- Bitcoin consolidated between $101K and $105.5K last week, while Ethereum exhibited early signs of structural rotation. This was supported by rising realized price, cross-chain inflows, and a record share in the real-world asset (RWA) sector. Institutional activity remained robust, highlighted by Coinbase’s inclusion in the S&P 500, JPMorgan’s on-chain treasury settlement, and growing stablecoin integrations across major fintech platforms

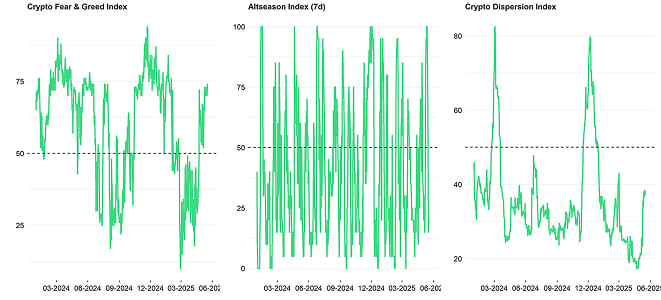

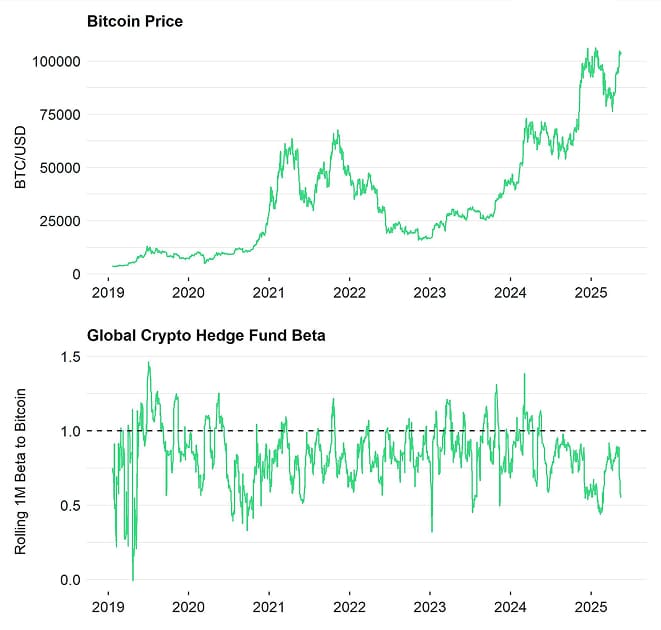

- Our Cryptoasset Sentiment Index softened from the previous week, as only 10% of tracked altcoins outperformed BTC and market dispersion stayed low. Altcoin rotation slowed notably, with Ethereum underperforming BTC into the weekend—indicating a short-term cooling in risk appetite.

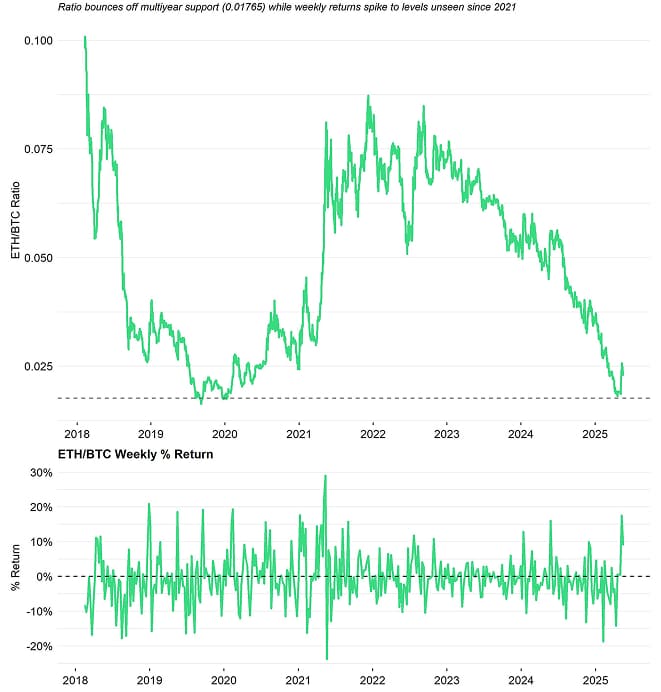

- Chart of the Week: ETH/BTC rebounded off the 0.01765 level—a key structural support last touched in 2019—just as our 7-day Altseason Index dropped from 100 to 20. Weekly ETH/BTC returns surged to levels not seen since before 2022. If the 1-month Altseason Index follows suit, historical patterns suggest potential for a mean-reversion-driven upside.

Chart of the Week

ETH/BTC Rebounds Off Cycle Lows as Weekly Momentum Snaps Back

Source: Bloomberg, Bitwise Europe

Source: Bloomberg, Bitwise Europe

Performance

Last week, Bitcoin traded between $101,000 and $105,500, consolidating gains after breaching six figures earlier this month. Ethereum broadly followed the same pattern, with both assets largely range-bound throughout the week. While volatility remained subdued on the surface, several notable developments took place ranging from a U.S. credit downgrade to Ethereum's outperformance relative to Bitcoin.

The ETH/BTC pair (Chart-of-the-week) bounced decisively last week off the 0.01765 level, a structural support that previously marked inflection points in August and December 2019. At the same time, our 7-day Altseason Index collapsed from a peak reading of 100% to just 20%, suggesting altcoin momentum has reset sharply. Historically, as we pointed out in our previous Espresso report, if the 1-month Altseason Index follows suit, forward ETH/BTC returns tend to skew positive, flagging a contrarian entry point as excess risk is flushed.

The pair appears to have continued its reversal of its trend after many months of underperformance, following what could be described as one of the most statistically stretched valuation dislocations in recent history.

As we pointed out last week, standardized residuals from our ETH/BTC regression model had reached –2 standard deviations, a point where mean-reversion behaviour and a reversal in ETH/BTC was likely. We had highlighted this possibility in our Expresso report from February, flagging that Ethereum's pricing relative to Bitcoin had diverged materially from its underlying on-chain activity.

While nothing can be said with certainty, it is our view that the recent stabilization and rebound in ETH/BTC may indicate a possible early-stage shift in structural capital rotation back into Ethereum after the Pectra upgrade.

It is also important to note that Ethereum's cost basis (realized price) surged 32.1% week-over-week, with the network capturing the most inflows from other chains at $187.3 mn, while the percentage of ETH addresses in profit last week hit 67.7% - levels not seen since February 2025.

Ethereum's Real-World Asset (RWA) market share also reached all-time highs to 58.78% of RWA Total Value Locked (TVL), reinforcing its dominance for institutions looking to ramp up tokenization efforts.

The macro environment is increasingly relevant to these trends. Moody's downgraded the U.S. sovereign credit rating from Aaa to Aa1, citing concerns over persistent deficits and political gridlock. This move removes the last remaining highest rating held by any of the major credit agencies and underscores growing scepticism over the long-term sustainability of U.S. fiscal policy.

Beyond macro and market structure, institutional activity continued to expand across multiple fronts. Coinbase is set to be included in the S&P 500, replacing Discover Financial Services. The move reflects both the company's improving profitability and the broader acceptance of crypto-native businesses within traditional equity indices. Coinbase is the very first crypto-native company to be included in the S&P 500.

Separately, JPMorgan completed its first on-chain settlement of tokenized U.S. Treasuries using Chainlink's public oracle infrastructure-an event that, while early in scale, implies a possible shift in institutional willingness to operate on public blockchains for high-grade financial instruments.

In the M&A space, Robinhood announced the acquisition of WonderFi in a $179 mn all-cash deal, giving it access to key Canadian crypto licenses and infrastructure. Anchorage Digital, one of the only federally chartered crypto banks, acquired Mountain Protocol, further consolidating the institutional stablecoin issuance market. Meanwhile, Animoca Brands is reportedly exploring a U.S. listing, and a new Bitcoin Treasury company backed by David Bailey-Nakamoto-is preparing to go public via a SPAC merger. The volume of transactions across equity, venture, and protocol infrastructure suggests that traditional financial actors continue to scale their crypto exposure across multiple vectors.

After losing momentum last week due to partisan reversals, the GENIUS stablecoin bill appears to be regaining traction. A revised version of the legislation is now back on the agenda, with a cloture vote scheduled for Monday that could advance it to the floor.

Meanwhile, the payments landscape is accelerating toward stablecoin integration. Mastercard, Stripe, Visa, and Modern Treasury all announced partnerships or product launches this month that enable fiat-like use of stablecoins within existing card and banking infrastructure. The messaging is clear: stablecoins are becoming invisible to end users. Whether through card-linked USDC balances or cross-border settlement via crypto rails, payments firms are increasingly embedding blockchain beneath familiar fintech interfaces.

This trend blurs the line between crypto and traditional finance. And this behaviour is the clearest signal of true adoption and validation of the industry.

At the agency level, the SEC issued updated guidance on broker-dealer rules for digital assets, notably retracting a 2019 staff statement that had prevented crypto custodianship under existing frameworks. This marks a subtle but meaningful shift in tone, opening the door for broader institutional participation even as congressional efforts remain slightly gridlocked.

Meanwhile, the idea of Bitcoin as a reserve asset is gaining further traction. Last week, the mayor of Panama City posted a cryptic reference to a “Bitcoin Reserve” following a meeting with El Salvador's Bitcoin leadership. While no formal plan has been announced, the post came shortly after Panama approved the use of crypto for municipal payments, indicating early groundwork for a potential city-level treasury model. If implemented, it would follow similar moves in Arizona and New Hampshire, and echo Ukraine's reported progress on a national Bitcoin reserve bill, now said to be in its final draft stages.

The corporate response has been even more visible. AsiaStrategy (formerly Top Win) saw its stock surge more than 60% after announcing a Bitcoin treasury strategy in partnership with Sora Ventures, joining a growing cohort of publicly listed firms pivoting their balance sheets toward BTC. Brazil's Méliuz also secured shareholder approval to become the country's first Bitcoin treasury company, acquiring nearly $28.4 mn in BTC. The firm's stock has more than doubled since its first purchase in March. These moves are part of a broader corporate trend, with treasuries across Japan, Latin America, and the Gulf increasingly experimenting with Bitcoin-denominated reserves.

Together, these developments suggest a quiet normalization of Bitcoin as a strategic reserve asset-not just for countries under stress, but for corporates seeking non-correlated hedges and optionality within a shifting macro landscape.

While institutional adoption is clearly accelerating, retail participation remains notably subdued. Google search volume for “Bitcoin” is flat and app store rankings for crypto platforms like Coinbase are near six-month lows, suggesting that broader public interest has yet to catch up with market developments.

This divergence reinforces the idea that the current phase of crypto adoption is being led not by retail exuberance, but by quiet structural integration at the institutional and sovereign level.

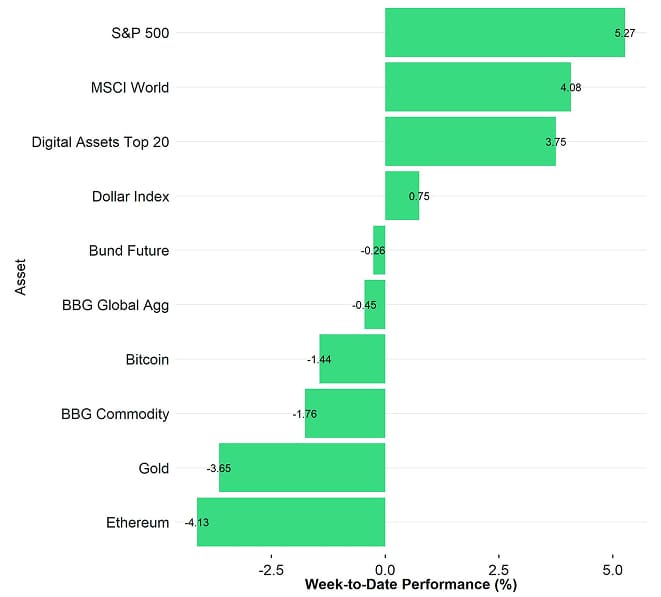

Cross Asset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

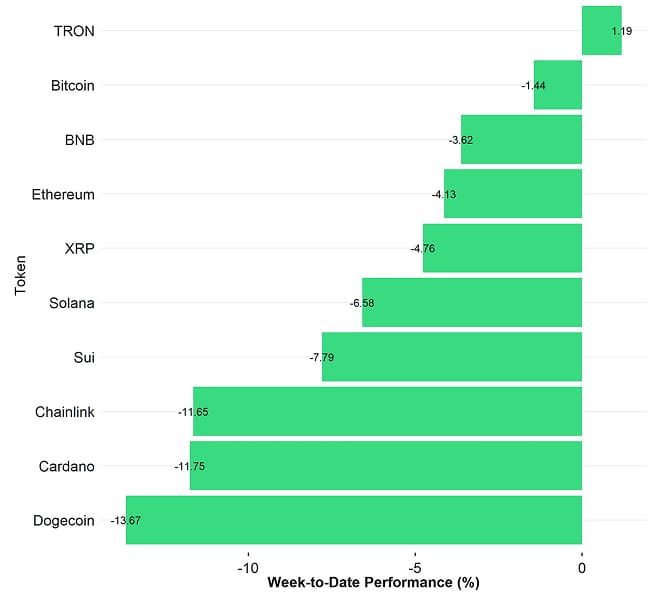

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Bloomberg, Coinmarketcap; performances in USD exept Bund Future

Top 10 Cryptoasset Performance (Week-to-Date)

Source: Coinmarketcap

Source: Coinmarketcap

In general, among the top 10 crypto assets TRON, Bitcoin and BNB were the relative outperformers.

Overall, altcoin outperformance vis-à-vis Bitcoin decreased from last week, with 10% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Furthermore, Ethereum underperformed Bitcoin last week.

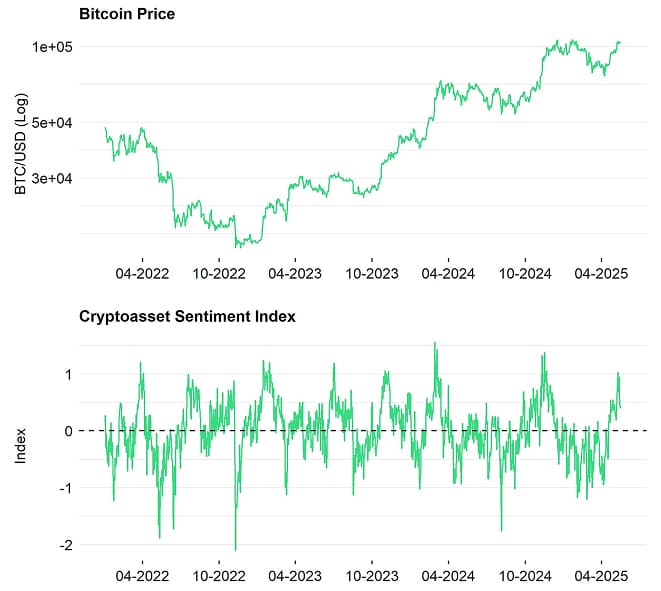

Sentiment

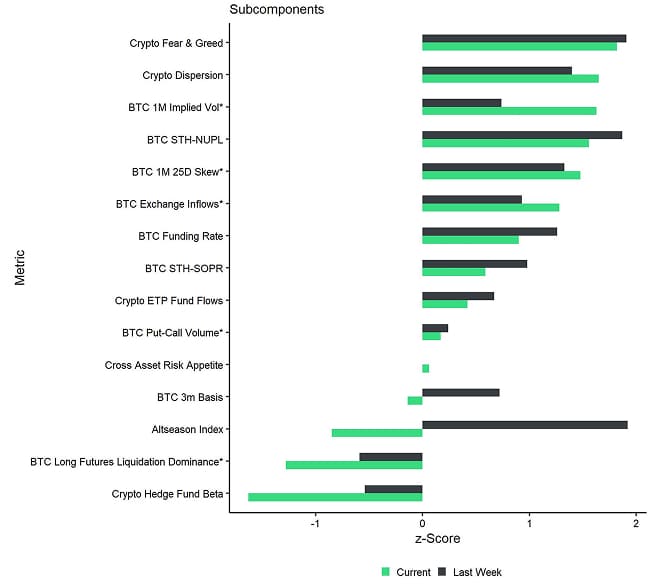

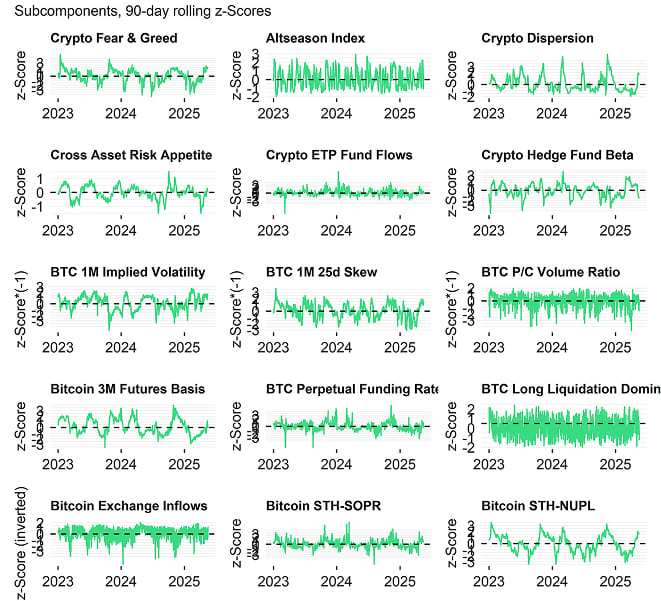

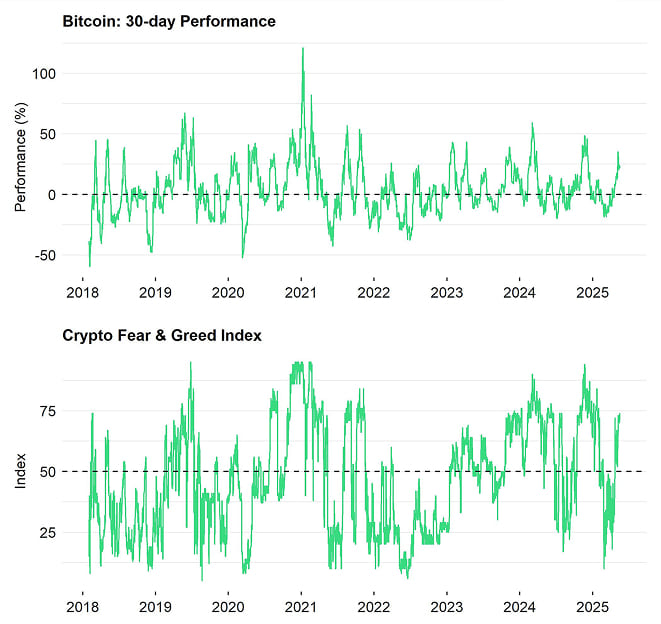

Our in-house “Cryptoasset Sentiment Index” has continued to signal bullish sentiment although it has come off its recent highs.

At the moment, 10 out of 15 indicators are above their short-term trend.

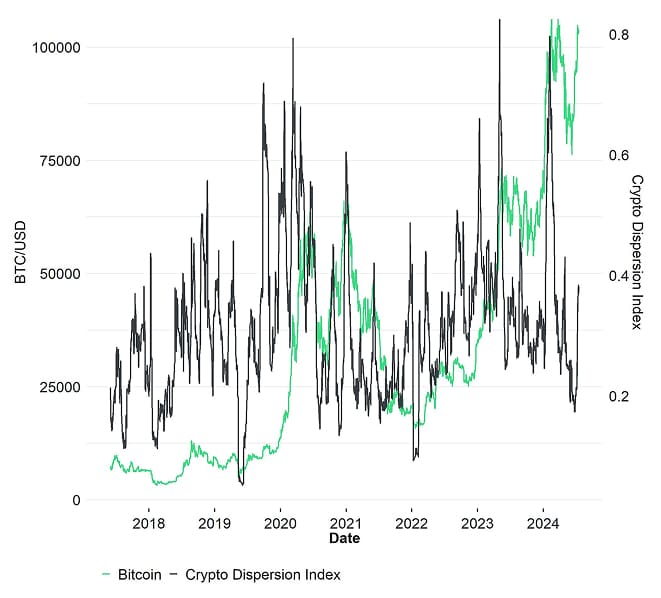

The Crypto Dispersion and BTC Exchange Inflows metrics had improved last week, while the Crypto Fear & Greed index had a slight pull back, while our Altseason Index had reverted drastically.

The Crypto Fear & Greed Index currently signals a “Greed” level of sentiment as of this morning, improving from last week.

Performance dispersion among cryptoassets remained stagnant last week, signalling that altcoins have kept their correlation with the performance of Bitcoin, as reflected in our top 10 cryptoasset performance chart above.

Altcoin outperformance vis-à-vis Bitcoin has decreased from last week, with around 10% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Furthermore, Ethereum managed to underperform Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin outperformance signals a bullish risk appetite at the moment.

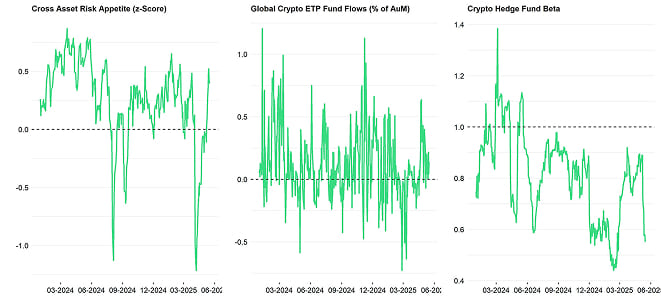

Sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) has improved further while remaining at low levels, moving from 0.09 to 0.4.

Fund Flows

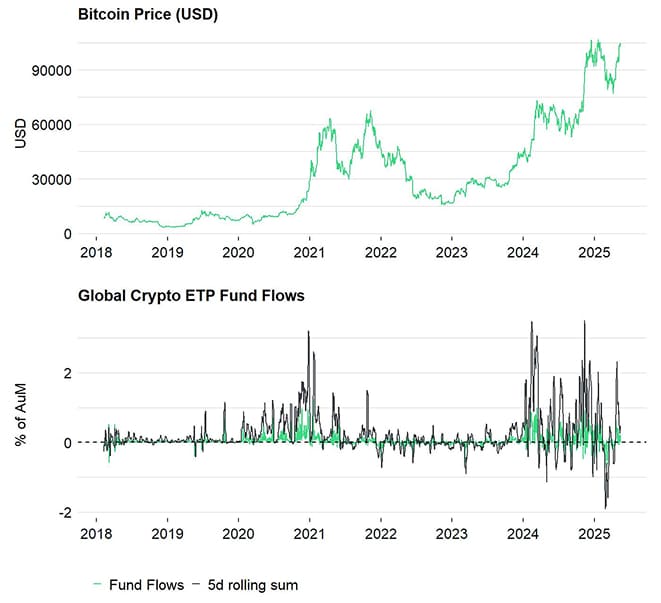

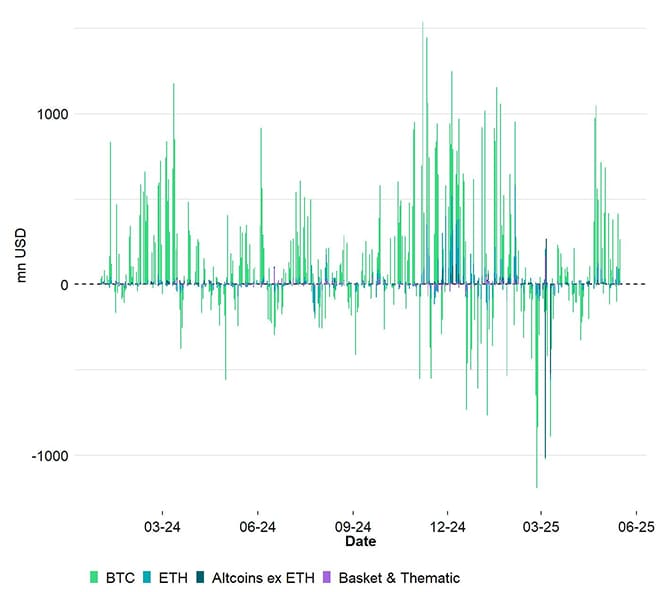

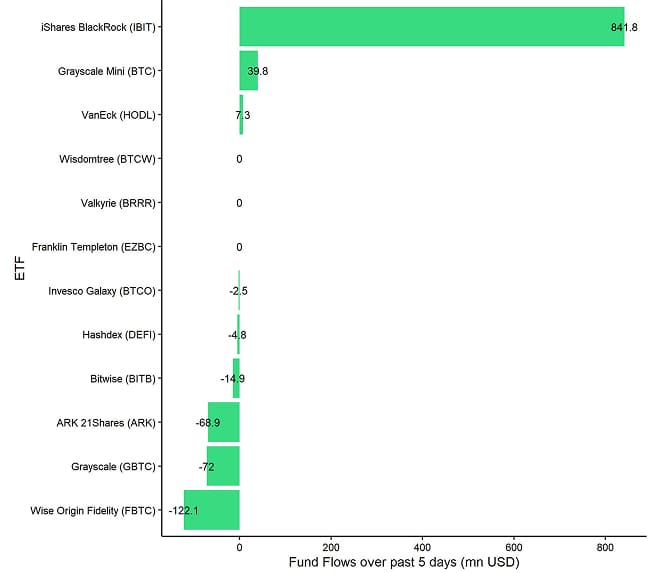

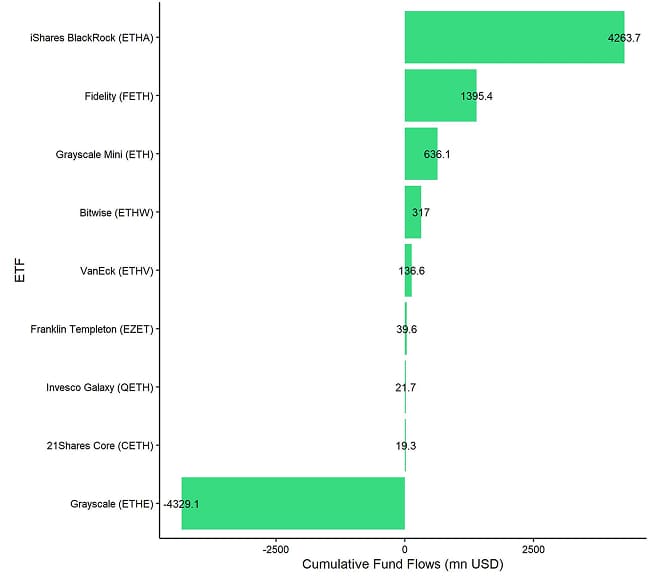

Weekly fund flows into global crypto ETPs have continued to post large net inflows last week.

Global crypto ETPs saw around +777.3 mn USD in weekly net inflows across all types of cryptoassets, after +857.7 mn USD in net inflows the previous week.

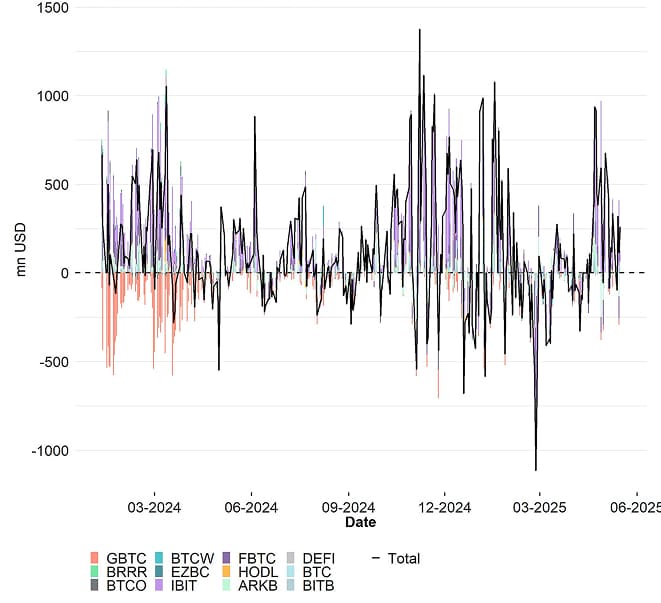

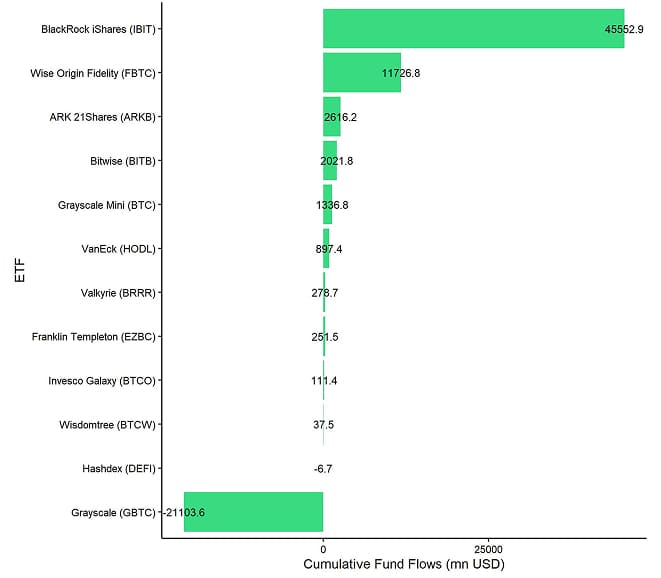

Global Bitcoin ETPs have experienced net inflows totalling +545.4 mn USD last week, of which +603.7 mn USD in net inflows were related to US spot Bitcoin ETFs.

The Bitwise Bitcoin ETF (BITB) in the US experienced net outflows, totalling -14.9 mn USD last week.

In Europe, the Bitwise Physical Bitcoin ETP (BTCE) also experienced net outflows equivalent to -0.9 mn USD, while the Bitwise Core Bitcoin ETP (BTC1) experienced minor net inflows of +2.5 mn USD.

The Grayscale Bitcoin Trust (GBTC) has posted net outflows of -72.0 mn USD. The iShares Bitcoin Trust (IBIT), however, experienced net inflows of around +841.8 mn USD last week.

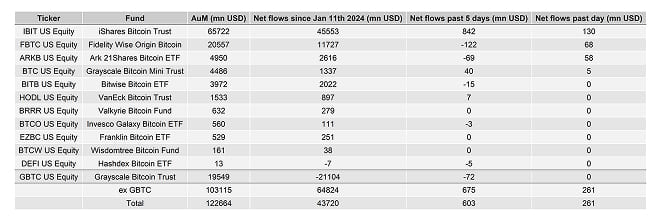

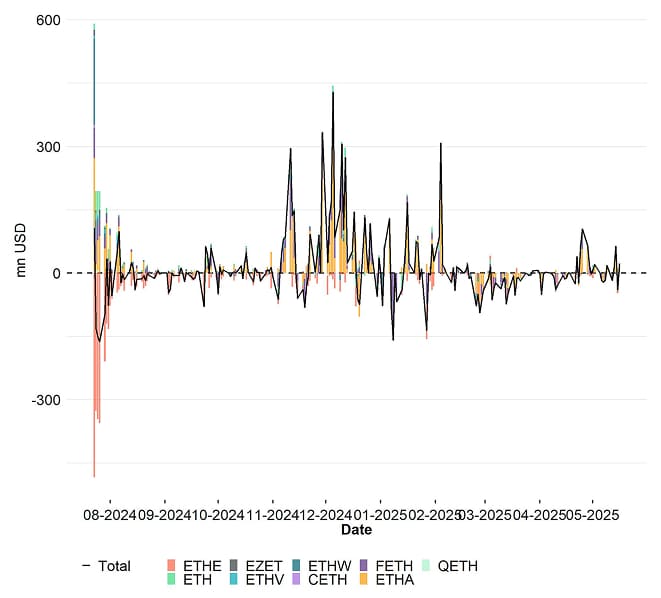

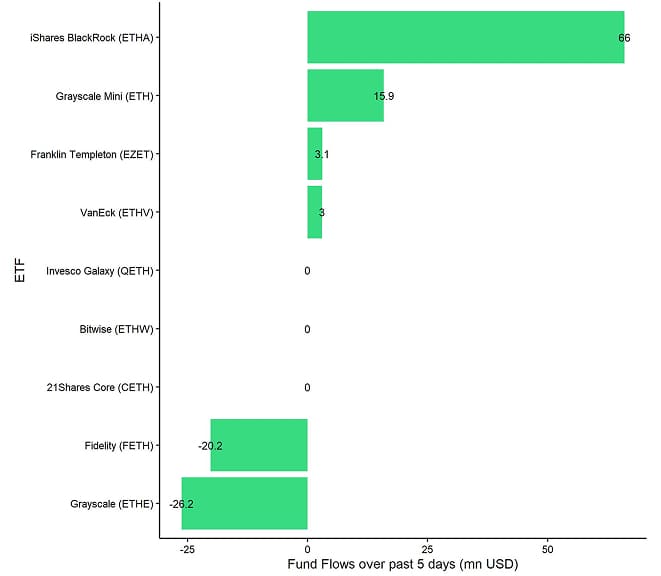

Meanwhile, flows into global Ethereum ETPs flipped to positive last week, with around +234.4 mn USD in net inflows last week

US Ethereum spot ETFs, also recorded net inflows of around +41.6 mn USD on aggregate. The Grayscale Ethereum Trust (ETHE), however, experienced minor net outflows of around -26.2 mn USD last week

The Bitwise Ethereum ETF (ETHW) in the US had had sticky AuM (+/- 0 mn USD).

In Europe, the Bitwise Physical Ethereum ETP (ZETH) saw minor net inflows of +7.1 mn USD while the Bitwise Ethereum Staking ETP (ET32) saw very significant net inflows of around +46.0 mn USD on aggregate.

Altcoin ETPs ex Ethereum had experienced a reversal of flows last week, with around +10.4 mn USD in global net inflows.

Furthermore, thematic & basket crypto ETPs experienced net outflows of around -12.9 mn USD on aggregate last week. The Bitwise MSCI Digital Assets Select 20 ETP (DA20) had had sticky AuM (+/- 0 mn USD).

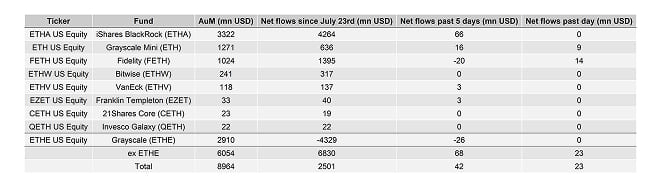

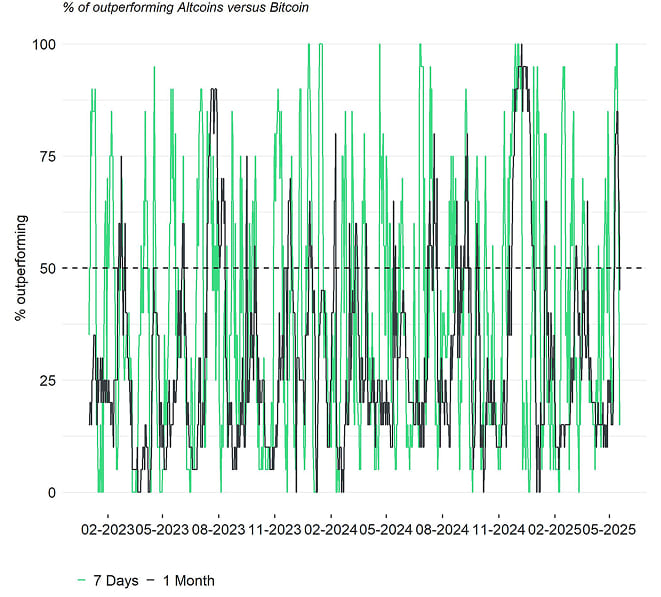

Global crypto hedge funds have decreased their market exposure to Bitcoin. The 20-days rolling beta of global crypto hedge funds' performance to Bitcoin consolidated to around 0.55 per yesterday's close, down from 0.69 from the week before.

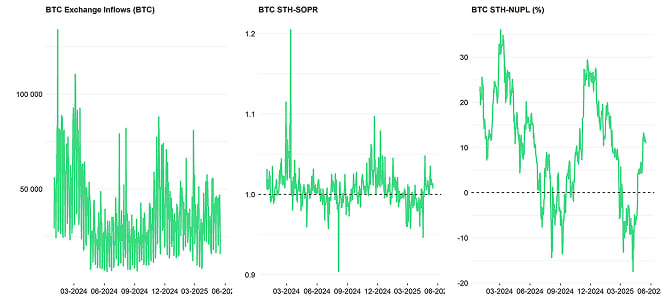

On-Chain Data

Broadly speaking, Bitcoin's on-chain activity has remained slightly bullish last week.

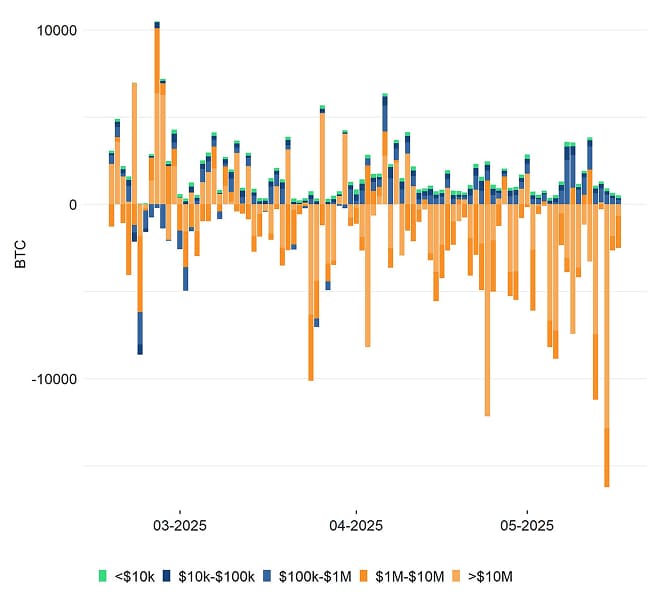

Bitcoin spot exchanges saw selling pressure ease, with net selling volumes decreasing to approximately -$0.29 bn compared to -$0.5 bn two weeks ago.

The Spot Cumulative Volume Delta (CVD), which tracks the difference between buying and selling volumes, remained mostly negative throughout last week, but confirmed an ease in the sell-side pressure and similarly showing improvement from prior levels.

In terms of supply dynamics, we are observing a similar pattern. Whales have continued to removed bitcoins from exchanges on a net basis, indicating a decrease in whale selling pressure. More specifically, BTC whales removed -43,574 BTC on exchanges last week. Network entities that possess at least 1,000 Bitcoin are referred to as whales.

Based on recent data from Glassnode, the overall downward trend in exchange-held Bitcoin reserves remains intact. The current level stands at 3 million coins, representing approximately 15.1% of the total circulating supply. This figure continues to reflect the broader trend of Bitcoin moving off exchanges, with current levels last observed in January 2022.

That being said, a measure of “apparent demand” for Bitcoin over the past 30 days has flipped positive since January 9th 2025, reflecting an increase in demand.

Additionally, Ethereum's cost basis (realized price) surged 32.1% week-over-week, with the network capturing the most inflows from other chains at $187.3 mn, while the percentage of ETH addresses in profit last week hit 67.7%.

Furthermore, its share of RWA total value locked increased to 58.19% and the Ethereum's DeFi TVL has hit $61.1 bn, levels last seen in May 2022.

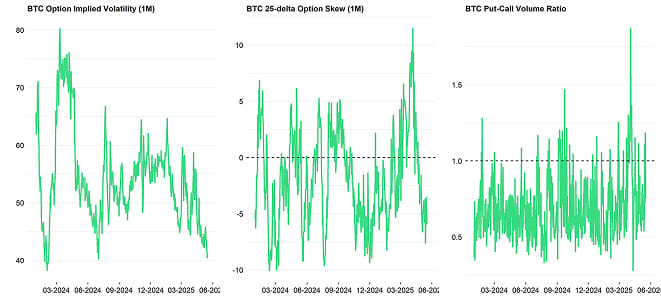

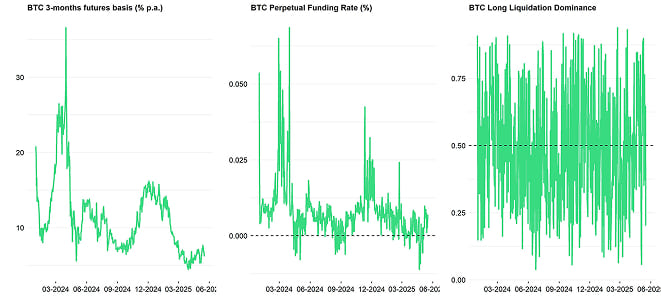

Futures, Options & Perpetuals

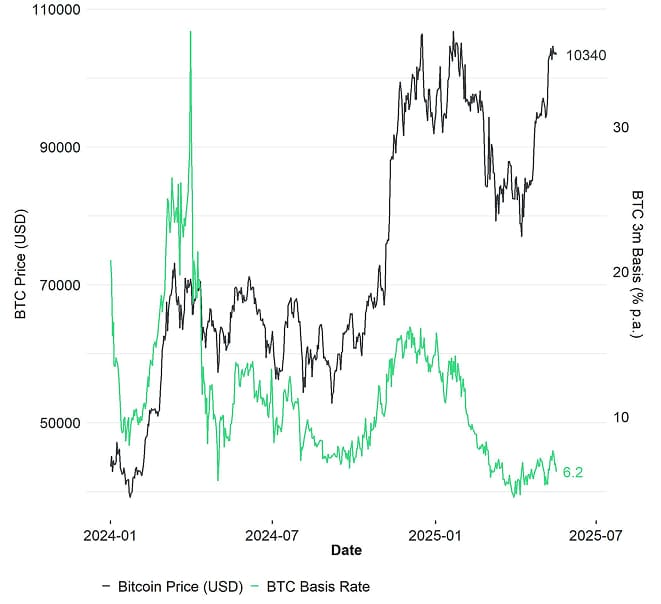

Last week, BTC futures open interest increased last week but ended by decreasing around -0.3k BTC while perpetual open interest increased by around 1.2k BTC.

BTC perpetual funding rates remained positive last week, indicating a bullish sentiment among traders in the perpetual futures market.

In general, when the funding rate is positive (negative), long (short) positions periodically pay short (long) positions, which is indicative of bullish (bearish) sentiment.

The BTC 3-months annualised basis decreased from around 6.9% p.a to around 6.2% p.a. averaged across various futures exchanges last week. BTC option open interest increased by around +5.4k BTC. The put-call open interest ratio had spiked to 0.6 before ending the week at 0.59.

The 1-month 25-delta skew for BTC increased slightly last week, before dropping to -6.97, indicating a modest decrease in demand for put options and a slightly risk-on market sentiment.

BTC option implied volatilities remained muted last week, with 1-month realized volatility ending the week by decreasing by around -0.36%.

At the time of writing, implied volatilities of 1-month ATM Bitcoin options are currently at around 43.64% p.a.

Bottom Line

- Bitcoin consolidated between $101K and $105.5K last week, while Ethereum exhibited early signs of structural rotation. This was supported by rising realized price, cross-chain inflows, and a record share in the real-world asset (RWA) sector. Institutional activity remained robust, highlighted by Coinbase’s inclusion in the S&P 500, JPMorgan’s on-chain treasury settlement, and growing stablecoin integrations across major fintech platforms

- Our Cryptoasset Sentiment Index softened from the previous week, as only 10% of tracked altcoins outperformed BTC and market dispersion stayed low. Altcoin rotation slowed notably, with Ethereum underperforming BTC into the weekend—indicating a short-term cooling in risk appetite.

- Chart of the Week: ETH/BTC rebounded off the 0.01765 level—a key structural support last touched in 2019—just as our 7-day Altseason Index dropped from 100 to 20. Weekly ETH/BTC returns surged to levels not seen since before 2022. If the 1-month Altseason Index follows suit, historical patterns suggest potential for a mean-reversion-driven upside.

Appendix

Bitcoin Price vs Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe; *multiplied by (-1)

Cryptoasset Sentiment Index

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, Coinmarketcap, Glassnode, NilssonHedge, alternative.me, Bitwise Europe

TradFi Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Bloomberg, NilssonHedge, Bitwise Europe

Crypto Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Coinmarketcap, alternative.me, Bitwise Europe

Crypto Options' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe

Crypto Futures & Perpetuals' Sentiment Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe; *Inverted

Crypto On-Chain Indicators

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: Glassnode, Bitwise Europe

Bitcoin vs Crypto Fear & Greed Index

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: alternative.me, Coinmarketcap, Bitwise Europe

Bitcoin vs Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only, data subject to change

Global Crypto ETP Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; ETPs only; data subject to change

US Spot Bitcoin ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Bitcoin ETFs: Flows since launch

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomberg, Fund flows since traiding launch on 11/01/24; data subject to change

US Spot Bitcoin ETFs: 5-days flow

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomber; data subject to change

US Bitcoin ETFs: Net Fund Flows since 11th Jan mn USD

Source: Bloomberg, Bitwise Europe; data as of 16-05-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data as of 16-05-2025

US Spot Ethereum ETF Fund Flows

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Bitwise Europe; data subject to change

US Spot Ethereum ETFs: Flows since launch

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg, Fund flows since trading launch on 23/07/24; data subject on change

US Spot Ethereum ETFs: 5-days flow

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg; data subject on change

US Ethereum ETFs: Net Fund Flows since 23rd July

Source: Bloomberg, Bitwise Europe; data as of 16-05-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Bloomberg, Bitwise Europe; data as of 16-05-2025

Bitcoin vs Crypto Hedge Fund Beta

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Glassnode, Bloomberg, NilssonHedge, Bitwise Europe

Altseason Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmetrics, Bitwise Europe

Bitcoin vs Crypto Dispersion Index

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Coinmarketcap, Bitwise Europe; Dispersion = (1 - Average Altcoin Correlation with Bitcoin)

Bitcoin Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-05-17

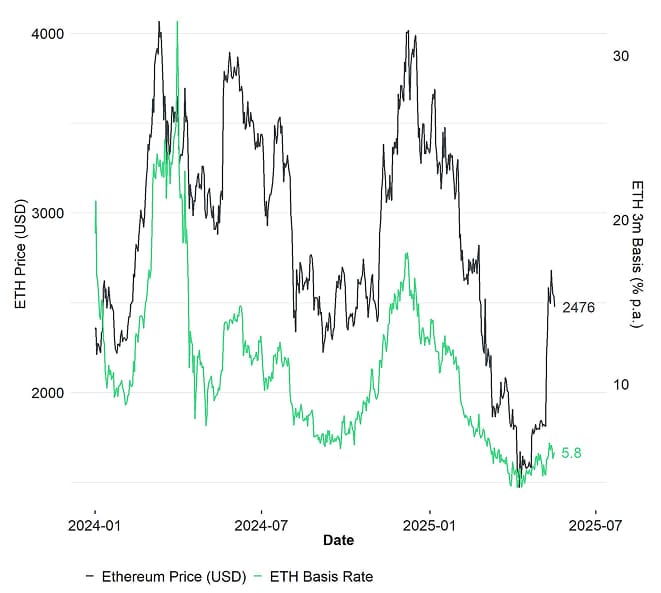

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-05-17

Ethereum Price vs Futures Basis Rate

Source: Glassnode, Bitwise Europe; data as of 2025-05-17

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe; data as of 2025-05-17

BTC Net Exchange Volume by Size

Source: Glassnode, Bitwise Europe

Source: Glassnode, Bitwise Europe

Important Information

The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations.

Nothing in this communication should be construed as a recommendation, endorsement, or inducement to engage in any investment activity. Readers are encouraged to seek independent legal, tax, or financial advice where appropriate.

For further information on the content of this research, please contact europe@bitwiseinvestments.com