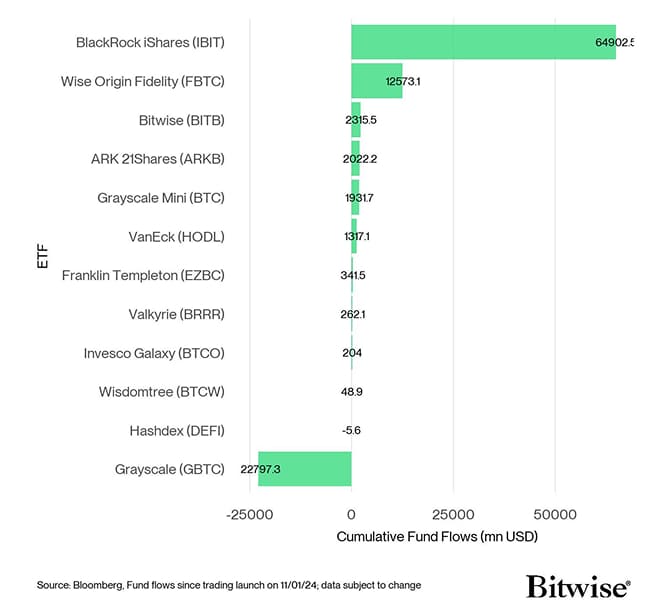

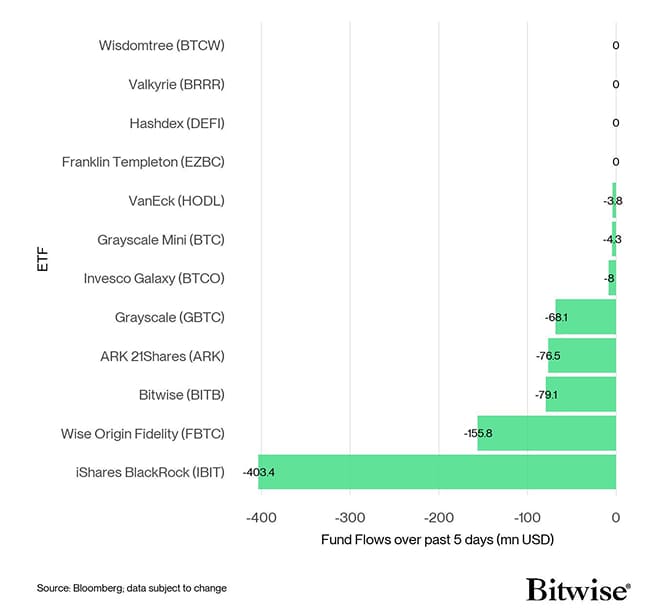

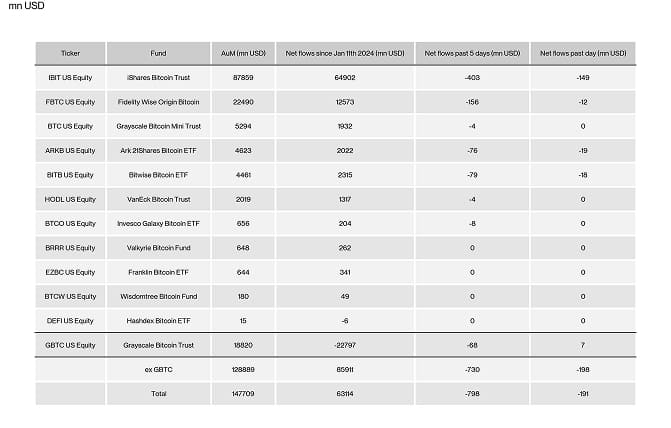

Global Bitcoin ETPs have continued to experience net outflows totalling -752.2 USD last week, of which -798.9 mn USD in net outflows were related to US spot Bitcoin ETFs.

The Bitwise Bitcoin ETF (BITB) in the US experienced net outflows, totalling -79.1 mn USD last week.

In Europe, the Bitwise Physical Bitcoin ETP (BTCE) experienced net outflows equivalent to -2.1 mn USD, while the Bitwise Core Bitcoin ETP (BTC1) experienced minor net inflows of +0.4 mn USD.

The Grayscale Bitcoin Trust (GBTC) has posted net outflows of -68.1 mn USD. The iShares Bitcoin Trust (IBIT), experienced net outflows of around -403.4 mn USD last week.

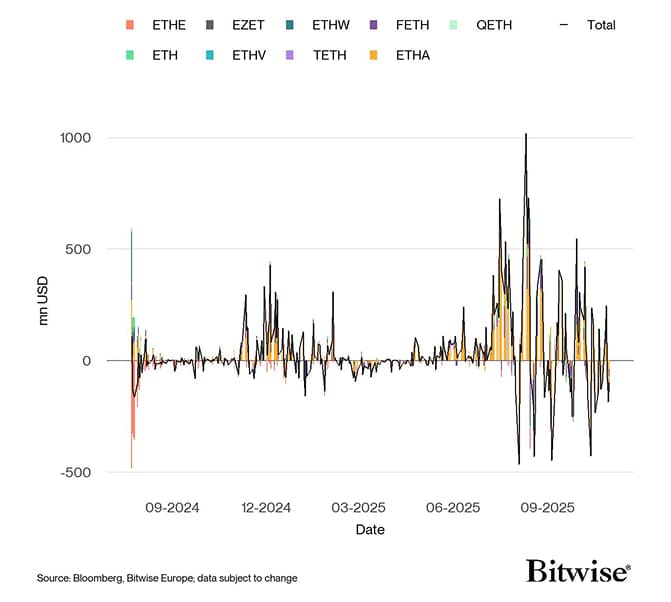

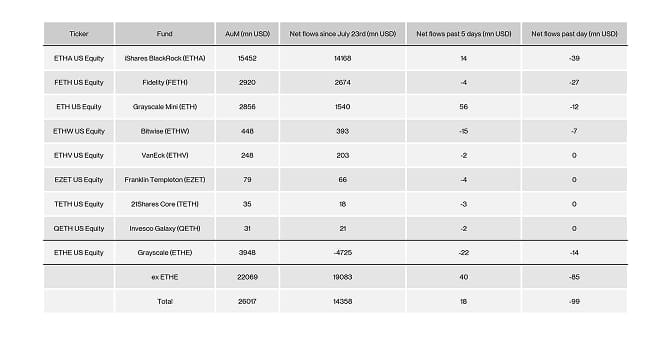

Meanwhile, flows into global Ethereum ETPs maintained its positive trend last week, with around +44.9 mn USD in net inflows.

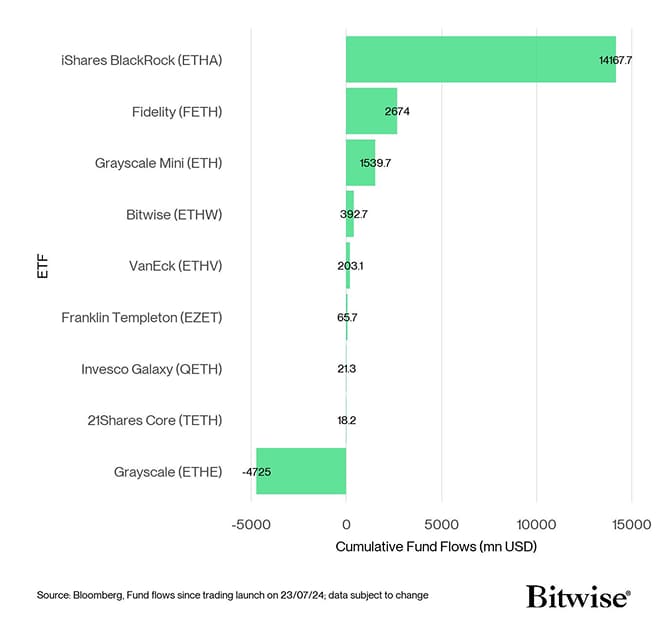

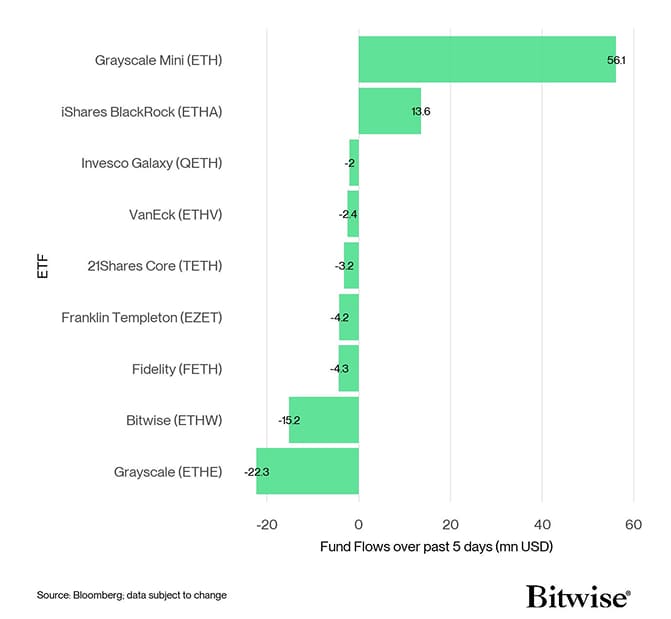

US spot Ethereum ETFs, also recorded net inflows of around +16 mn USD on aggregate. The Grayscale Ethereum Trust (ETHE), has posted net outflows of -22.3 mn USD.

The Bitwise Ethereum ETF (ETHW) in the US has also posted net outflows of -15.2 mn USD.

In Europe, the Bitwise Physical Ethereum ETP (ZETH) saw net inflows of +9 mn USD while the Bitwise Ethereum Staking ETP (ET32) saw minor net inflows of +0.2 mn USD.

Altcoin ETPs ex Ethereum also experienced net inflows of +441.6 mn USD last week. This largely stemmed from Bitwise's physical Solana ETP (BSOL) with +417 mn of net inflows, including seed.

Thematic & basket crypto ETPs, however, posted net inflows of +19.1 mn USD on aggregate last week. The Bitwise MSCI Digital Assets Select 20 ETP (DA20) has experienced zero flows (+/- 0 mn USD) on aggregate.

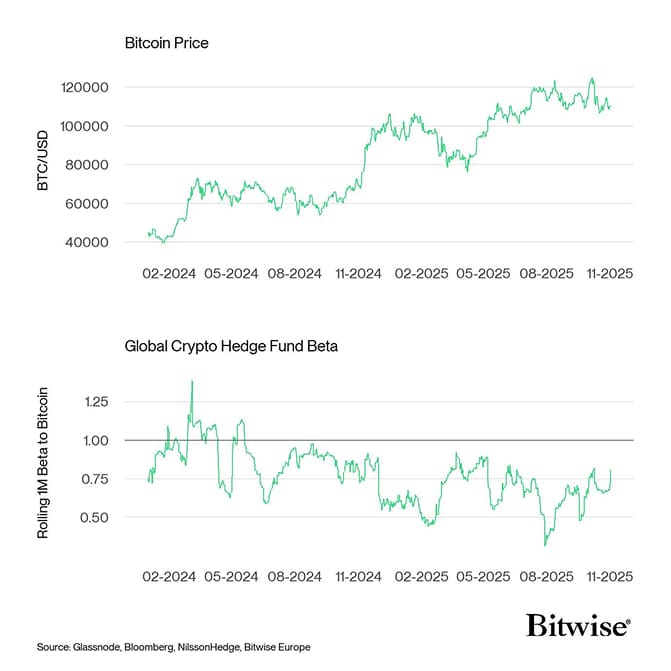

Global crypto hedge funds exposure to Bitcoin has increased significantly last week. The 20-days rolling beta of global crypto hedge funds' performance to Bitcoin increased to around 0.8 per yesterday's close, up from 0.67 from the week before.

On-Chain Data

Sell-side pressure across exchanges continues to moderate, with intraday spot buying minus selling closing the week at approximately –$469mm, down from –$835mm last week. This indicates that net spot selling has eased substantially, even though flows remain marginally negative overall. However, on-chain profit taking remains elevated at around +$777mm per day, suggesting some investors are continuing to de-risk into market weakness.

Bitcoin whales (entities holding at least 1k BTC) have begun sending modest inflows to exchanges, totalling roughly +4.9k BTC over the past week. This suggests early signs of accumulation-driven positioning, although the scale remains muted relative to historical activity.

Furthermore, based on recent data from Glassnode, the overall downward trend in exchange-held Bitcoin reserves has continued its downward trend. The current level stands at 2.85 million BTC, representing approximately 14.3% of the total circulating supply - a 26 bps decrease from last week.

The market is beginning to show early signs of fragility, having broken below both the 200-day moving average at $108k and the Short-Term Holder cost basis at $113k. This drawdown has pushed a large portion of recent buyers back into unrealized loss, exerting pressure on investor sentiment. Reclaiming these levels would be essential to restore constructive momentum and signal renewed market strength.

Positively, the Accumulation Trend Score, which measures changes in supply held across wallets of all sizes, has remained robust, week over week. Notably, wallets ranging from less than 1 BTC up to 1,000 BTC are net accumulators, indicating broad-based dip-buying across both retail and large holders.

All in all, on-chain conditions are starting to soften, with recent price weakness reflected across key technical and cost-basis levels. The loss of both the 200-day moving average at $108k and the Short-Term Holder cost basis at $113k has pushed a meaningful share of recent investors back into loss, weighing on sentiment. Sell-side pressure across exchanges continues to moderate but remains negative, while on-chain profit taking remains elevated, potentially creating short-term headwinds. However, the Accumulation Trend Score remains robust week over week, suggesting that some degree of sell-side pressure is being absorbed. Most importantly, reclaiming the lost support levels would be critical for restoring constructive momentum, as prolonged weakness below them could risk returning the market to a more defensive posture.

Futures, Options & Perpetuals

Over the past week, BTC perpetual futures open interest increased by 14.4k BTC across all exchanges. However, open interest across CME futures contracts decreased by -15.3k BTC, signalling a downtick in institutional participation. However, in aggregate, futures positioning suggests that traders remain cautious in the aftermath of the recent deleveraging event, opting to scale back risk until clearer directional momentum re-emerges.

BTC perpetual funding rates remain positive but contained, indicating a cautiously optimistic market stance rather than signs of speculative excess.

In general, when the funding rate is positive (negative), long (short) positions periodically pay short (long) positions, which is indicative of bullish (bearish) sentiment.

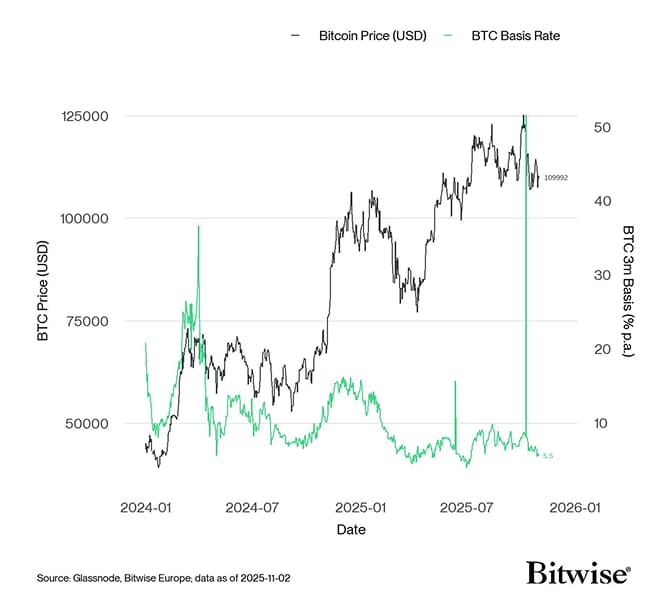

The BTC 3-months annualised basis declined to 6.4% p.a., averaged across various futures exchanges.

BTC options open interest has decreased by approximately -95k BTC, largely due to end of month expiries, while the put–call open interest ratio holds steady at 0.63. This indicates that demand for downside protection remains elevated, reflecting continued uncertainty around market direction.

Additionally, the 25-delta skew across major BTC option tenors has moderated notably, suggesting that although hedging appetite remains present, the price of downside protection is easing. The elevated put/call open interest highlights that traders remain cautious, however, the declining skew suggests the urgency to pay a premium for protection has eased.

Bottom Line

- Last week, cryptoassets underperformed traditional assets in a broad-based risk-off move despite a relatively positive news flow. There was a relaxation in US-China trade relations, the Fed cut rates and announced the end of QT and the US spot Solana ETF debut saw very significant inflows.

- Our in-house “Cryptoasset Sentiment Index” exhibited very bearish sentiment last week, although flipped back positive on Sunday.

- Chart of the Week: Global weekly net inflows into Solana ETPs surpassed +$400 mn last week – the second highest weekly inflow on record. Bitwise’s Solana Staking ETF (BSOL) was also the best crypto ETP and ranked 16th in terms flows globally.

Appendix

Bitcoin Price vs Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: alternative.me, Coinmarketcap, Bitwise Europe

Cryptoasset Sentiment Index: Daily vs Hourly

Source: alternative.me, Coinmarketcap, Bitwise Europe

Cryptoasset Sentiment Index: Daily vs Hourly

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, CFGI.io, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, CFGI.io, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomberg, Bitwise Europe; data as of 31-10-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data as of 31-10-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg, Bitwise Europe; data as of 31-10-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Bloomberg, Bitwise Europe; data as of 31-10-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

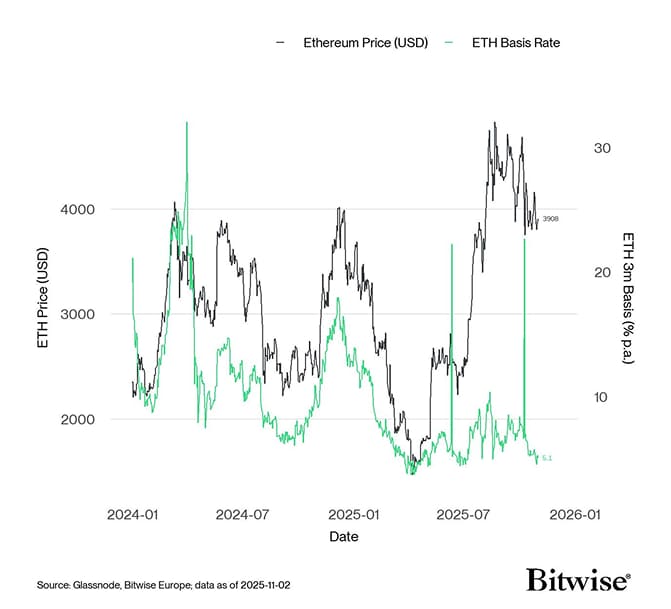

Source: Glassnode, Bitwise Europe; data as of 2025-11-02

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-11-02

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-11-02

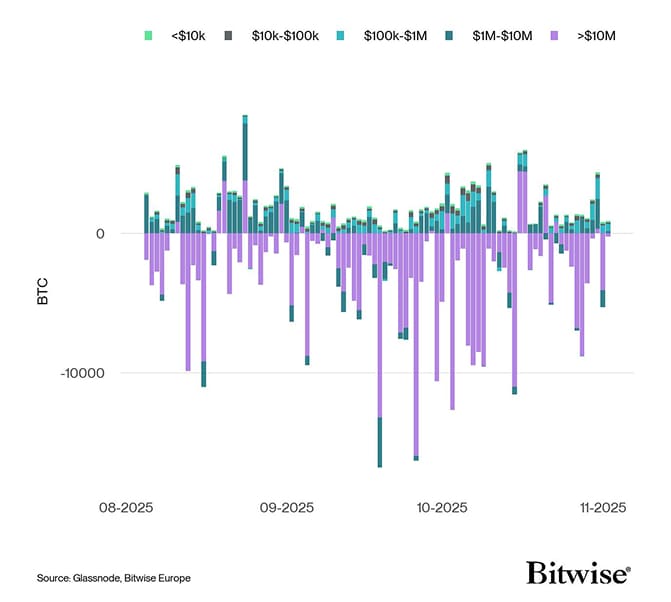

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe; data as of 2025-11-02

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe

Source: Glassnode, Bitwise Europe

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com