Institutions, miners focus on how much Bitcoin is left as Standard Chartered ups 2024 target to $120,000

How much Bitcoin is really left to buy? That's the question investors are starting to ask with less than 12 months until Bitcoin's fourth halving event.

Analysts at Standard Chartered have upped their bullish per-Bitcoin price target from $100,000 to $120,000 by the end of 2024, almost quadruple its current market value.

As Bloomberg reports, the British multinational bank's head of crypto research Geoff Kendrick said:

Increased miner profitability per BTC mined means they can sell less while maintaining cash inflows, reducing net BTC supply and pushing BTC prices higher.

Bitcoin could reach $50,000 by the end of this year, a 61.4% increase, the bank said.

Supply reduction boosts demand

While most readers should know that Bitcoin has a hard-capped supply limit of 21 million coins, there are actually far fewer available for sale. 92.51%, or 19.426 million coins, have already been issued. That leaves less than 8% of total supply yet to be mined.

Bitcoin's issuance is also cut in half every time 210,000 blocks are mined - which, at a rate of one block every 10 minutes, occurs approximately once every four years. When the chain reaches 840,000 blocks - around 29 May 2024 - the daily limit for the amount of Bitcoin that can be issued as rewards to miners will drop from 900 BTC to 450 BTC.

Every time there is a Bitcoin Halving - which has only happened three previous times - there has been a demand-driven event as market participants become acutely aware of the increasingly limited nature of the supply.

The Miner Factor

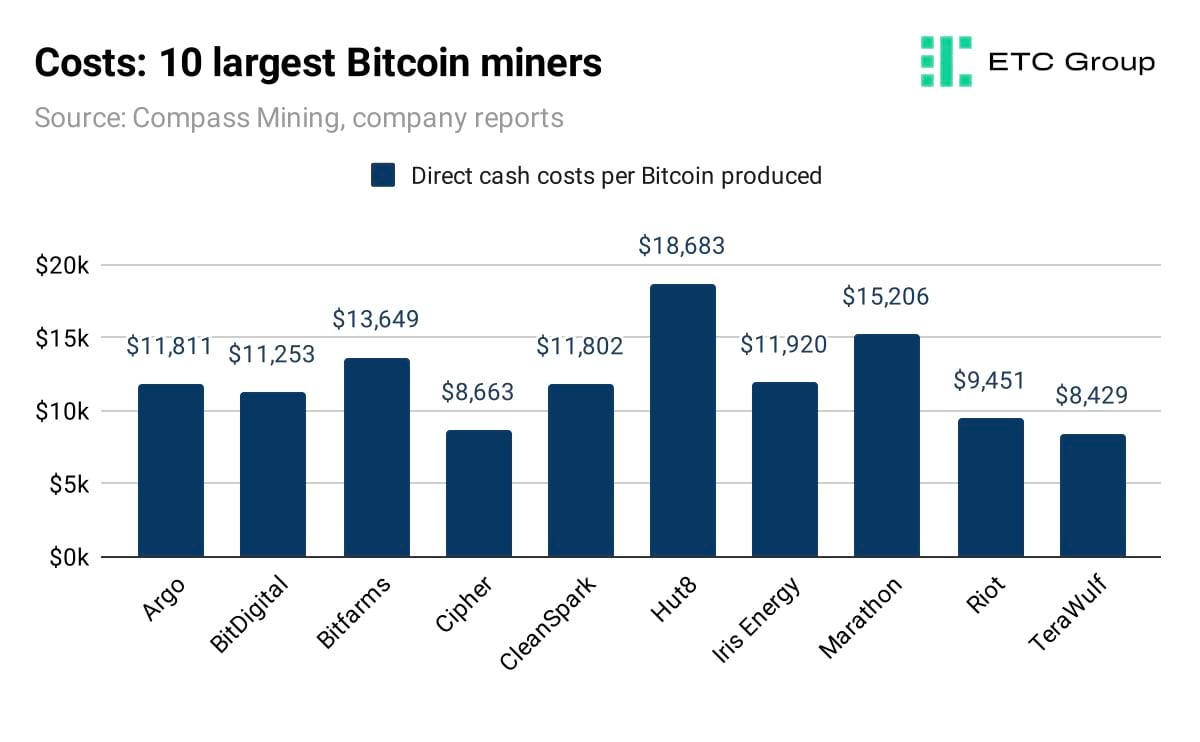

Data shows that the average cost-per-Bitcoin-mined at the major publicly-traded miners in the US stands at around $12,000.

Post halving, the Bitcoin block reward of 6.25 BTC (~$190,000) will fall to 3.125 BTC (~$95,000). If the Bitcoin hashrate - the total competitive computing power directed at mining - remains steady, then as Compass Mining notes, the cost of power to mine one Bitcoin will effectively double overnight.

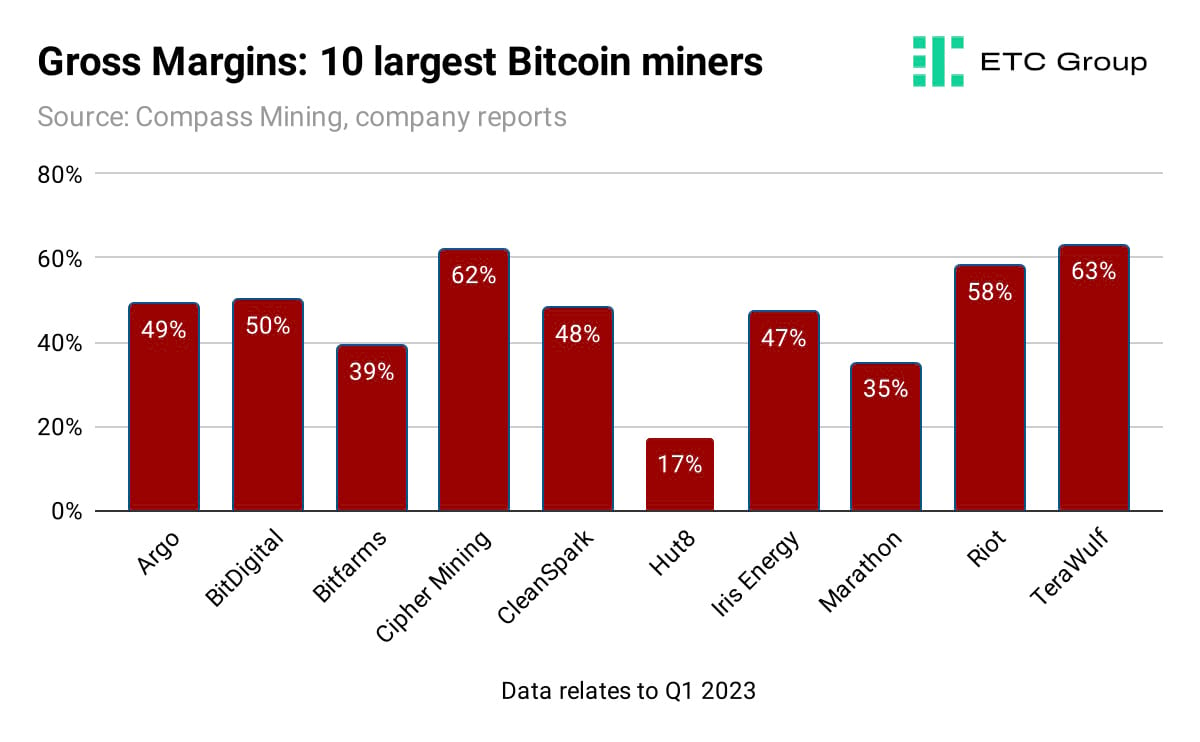

As of Q1 2023 the gross margins on Bitcoin production range from Hut 8 (NASDAQ:HUT) at 17%, to TeraWulf (NASDAQ:WULF) at 63%, but the Q1 2024 data will be much different. Only the most efficient miners with the leanest cost structure will be left in the race to discover the 1.6 million BTC that remain unmined.

The other half of the equation is the Bitcoin price at which miners can sell into the market. If Standard Chartered's predictions ring true, Riot Platforms (NASDAQ: RIOT) et al could be looking at a $75,000 spot price to sell onto the market by the time of May 2024's drastic supply reduction.

1.6m to mine, 4m lost, 8m unmoved

Estimates by data aggregators range from 1.46 million (Glassnode) to 3.77 million (Chainalysis) of the total Bitcoin supply being lost or otherwise permanently inaccessible. This could be from the loss of the private keys that control the wallets containing that Bitcoin.

Anecdotal examples have been reported relatively frequently over the last 10 years, before there was a professional market structure around custody. Lost Bitcoin alone would reduce today's putative total supply from 19.42 million to between 15.65 and 17.96 million. There is also the matter of Bitcoin held as digital gold, which has not moved in several years.

More than half of Bitcoin's circulating supply (53.61%) has not been moved in over two years. That means those particular holders sat through the huge run up from $33,000 to Bitcoin's all time high of $67,424 and all the way back down to today's approximate $30,700 market value. It stands to reason that those holders will be hanging on for a new all-time high past $70,000 before considering a sale.

Coinbase rejuvenated by TradFi Bitcoin ETF data surveillance

Exchange operator Cboe has filed amendments for five spot Bitcoin ETF applications that would see asset managers partner with Coinbase over surveillance sharing arrangements. The asset managers behind the ETF applications include WisdomTree, VanEck, and a dual effort from Invesco and Galaxy Digital.

The action by Cboe is intended to alleviate the SEC's apprehensions over market manipulation arising from the approval of spot Bitcoin investment products in the US. Data sharing agreements between financial exchanges, asset managers, and crypto exchanges are key to identifying cases of fraud.

The regulator had, until now, told Cboe that its previous applications did not meet the correct threshold, while also raising similar concerns with the Nasdaq exchange that leads the application process for BlackRock's spot Bitcoin application.

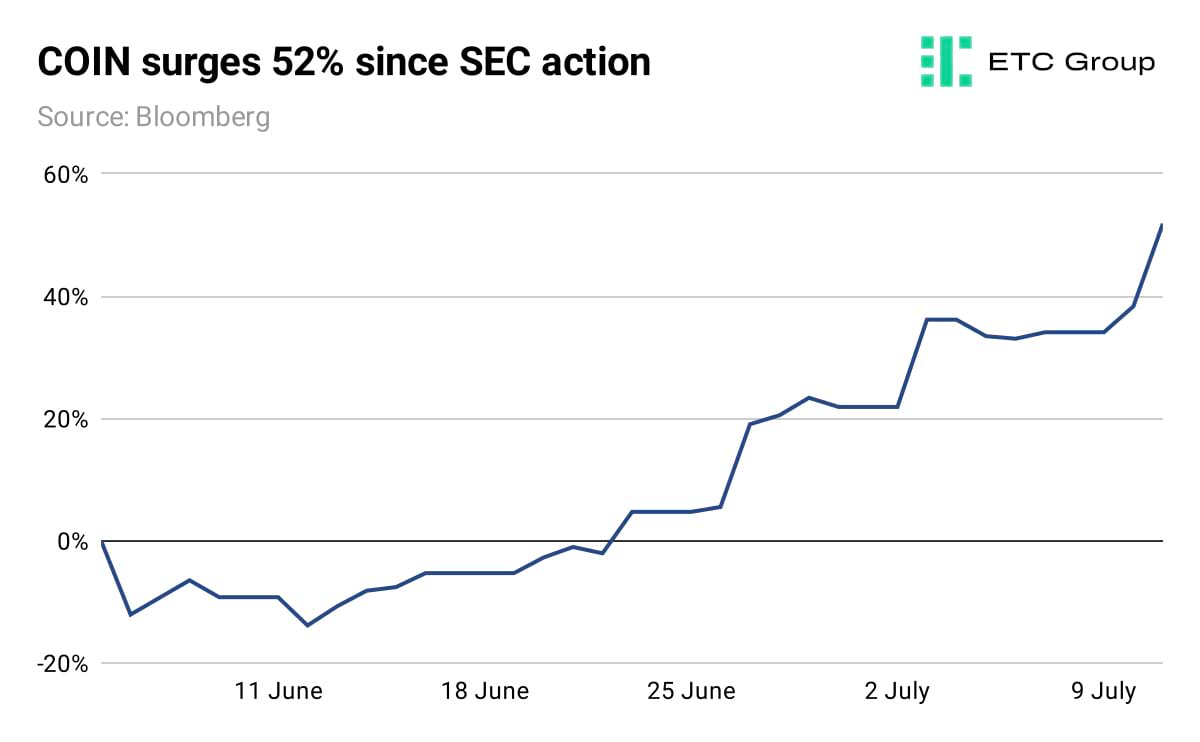

Despite the most discussed upstream effect of the BlackRock ETF filing being Bitcoin's upward price trajectory, Coinbase stock has soared by more than 50% to $89 since the US regulatory body began legal proceedings against the digital asset exchange.

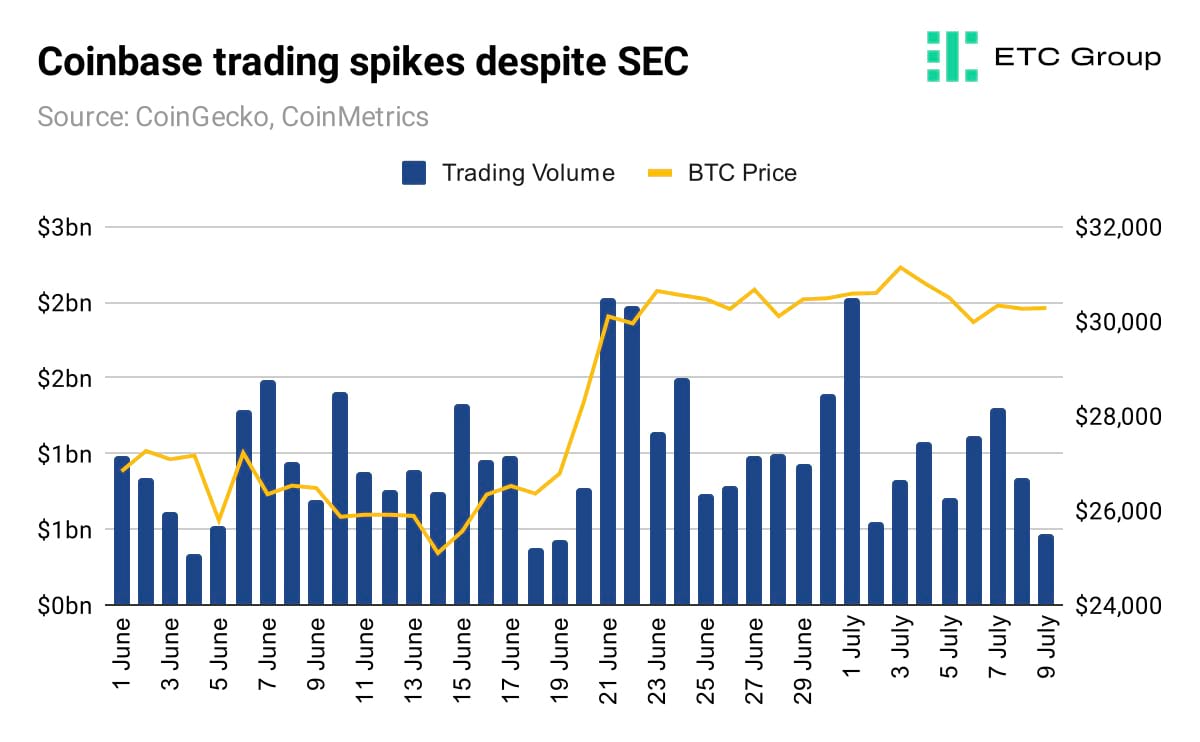

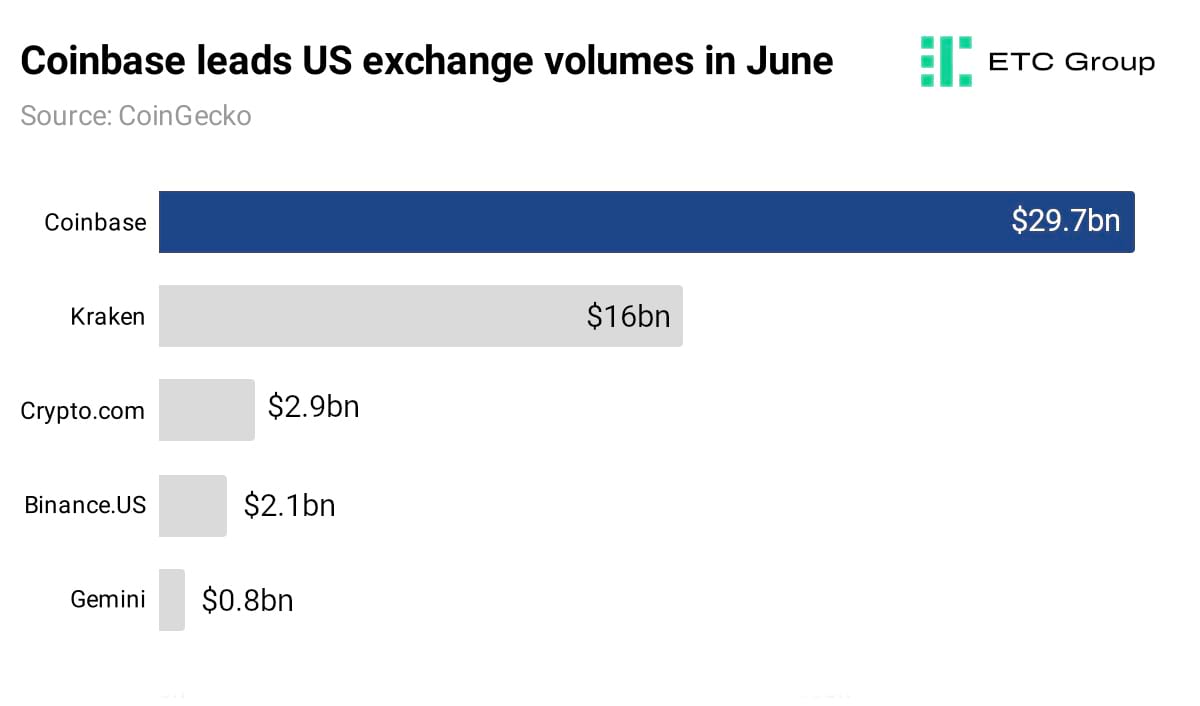

The SEC's quarrel with Coinbase has not dissuaded crypto traders either. Total trading volume on the exchange topped $29 billion in June – 12% more than recorded in May.

Coinbase's fortunes in the American market paint a sharp contrast to that of Binance. Binance is the world's largest retail exchange by trading volume, but its American arm Binance.US is facing a catalogue of legal challenges in the country.

Despite Coinbase and Binance.US both appearing on SEC's radar, it is the latter that is losing domestic market share and users. Binance's monthly trading volume fell from $10.4 billion in January to $2.1 billion in June – an 80% decline.

It is of material interest for investors to note that America's largest financial institutions are attempting to enter custody or data-surveillance agreements with exchanges that have regulatory approval in the US, boast strong trading volumes, and (unlike Binance) have largely avoided severe legal attention from regulatory bodies globally.

Despite Coinbase's legal issues with the SEC, it became the destined choice for BlackRock, Fidelity, and others because of its status as America's most trusted crypto-native exchange. Its position as a publicly listed company also aids its case, as it is regularly audited, and held to the same transparent standards as any other company that sees its shares traded on stock exchanges.

Can MSCI plug the gaps in Europe's landmark MiCA regulation?

The Markets in Crypto Assets (MiCA) framework was met much with much praise when it was passed by the EU in April 2023. It was a first-of-its-kind bill that introduced regulatory standards for stakeholders like digital asset exchanges and custodians, while recognising the utility of digital asset – and particularly stablecoin – payments in Europe.

But its reach does not extend far enough into the digital asset universe, according to the Association for Financial Markets in Europe (AFME). The banking sector trade body has called for stipulations on decentralised finance (DeFi) to be included in MiCA.

DeFi represents the movement of financial instruments – as tokenised real world assets (RWAs) – between users without the need for centralised intermediaries like banks. The space also includes the lending of crypto tokens in return for yield through staking, or the use of digital assets as collateral against loans.

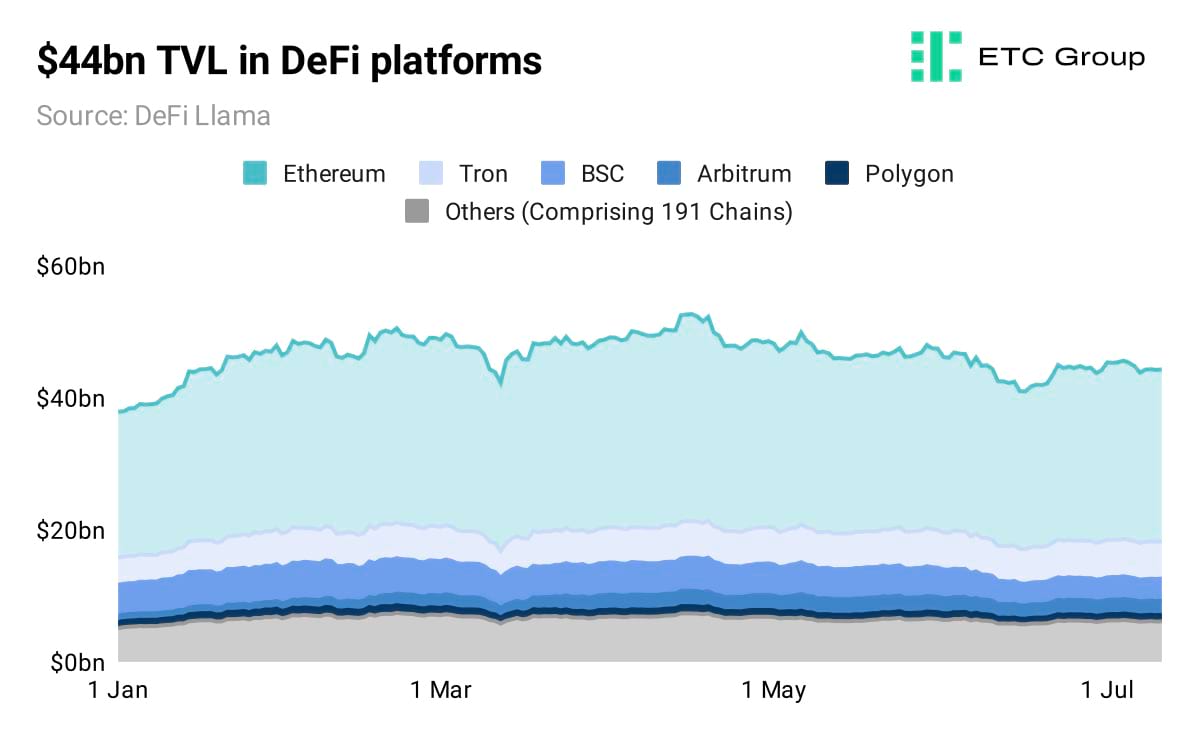

There is $44 billion worth of cryptocurrency spread throughout DeFi sub-sectors across 196 blockchains. Of this, Ethereum's giant ecosystem of decentralised exchanges, lending platforms, and liquidity pools make up almost 60% of the total value locked (TVL).

The AFME has warned that omitting activities taking place within the DeFi sector could endanger investors and have negative ramifications for wider capital markets if things were to go wrong. According to one estimate, $3 billion worth of crypto was lost to vulnerable DeFi protocols being exploited by hackers in 2022 alone.

A whitepaper released by the organisation says that

decentralised finance (DeFi) and its associated activities must be brought within the regulatory perimeter in an appropriate way to manage risks.

Real World Impact

Chief among the AMFE's concerns is the need to monitor the space in light of the growing impact tokenised RWAs will come to have on the global economy. Liquid assets, like bonds and equities, as well as illiquid assets, such as carbon credits and real estate are increasingly being tokenised. Citibank research cites a $4 trillion total market valuation for tokenised assets by 2030.

As ETC Group analysts noted in June, the digital transformation is being spearheaded by major banks and Web3 firms looking to capitalise on the deepening trading volumes, fractional costs, and improved settlement times that transferring tokenised assets on blockchains bring for clients.

The AMFE is not the first body to point to MiCA's shortcomings. A study commissioned by the European Parliament in June noted that the framework is not only lacking guidance around staking – a pillar central to DeFi – but also a system of classification for the diverse spectrum of crypto tokens in existence.

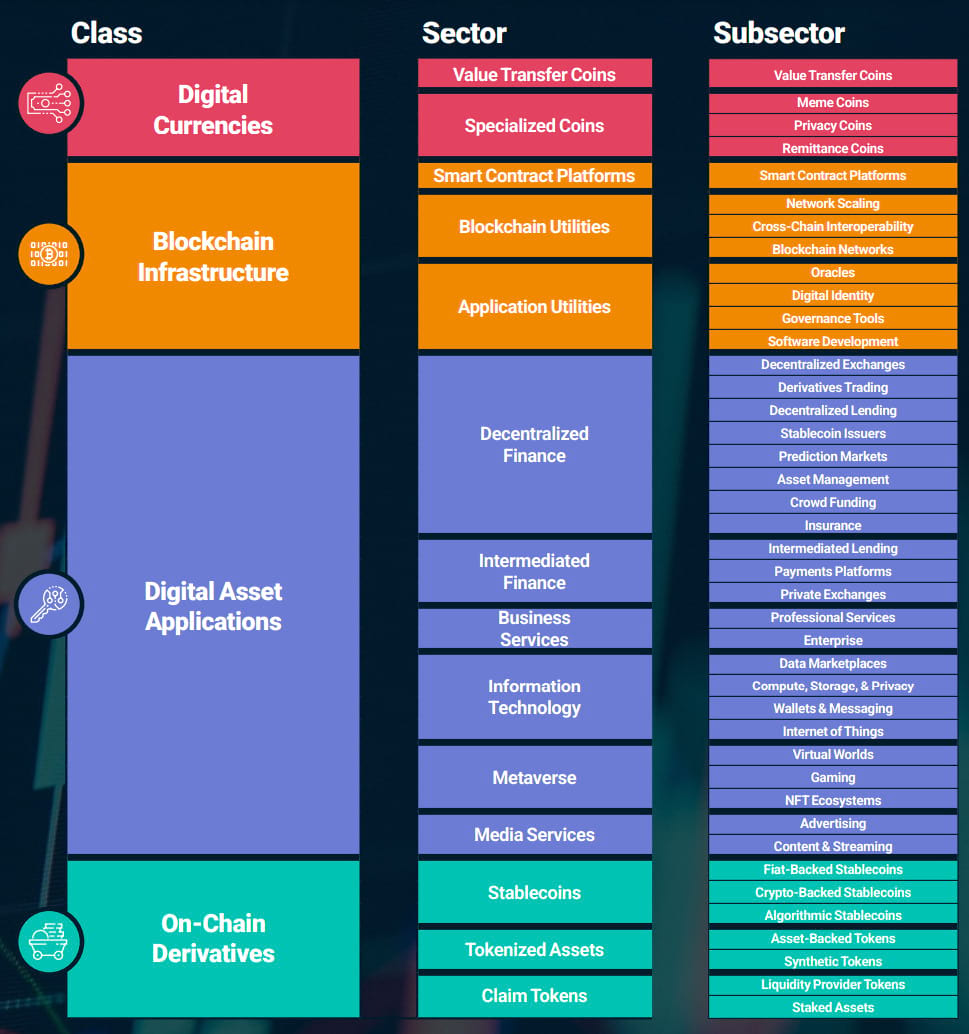

One method of classification that MiCA could incorporate is index provider MSCI's Datonomy framework, developed in collaboration with Goldman Sachs and blockchain data platform CoinMetrics.

Their taxonomy partitions digital assets into three overarching classes: digital currencies, blockchain infrastructure, and digital asset applications; before being further divided into specific sectors and subsectors. Significantly, Datonomy maps out a DeFi landscape of which European parliamentarians may do well to take account.

MSCI has also become a leader in the indexing of digital assets with its Global Digital Assets Top 20 Index becoming the benchmark for the overall health of the crypto market.

ETC Group's DA20 ETP is the first investment product to track an MSCI crypto index and provide investors exposure to its constituents. The underlying assets of the ETP are fully collateralised and represent about 85% of the digital asset market cap.

There is still time for European regulators to make amendments to MiCA. It is undergoing its first consultation phase this month with another two planned to take place in October and the first quarter of 2024, before coming into effect in December 2024.

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com