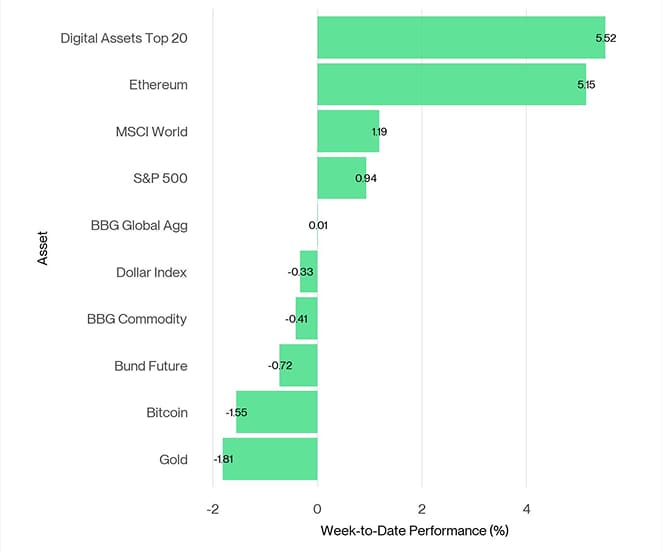

- Last week, cryptoassets continued to outperform traditional assets albeit with significantly higher performance dispersion. While major altcoins like Ethereum (ETH) continued to outperform, bitcoin exhibited a negative weekly performance.

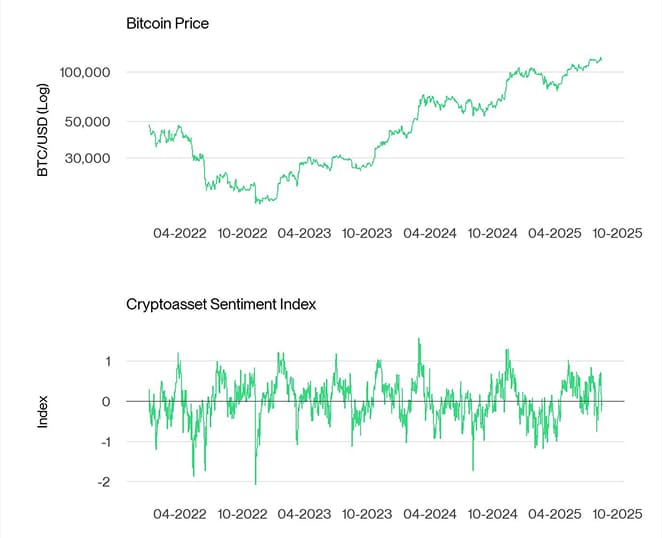

- Our in-house Cryptoasset Sentiment Index has reversed sharply from bullish readings to slightly bearish readings again on account of the most recent correction.

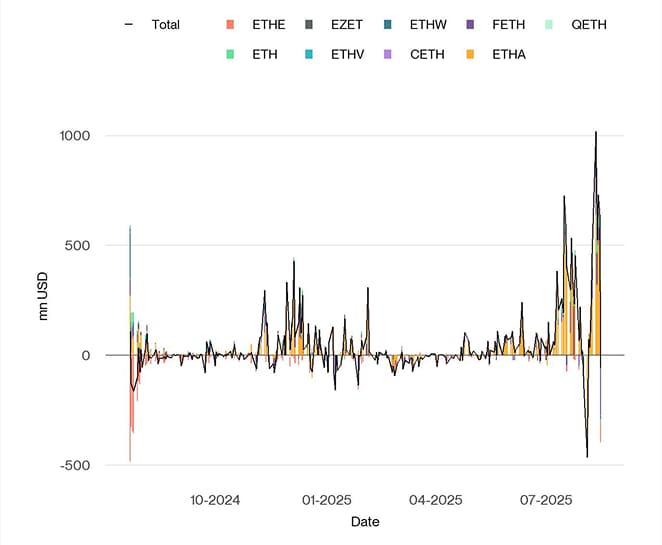

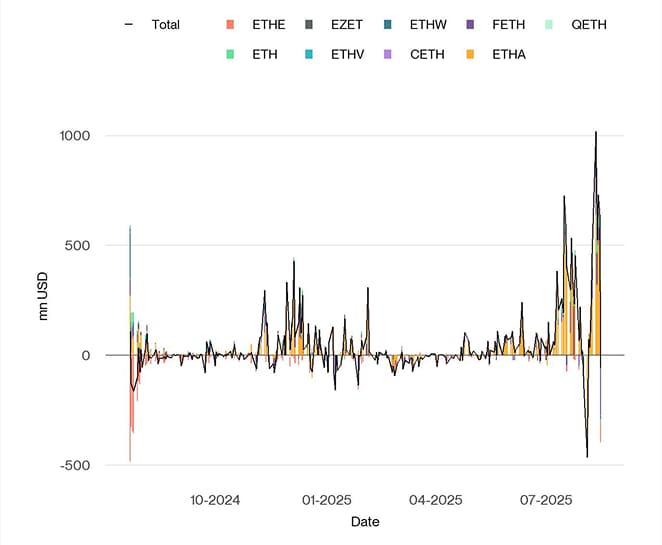

- Chart of the Week: Most of the recent outperformance of ether is attributed to the outsized fund flows into global Ethereum ETPs and US spot Ethereum ETFs in particular which recorded the highest daily net inflows on record on Monday last week with over +$1 billion in net inflows in a single day across all US issuers.

Chart of the Week

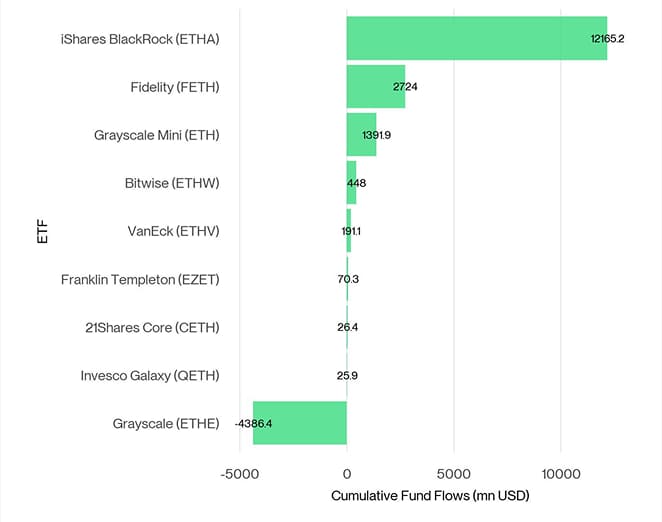

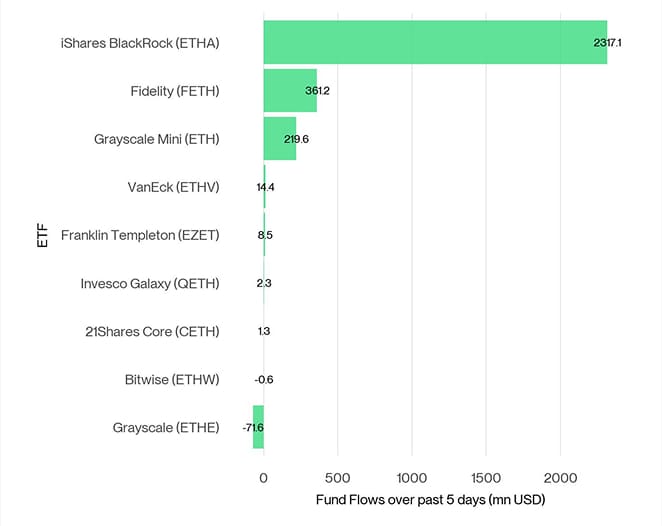

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

Source: Bloomberg, Bitwise Europe; data subject to change

Performance

Last week, cryptoassets continued to outperform traditional assets albeit with significantly higher performance dispersion. While major altcoins like Ethereum continued to outperform, bitcoin exhibited a negative weekly performance.

A key investment narrative remains the ongoing investor rotation from bitcoin (BTC) into ether (ETH) and the declining market cap dominance of Bitcoin. Bitcoin's dominance has recently declined to 58% - its lowest level since January 2025. Meanwhile, the relative performance ratio between ETH and BTC has climbed to a year-to-date high of 0.039 last week.

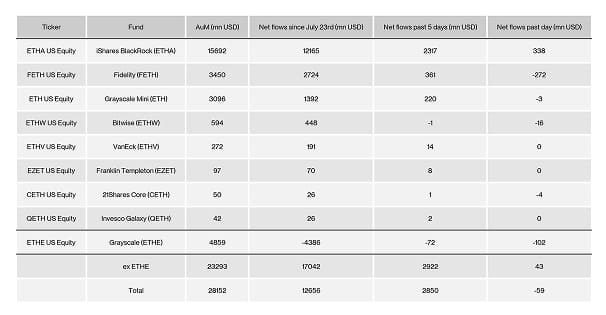

Most of the recent outperformance of ether is attributed to the outsized fund flows into global Ethereum ETPs and US spot Ethereum ETFs in particular which recorded the highest daily net inflows on record on Monday last week with over +$1 billion in net inflows in a single day across all US issuers (Chart-of-the-Week). Weekly inflows into global Ethereum ETPs amounted to +$2,726 million compared to +$540 million of capital that went into global Bitcoin ETPs. In other words, net inflows into global Ethereum ETPs were around 5 x times larger than inflows into global Bitcoin ETPs – also a new record.

The overall reversal in fund flows between Ethereum and Bitcoin is significant since inflows into global Bitcoin ETPs have historically been around 4.8 x times larger than inflows into global Ethereum ETPs.

As a result of these outsized fund flows into Ethereum, global ETH exchange balances have declined to a 9-year low according to data provided by Glassnode. This is signalling an increasing supply deficit / demand overhang for ETH on global crypto exchanges which bodes well for future performance.

Part of this increased institutional appetite could be attributed to the protocol's composability, decentralization, liquidity, brand-name, uptime and reliability made it a natural choice for institutions building on and using decentralised finance rails. That shift accelerated dramatically with the passage of the Genius Act, the United States' first major stablecoin regulatory framework. Suddenly, Ethereum was the backbone of compliant, internet-native dollars. To learn more about Etheum's progress over the last decade, read our report here.

Only Friday last week saw the first net outflow from global Ethereum ETPs since the 4th of August. Some analysts have attributed the most recent bout of volatility and pause of the rally to an increase in Ethereum's validator exit queue. In fact, Ethereum's validator exit queue has increased to 893.6k ETH – the highest level on record – while the entry queue has only increased to 295.8k ETH according to data provided by Ethereum Validator Queue. Traders are expecting increased selling pressure in the short term from this rush in validator exits.

Moreover, the most recent correction was amplified by a significant spike in futures long liquidations. For instance, bitcoin long liquidations spiked to the highest level since February 2025 according to data provided by Glassnode. Forced long liquidations tend to amplify downside moves in price as long traders need to sell the underlying asset to neutralise their long position.

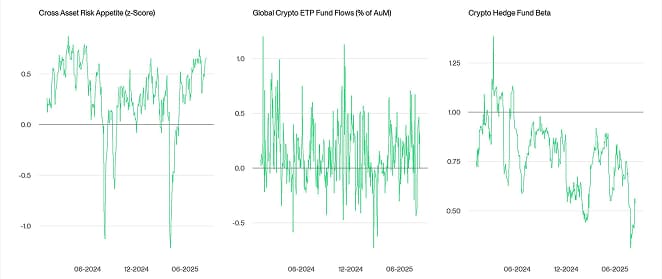

One of the key reasons for the recent investor rotation into ether and other altcoins appears to be related to the sharp increase in global risk appetite. Our in-house indicator for Cross Asset Risk Appetite (CARA) has increased to the highest level since early 2021. The indicator measures risk appetite across a variety of traditional asset performances such as US cyclicals-defensives stocks, the copper-gold ratio or the relative performance of high yield bonds vis-à-vis investment grade bonds.

It is important to highlight that these bursts in cross asset risk appetite tend to happen at the beginning of the macro cycle, rather than the end.

This development is not surprising considering the renewed increase in Fed rate cut odds. Despite a very significant positive surprise in US producer price inflation last week (+0.9% m/m vs +0.2% expected), Fed Funds Futures traders still expect the Fed to cut rates in September with an 84% probability. A continuation of the Fed's rate cutting cycle would most certainly prolong the current economic recovery in the US and the overall macro cycle which will likely prolong the bull cycle in bitcoin and cryptoassets as well.

Cross Asset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

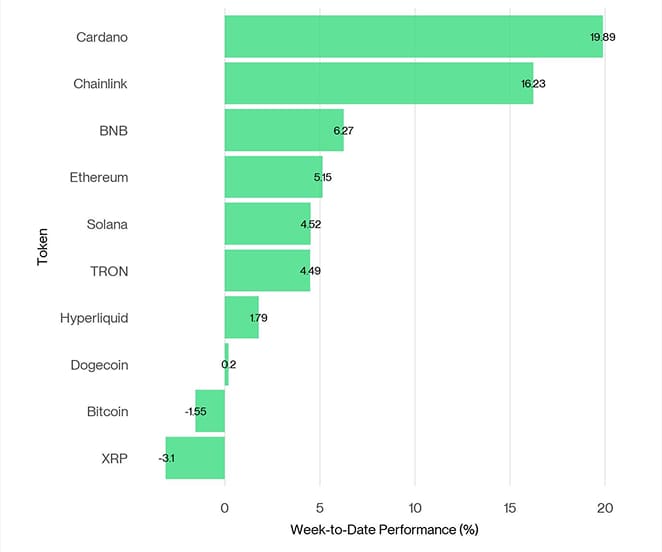

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Coinmarketcap

Source: Coinmarketcap

In general, among the top 10 crypto assets Cardano, Chainlink, and BNB were the relative outperformers.

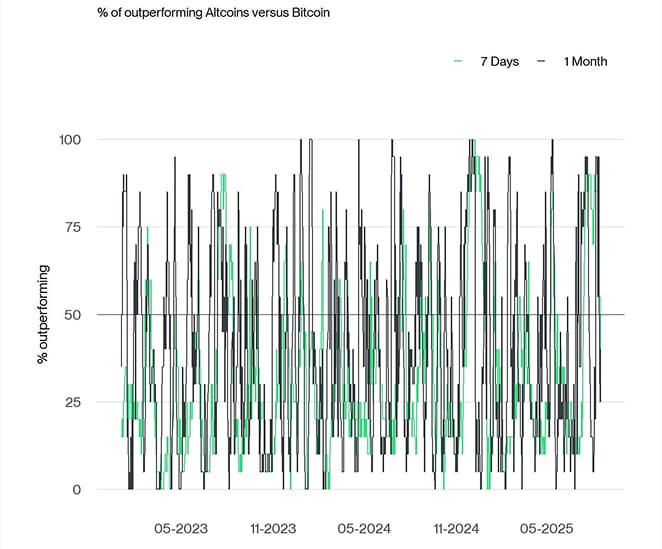

Overall altcoin outperformance vis-à-vis bitcoin decelerated somewhat last week, with 40% of our tracked altcoins managing to outperform bitcoin on a weekly basis. However, Ethereum continued outperform bitcoin significantly last week.

Sentiment

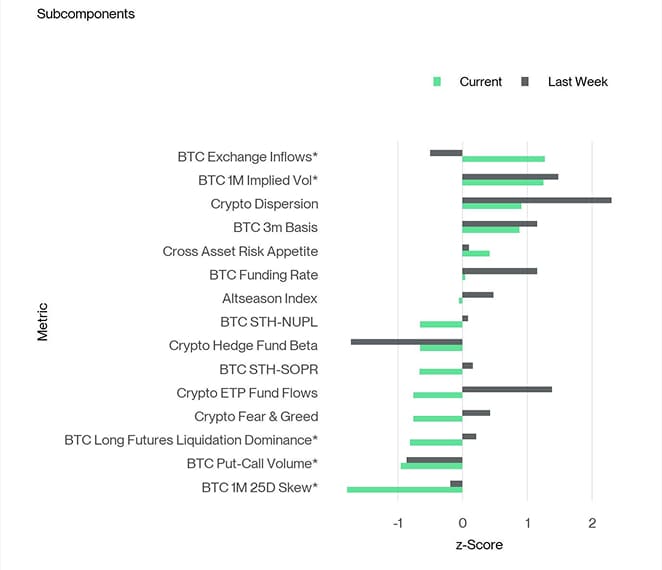

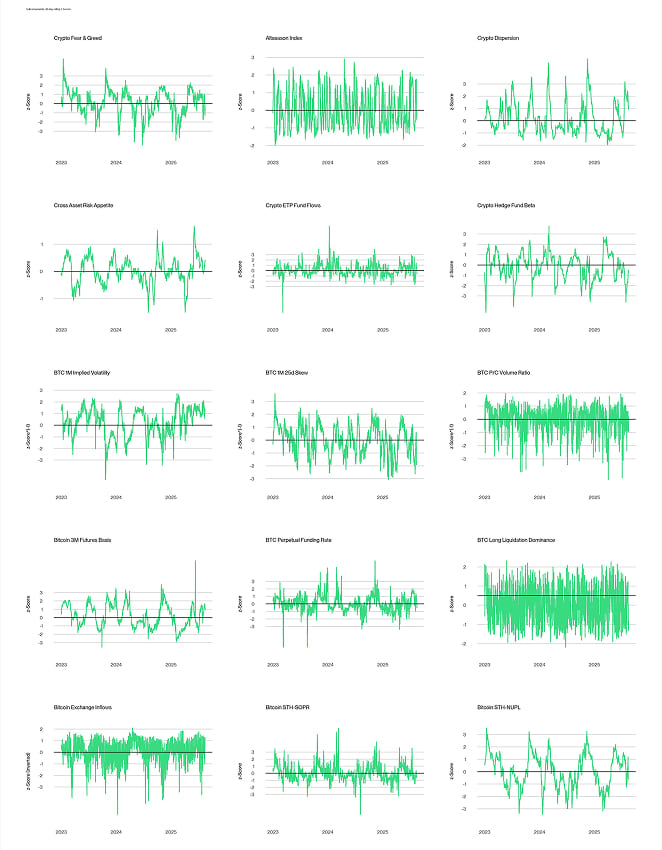

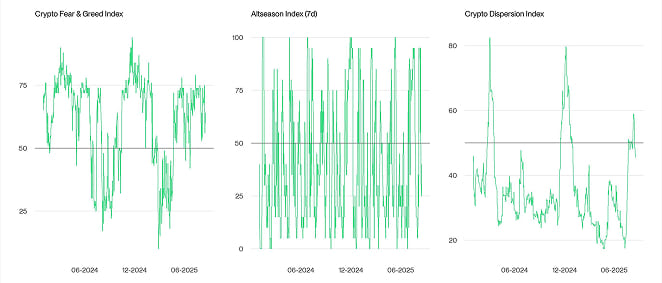

Our in-house Cryptoasset Sentiment Index has reversed sharply from bullish readings to a slightly bearish sentiment. There are signs of fatigue emerging, with froth-like behaviour that often precedes buyer exhaustion

At the moment, 6 out of 15 indicators are above their short-term trend.

BTC Exchange Inflows and the Crypto Dispersion Index showed very positive movements.

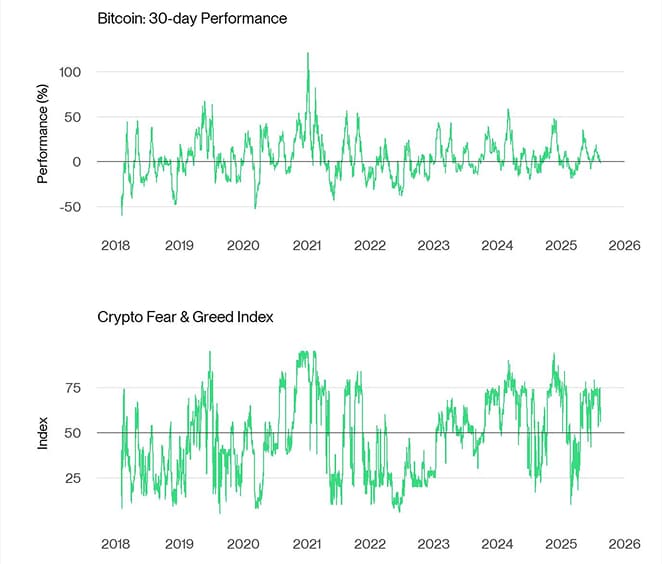

The Crypto Fear & Greed Index currently signals a “Greed” level of sentiment as of this morning. Throughout last week, this index consolidated from 70 to 60 as of this morning.

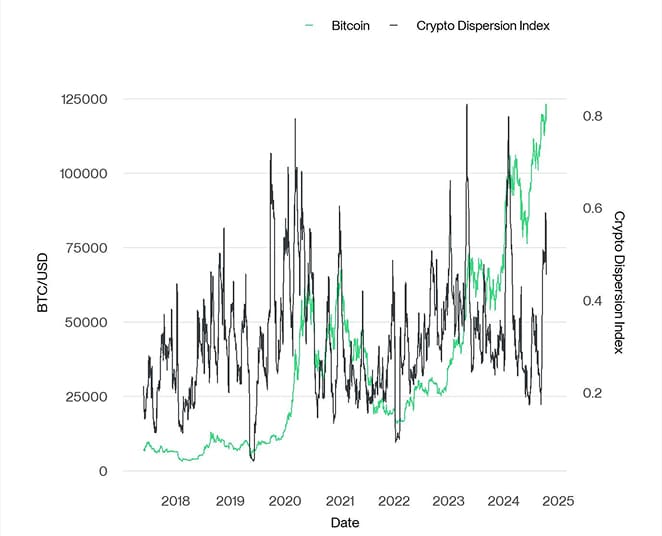

Performance dispersion among cryptoassets remained low and declined from 0.59 to 0.45 last week, signalling that altcoins have continued to be highly correlated with the performance of bitcoin.

Altcoin outperformance vis-à-vis Bitcoin has decreased from last week, with around 40% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. However, Ethereum also managed to outperform Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin outperformance signals a increasing risk appetite at the moment.

Sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) has also increased, moving from 0.47 to 0.66.

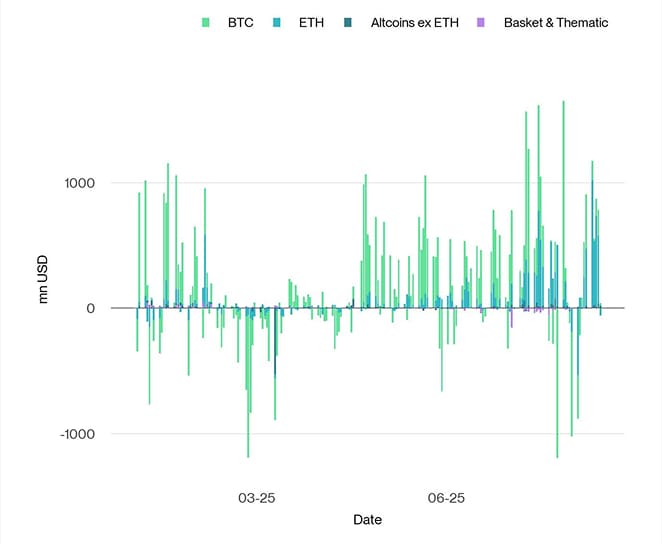

Fund Flows

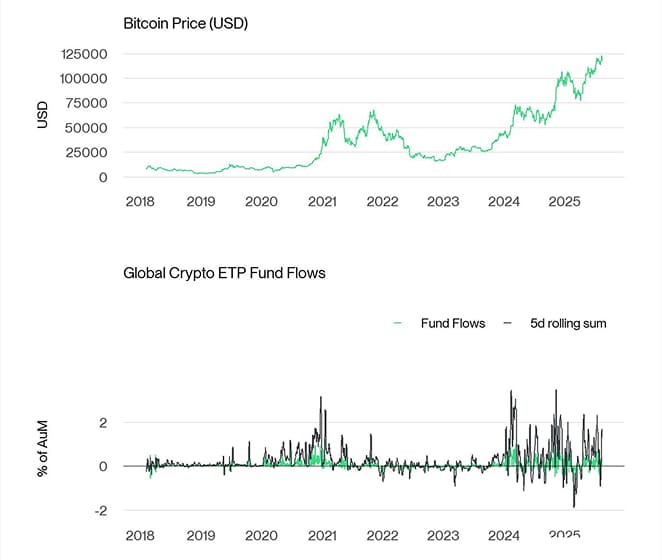

Weekly fund flows into global crypto ETPs accelerated significantly, with outsized fund flows into global Ethereum ETPs and US spot Ethereum ETFs in particular.

Global crypto ETPs saw around +3,765.1 mn USD in weekly net inflows across all types of cryptoassets, after + 409.9 mn USD in net inflows the previous week.

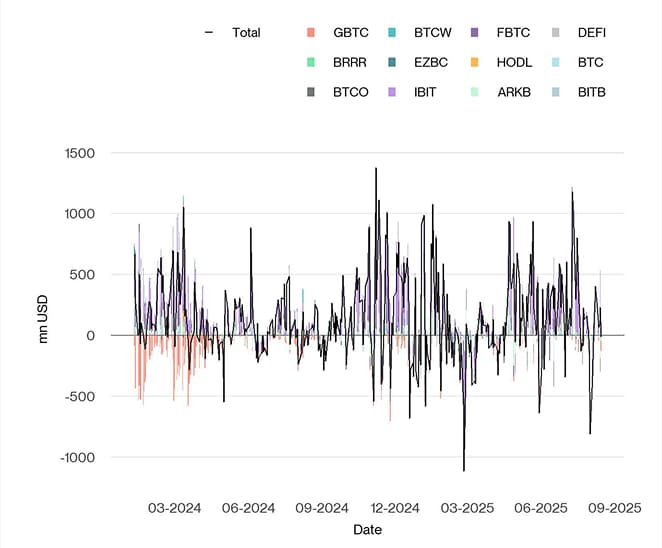

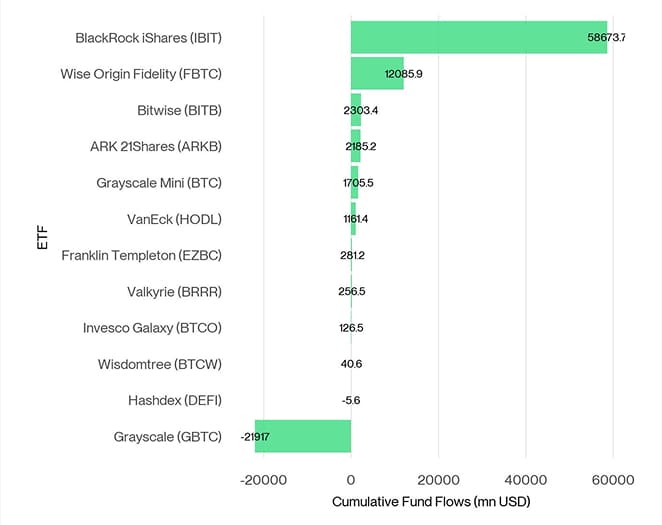

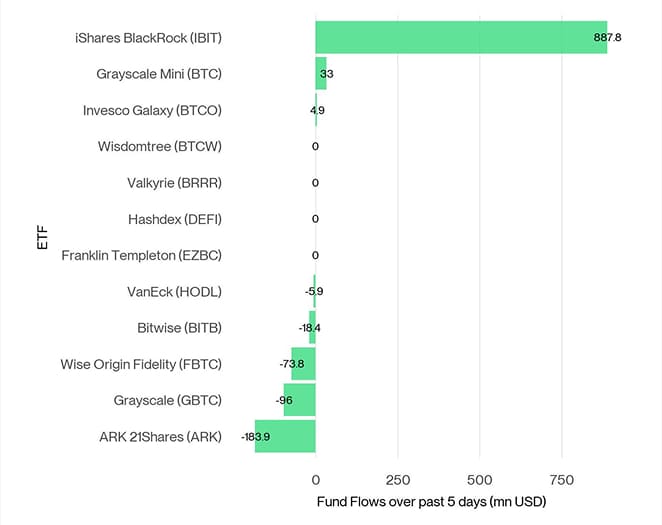

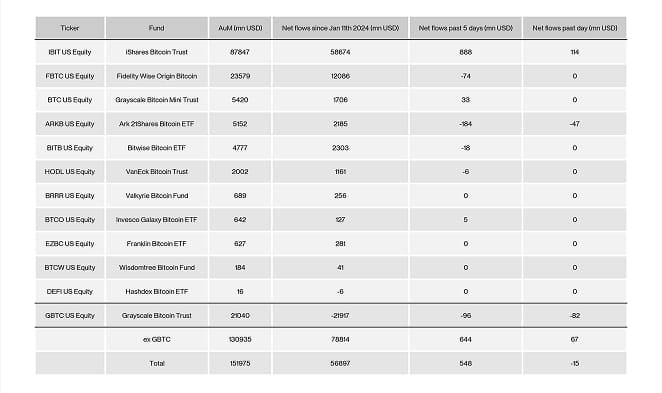

Global Bitcoin ETPs have experienced net inflows totalling +539.0 mn USD last week, of which +547.8 mn USD in net inflows were related to US spot Bitcoin ETFs.

The Bitwise Bitcoin ETF (BITB) in the US experienced net outflows, totalling -18.4 mn USD last week.

In Europe, the Bitwise Physical Bitcoin ETP (BTCE) also experienced minor net outflows equivalent to -5.6 mn USD, while the Bitwise Core Bitcoin ETP (BTC1) experienced minor net inflows of +2.8 mn USD.

The Grayscale Bitcoin Trust (GBTC) has posted net outflows of -96.0 mn USD. The iShares Bitcoin Trust (IBIT), experienced strong net inflows of around +887.8 mn USD last week.

Meanwhile, flows into global Ethereum ETPs also accelerated last week, which recorded the highest daily net inflows on record on Monday last week, with around +2724.9 mn USD in net inflows.

US spot Ethereum ETFs, also recorded net inflows of around +2852.1 mn USD on aggregate. The Grayscale Ethereum Trust (ETHE), has posted net inflows of -71.6 mn USD.

The Bitwise Ethereum ETF (ETHW) in the US has posted net outflows of -0.6 mn USD.

In Europe, the Bitwise Physical Ethereum ETP (ZETH) saw minor net inflows of +9.3 mn USD while the Bitwise Ethereum Staking ETP (ET32) saw net outflows of -31.7 mn USD.

Altcoin ETPs ex Ethereum also experienced modest net inflows of +91.0 mn USD last week underscoring the rising risk appetite for altcoins.

However, thematic & basket crypto ETPs continued to be out of favour with net outflows of around -12.3 mn USD on aggregate last week. The Bitwise MSCI Digital Assets Select 20 ETP (DA20) had sticky AuM (+/- 0 mn USD).

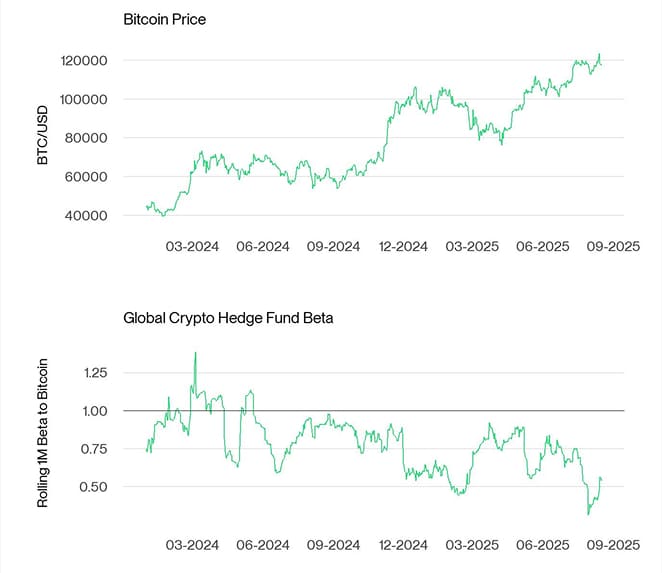

Global crypto hedge funds exposure to Bitcoin has increased last week. The 20-days rolling beta of global crypto hedge funds' performance to Bitcoin increased to around 0.54 per yesterday's close, up from 0.41 from the week before.

On-Chain Data

Last week, Bitcoin's on-chain backdrop looks mixed, while capital rotation into ETH continues to build momentum.

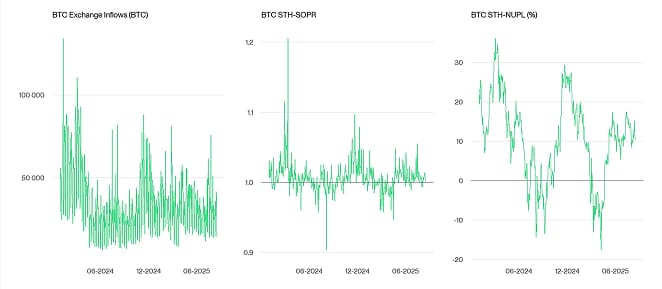

Net buying volumes on bitcoin spot exchanges had reversed last week. While starting the week positive, we saw around 0.61 bn USD in selling pressure, highlighting ongoing selling pressure on bitcoin spot exchanges despite the recent new all-time highs.

That being said, bitcoin whales have continued to take bitcoins off exchanges on a net basis, indicating an increase in whale buying interest. More specifically, BTC whales removed -8,143 BTC from exchanges last week which significantly influenced overall net exchange transfers. This tends to put upward pressure on prices. Network entities that control at least 1,000 Bitcoin are referred to as whales.

Furthermore, based on recent data from Glassnode, the overall downward trend in exchange-held Bitcoin reserves remains intact. The current level stands at 2.903 million BTC, representing approximately 14.58% of the total circulating supply.

It's worth noting that the 30-day measure of “apparent demand” for Bitcoin remained positive, but continued to deccelerate over the past week. This is signalling a decreasing renewed influx of short-term holders (read “retail investors”) as well.

All in all, on-chain metrics have improved but selling pressure on spot exchanges remains evident, even as whales accumulate and exchange reserves trend lower. Meanwhile, the ETH/BTC ratio is grinding higher at 0.38 (its strongest level since December 2024) underscoring investor rotation from BTC into ETH, fuelled by record Ethereum ETP inflows and declining Bitcoin dominance

Futures, Options & Perpetuals

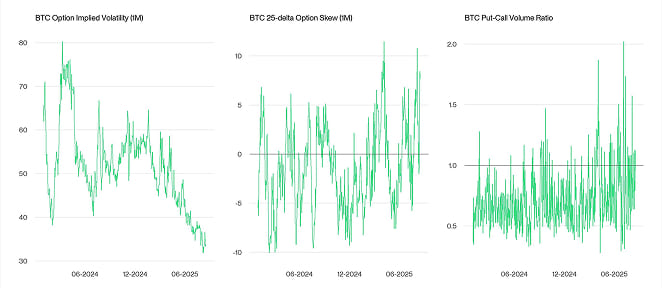

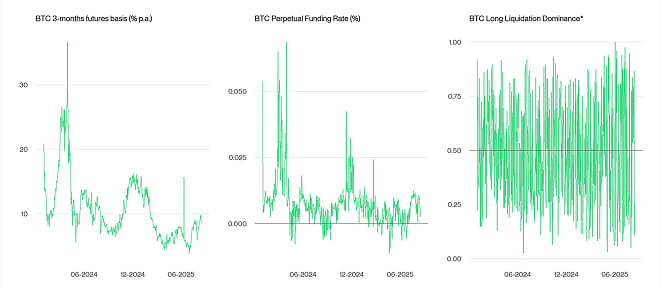

Last week, BTC futures open interest increased last week by +8.5k BTC across all exchanges, and increased by +3.6k BTC on CME. Meanwhile, perpetual open interest increased by around +7.6k BTC.

BTC perpetual funding rates continued to remain positive indicating a bullish sentiment among traders in the perpetual futures market and a long bias.

In general, when the funding rate is positive (negative), long (short) positions periodically pay short (long) positions, which is indicative of bullish (bearish) sentiment.

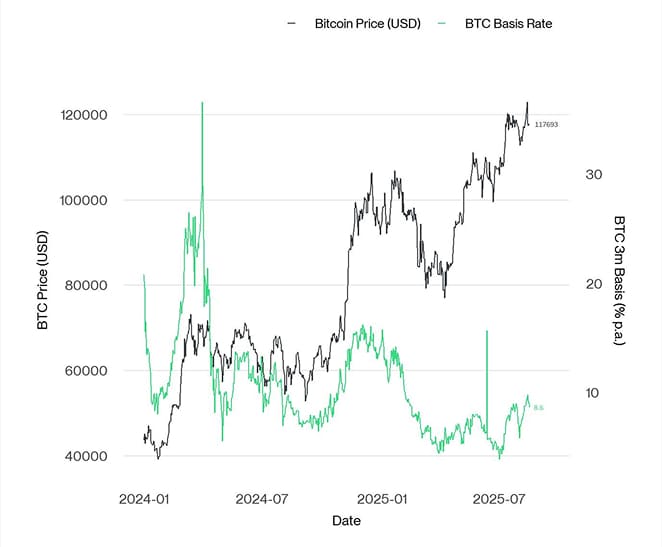

The BTC 3-months annualised basis declining last week to 6%-7% p.a., averaged across various futures exchanges.

BTC option open interest decreased by around +0.1k BTC while the put-call open interest ratio increased to 0.6. We observed some significant spikes in the put-call volume ratio indicating an increasing appetite for downside protection during this rally.

Meanwhile, the 1-month 25-delta skew for BTC increased significantly throughout the week from +0.22% to +11.66% signalling increasing appetite for put options. The presence of a positive skew indicates some preference for downside protection.

BTC option implied volatilities increased slightly compared to last week, while the 1-month realized volatility has declined to the lowest point since October 2023, ~25% p.a.

At the time of writing, implied volatilities of 1-month ATM Bitcoin options are currently at around 35% p.a. on Deribit.

Bottom Line

- Last week, cryptoassets continued to outperform traditional assets albeit with significantly higher performance dispersion. While major altcoins like ether continued to outperform, bitcoin exhibited a negative weekly performance.

- Our in-house Cryptoasset Sentiment Index has reversed sharply from bullish readings to slightly bearish readings again on account of the most recent correction.

- Chart of the Week: Most of the recent outperformance of ether is attributed to the outsized fund flows into global Ethereum ETPs and US spot Ethereum ETFs in particular which recorded the highest daily net inflows on record on Monday last week with over +$1 billion in net inflows in a single day across all US issuers.

Appendix

Bitcoin Price vs Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomberg, Bitwise Europe; data as of 15-08-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data as of 15-08-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg, Bitwise Europe; data as of 15-08-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Bloomberg, Bitwise Europe; data as of 15-08-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

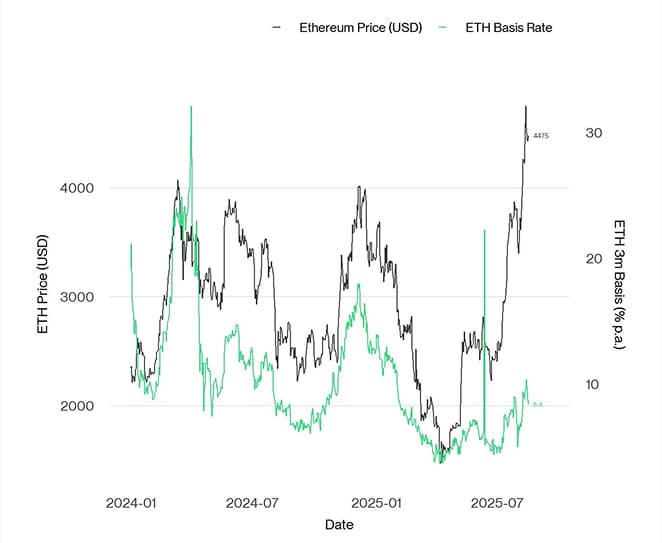

Source: Glassnode, Bitwise Europe; data as of 2025-08-17

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-08-17

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-08-17

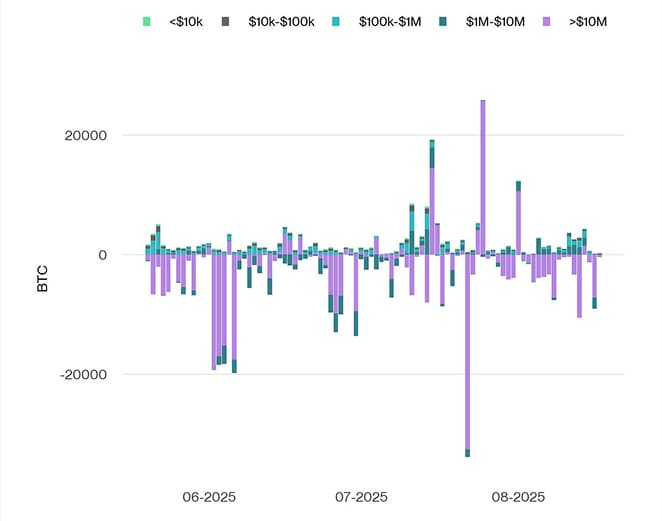

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe; data as of 2025-08-17

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe

Source: Glassnode, Bitwise Europe

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com