- Last week, cryptoassets continued to be weighed down by ongoing economic and geopolitical uncertainty as well as a decline in cross asset risk appetite.

- Our in-house “Cryptoasset Sentiment Index” still signals a bearish sentiment.

- We are already observing a gradual decline in intra-day correlations between Bitcoin and S&P 500 Futures, so any further downside in US equities should probably affect cryptoassets less severely going forward.

Chart of the Week

Bitcoin vs S&P 500 Future

Source: Bloomberg, Bitwise Europe;

Source: Bloomberg, Bitwise Europe;

*based on 10-minutes intray-day closing bars

Performance

Last week, cryptoassets continued to be weighed down by ongoing economic and geopolitical uncertainty as well as a decline in cross asset risk appetite.

Global markets are still in the crosshairs of the new US tariff policy.

China's retaliatory tariffs on U.S. goods took effect Monday, escalating the trade war as President Trump threatened more tariffs on other nations. Beijing announced the move on February 4, shortly after new U.S. tariffs of 10% on Chinese products began, and has also launched an anti-monopoly probe into Google while restricting exports of 25 rare metals. Trump's newest plan includes a 25% tariff on steel and aluminium imports, with further details expected soon.

Traditional risky assets like US equities traded down last week, which also dragged down major cryptoassets like Bitcoin.

On the bright side, we are already observing a gradual decline in intra-day correlations between Bitcoin and S&P 500 Futures, so any further downside in US equities should probably affect cryptoassets less severely going forward (Chart-of-the-Week).

Overall, cryptoasset sentiment is already relatively bearish and our in-house Cryptoasset Sentiment index has triggered several technical contrarian buying signals over the past week, which also implies that downside risks are limited.

Furthermore, significant bitcoin net exchange transfers imply that institutional buyers are already stepping back into the market, which is supporting prices at current levels. In fact, last week saw the highest bitcoin net exchange outflow since April 2024.

An exchange outflow implies increasing buying interest as bitcoins are usually transferred out of exchanges into cold wallets to mitigate exchange counterparty risks. Exchange outflows also reduce the available amount of liquid supply on exchanges, which tends to be a positive performance factor.

The recent underperformance in crypto markets appears to be more pronounced in altcoins, especially in Ethereum which once again significantly underperformed Bitcoin last week.

That being said, it looks as of ETP investors are already making use of these lower prices and have bought the highest amount of Ethereum ETPs since December 2024. Last week saw +862.6 mn USD net inflows into Ethereum ETPs globally while Bitcoin ETPs only saw +356.8 mn USD in net inflows.

The same is true for US spot ETFs where Ethereum ETFs scooped up +420.0 mn USD while Bitcoin ETFs only gathered +203.5 mn USD in new capital.

Cross Asset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Coinmarketcap

Source: Coinmarketcap

In general, among the top 10 crypto assets, TRON, BNB, and Bitcoin were the relative outperformers.

Overall altcoin outperformance vis-à-vis Bitcoin continued to be low last week, with only 15% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Ethereum has also underperformed Bitcoin last week.

Sentiment

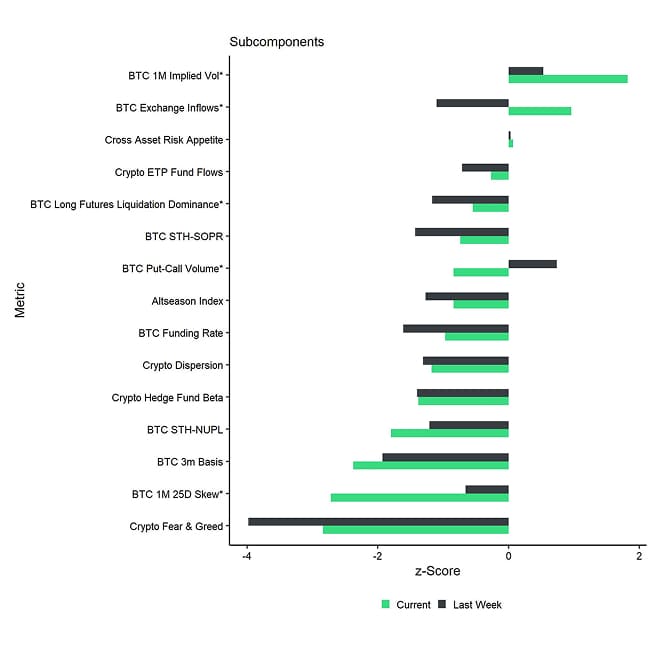

Our in-house “Cryptoasset Sentiment Index” still signals a bearish sentiment.

At the moment, only 3 out of 15 indicators are above their short-term trend.

We are currently observing significant bearishness in the Crypto Fear & Greed Index as well as the BTC 1-month 25-delta option skew.

The Crypto Fear & Greed Index currently signals a “Fear” level of sentiment as of this morning.

Performance dispersion among cryptoassets has continued its decline to very low levels, signalling that altcoins have continued to be increasingly correlated with the performance of Bitcoin lately.

Altcoin outperformance vis-à-vis Bitcoin has also remained low last week, with around 15% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Ethereum has also continued to underperform Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin underperformance still signals bearish risk appetite at the moment.

Sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) declined slightly last week. However, the index still signals a neutral cross asset risk appetite.

Fund Flows

Weekly fund flows into global crypto ETPs have accelerated somewhat last week, mainly due to higher inflows into Ethereum ETPs.

Global crypto ETPs saw around +1,359.0 mn USD in weekly net inflows across all types of cryptoassets, after +761.1 mn USD in net inflows the previous week.

Global Bitcoin ETPs flows have continued to decelerate with net inflows totalling +356.8 mn USD last week, of which +203.5 mn USD in net inflows were related to US spot Bitcoin ETFs.

The Bitwise Bitcoin ETF (BITB) in the US experienced net inflows, totalling +21.1 mn USD last week.

In Europe, the Bitwise Physical Bitcoin ETP (BTCE) experienced minor net inflows equivalent to +0.3 mn USD, while the Bitwise Core Bitcoin ETP (BTC1) managed to attract capital of around +0.6 mn USD.

Outflows from the Grayscale Bitcoin Trust (GBTC) continued unabated although at a slower pace, with around -14.6 mn USD in net outflows last week. The iShares Bitcoin Trust (IBIT) saw around +315.3 mn USD in net inflows last week.

Meanwhile, flows into global Ethereum ETPs accelerated significantly, with around +862.6 mn USD in net inflows after only +3.2 mn USD in net inflows the week before – highest weekly level since December 2024.

US Ethereum spot ETFs also recorded net inflows with around +420.1 mn USD on aggregate. The Grayscale Ethereum Trust (ETHE) experienced net inflows with around +8.7 mn USD last week.

The Bitwise Ethereum ETF (ETHW) in the US experienced +4.1 USD in net inflows last week.

In Europe, the Bitwise Physical Ethereum ETP (ZETH) experienced minor net inflows of +0.3 mn USD while the Bitwise Ethereum Staking ETP (ET32) experienced some net outflows of around -0.5 mn USD.

Altcoin ETPs ex Ethereum continued to attract capital last week, with around +41.1 mn USD in global net inflows on aggregate. The Bitwise Physical Solana ETP (ESOL) and the Bitwise Solana Staking ETP (BSOL) both did not experience any creations or redemptions last week (+/- 0 mn USD).

Furthermore, thematic & basket crypto ETPs experienced accelerating net inflows of around +98.5 mn USD on aggregate last week. The Bitwise MSCI Digital Assets Select 20 ETP (DA20) did neither see in- nor outflows last week (+/- 0 mn USD).

Global crypto hedge funds have continued to pair back their market exposure to Bitcoin last week. The 20-days rolling beta of global crypto hedge funds' performance to Bitcoin has declined to around 0.47 per yesterday's close, down from 0.48 the week before.

On-Chain Data

In general, Bitcoin's on-chain developments have been rather negative lately.

Selling pressure continued to be very high, with around -2.03 bn USD in net selling volumes on BTC spot exchanges – the highest amount since June 2022, when 3 Arrows Capital (3AC) collapsed.

However, this implies that sellers are increasingly becoming exhausted which would be a contrarian buying signal in itself consistent with our weak sentiment readings.

That being said, it is worth noting that supply dynamics on exchanges continue to provide a tailwind for Bitcoin and cryptoassets.

On a positive note, exchange balances have continued to drift lower last week, indicating a continuous drop in the amount of liquid supply available on exchanges which should support prices going forward.

In fact, last week saw the highest bitcoin amount of net transfers from exchange since April 2024 indicating increased whale buying interest.

At the time of writing, only 2.719 million BTC remain on exchanges, according to data provided by Glassnode.

Whales have also continued to take bitcoins off exchanges on a net basis, albeit at a slower pace than the week before. More specifically, BTC whales removed -5004 BTC from exchanges, indicating an increase in whale buying pressure. Network entities that possess at least 1,000 Bitcoin are referred to as whales.

Futures, Options & Perpetuals

Last week, BTC futures open interest declined somewhat. More specifically, BTC futures open interest declined by around -17k BTC while perpetual open interest declined by around -18k BTC.

This mainly due to the spike in both long and short BTC futures liquidations at the beginning of last week.

BTC perpetual funding rates turned negative both on Monday and Friday last week – signalling overly bearish sentiment among perpetual futures traders.

In general, when the funding rate is positive (negative), long (short) positions periodically pay short (long) positions, which is indicative of bullish (bearish) sentiment.

The BTC 3-months annualised basis declined sharply to around 8.7% p.a. averaged across various futures exchanges as futures traders paired back their bullish price expectations.

Meanwhile, BTC option open interest saw a significant increase by around +23k BTC last week. The put-call open interest ratio also increased somewhat, signalling increased relative put buying last week.

This was also very much reflected in the 1-month 25-delta skew for BTC which also increased significantly and signals an increase in bearish sentiment. BTC option traders are now willing to pay up for delta-equivalent puts with a 1-month expiry.

Apart from the spike at the beginning of the week, BTC option implied volatilities have remained relatively flat.

At the time of writing, implied volatilities of 1-month ATM Bitcoin options are currently at around 51.5% p.a.

Bottom Line

- Last week, cryptoassets continued to be weighed down by ongoing economic and geopolitical uncertainty as well as a decline in cross asset risk appetite.

- Our in-house “Cryptoasset Sentiment Index” still signals a bearish sentiment.

- We are already observing a gradual decline in intra-day correlations between Bitcoin and S&P 500 Futures, so any further downside in US equities should probably affect cryptoassets less severely going forward.

Appendix

Bitcoin Price vs Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomberg, Bitwise Europe; data as of 07-02-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data as of 07-02-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg, Bitwise Europe; data as of 07-02-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Bloomberg, Bitwise Europe; data as of 07-02-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-02-09

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-02-09

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-02-09

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe; data as of 2025-02-09

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe

Source: Glassnode, Bitwise Europe

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com