- Crypto markets rallied sharply last week, with Bitcoin breaching $100K and Ethereum posting its largest daily gain YTD following the Pectra upgrade—contributing to a 60.4% MTD surge. Macro optimism around U.S.–U.K. trade progress and hopes for a U.S.–China thaw helped lift total crypto market cap by 11.7% to $3.28T.

- Our in-house Cryptoasset Sentiment Index remains bullish, with 80% of tracked altcoins outperforming BTC and ETH gaining dominance in tokenized asset flows. Altseason Index spiked from 15 to 85, while Ethereum realized price surged 21.6% WoW—signalling a return of risk appetite and altcoin leadership.

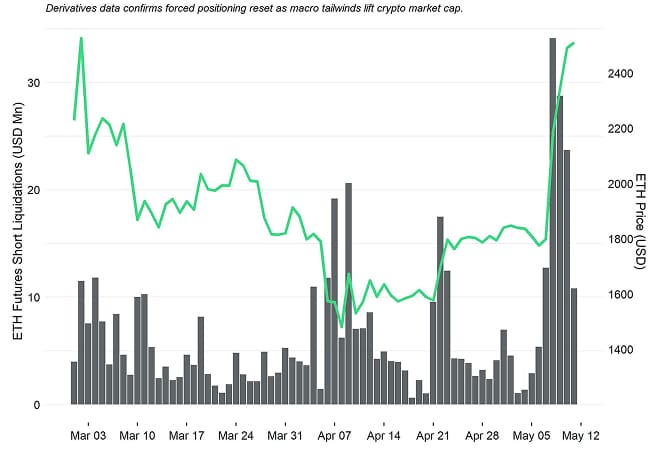

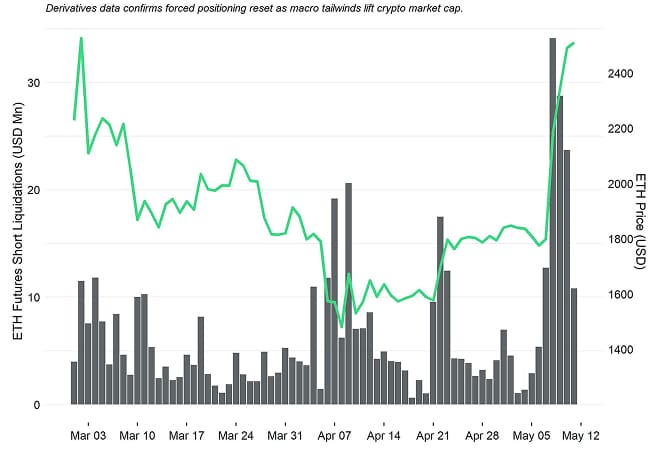

- Chart of the Week: Ethereum experienced its largest notional short squeeze of 2025, with futures short liquidations hitting their highest level since Nov 2024. This flush of positioning, paired with ETH’s +60% rally, underscores a structurally driven breakout—not just sentiment, but rotation, flows, and unwinds.

Chart of the Week

ETH Price Spike and Short Futures Liquidations Post-Pectra

Source: Glassnode, Bloomberg, Bitwise Europe

Source: Glassnode, Bloomberg, Bitwise Europe

Performance

Crypto markets rallied sharply last week, with Bitcoin surging past the psychological $100K threshold and Ethereum posting its largest daily YTD. Bitcoin rose from $93,000 to a high of $104,300, with May 8th marking the third-largest single-day gain for BTC in 2025. Ethereum outpaced even that, jumping 60.4% MTD to break above $2,400 following the rollout of its Pectra upgrade.

Momentum extended into the weekend, driven by improving risk sentiment around geopolitics. The White House announced a provisional trade framework with the U.K., including lower levies on auto exports and increased U.S. access to food and ethanol markets. While the deal is limited in scope-given the U.K.'s modest trade weight in the U.S. economy-it served as a symbolic signal. Meanwhile, all eyes turned to the upcoming U.S.–China “icebreaker” talks that took place this weekend in Geneva.

Treasury Secretary Bessent has emphasized U.S. investment appeal, citing productivity and deregulation, while Commerce Secretary Lutnick cautioned that discussions with Japan and South Korea remain complex. These mixed signals underscore the balancing act in play. More broadly, the Trump administration is leaning into forward guidance on growth and equities at a time when the Fed remains on pause. Markets are adjusting to the realization that a 10% baseline tariff is now the floor-not the ceiling-raising the odds of structurally higher inflation and slower global growth. That repricing has implications across rates, risk assets, and currency markets.

As of time of writing, BTC holds firm at $104,587 (+9.04%) and ETH at $2,340 (+36.69%) on the week, helping lift total crypto market cap by nearly 11.7% to $3.28 tn.

May 8th marked a decisive short squeeze across crypto markets. Short liquidations totalled $836 mn, dwarfing long liquidations which came in at just $132 mn, according to Coinglass data. Bitcoin accounted for $394 mn of the short-side liquidations, while Ethereum saw $259 mn-its highest single-day short liquidation event of 2025. The imbalance between shorts and longs reflects how aggressively traders had positioned against the rally, only to be caught offside amid renewed risk sentiment.

The scale of Ethereum's unwind is historically significant: total ETH futures short liquidations over the past seven days marked the highest notional value since November 16, 2024-making it the most severe short squeeze YTD in dollar terms (Chart-of-the-Week). This adds quantitative backing to Ethereum's sharp rebound post-Pectra and visually reinforces the idea that ETH's +60% MTD move wasn't purely speculative but structurally driven by aggressive short positioning being flushed out of the system.

ETH Price Spike and Short Futures Liquidations Post-Pectra

Source: Glassnode, Bloomberg, Bitwise Europe

Source: Glassnode, Bloomberg, Bitwise Europe

Altcoins followed suit. The $TOTAL2 index-a measure of the total crypto market capitalization excluding Bitcoin-reclaimed $1.25 tn last week, a former breakdown level from February, confirming a new structural leg higher. The move confirms that the rally is expanding beyond BTC. Internal rotation data supports this: our in-house Altcoin Index captured the surge, printing new highs from 15 to 85, signalling renewed risk appetite beyond Bitcoin.

Ethereum led the charge, pulling in $446 mn in net inflows from other chains last week, while its share of RWA total value locked rose to 58.19%, underscoring its growing dominance as the hub for tokenized assets.

This follows a significant drawdown in the ETH/BTC ratio (–32.6% YTD), creating room for mean reversion that materialized in a 28.24% rally last week. With the Pectra upgrade now live-introducing smart accounts, increased validator thresholds, and improved UX-Ethereum is accelerating its transition from a B2C protocol built for retail activity to a B2B infrastructure layer designed to onboard and service institutional actors. Investors appear to be recognizing this pivot, positioning early for Ethereum's evolving role as the backbone for enterprise-grade roll-ups, tokenized assets, and data availability infrastructure.

Despite the rally, Washington continues to muddle progress. The GENIUS stablecoin bill-once poised for bipartisan passage-lost momentum after key Democrats reversed their support. That reversal came even after the bill was amended to bolster AML/KYC compliance, suggesting political optics around Trump's crypto agenda, declining approval ratings and political infighting has stalled legislative traction on crypto.

Still, the regulatory tide is shifting at the agency level. The OCC's greenlight for crypto trading and third-party outsourcing by banks points to growing normalization, even in the absence of formal legislation. Meanwhile, private sector bets are escalating: Coinbase's $2.9 bn acquisition of Deribit cements its dominance in crypto derivatives, and Stripe's new AI-native stablecoin payment stack-built on its $1.1 bn Bridge acquisition-cements the inevitable shift towards a future of on-chain finance.

Furthermore, the launch of Coinbase's x402 protocol-built to make stablecoins native to the internet-could prove as transformative as HTTPS, enabling pay-as-you-go APIs, frictionless AI payments, and autonomous agent commerce. This initiative is supported alongside some big names like AWS, Anthropic, Circle, and NEAR protocol.

Looking forward, macro data will set the tone. The upcoming U.S. CPI and PPI prints will shape expectations for monetary easing. A softer inflation read could amplify the rally, while a hotter print may challenge rate cut assumptions and temporarily cool risk sentiment.

However, as tariff models now price in 15–20% effective rates across sectors like autos, pharmaceuticals, and entertainment, the consensus U.S. outlook-2.5% CPI and near-zero real GDP for 2025-could shift quickly depending on this weekend's trade outcomes.

In other crypto-related developments: Germany seized $38 mn from a crypto laundering platform connected to the Bybit and Genesis hacks, with authorities identifying over $1.9 bn in illicit flows. Japan's Metaplanet, now the largest BTC holder among listed firms outside North America, announced a $21 mn bond raise to buy more Bitcoin. And in Florida, a pharmaceutical firm closed a $50 mn financing deal that integrates XRP for real-time payments, citing the asset's advantages for transaction efficiency in healthcare infrastructure.

On the altcoin front, token unlocks could introduce short-term selling pressure: Aptos ($65 mn on May 12), Arbitrum ($36 mn on May 16), and Fasttoken ($87 mn on May 18) all represent meaningful percentages of circulating supply.

Still, despite the strength of the recent rally, investors should approach the coming weeks with measured caution. Our in-house Cryptoasset Sentiment Index has shifted toward elevated levels, increasingly signalling an overheated market environment. While this doesn't imply an imminent reversal, it could allude to the fact that short-term positioning has become stretched.

With altcoins outperforming, funding rates rising and leverage building in derivatives markets, the risk of volatility spiked around macro catalysts- such as the upcoming CPI and PPI prints-remains material.

Still, these are short-term frictions within a longer-term uptrend driven by fresh capital inflows, improving infrastructure, and increasing global recognition that crypto-regulation or not-is becoming the rails of the next internet.

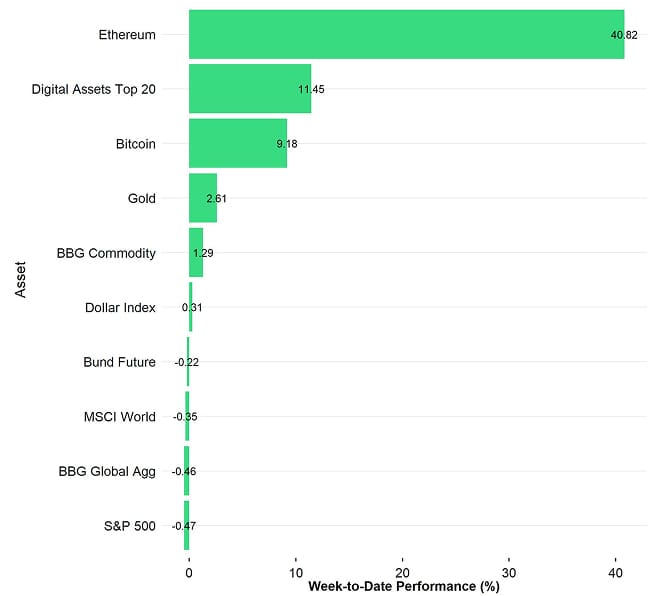

Cross Asset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

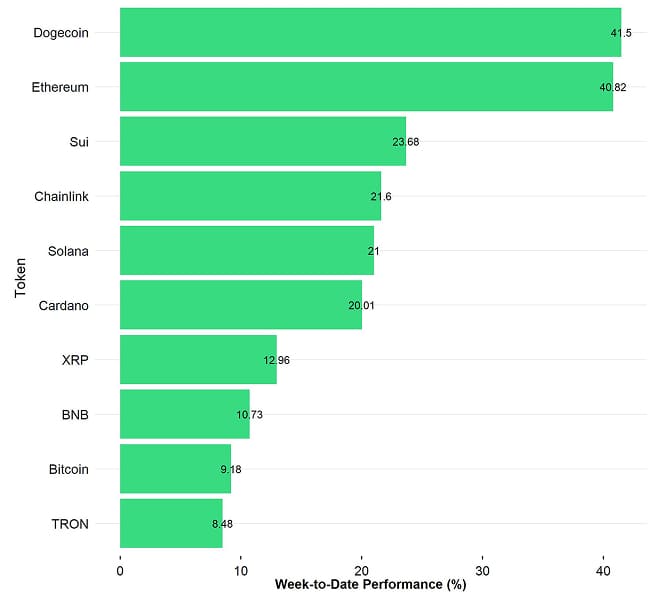

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Coinmarketcap

Source: Coinmarketcap

In general, among the top 10 crypto assets Dogecoin, Ethereum and Sui were the relative outperformers.

Overall, altcoin outperformance vis-à-vis Bitcoin increased from last week, with 80% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Furthermore, Ethereum outperformed Bitcoin last week.

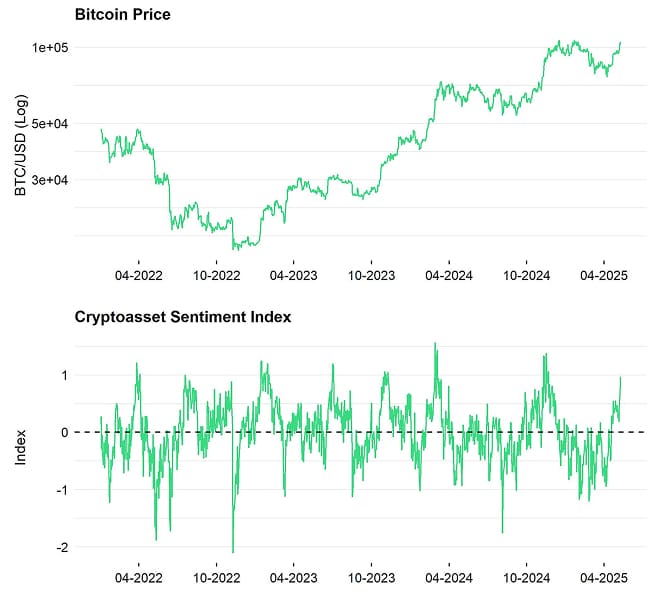

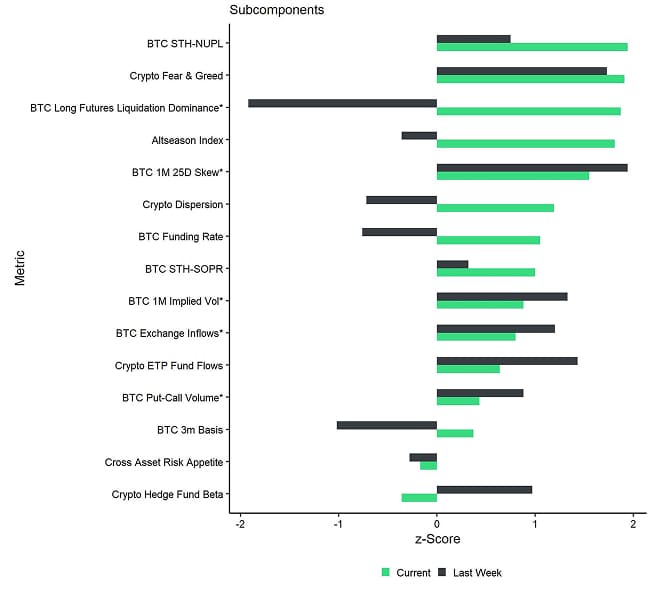

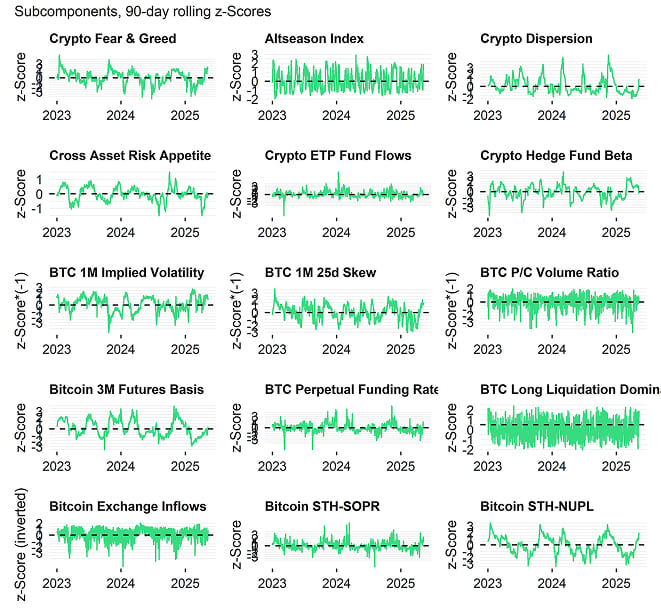

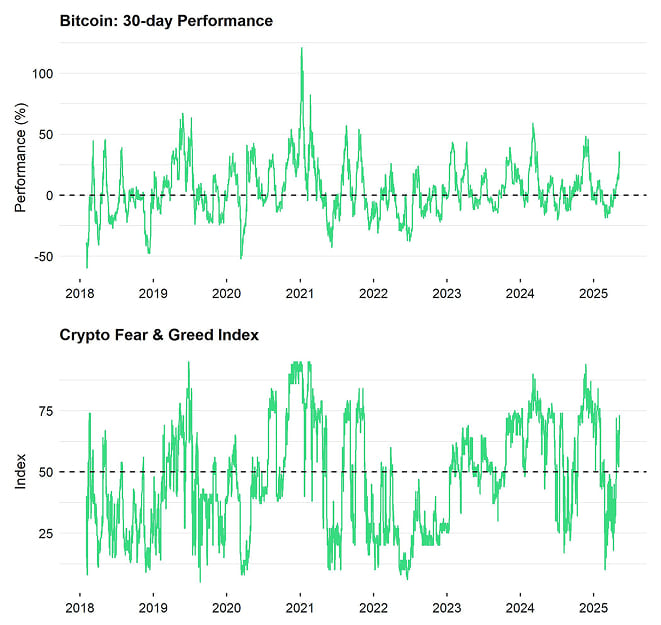

Sentiment

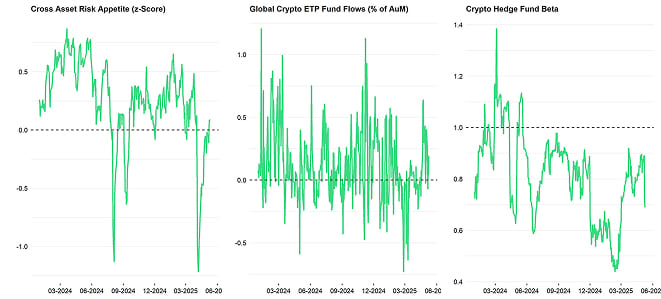

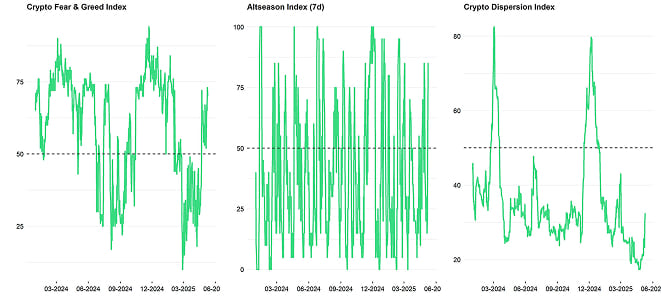

Our in-house “Cryptoasset Sentiment Index” has continued to signal a bullish sentiment.

At the moment, 8 out of 15 indicators are above their short-term trend.

The Crypto Fear & Greed and Altseason Index metrics have improved drastically last week, while the BTC Funding Rate increased, indicating heightened bullish sentiment as long positions are now periodically paying short positions.

The Crypto Fear & Greed Index currently signals a “Greed” level of sentiment as of this morning, improving from last week.

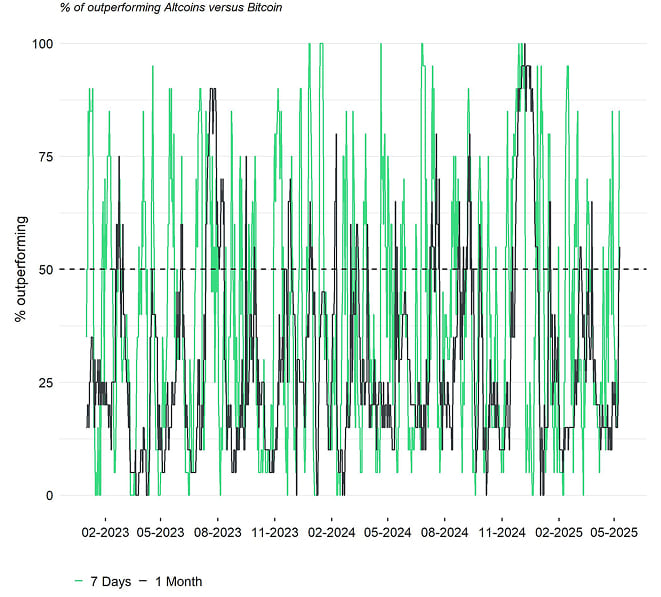

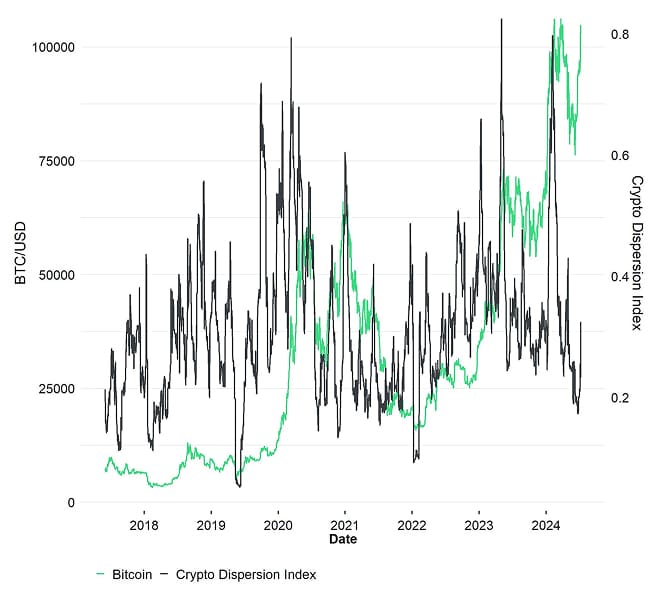

Performance dispersion among cryptoassets started to climb last week, signalling that altcoins have started to be slightly decrease their correlation with the performance of Bitcoin, as reflected in our top 10 cryptoasset performance chart above.

Altcoin outperformance vis-à-vis Bitcoin has increased from last week, with around 80% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Ethereum also managed to outperform Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin outperformance signals a bullish risk appetite at the moment.

Sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) has improved further while remaining at low levels, moving from 0 to 0.09.

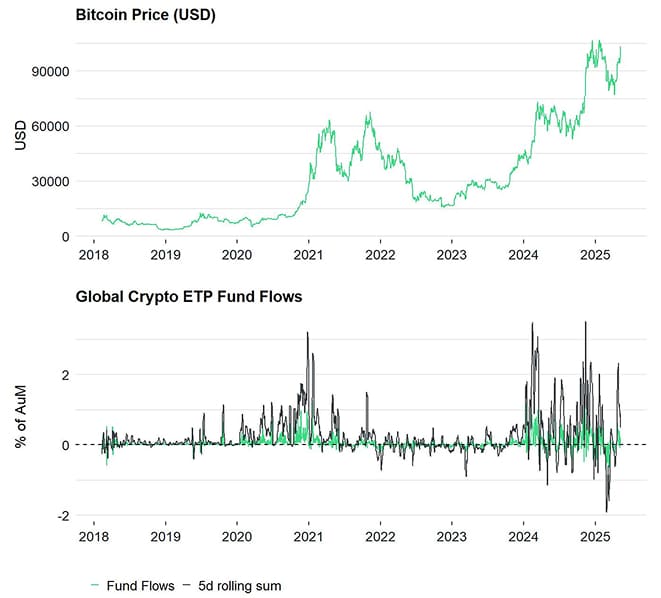

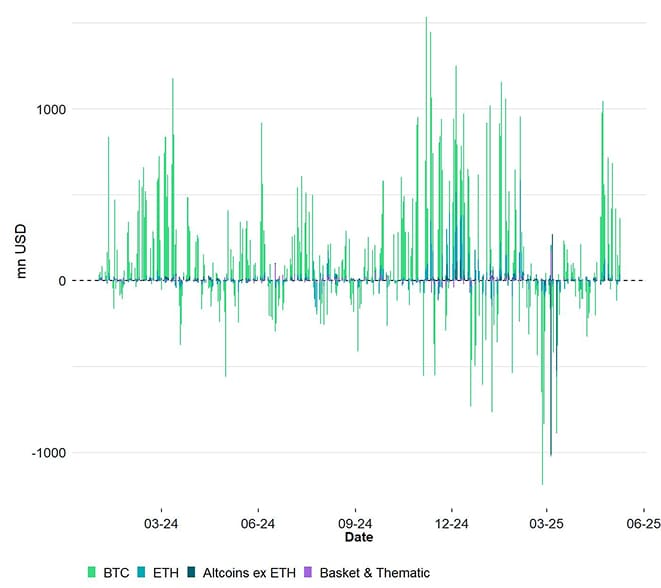

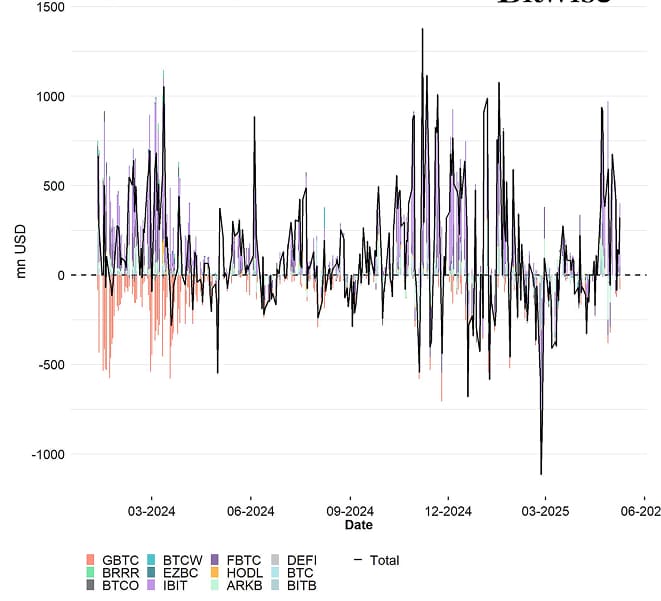

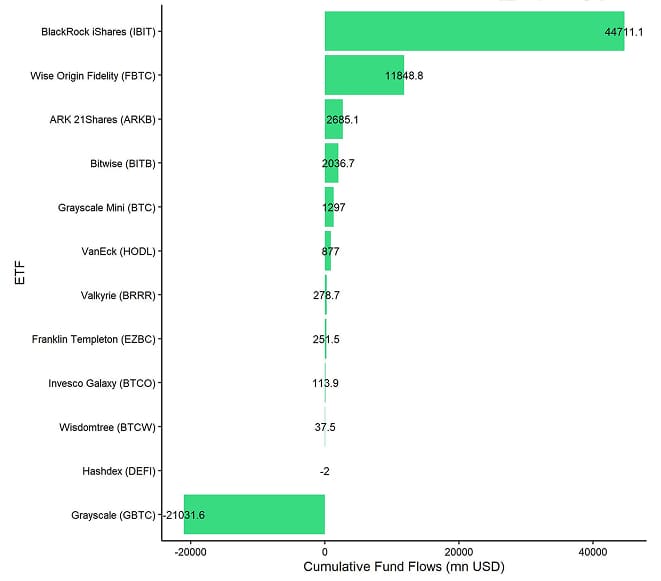

Fund Flows

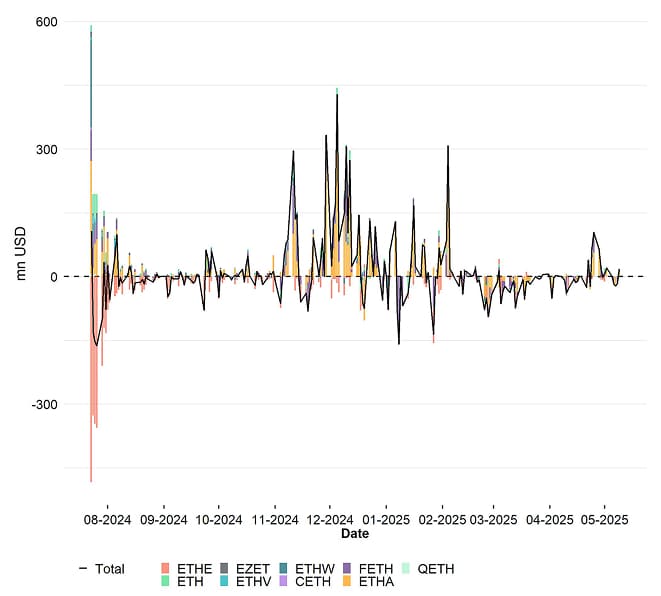

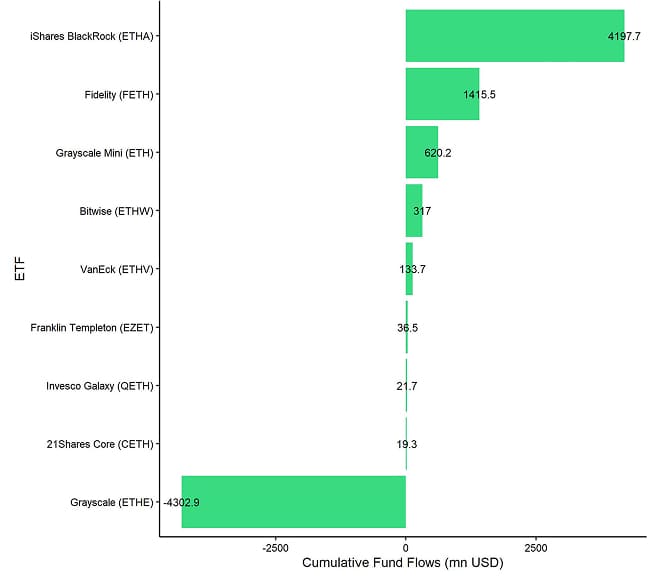

Weekly fund flows into global crypto ETPs have continued to post large net inflows last week.

Global crypto ETPs saw around +857.7 mn USD in weekly net inflows across all types of cryptoassets, after +1987.9 mn USD in net inflows the previous week.

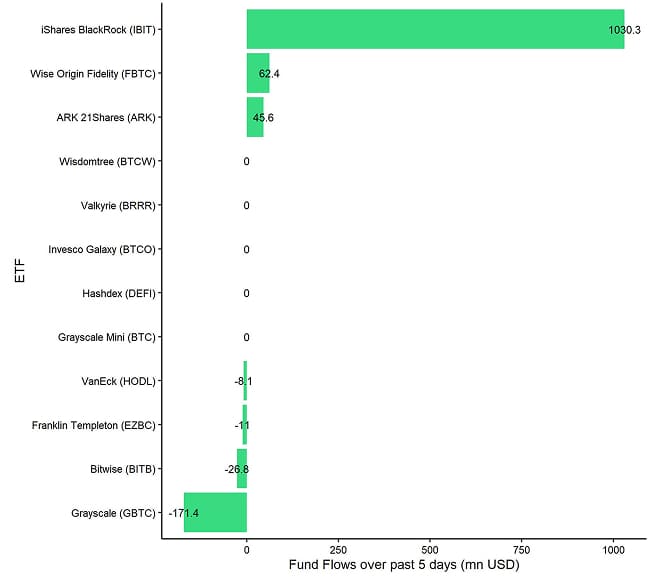

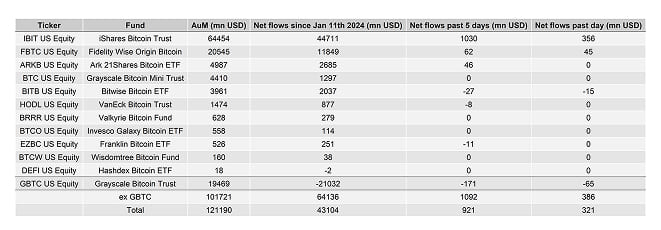

Global Bitcoin ETPs have experienced net inflows totalling +865.4 mn USD last week, of which +921.0 mn USD in net inflows were related to US spot Bitcoin ETFs.

The Bitwise Bitcoin ETF (BITB) in the US experienced net outflows, totalling -26.8 mn USD last week.

In Europe, the Bitwise Physical Bitcoin ETP (BTCE) also experienced net outflows equivalent to -6.6 mn USD, while the Bitwise Core Bitcoin ETP (BTC1) experienced minor net inflows of +0.6 mn USD.

The Grayscale Bitcoin Trust (GBTC) has posted net outflows of -171.4 mn USD. The iShares Bitcoin Trust (IBIT), however, experienced net inflows of around +1030.3 mn USD last week.

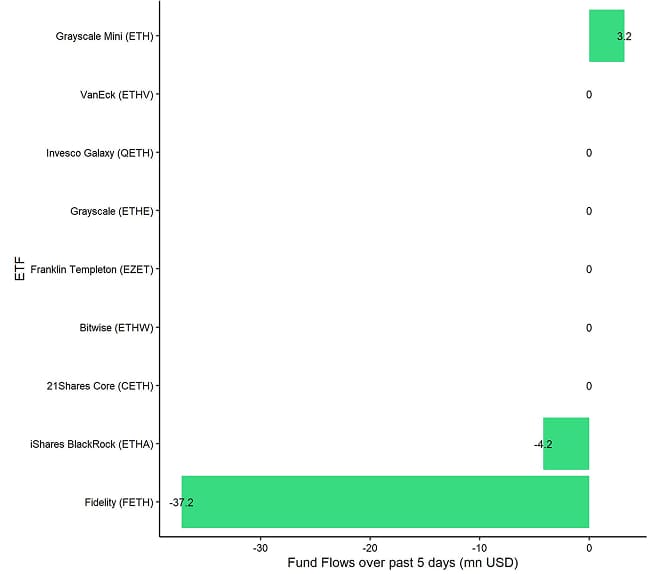

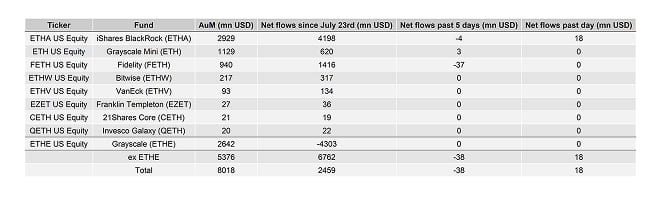

Meanwhile, flows into global Ethereum ETPs flipped to negative last week, with around -3.4 mn USD in net outflows last week

US Ethereum spot ETFs, also recorded net outflows of around -38.2 mn USD on aggregate. The Grayscale Ethereum Trust (ETHE), however, had had sticky AuM (+/- 0 mn USD).

The Bitwise Ethereum ETF (ETHW) in the US also followed suit and had had sticky AuM (+/- 0 mn USD).

In Europe, the Bitwise Physical Ethereum ETP (ZETH) saw minor net inflows of +1.1 mn USD while the Bitwise Ethereum Staking ETP (ET32) saw net inflows of around +24.5 mn USD on aggregate.

Altcoin ETPs ex Ethereum had experienced a reversal of flows last week, with around -1.8 mn USD in global net inflows.

Furthermore, thematic & basket crypto ETPs experienced net outflows of around -2.4 mn USD on aggregate last week. The Bitwise MSCI Digital Assets Select 20 ETP (DA20) had had sticky AuM (+/- 0 mn USD).

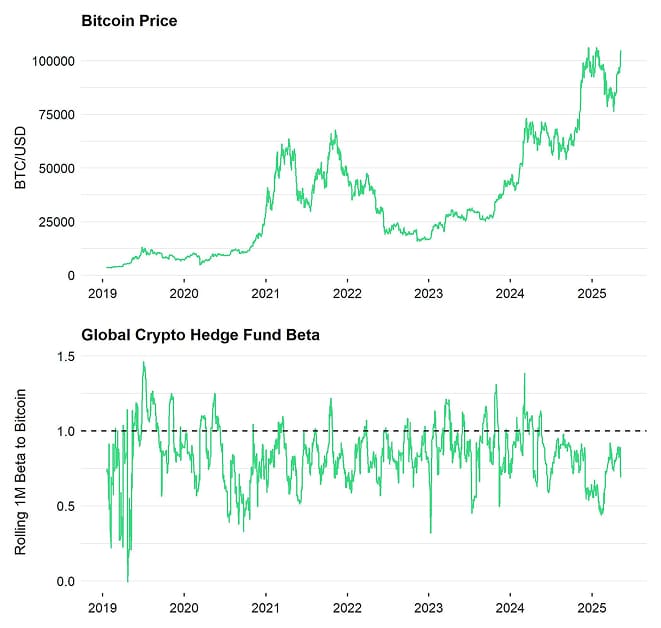

Global crypto hedge funds have decreased their market exposure to Bitcoin. The 20-days rolling beta of global crypto hedge funds' performance to Bitcoin consolidated to around 0.69 per yesterday's close, down from 0.88 from the week before.

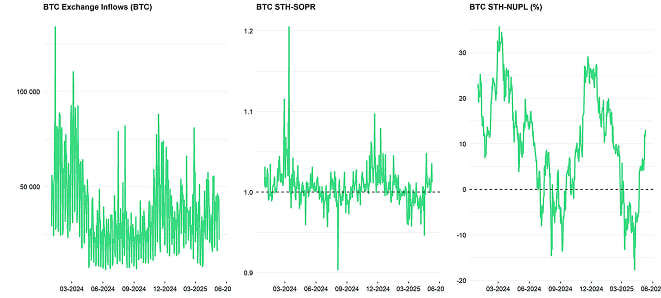

On-Chain Data

Broadly speaking, Bitcoin's on-chain activity, while starting off weak, improved throughout last week.

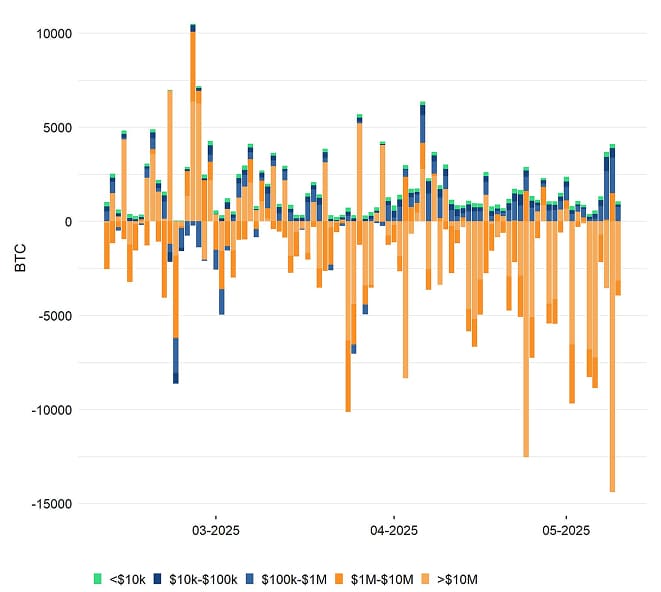

Bitcoin spot exchanges saw selling pressure ease, with net selling volumes decreasing to approximately -$0.5 billion compared to -$1.3 billion two weeks ago, reflective of last week's development.

The Spot Cumulative Volume Delta (CVD), which tracks the difference between buying and selling volumes, remained mostly negative throughout last week, confirming the prevailing sell-side pressure and similarly showing improvement from prior levels.

In terms of supply dynamics, we are observing a similar pattern. Whales have removed bitcoins from exchanges on a net basis, indicating a decrease in whale selling pressure. More specifically, BTC whales removed -52,133 BTC on exchanges last week. Network entities that possess at least 1,000 Bitcoin are referred to as whales.

Based on recent data from Glassnode, the overall downward trend in exchange-held Bitcoin reserves remains intact. The current level stands at 3.02 million coins, representing approximately 15.2% of the total circulating supply. This figure continues to reflect the broader trend of Bitcoin moving off exchanges, with current levels last observed in January 2022.

That being said, a measure of “apparent demand” for Bitcoin over the past 30 days has flipped positive since April 24 th 2025, reflecting an increase in demand.

Furthermore, Ethereum took center stage last week, with its realized price - representing the average on-chain cost basis - surging 21.6% over the 7-day period, dramatically outpacing Bitcoin's modest 3.9% increase.

Additionally, Ethereum attracted $446 million in net inflows from other blockchains last week, while its share of RWA total value locked increased to 58.19%, highlighting its strengthening position as the primary hub for tokenized assets.

Futures, Options & Perpetuals

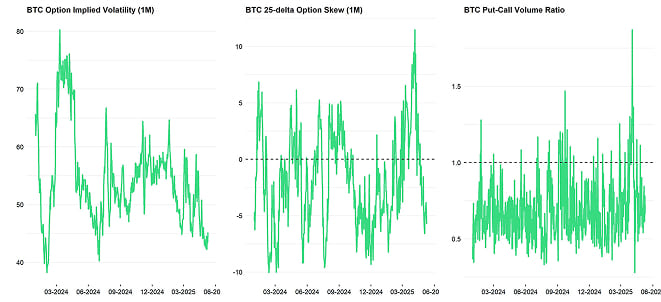

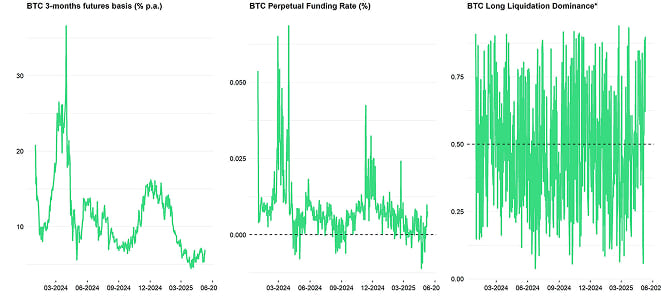

Last week, BTC futures open interest increased by around -0.2k BTC while perpetual open interest decreased by around -0.3k BTC.

BTC perpetual funding rates turned positive last week, indicating a bullish sentiment among traders in the perpetual futures market.

In general, when the funding rate is positive (negative), long (short) positions periodically pay short (long) positions, which is indicative of bullish (bearish) sentiment.

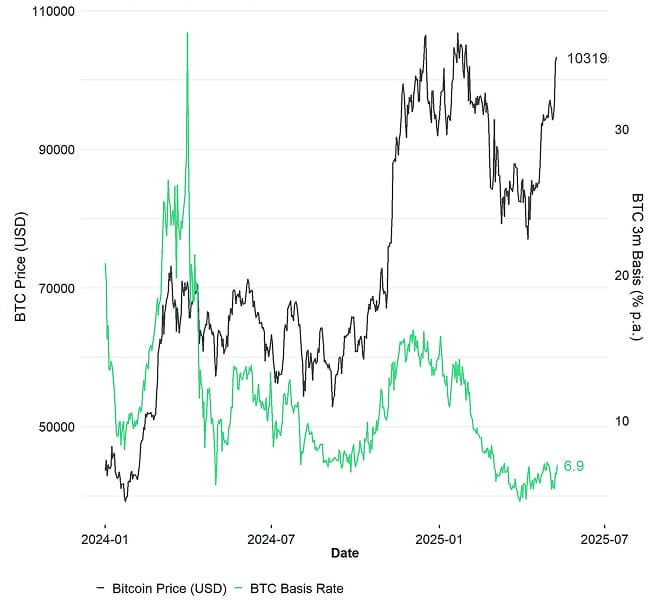

The BTC 3-months annualised basis increased from around 6.2% p.a to around 6.9% p.a. averaged across various futures exchanges last week. BTC option open interest increased by around +30.4k BTC. The put-call open interest ratio had remained at 0.56 last week.

The 1-month 25-delta skew for BTC increased slightly last week, before dropping following Thursday, indicating a modest decrease in demand for put options and a slightly bullish market sentiment.

BTC option implied volatilities fluctuated up last week, with 1-month realized volatility ending the week by increasing by around +2.39%.

At the time of writing, implied volatilities of 1-month ATM Bitcoin options are currently at around 45.75% p.a.

Bottom Line

- Crypto markets rallied sharply last week, with Bitcoin breaching $100K and Ethereum posting its largest daily gain YTD following the Pectra upgrade—contributing to a 60.4% MTD surge. Macro optimism around U.S.–U.K. trade progress and hopes for a U.S.–China thaw helped lift total crypto market cap by 11.7% to $3.28T.

- Our in-house Cryptoasset Sentiment Index remains bullish, with 80% of tracked altcoins outperforming BTC and ETH gaining dominance in tokenized asset flows. Altseason Index spiked from 15 to 85, while Ethereum realized price surged 21.6% WoW—signalling a return of risk appetite and altcoin leadership.

- Chart of the Week: Ethereum experienced its largest notional short squeeze of 2025, with futures short liquidations hitting their highest level since Nov 2024. This flush of positioning, paired with ETH’s +60% rally, underscores a structurally driven breakout—not just sentiment, but rotation, flows, and unwinds.

Appendix

Bitcoin Price vs Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomberg, Bitwise Europe; data as of 09-05-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data as of 09-05-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg, Bitwise Europe; data as of 09-05-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Bloomberg, Bitwise Europe; data as of 09-05-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-05-10

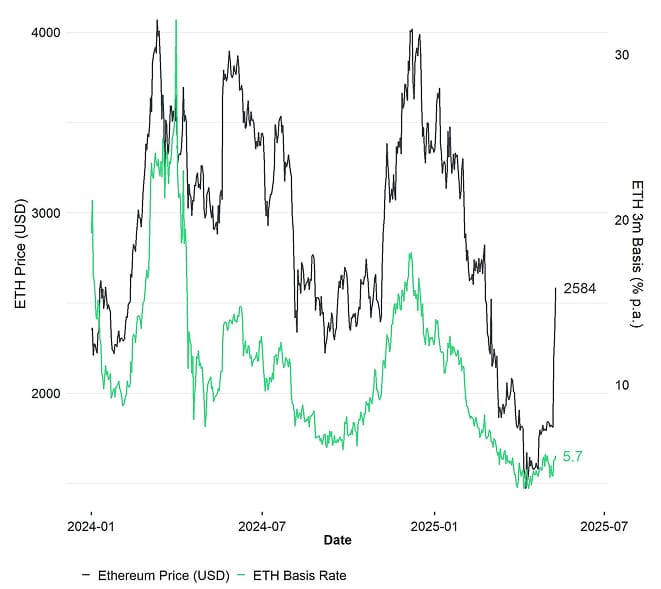

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-05-10

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-05-10

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe; data as of 2025-05-10

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe

Source: Glassnode, Bitwise Europe

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com