- Performance: While October was marked by a sharp deleveraging event and temporary weakness across cryptoassets, market dynamics now point to a constructive outlook. With seasonal tailwinds, renewed ETP inflows, and a shift toward easier monetary policy, we expect crypto markets - led by bitcoin - to resume their upward trajectory in the coming weeks.

- Macro: The global macro backdrop remains strongly supportive for risk-on assets, driven by accelerating liquidity expansion and ongoing rate cuts that are likely to extend the business cycle well into 2026. While short-term funding stress in the US banking system poses risks, it also increases the likelihood of renewed QE, reinforcing the bullish liquidity outlook. In this environment, capital rotation from gold and rising ETP inflows could significantly amplify Bitcoin’s upside potential.

- On-Chain: Despite a moderation in capital inflow momentum, Bitcoin’s Realized Cap at record highs highlights continued strong underlying demand and healthy market absorption of sell-side pressure. With structural resilience intact and key support levels holding, the setup remains constructive for a renewed uptrend once buy-side momentum reaccelerates.

Chart of the Month

Bitcoin ETP Flows will likely accelerate towards year-end

Performance

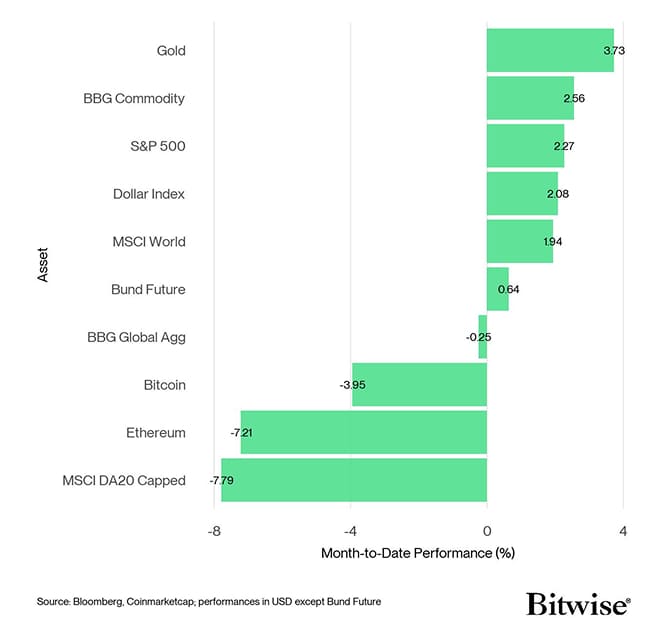

Cryptoassets underperformed traditional assets in October due to a very significant deleveraging event on the 10th of October caused by renewed uncertainty around US-China trade policies.

In short, a sell-off in traditional equity markets caused by elevated trade uncertainty was propagated to crypto markets and was exacerbated by levered long futures liquidations in an auto-liquidation cascade that saw a record number of crypto traders being wiped out. (We published a “post-mortem” on this event here as well.)

Forced liquidations tend to exacerbate downside moves as leveraged long traders need to short the underlying to neutralise their position.

On the bright side, this deleveraging event pushed our intraday Cryptoasset Sentiment Index to the lowest level since the “Yen Carry-Trade Unwind” as highlighted here which implied that more downside risks were fairly limited.

Put simply, the market reached a state of “seller exhaustion” in early October – essentially a state where selling pressure is largely gone and the market can't move significantly lower. It is worth pointing out that bitcoin was trading more than 40% higher only one month after event in August 2024.

Although bitcoin and other cryptoassets continue to consolidate as we write this report on Monday morning, we expect bitcoin to reach new all-time highs in the short term due to the following reasons:

Performance seasonality tends to be best in November – November has historically been the best month for bitcoin with an average performance of +35.5% since 2010.

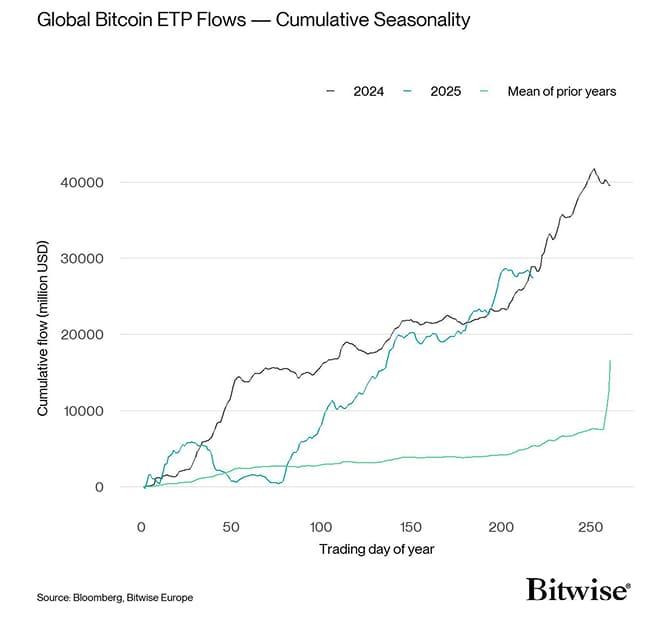

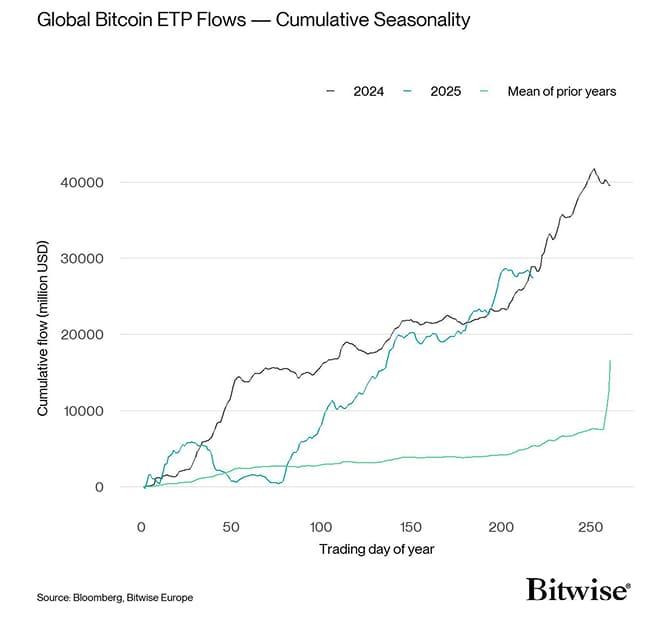

Not only bitcoin's performance exhibits a positive seasonality in November but also bitcoin ETP flows – ETP flows tend to be strongest in November and Q4 more broadly (Chart-of-the-month) as fund managers tend to allocate more to cryptoassets due to “window dressing” and portfolio rebalancing towards year-end as pointed out in one of our CIO Memos as well.

Most notably, the years 2020 and 2023, and 2024 have seen very significant pick-ups in ETP fund flows over the last 50 trading days in each of those years.

In any case, the key takeaway is that global bitcoin ETP flows will most likely accelerate signficantly over the coming weeks.

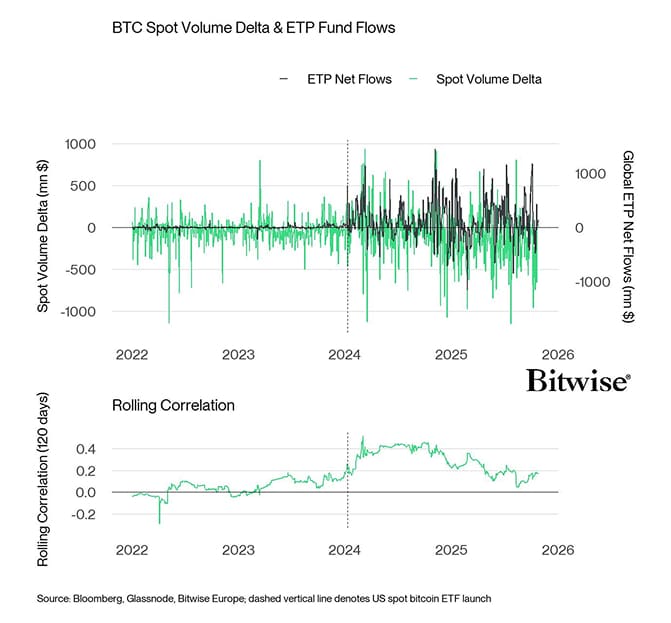

Combine this with the observation that bitcoin ETP flows and US spot bitcoin ETF flows in particular have become the “marginal buyer” on native bitcoin spot exchanges which we highlighted in one of our Crypto Market Espresso reports more recently.

On that note we have already seen a significant number of net inflows into Solana ETPs in the US, especially into Bitwise's Solana Staking ETF (BSOL) which saw a record number of inflows in the first week of trading.

This implies that risk appetite among investors is still very much present in the market.

Furthermore, the Fed has cut interest rates by another 25 basis points in October and has announced to end Quantitative Tightening (“QT”) – i.e. the run-down of its bond holdings and balance sheet – in December. Rate cuts tend to steepen the yield curve which incentivises bank lending and money supply growth – a key bullish factor for scarce assets like bitcoin. The announcement of the end of QT alone can lead to an acceleration of market-based inflation expectations as highlighted in our Crypto Market Compass report last week.

A decline in yields to due Fed rate cuts and accelerating inflation expectations will lead to a decline in real yields signalling a return of easy monetary policy and “financial repression”. These macro environments tend to be very supportive for bitcoin and other cryptoassets as highlighted in our Bitcoin Macro Investor report last month as well.

A negative wild card remains a renewed interbank funding crisis in the US like the one witnessed in early 2023. In fact, reserve balances at the Fed remain relatively low and the SOFR-Fed Funds Rate spread – a key metric for repo market funding stress - has already reached the highest level year-to-date. While short-term funding stress in the US banking system poses risks in the short term, it also increases the likelihood of renewed (earlier) QE, reinforcing the bullish liquidity outlook over the medium to long term.

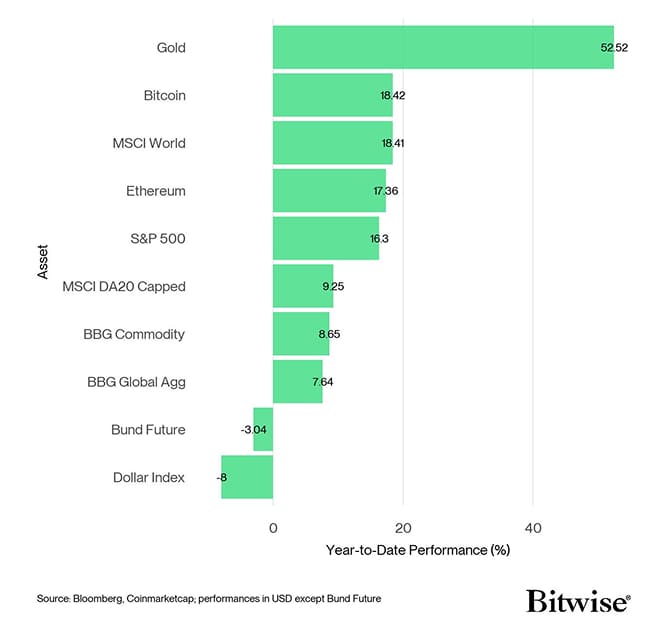

All in all, our base case remains a renewed risk-on scenario as easy monetary policy across the globe will continue to support positive global growth expectations and global risk appetite. A key metric to watch over the coming weeks will be the relative performance between bitcoin and gold – a key “risk-on/risk-off” gauge. As highlighted in one of our previous Crypto Market Compass reports, even a small capital rotation from gold to bitcoin could have very significant performance effects on bitcoin.

Cross Asset Performance (YtD)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Cross Asset Performance (MtD)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Cross Asset Performance (MtD)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Bitwise Europe Product Performance Overview (%)

Source: Bloomberg, Coinmarketcap; performances in USD except Bund Future

Bitwise Europe Product Performance Overview (%)

Source: Bloomberg, Bitwise Europe; Performances in EUR; all information are subject to change; past performance not indicative of future returns; Data as of 2025-11-30

Source: Bloomberg, Bitwise Europe; Performances in EUR; all information are subject to change; past performance not indicative of future returns; Data as of 2025-11-30

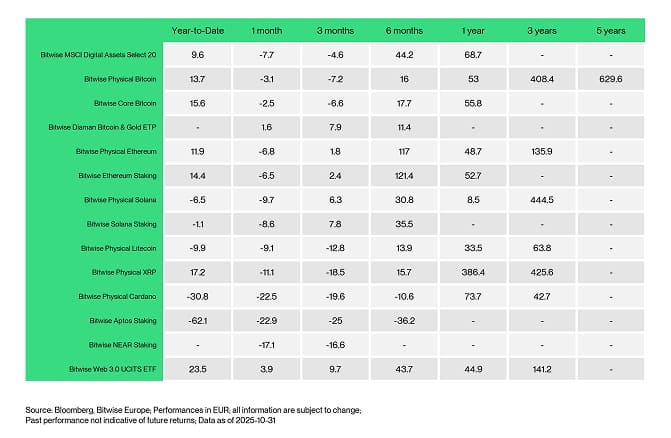

A closer look at our product performances also reveals that most major cryptoassets exhibited a negative performance in October. An exception was the Bitwise Diaman Bitcoin & Gold ETP which still saw a slightly positive performance despite the correction in the price of gold in October.

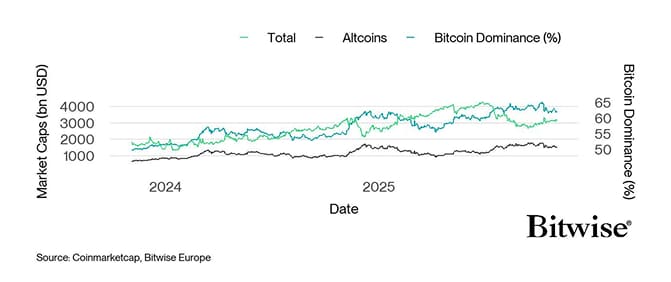

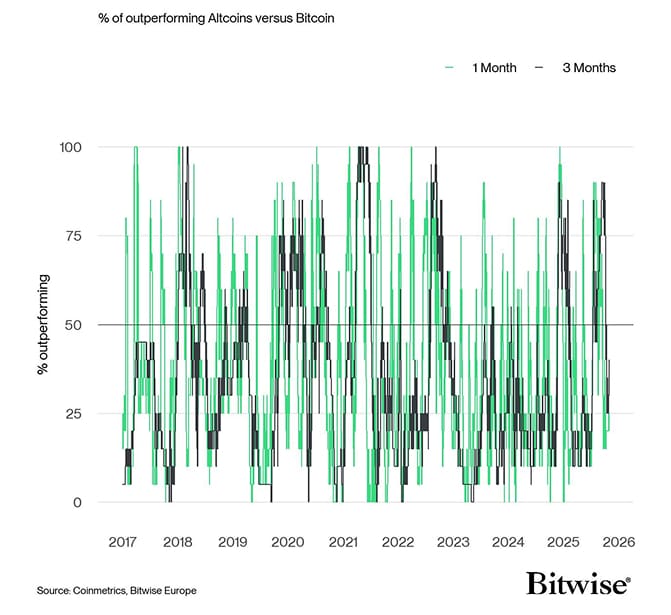

Performance dispersion among altcoins remained relatively low in October implying a relatively high correlation between bitcoin's performance and altcoins. Only 20% of our tracked altcoins managed to outperform bitcoin on a monthly basis as bitcoin's market cap dominance increased in October.

Bottom Line: In summary, while October was marked by a sharp deleveraging event and temporary weakness across cryptoassets, market dynamics now point to a constructive outlook. With seasonal tailwinds, renewed ETP inflows, and a shift toward easier monetary policy, we expect crypto markets - led by bitcoin - to resume their upward trajectory in the coming weeks.

Macro Environment

Our main bullish macro thesis remains the ongoing liquidity expansion as outlined in our previous Bitcoin Macro Investor reports here, here, and here.

In our view, this macro thesis is still intact.

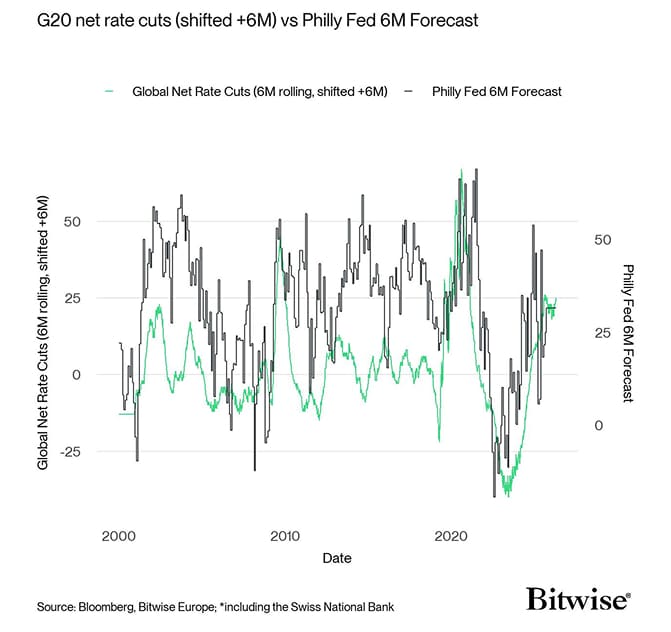

The key takeaway is that we're currently seeing post-subprime / post-Covid levels of global monetary easing, which typically supports a renewed upswing in the business cycle both in the US and worldwide. For instance, over the past 24 months the global number of rate cuts has already exceeded the total number of rate cuts post-Covid and is only second to the number of rate cuts seen after the subprime crisis of 2008/09.

So, there is an extraordinary amount of monetary stimulus already happening globally.

Historically, the aggregate amount of rate cuts by major central banks tends to lead US “animal spirits,” such as the Philly Fed's 6-month outlook for general business activity. This is shown in the following chart:

Central bank rate cuts continue to support a renewed business cycle upturn

Moreover, both of these indicators typically precede movements in the ISM Manufacturing Index by several additional months.

In short, the data suggest that the current macroeconomic expansion is likely to continue for at least another six months.

Our base case remains that the macro cycle will persist well into 2026, which has highly constructive implications for risk-on assets such as bitcoin and broader crypto markets.

It's also worth noting that the Fed has just cut the Fed Funds Target Rate by another 25 basis points and has also announced the end of Quantitative Tightening (QT) by December 1st which implies that the Fed is returning to balance sheet expansion, albeit slowly.

Although there hasn't been new data releases due to the US government shutdown, alternative data suggest that consumer price inflation has continued to re-accelerate since the previous FOMC meeting in September. The fact that the Fed is continuing to cut rates into an environment of accelerating inflation implies that the Fed may have a higher tolerance for inflation – probably closer to 3%. It is quite likely that US inflation expectations will continue to drift higher as previous monetary policy easing announcements by the Fed have been instantly followed by increases in market-based inflation expectations as highlighted in our Crypto Market Compass report.

It increasingly looks like we are entering a renewed “financial repression scenario” with declining real yields which is essentially synonymous with a significant easing in monetary policy as described in our previous Bitcoin Macro Investor report. This tends to be a strong tailwind for bitcoin and cryptoassets.

In an environment characterized by accelerating rate cuts and expanding liquidity, even significant external shocks - like the April 2025 tariff shock - are unlikely to meaningfully disrupt the business cycle or trigger a recession.

Such risks only materialize when liquidity growth slows and central banks shift back toward net rate hikes, which is also when equity valuations tend to come under pressure.

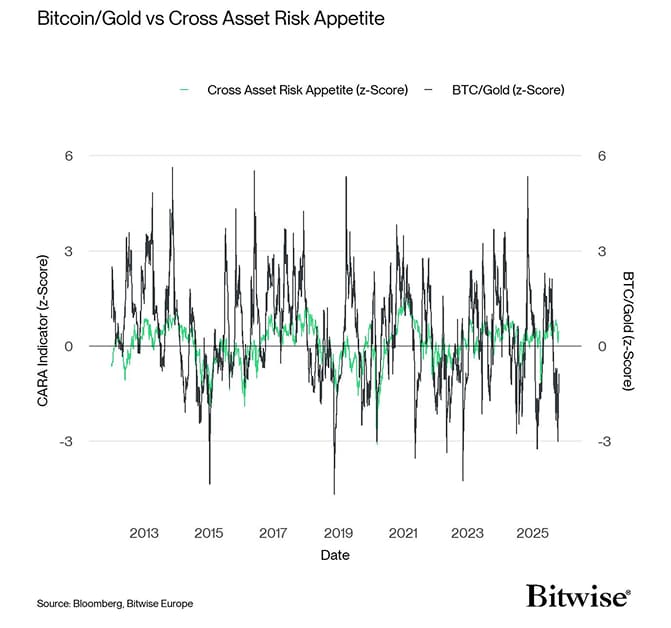

Gold has anticipated these devlopments earlier than bitcoin and other cryptoassets as it has been more sensitive to monetary policy and the US Dollar while bitcoin has been more sensitive to global growth expectations as mentioned here.

That being said, the rally in gold appears to be somewhat streched especially with respect to a potential return of a risk-on investment environment.

It s quite likely that the performance leadership will change in favour of bitcoin in such an environment as the relative performance between bitcoin and gold tends to gyrate with cross asset risk appetite in traditional financial markets.

In other words, risk-on: bitcoin outperforms; risk-off: gold outperforms.

Once global risk appetite returns, bitcoin will likely outperform gold again

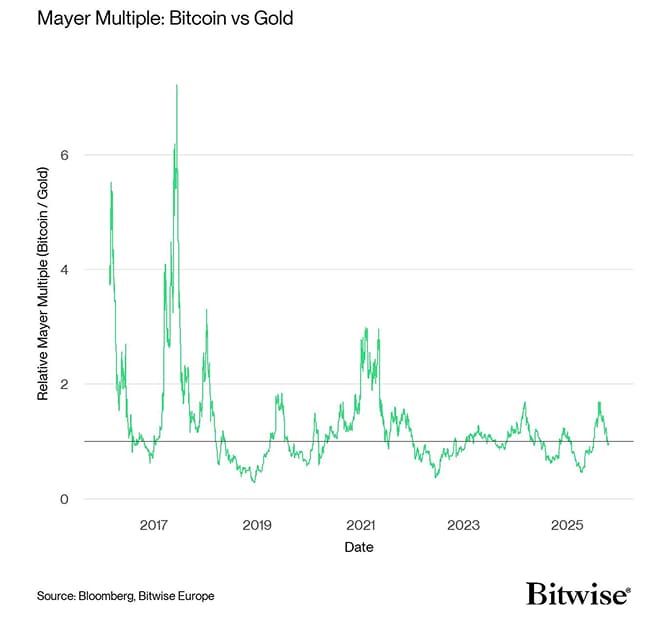

What is even more is that Bitcoin is relatively cheap compared to gold right now – from a pure strategic allocation perspective it is quite reasonable to assume that some capital could rotate from gold to bitcoin, especially in a renewed US business cycle upturn and risk-on phase of the market.

Bitcoin is relatively cheap compared to Gold

In this context, even small amounts of capital rotation from gold to bitcoin could have very significant performance effects on bitcoin. In fact, only 4% of capital rotation is necessary for bitcoin to double from here as outlined in one of our weekly Crypto Market Compass reports.

A positive wild card in this context is a potential sale of US government gold holdings to acquire bitcoin in a budget-neutral way. Several (former) government officials such as Bo Hines or Cynthia Lummis have repeatedly mentioned this approach in the past.

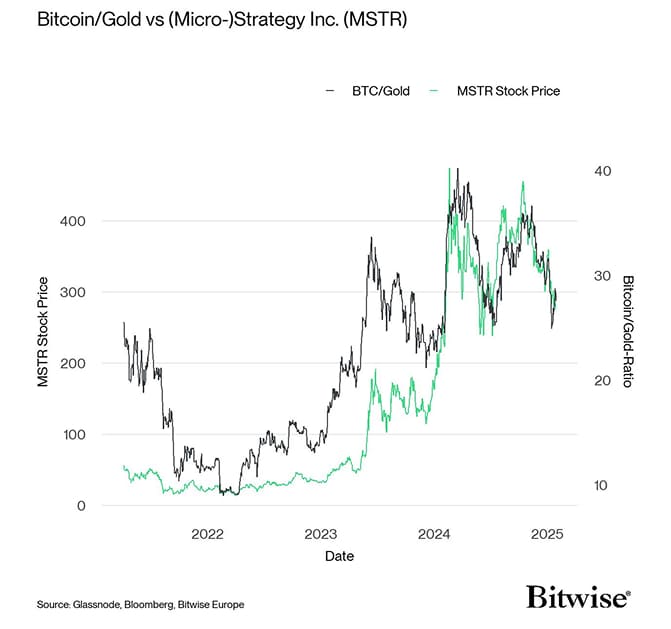

Moreover, the bitcoin-gold-ratio tends to correlate with bitcoin treasury company stocks such as (Micro-)Strategy Inc. (MSTR) very well.

When bitcoin outperforms gold again, Bitcoin treasury companies should experience renewed mNAV expansion which will allow them to issue more capital to buy bitcoin and create the positive flywheel again.

An outperformance of bitcoin vs gold would also suggest a renewed rally in MSTR

Source: Bloomberg, Bitwise Europe

Source: Bloomberg, Bitwise Europe

From a pure fundamental point-of-view, we think that this “institutional bid for bitcoin” remains the key driver in this market.

Another key element in this context remains the demand from global bitcoin ETPs. As global liquidity growth accelerates and global adoption continues, we think ETP inflows will also accelerate over the coming months and especially towards year-end.

This is supported by the fact that ETP flows generally tend to accelerate towards the end of the year due to window dressing and year-end rebalancings by fund managers as mentioned in one of our previous CIO memos.

Bitcoin ETP Flows will likely accelerate towards year-end

Bitcoin ETP flows have been one of the key performance drivers in this cycle as highlighted in one of our Crypto Market Espresso reports. The key reason is that net flows into global bitcoin ETPs have become a key determinant of spot exchange volume deltas for bitcoin – in other words, bitcoin ETPs have become the “marginal buyer” on spot exchanges.

Bitcoin ETP flows are increasingly influencing spot exchange markets

A negative wild card remains a short-term risk-off due to the tight interbank liquidity in the US. Despite renewed rate cuts by the Fed, liquidity measures such as bank reserves at the Fed have continued to decline due to a decline in bond holdings at the Fed and an increase in the Treasury General Account (TGA) that tends to drain liquidity from the banking system.

The level of bank reserves has already reached around 10% relative to US GDP which has been identified by Fed governors as being a critical threshold for ample reserve liquidity. It is no surprise that interbank funding rates such as the SOFR-Fed Funds Rate spread have spiked to multi-year highs signalling increasing funding stress among commercial banks. In this context, regional bank stocks have come under renewed pressure reminiscent of the regional banking crisis in early 2023.

This tends to dampen loan origination which is why deliquencies have been on the rise especially in the subprime auto loan market. According to Fitch Ratings, more than 6% of subprime auto loans were over 60 days delinquent as of August 2025 - the highest level ever recorded. This suggests growing hardship among borrowers with weaker credit profiles and limited financial flexibility.

The key takeaway from this is that systemic risks in the US banking system are on the rise due to tight liquidity conditions which imply a return to Quantitative Easing (“QE”) by the Fed rather sooner than later.

In fact, this implies that the Fed may return outright QE earlier if systemic risks in the banking system resurface.

A fiscal dominant environment with high deficits and high Treasury bond issuances is probably contributing to this move as well. The reason is that even Fed rate cuts have had little impact on the long end of the Treasury curve so far. The Fed might resume QE just in order to regain a greater grip on the market.

Tight interbank liquidity is also jeopardizing financial stability as they increase repo rates on US Treasury bonds itself. That alone can entice the Fed to resume QE in order to avoid a repetition of a repo crisis as in 2019.

A potential “accident” in funding markets and a renewed regional banking crisis would certainly lead to even higher liquidity expansion which would “supercharge” our macro scenario described above.

Bottom Line: The global macro backdrop remains strongly supportive for risk-on assets, driven by accelerating liquidity expansion and ongoing rate cuts that are likely to extend the business cycle well into 2026. While short-term funding stress in the US banking system poses risks, it also increases the likelihood of renewed QE, reinforcing the bullish liquidity outlook. In this environment, capital rotation from gold and rising ETP inflows could significantly amplify Bitcoin's upside potential.

On-Chain Developments

The Realized Cap remains a cornerstone metric in on-chain analytics, capturing the cumulative capital inflows into Bitcoin. It currently stands at an all-time high of $1.1tn, with over $700bn in new liquidity entering the asset this cycle alone.

While capital flows remain positive, with the Realized Cap still expanding at roughly +3% per month (+$33.3bn), the pace of growth has steadily slowed since the first all-time high in March 2024, signalling a moderation in relative demand-side momentum. Over a long-term view, this may resemble a bearish divergence, with price trending higher even as capital inflow growth decelerates.

However, the absolute level of liquidity entering the market remains exceptionally large, indicating that aggregate demand is still strong, yet price continues to drift lower, signalling that sellers currently dominate at the margin. This implies that marginal buy-side liquidity at current price levels is insufficient to absorb the prevailing sell-side supply.

For the bull market to continue, a repricing event will need to attract a stronger wave of buy-side participation. That next influx of demand could arise either from value-motivated buyers at lower levels or from momentum-driven capital re-engaging at higher prices. Should the buy-side fail to step in, this divergence could ultimately evolve into a more sustained drawdown.

Realized Cap

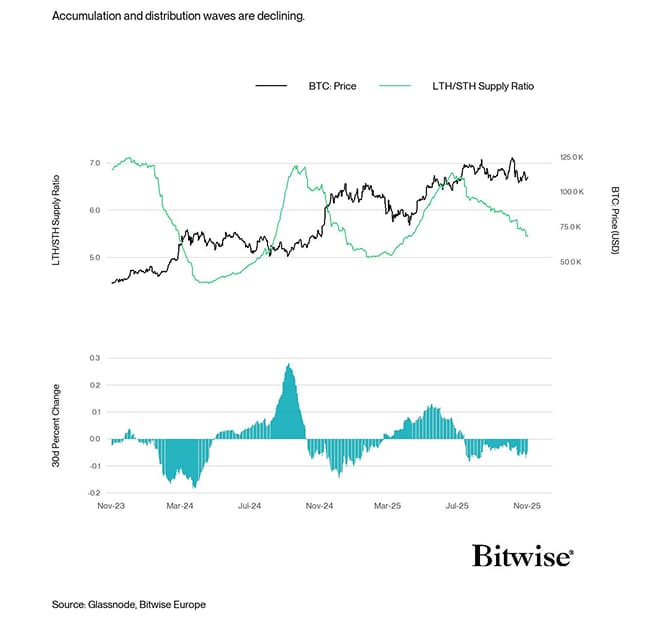

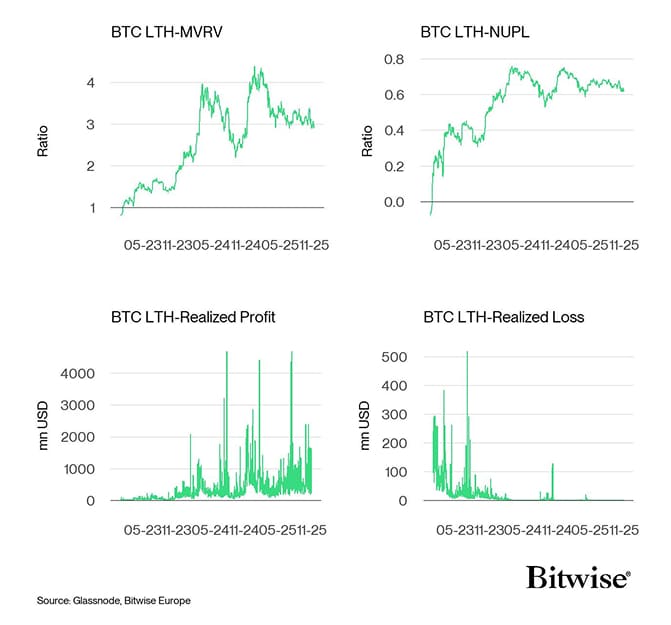

Long-Term Holders (LTHs) are typically the dominant source of distribution during bull markets, accumulating supply throughout bear markets and gradually releasing it into strength as prices trend higher. Since the introduction of regulated ETF products, there has been a notable balance between LTH distribution and ETF accumulation, creating a hallmark structure of this cycle where institutional inflows offset long-term holder sell-side pressure.

Across the current cycle, three distinct waves of maturation and distribution have formed a highly structured market profile. The result is a stair-stepping pattern of capital rotation, where distribution is followed by renewed maturation to rebuild the capital base. At present, the market remains in a distributive phase, with mature investors continuing to realise profits despite the market downturn, suggesting a degree of de-risking is occurring. Constructively, price has only retraced by around 12.4% from all-time highs, indicating that the market is still absorbing this supply relatively well as of current.

More recently the amplitude of both maturation and distribution waves have been diminishing, while the frequency of these rotations has increased. This shift suggests that the structure of this bull market is becoming less stable over time, with the instability potentially raising volatility expectations.

LTH/STH Supply Ratio

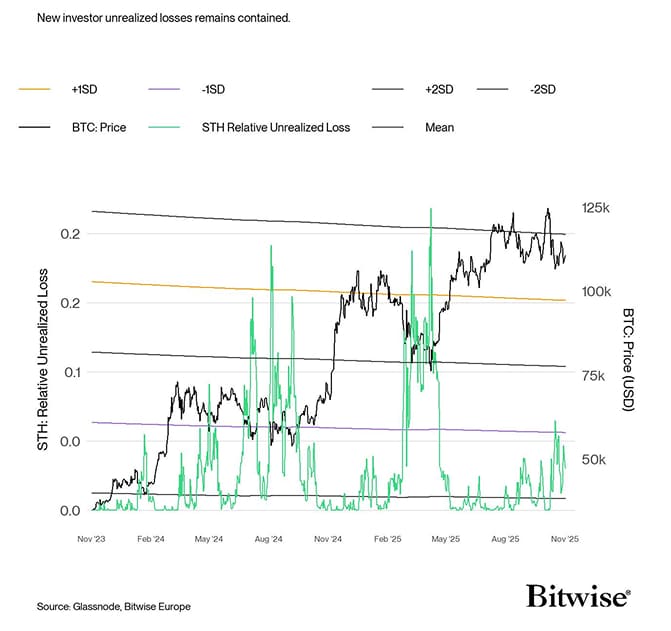

With the market facing heightened sell-side pressure, we can assess whether this factor is beginning to translate into weakening market conditions by examining the unrealized losses held within the Short-Term Holder (STH) cohort, whose profitability tends to deteriorate far more rapidly than that of the broader market.

At present, unrealized losses among new-demand investors remain relatively shallow (3% of STH market cap), especially when compared to prior cycle stress events such as the yen-carry unwind and the Trump tariff tantrums. Historically, sustained bear markets have taken hold once the cohort's unrealized loss stabilizes above the +1σ threshold, a level briefly reached but swiftly reversed during those previous episodes.

Despite the palpable fear currently circulating in the market, this metric suggests that capitulation pressure has yet to fully permeate the newest of investors. However, this risk could escalate should market stress persist and price contraction deepen meaningfully.

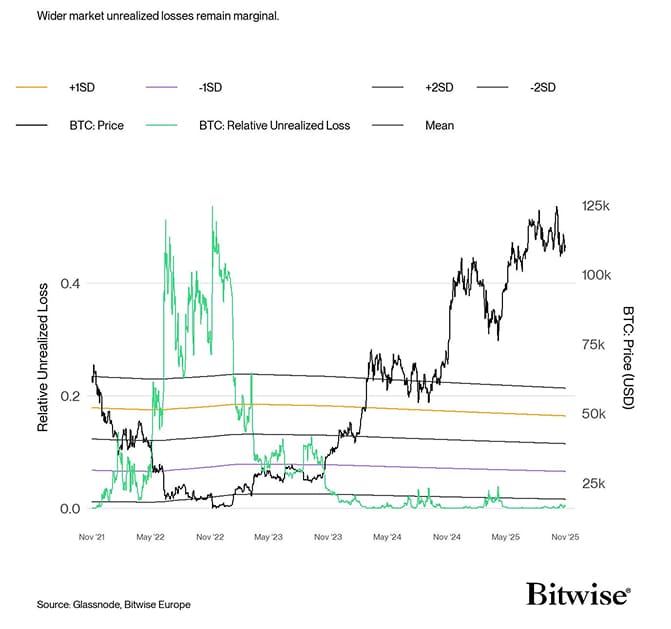

STH Relative Unrealized Loss

Expanding our view to the wider market, unrealized losses across the aggregate investor base remain minimal, accounting for only around 0.4% of total market capitalization. This supports the view that, despite recent volatility, investor portfolios remain relatively robust at present. Typically, unrealized losses equivalent to 11.5% of market cap have been conducive to the onset of deep bear market conditions, yet investor portfolios remain far from this measure.

Relative Unrealized Loss

The Short-Term Holder Cost-Basis and the 111-day Moving Average serve as two key levels that blend on-chain and technical analysis, defining the boundary between local bull and bear market conditions. The STH Cost Basis is particularly important, as it represents the average acquisition price for new investors in the market, and tends to act as a centre of gravity for local momentum, where reclaiming the level frequently marks the point at which new investors return to profit and trend confidence is restored. With the market currently trading below both thresholds, we can assess the degree of “duration pain” by measuring how long spot prices remain under these levels over a 90-day window.

Assuming broader bull market conditions remain intact, the market has spent around 60 days below these levels on average across the drawdowns of our current cycle. At present, price has spent 26 days below both, providing a useful durational gauge for how much longer this local phase of weakness could persist if conditions do not materially improve.

STH Cost-Basis and 111DMA Duration

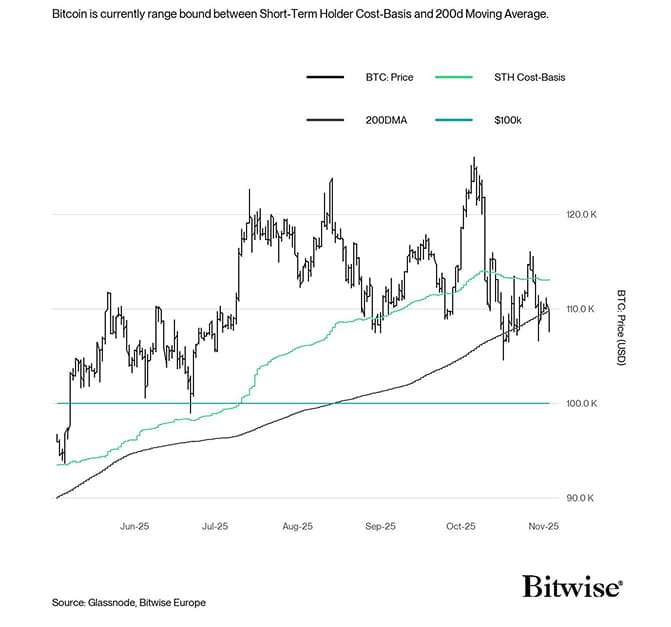

To identify key zones of market support and resistance, we can assess how price is interacting with the aforementioned STH-CB, alongside the 200d Moving Average, a traditional bull and bear market threshold, as well as the $100k level, which can be considered as a key psychological threshold to maintain.

- STH-CB: $113k

- 200d Moving Average: $108k

- Psychological Level: $100k

As of current, price remains rangebound between the STH-CB and the 200d Moving Average suggesting a degree of market indecision. These critical levels must be held or reclaimed for further bull market appreciation.

Key Pricing Levels

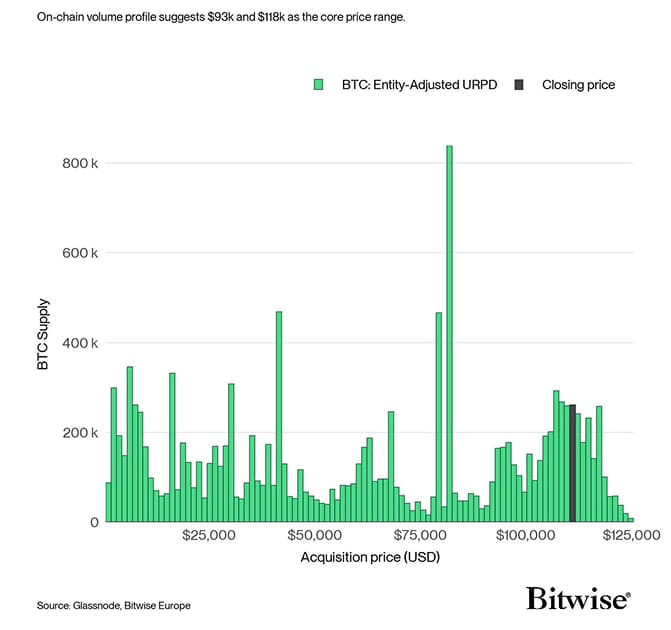

Additionally, we can employ the URPD (UTXO Realized Price Distribution) metric, which maps the on-chain volume profile of held supply. Notably, a substantial cluster of supply is concentrated between $93k and $118k level.

The $118K region defines the upper bound of the current node structure, with comparatively limited transacted supply above. A sustained break beyond this level could act as a catalyst for renewed momentum, with relatively little overhead resistance as the market moves into a thinner on-chain supply landscape.

Below this range, the $93K level represents the lower boundary of the dense supply structure, beneath which supply volumes become relatively thin, marking an important threshold to defend for continued market stability.

BTC: Entity-Udjusted URPD

Bottom Line: In summary, despite a moderation in capital inflow momentum, Bitcoin's Realized Cap at record highs highlights continued strong underlying demand and healthy market absorption of sell-side pressure. With structural resilience intact and key support levels holding, the setup remains constructive for a renewed uptrend once buy-side momentum reaccelerates.

Bottom Line

- Performance: While October was marked by a sharp deleveraging event and temporary weakness across cryptoassets, market dynamics now point to a constructive outlook. With seasonal tailwinds, renewed ETP inflows, and a shift toward easier monetary policy, we expect crypto markets - led by bitcoin - to resume their upward trajectory in the coming weeks.

- Macro: The global macro backdrop remains strongly supportive for risk-on assets, driven by accelerating liquidity expansion and ongoing rate cuts that are likely to extend the business cycle well into 2026. While short-term funding stress in the US banking system poses risks, it also increases the likelihood of renewed QE, reinforcing the bullish liquidity outlook. In this environment, capital rotation from gold and rising ETP inflows could significantly amplify Bitcoin’s upside potential.

- On-Chain: Despite a moderation in capital inflow momentum, Bitcoin’s Realized Cap at record highs highlights continued strong underlying demand and healthy market absorption of sell-side pressure. With structural resilience intact and key support levels holding, the setup remains constructive for a renewed uptrend once buy-side momentum reaccelerates.

Appendix

Cryptoasset Market Overview

Global Cryptoasset Market Caps

Source: Glassnode, Bitwise Europe

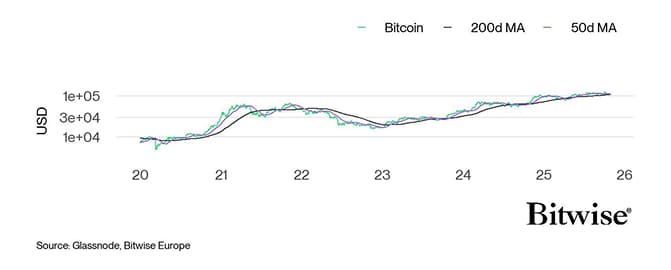

Bitcoin Performance

Source: Glassnode, Bitwise Europe

Bitcoin Performance

Source: Glassnode, Bitwise Europe

Ethereum Performance

Source: Glassnode, Bitwise Europe

Ethereum Performance

Source: Glassnode, Bitwise Europe

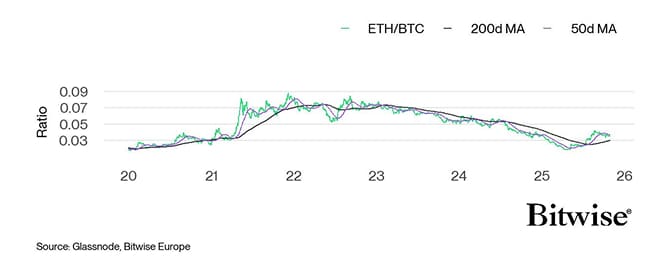

Ethereum vs Bitcoin Relative Performance

Source: Glassnode, Bitwise Europe

Ethereum vs Bitcoin Relative Performance

Source: Glassnode, Bitwise Europe

Altseason Index

Source: Glassnode, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

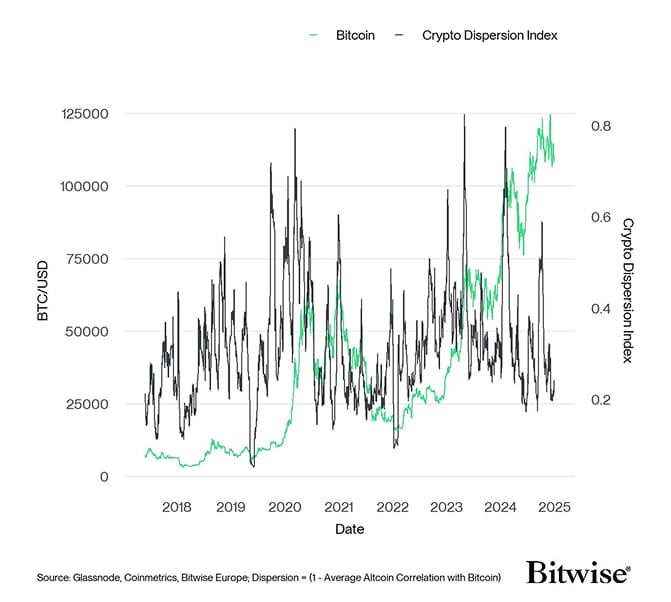

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Glassnode, Coinmetrics, Bitwise Europe; Despersion = (1 - Average Altcoin Correlation with Bitcoin)

Source: Glassnode, Coinmetrics, Bitwise Europe; Despersion = (1 - Average Altcoin Correlation with Bitcoin)

Cryptoassets & Macroeconomy

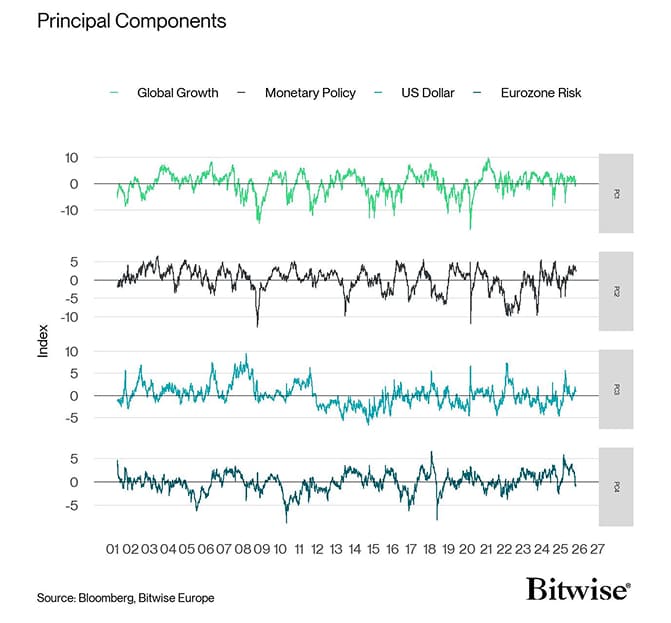

Macro Factor Pricing

Source: Bloomberg, Bitwise Europe

How much of Bitcoin's performance can be explained by macro factors?

Source: Bloomberg, Bitwise Europe

How much of Bitcoin's performance can be explained by macro factors?

Source: Bloomberg, Bitwise Europe

Source: Bloomberg, Bitwise Europe

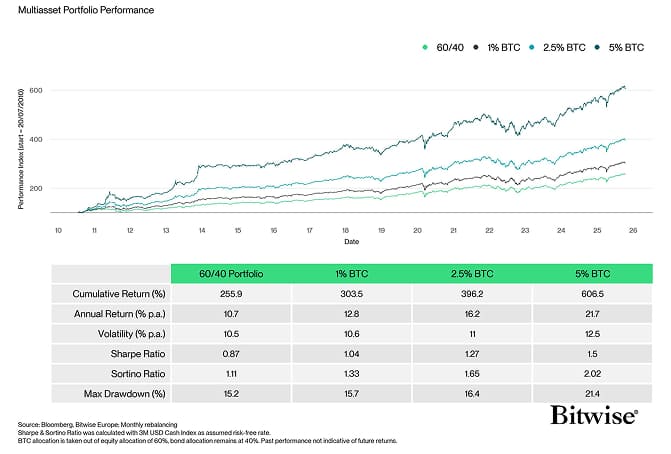

Cryptoassets & Multiasset Portfolios

Multiasset Performance with Bitcoin (BTC)

Source: Bloomberg, Bitwise Europe; Monthly rebalancing; Sharpe Ratio was calculated with 3M USD Cash Index as assumed risk-free rate; BTC allocation is taken out of equity allocation of 60%, bond allocation remains at 40%; Past performance not indicative of future returns.

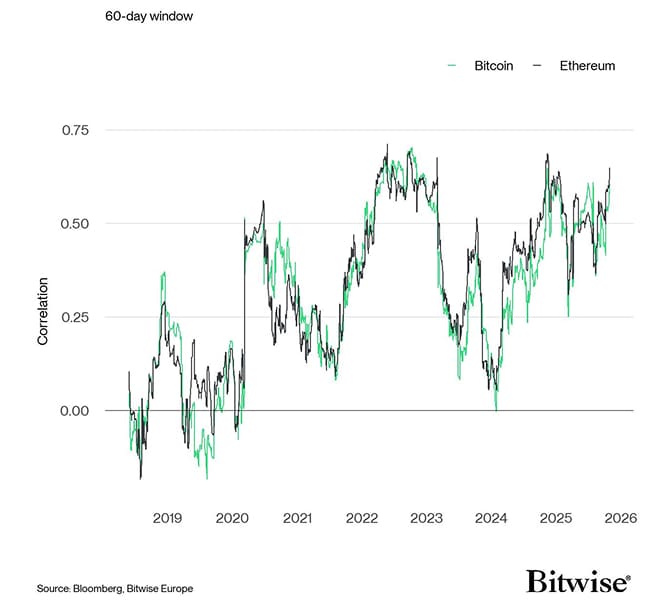

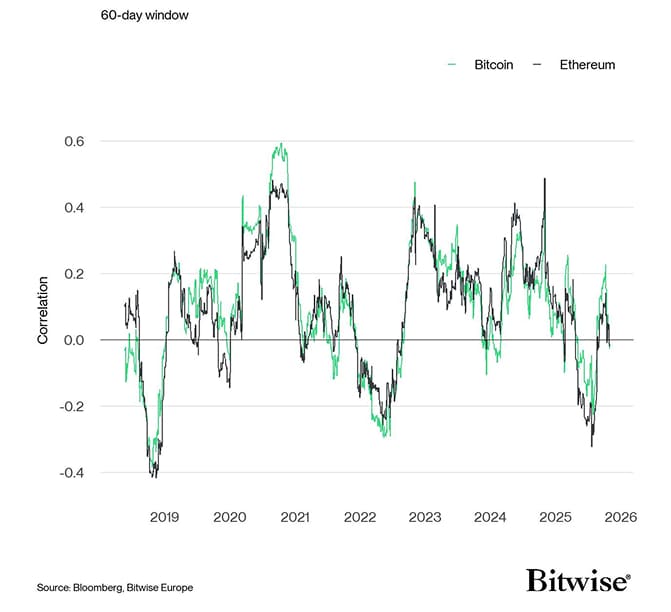

Rolling correlation: S&P 500

Source: Bloomberg, Bitwise Europe; Monthly rebalancing; Sharpe Ratio was calculated with 3M USD Cash Index as assumed risk-free rate; BTC allocation is taken out of equity allocation of 60%, bond allocation remains at 40%; Past performance not indicative of future returns.

Rolling correlation: S&P 500

Source: Bloomberg, Bitwise Europe

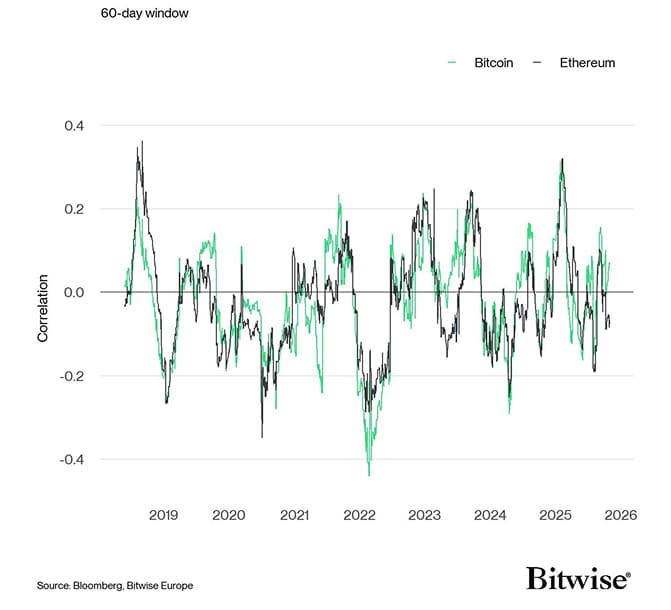

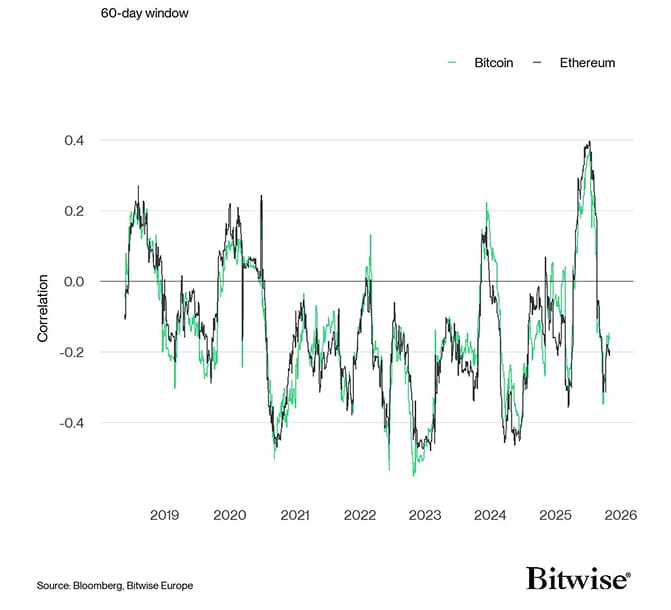

Rolling correlation: Bund Future

Source: Bloomberg, Bitwise Europe

Rolling correlation: Bund Future

Source: Bloomberg, Bitwise Europe

Rolling correlation: Gold

Source: Bloomberg, Bitwise Europe

Rolling correlation: Gold

Source: Bloomberg, Bitwise Europe

Rolling correlation: Dollar Index (DXY)

Source: Bloomberg, Bitwise Europe

Rolling correlation: Dollar Index (DXY)

Source: Bloomberg, Bitwise Europe

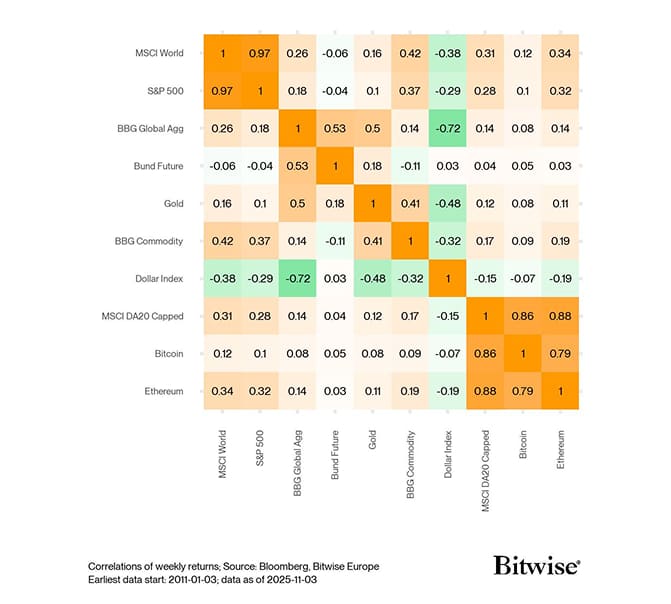

Cross Asset Correlation Matrix

Source: Bloomberg, Bitwise Europe

Cross Asset Correlation Matrix

Source: Correlations of weekly returns; Source: Bloomberg, Bitwise Europe earliest data start: 2011-01-03; data as of 2025-11-03

Source: Correlations of weekly returns; Source: Bloomberg, Bitwise Europe earliest data start: 2011-01-03; data as of 2025-11-03

Cryptoasset Valuations

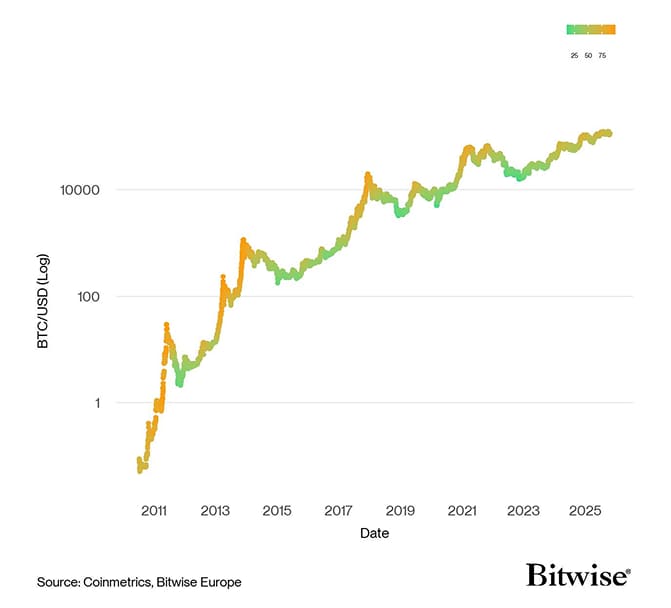

Bitcoin: Price vs Composite Valuation Indicator

Source: Coinmetrics, Bitwise Europe

Bitcoin: Composite Valuation Indicator

Source: Coinmetrics, Bitwise Europe

Bitcoin: Composite Valuation Indicator

Source: Coinmetrics, Bitwise Europe

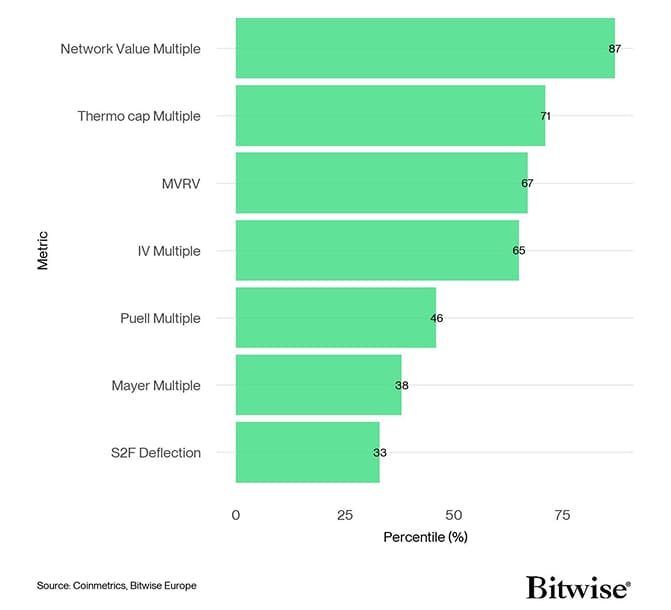

Bitcoin: Valuation Metrics

Source: Coinmetrics, Bitwise Europe

Bitcoin: Valuation Metrics

Source: Coinmetrics, Bitwise Europe

Source: Coinmetrics, Bitwise Europe

On-Chain Fundamentals

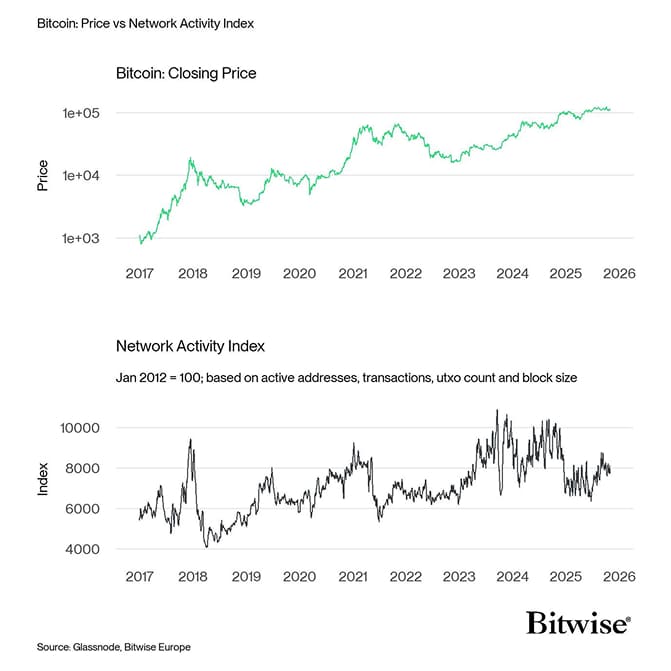

Bitcoin: Price vs Network Activity Index

Source: Glassnode, Bitwise Europe

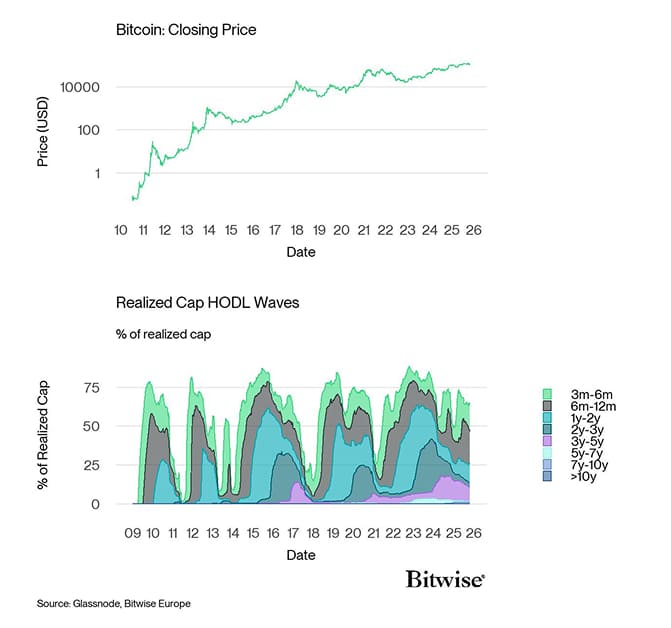

Bitcoin: Closing Price

Source: Glassnode, Bitwise Europe

Bitcoin: Closing Price

Source: Glassnode

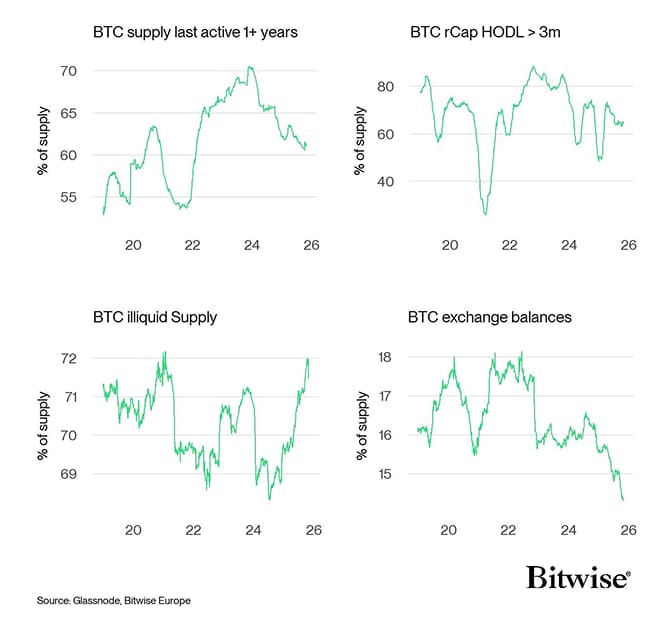

Bitcoin's supply scarcity is more pronounsed that during the last cycle

Source: Glassnode

Bitcoin's supply scarcity is more pronounsed that during the last cycle

Source: Glassnode, Bitwise Europe

Bitcoin Long-term Holder (LTH) Dashboard

Source: Glassnode, Bitwise Europe

Bitcoin Long-term Holder (LTH) Dashboard

Source: Glassnode, Bitwise Europe

Bitcoin Short-term Holder (STH) Dashboard

Source: Glassnode, Bitwise Europe

Bitcoin Short-term Holder (STH) Dashboard

Source: Glassnode, Bitwise Europe

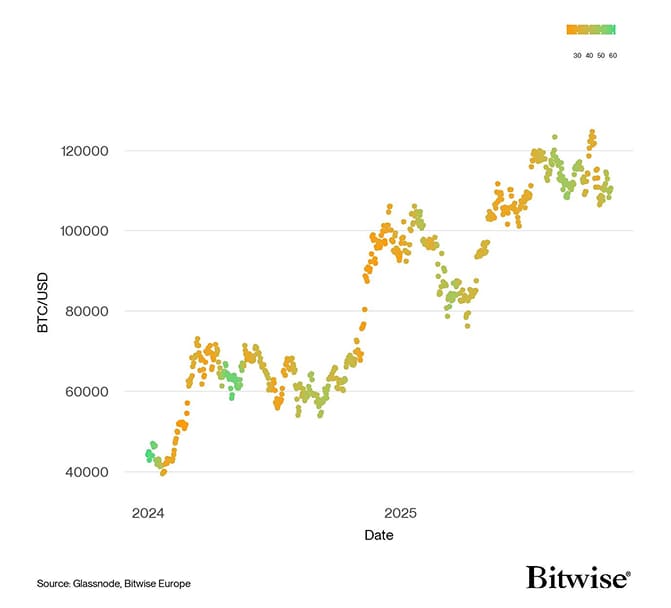

Bitcoin: Price vs Average Accumulatio Score

Source: Glassnode, Bitwise Europe

Bitcoin: Price vs Average Accumulatio Score

Source: Glassnode, Bitwise Europe

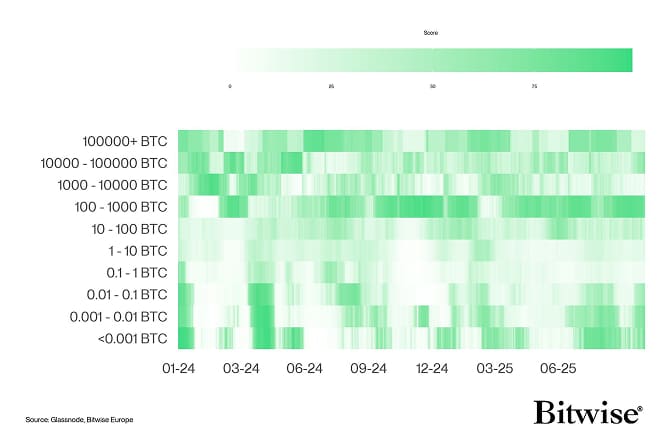

Bitcoin Accumulation Score

Source: Glassnode, Bitwise Europe

Bitcoin Accumulation Score

Source: Glassnode, Bitwise Europe

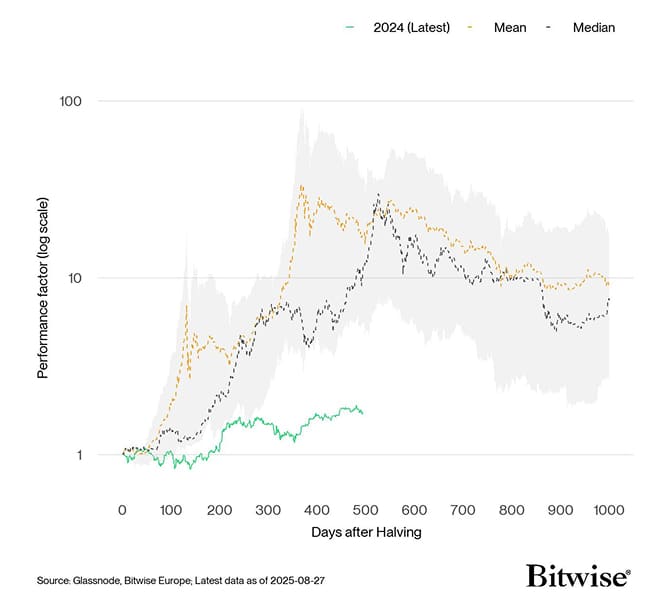

Bitcoin: Post-Halving Performance

Source: Glassnode, Bitwise Europe

Bitcoin: Post-Halving Performance

Source: Glassnode, Bitwise Europe; Results based on the previous Halvings in 2012, 2016, and 2020

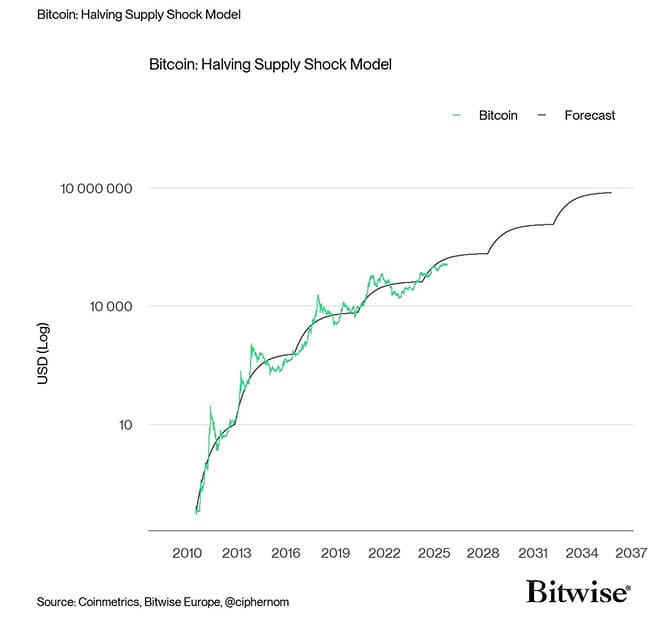

Bitcoin: Steady increase in scarcity will provide a tailwind for price appreciations

Source: Glassnode, Bitwise Europe; Results based on the previous Halvings in 2012, 2016, and 2020

Bitcoin: Steady increase in scarcity will provide a tailwind for price appreciations

Source: Coinmetrics, Bitwise Europe; @ciphernom

Source: Coinmetrics, Bitwise Europe; @ciphernom

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com